In a world buzzing with financial advice, many of us still find ourselves adrift, feeling like our budgets are more of a tangled mess than a clear roadmap. We try to save, we attempt to cut back, but often, the old habits and the inertia of previous spending patterns pull us back into the familiar cycle. It’s a common story: a new month begins, and we simply roll over last month’s financial framework, tweaking a number here or there, without truly questioning whether every dollar is serving our current goals.

Imagine hitting a reset button, wiping the slate clean, and building your financial future from the ground up, dollar by dollar. This isn’t just a hypothetical exercise; it’s the core philosophy behind the Point Zero Budget Template, a powerful tool designed to give you absolute clarity and control over your money. Whether you’re an individual struggling with debt, a family saving for a major milestone, or a small business owner aiming for lean operations, this approach offers a profound shift in how you view and manage your finances, empowering you to make intentional choices that truly reflect your priorities.

Unlocking the Power of a Fresh Start

The traditional budgeting method often involves looking at last month’s spending and making incremental adjustments. This approach, while seemingly straightforward, carries forward inefficiencies and outdated priorities. It assumes that what you spent before is what you should spend now, creating a default acceptance of past financial decisions. This can lead to persistent overspending in certain categories or a missed opportunity to redirect funds towards more meaningful goals.

The essence of a zero-based budgeting approach, embodied in this template, is a radical departure from this norm. It demands that every single dollar of your income be justified and allocated to a specific purpose at the start of each new budgeting period. Instead of asking "Where did my money go?", you’re asking "Where do I want my money to go?". This re-evaluation ensures that your financial plan is always aligned with your most current goals, rather than being dictated by historical spending habits. It’s a proactive, deliberate, and incredibly effective way to manage your finances, fostering a deep understanding of your financial flow.

Essential Components of Your Clean-Slate Financial Plan

Building your fresh-start budgeting framework requires a meticulous yet empowering inventory of your financial life. Every element plays a crucial role in constructing a robust and responsive financial blueprint that serves your objectives. This detailed breakdown allows for transparency and accountability, ensuring no dollar is left unaccounted for.

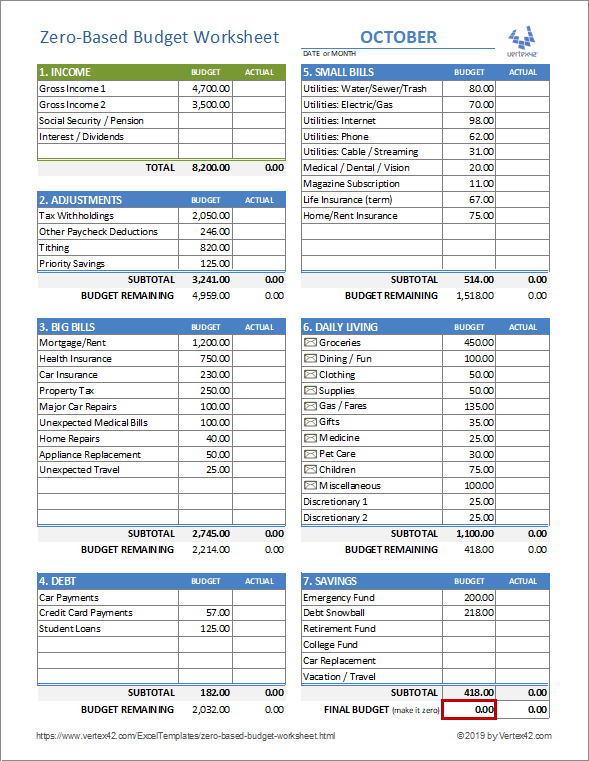

First, you’ll comprehensively list all income sources. This includes your regular salary, freelance earnings, passive income, and any other money flowing into your accounts during the budgeting period. Understanding your total available resources is the foundational step, providing the pool of money you will then strategically allocate. Don’t overlook smaller, less frequent income streams; every dollar counts when you’re building from zero.

Next, identify and detail your fixed expenses. These are the non-negotiable costs that generally remain the same each month, such as rent or mortgage payments, loan installments, insurance premiums, and subscription services. These form the bedrock of your spending commitments and must be accounted for first. Categorizing these allows you to see your essential recurring obligations clearly.

