In a world brimming with financial apps and complex software, the quest for a simple, yet powerful, tool to manage personal finances often leads many down a path of subscription fees and steep learning curves. Yet, for millions of Apple users, a potent and entirely free solution lies readily available within their ecosystem: Apple Numbers. This versatile spreadsheet application offers an elegant, intuitive, and highly customizable environment perfect for crafting a robust personal budget, allowing you to take control of your money without the bloat.

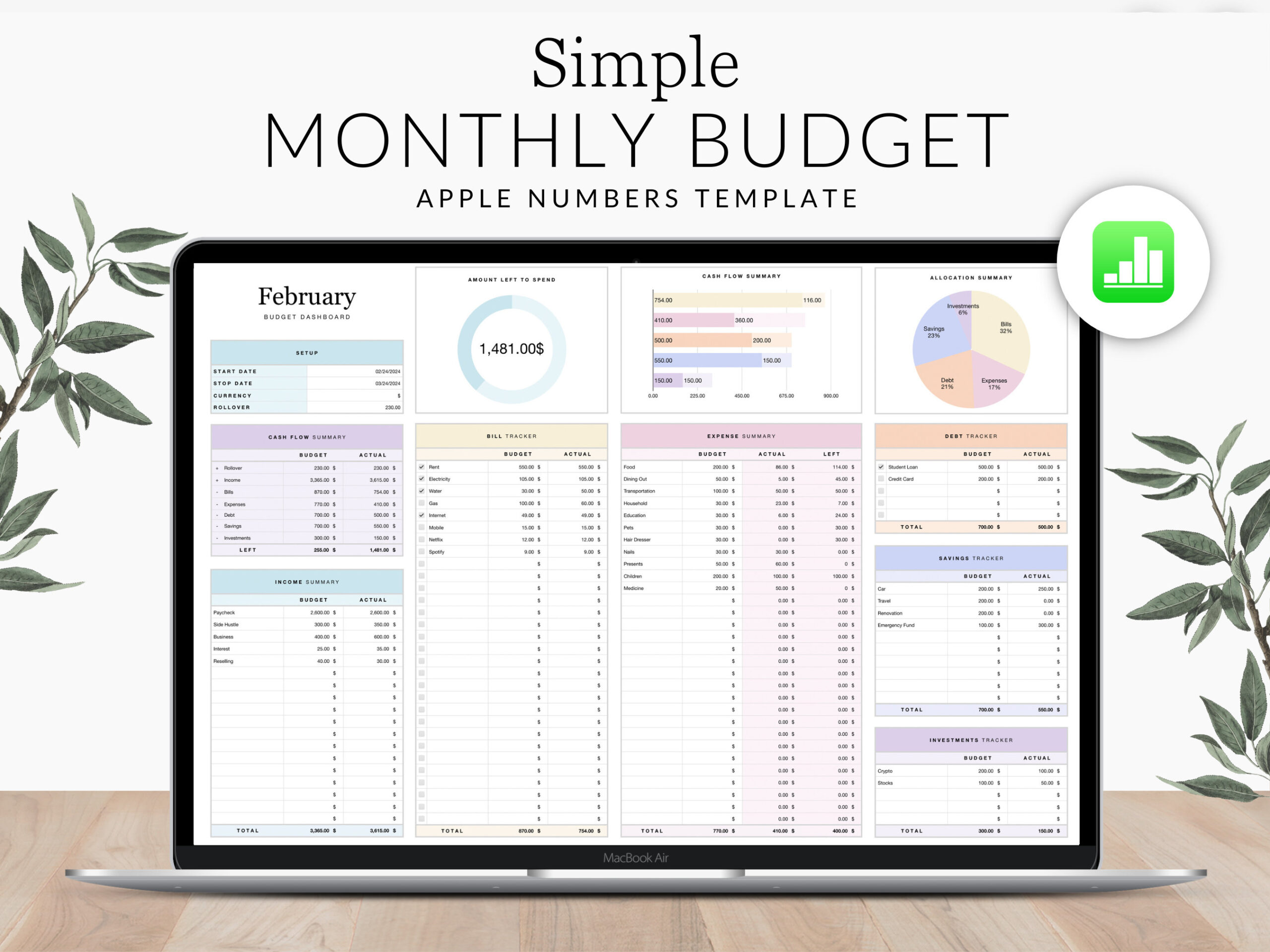

Imagine having a clear, visual representation of your financial landscape, accessible across all your Apple devices, from your Mac to your iPhone. This isn’t just about tracking expenses; it’s about understanding your spending habits, identifying areas for savings, and strategically planning for future goals. A well-designed Personal Budget Template In Numbers Apple empowers you to transform abstract financial data into actionable insights, providing clarity and peace of mind in your money journey.

Why Your Finances Deserve the Apple Touch

Apple Numbers isn’t just another spreadsheet program; it’s designed with the user experience firmly in mind, making it exceptionally well-suited for personal financial management. Its clean interface, powerful calculation capabilities, and seamless integration across macOS, iPadOS, and iOS devices set it apart. Unlike generic budgeting apps that might lock you into their predefined categories or display limitations, Numbers offers unparalleled flexibility.

One of its significant advantages is its visual appeal. Numbers allows you to create beautiful, easy-to-read tables and graphs that make analyzing your financial data not just bearable, but genuinely insightful. Conditional formatting can highlight overspending categories, while interactive charts can quickly show your progress toward savings goals. This visual clarity can be a powerful motivator, turning the often-daunting task of budgeting into an engaging and empowering process. Furthermore, being part of the Apple ecosystem means your budget is always with you, updated in real-time via iCloud, ensuring you have the latest financial snapshot whether you’re at your desk or on the go.

Getting Started: The Anatomy of a Budget in Numbers

Embarking on your budgeting journey with Apple Numbers begins with understanding the core components of any effective financial plan. While Numbers offers several pre-built templates, crafting your own or modifying one to fit your exact needs provides the most control. The fundamental elements you’ll want to include are income, fixed expenses, variable expenses, savings, and debt repayment. Each of these plays a crucial role in providing a complete picture of your financial health.

Think of your budget as a living document that needs to reflect your unique financial situation. Start by identifying all your sources of income, whether it’s your primary salary, freelance work, or other passive earnings. Next, list out all your fixed expenses – those costs that remain relatively constant each month, like rent or mortgage, car payments, insurance premiums, and subscription services. The true art of financial tracking often lies in managing variable expenses, which fluctuate from month to month, encompassing everything from groceries to entertainment and dining out. Finally, allocate specific amounts for savings and any debt repayment you are prioritizing.

Crafting Your Custom Budget Spreadsheet

Creating a truly effective budget spreadsheet in Apple Numbers involves more than just listing numbers; it requires thoughtful categorization and the strategic use of Numbers’ features to automate calculations and provide clear insights. This approach allows you to tailor the budget precisely to your lifestyle and financial goals.

Here’s a breakdown of the essential elements and how to incorporate them into your budget sheet:

- Income Sources: Create a section dedicated to all your earnings. This could include your monthly salary, any freelance income, or other miscellaneous earnings. Ensure you track both gross and net income if applicable, focusing on the net for budgeting purposes.

- Fixed Expenses: List all expenditures that remain consistent. Examples include rent or mortgage, loan payments (car, student), insurance premiums, and utility bills (if flat-rate). These are the non-negotiables that form the base of your monthly outgoing funds.

- Variable Spending: This is where most people find opportunities for adjustment. Categories here might include groceries, dining out, transportation costs (gas, public transit), entertainment, personal care, and clothing. Breaking these down helps identify where your money truly goes.

- Savings Goals: Dedicate clear lines for different savings objectives. This could be an emergency fund, a down payment fund for a house or car, retirement contributions, or vacation savings. Assigning specific amounts helps reinforce these priorities.

- Debt Repayment: If you have credit card debt or other loans beyond fixed payments, create a section to track these. This allows you to monitor additional payments and see your progress in reducing balances.

- Categorization and Subcategories: Don’t just list expenses; categorize them. Numbers’ ability to create hierarchical categories within tables (using Headers and Footer Rows) can make this very intuitive. For example, "Food" could have subcategories like "Groceries" and "Restaurants."

- Formulas and Automation: Leverage Numbers’ robust formula capabilities. Use

SUM()to total categories,IF()statements for conditional logic, and simple subtraction to calculate your remaining balance. Conditional formatting can be particularly powerful, automatically coloring cells red if you exceed a budget in a category or green if you are under budget.