Following fixed expenses, you’ll tackle variable expenses. This category requires more active management and estimation. It includes costs like groceries, utilities (which fluctuate), transportation, dining out, and personal care. The clean-slate approach encourages you to scrutinize these categories with a fresh perspective, asking whether each expense is truly necessary and how much you genuinely need to allocate to it. This is where many individuals discover significant opportunities for savings and realignment.

Crucially, savings and debt repayment goals are treated not as afterthoughts, but as essential line items within your budget. Whether it’s building an emergency fund, saving for a down payment, or aggressively paying down high-interest debt, these financial priorities are given a specific job for your money. By allocating funds to them from the outset, you prioritize your future financial security and freedom alongside your current needs, making progress inevitable.

Implementing Your Zero-Based Budgeting Approach Step-by-Step

Adopting this powerful method might seem daunting at first, but with a structured approach, it becomes intuitive and incredibly rewarding. The Point Zero Budget Template guides you through each stage, ensuring you build a budget that is both comprehensive and actionable. Here’s a practical sequence to follow when creating your customized financial plan:

- Gather all income documentation: Start by compiling every source of income you anticipate for the upcoming budgeting period. This might include pay stubs, freelance invoices, interest statements, or any other regular or irregular income streams. Knowing your total incoming funds is the absolute first step.

- List fixed monthly expenses: Detail all your recurring, non-negotiable costs. Think mortgage/rent, car payments, insurance, loan repayments, and essential subscriptions. These are the expenses that have a set amount and often an unchanging due date, forming the backbone of your essential outgoings.

- Estimate and allocate for variable expenses: This step requires careful consideration. For categories like groceries, utilities, transportation, and discretionary spending, determine a realistic amount you *need* or *choose* to spend. Remember, you’re building from zero, so don’t just copy last month’s figures; justify each allocation.

- Prioritize savings and debt repayment: Before allocating to non-essential spending, designate specific amounts for your financial goals. Treat your emergency fund contribution, retirement savings, or debt snowball payments as mandatory expenses. This ensures you’re always progressing towards your long-term objectives.

- Assign every dollar a job: This is the fundamental principle of starting from zero. Once all income and expenses are listed, subtract your total expenses from your total income. The goal is for this difference to be zero. Every dollar must be assigned to an expense, a savings goal, or debt repayment. If you have a surplus, allocate it; if you have a deficit, re-evaluate your expenses.

- Track and review regularly: A budget is a living document, not a static plan. Throughout the month, track your actual spending against your allocated amounts. At the end of the budgeting period, review your performance. What worked well? Where did you overspend? Adjust your next clean-slate financial plan based on these insights. This continuous feedback loop is vital for long-term success.

The Transformative Benefits of Budgeting from Scratch

Embracing the Point Zero Budget Template offers more than just a new way to track money; it provides a pathway to profound financial transformation. The commitment to justify every expense cultivates a deeper relationship with your finances, leading to a host of tangible benefits. This methodical approach empowers you, moving you from passive observer to active manager of your financial destiny.

One of the most significant advantages is increased financial awareness and control. By scrutinizing every dollar, you gain an intimate understanding of where your money truly goes and why. This clarity replaces guesswork with concrete data, allowing you to make informed decisions rather than reactive ones. You become the master of your money, not its unwitting servant.

This heightened awareness naturally leads to reduced wasteful spending. When you’re forced to justify each expense, it becomes much harder to rationalize impulse purchases or subscriptions you no longer use. You’ll find yourself questioning whether certain expenditures genuinely align with your values and goals, often discovering areas where you can cut back without feeling deprived. This lean approach liberates funds for more impactful uses.

Furthermore, a fresh-start budgeting strategy significantly accelerates debt repayment and savings. By intentionally allocating funds to these categories from the start, they become non-negotiable priorities. You’re not just saving what’s left over; you’re proactively funding your future and chipping away at financial burdens. This deliberate action often leads to achieving financial milestones far quicker than with traditional budgeting methods.

The process also provides greater clarity on financial priorities. When you’re constantly evaluating where your money should go, your true financial goals emerge with precision. You identify what truly matters to you – whether it’s travel, education, early retirement, or giving back – and you build your budget around those aspirations. This alignment of money with purpose is incredibly empowering.