By thoughtfully laying out these sections and utilizing Numbers’ functions, you transform a basic table into a dynamic financial tool, a truly personalized budget template in Apple Numbers.

Advanced Tips for Mastering Your Money with Apple Numbers

Once you’ve established your basic budget framework, Numbers offers a wealth of features to deepen your financial insights and streamline your tracking process. Moving beyond simple entry, you can turn your budgeting tool into a comprehensive financial dashboard.

One powerful technique is to leverage Numbers’ multiple sheet capabilities. You can create a new sheet for each month, allowing you to easily compare spending patterns month-over-month and track progress throughout the year. Another sheet could be dedicated to long-term financial goals, like a house down payment or retirement savings, with formulas pulling data from your monthly budget to show cumulative progress. Visualizing this data is where Numbers truly shines. Utilize its chart features to create compelling graphs that illustrate your spending distribution, income vs. expenses, or savings growth. A pie chart of your variable expenses can quickly highlight where you might be overspending, while a line graph can show your net worth trend over time. Consider using categories for detailed analysis; Numbers allows you to create tables that automatically summarize data based on categories, providing instant insights without manual calculations. For those who track every transaction, using forms within Numbers can make data entry quicker and more consistent, especially on an iPad or iPhone. Remember to review your budget regularly, ideally at the end of each week or bi-weekly, to log transactions and assess your current standing. This frequent engagement keeps you informed and allows for timely adjustments.

The Power of Consistency: Making Budgeting a Habit

Creating a detailed budgeting sheet in Apple Numbers is a fantastic first step, but its true power is unlocked through consistent engagement. Budgeting isn’t a one-time task; it’s an ongoing practice that evolves with your life and financial situation. Think of your Numbers budgeting solution as a fitness tracker for your money – it only works if you use it regularly.

The discipline of logging every transaction, no matter how small, is crucial. This can be done daily or a few times a week, whatever fits your routine best. This consistent tracking reveals where your money actually goes, contrasting it with where you think it goes. Over time, you’ll identify patterns, discover spending leaks, and develop a more mindful approach to your purchases. Furthermore, life rarely stands still. Your income might change, new expenses arise, or your financial goals shift. A flexible budget in Apple Numbers allows you to easily adjust categories, amounts, and priorities as needed. Regularly review your progress, perhaps at the end of each month, to celebrate successes and identify areas for improvement. This iterative process of tracking, reviewing, and adjusting is what truly transforms your financial outlook, leading to greater financial security and confidence.

Frequently Asked Questions

Is Apple Numbers Free to Use?

Yes, Apple Numbers is free for anyone who owns an Apple device (Mac, iPad, iPhone). It comes pre-installed on new devices or can be downloaded for free from the App Store.

Can I Share My Budget Spreadsheet with Others?

Absolutely. Apple Numbers fully supports collaboration. You can share your budget spreadsheet via iCloud with family members or financial advisors, allowing multiple people to view or edit the document in real-time, even across different Apple devices.

What if I’m New to Spreadsheets?

Numbers is designed to be very user-friendly, even for spreadsheet novices. Its intuitive interface, pre-built templates, and clear visual cues make it less intimidating than other spreadsheet programs. There are also numerous tutorials and guides available online to help you get started.

How Often Should I Update My Budget?

For optimal results, aim to log your transactions at least a few times a week, or even daily if your spending is frequent. A comprehensive review of your budget and financial standing should be conducted monthly to assess progress and make any necessary adjustments for the upcoming period.

Can Numbers Connect to My Bank Account?

No, Apple Numbers does not have direct integration with bank accounts for automatic transaction syncing. You will need to manually enter your transactions, or in some cases, you might be able to export your bank statement data (often as a CSV file) and import it into your Numbers spreadsheet for easier entry.

Taking control of your finances doesn’t have to be an overwhelming or expensive endeavor. With the power and flexibility of a personal budget template in Numbers Apple, you have an incredibly capable tool at your fingertips, ready to be customized to your unique needs and goals. It offers a transparent, visual, and accessible way to understand where your money goes, empowering you to make informed decisions that align with your financial aspirations.

Embrace the simplicity and elegance of Numbers to build a financial foundation that stands the test of time. Start today by organizing your income and expenses, setting clear savings targets, and watching your financial picture become clearer and more manageable with each entry. Your journey to financial clarity and empowerment begins with that first organized cell in your Apple Numbers budget sheet.