Finally, starting from zero fosters flexibility and adaptability. While it sounds rigid, the monthly (or bi-weekly) re-creation of your budget means you’re constantly adjusting to your current life circumstances. Did you get a raise? Did an unexpected expense pop up? Your clean-slate financial plan can be quickly updated to reflect these changes, ensuring your budget always serves your present reality, not a past one.

Customizing Your Personal Financial Blueprint

While the core principles of the Point Zero Budget Template remain consistent, its true power lies in its adaptability. This isn’t a one-size-fits-all straitjacket, but rather a flexible framework that you can mold to fit your unique life circumstances, income patterns, and specific financial aspirations. Tailoring the zero-based method ensures it remains practical and relevant for you.

For individuals with irregular income, customizing is crucial. Instead of budgeting monthly, you might budget for the next pay period, or even weekly, based on anticipated income. You could also build a "buffer" savings category to smooth out income fluctuations, treating it as an essential expense until it reaches a comfortable level. The key is to project income cautiously and allocate conservatively.

Different life stages also call for varied approaches. A student might focus heavily on tuition, books, and minimal living expenses, using the budget to minimize debt. A young professional might prioritize aggressive debt repayment and building an emergency fund. Families will naturally allocate more to housing, childcare, and groceries, while retirees might shift focus to healthcare, travel, and legacy planning. The clean-slate approach allows you to adjust your spending priorities as your life evolves, ensuring your budget always reflects your current season.

Integrating specific financial goals is where customization truly shines. If you’re saving for a down payment on a home, that allocation becomes a prominent "expense" in your budget. If you dream of an overseas trip, a dedicated travel fund takes precedence. This template ensures your aspirations are not just wishes but concrete, funded line items. By making these goals explicit parts of your spending plan, you’re actively working towards them with every dollar. The recurring nature of this budgeting style reinforces your commitment, helping you stay on track towards achieving what truly matters to you.

Frequently Asked Questions

Is the Point Zero Budget Template only for people in debt?

Absolutely not. While it’s incredibly effective for debt repayment, this clean-slate approach is beneficial for anyone seeking greater financial clarity, wanting to optimize their spending, or aiming to achieve specific savings goals. It helps you gain control, regardless of your current financial standing.

How often should I create a new zero-based budget?

Most experts recommend creating a fresh budget using the zero-based method at the beginning of each month. This allows you to account for monthly income, recurring bills, and any anticipated changes in spending. However, you can adjust this frequency based on your income cycle (e.g., bi-weekly) or whenever significant life events occur.

What if I can’t make my expenses equal my income with this template?

If your initial allocation results in more expenses than income, the zero-based budgeting approach highlights an important issue: you’re currently overspending. This is an opportunity to re-evaluate your allocations, prioritize essential expenses, and find areas to cut back, especially in discretionary spending. It might also prompt you to explore ways to increase your income.

Is this budgeting style too complicated for beginners?

While it requires more initial detail and thought than traditional budgeting, the clean-slate financial plan is remarkably straightforward once you grasp the core concept of “giving every dollar a job.” Many find that the initial effort pays dividends in clarity and financial control, making it well worth the learning curve for beginners.

Can I use this budget for my small business?

Yes, the principles of zero-based budgeting are highly applicable and widely used in business. It helps small businesses ensure every expense contributes to revenue generation or essential operations, fostering efficiency and preventing wasteful spending. The Point Zero Budget Template can be adapted to suit business financial planning effectively.

Taking control of your finances doesn’t have to feel like a perpetual struggle against an invisible force. With the clarity and intentionality provided by the Point Zero Budget Template, you have the power to transform your financial reality. It’s more than just a spreadsheet; it’s a philosophy that empowers you to align your money with your deepest values and most ambitious goals, giving every dollar a purpose and every decision meaning.

Embrace the liberating feeling of a financial fresh start. By committing to this powerful method, you’re not just budgeting; you’re actively designing your future, one purposeful dollar at a time. Don’t let old habits dictate your financial destiny. Take the step today to build a budget that truly serves you, bringing confidence, control, and peace of mind to your financial journey.