Understanding your finances can often feel like navigating a complex maze, a journey many embark on with a simple budget as their sole compass. While budgeting is undoubtedly a cornerstone of sound financial management, it primarily offers a snapshot of your cash flow – where your money comes from and where it goes. To truly grasp your financial standing, to see the bigger picture of your wealth, you need a different lens, one that captures everything you own and everything you owe. This is precisely where a Personal Balance Sheet Spreadsheet Template For Budget becomes an indispensable tool.

This comprehensive financial instrument moves beyond just income and expenses, painting a clear, static portrait of your financial health at any given moment. It’s the difference between knowing your monthly salary and rent payment, and understanding your net worth, the true measure of your accumulated wealth. For anyone serious about building a robust financial future, gaining clarity on assets versus liabilities is not just beneficial; it’s essential.

Understanding Your Financial Snapshot: Beyond the Budget

Many individuals diligently track their monthly income and outgoings, a practice foundational to controlling spending and saving. However, a budget alone doesn’t reveal the full scope of one’s financial reality. It tells you if you’re living within your means, but it doesn’t show your financial position if you were to liquidate everything today.

This is where the concept of a personal financial statement, often referred to as a net worth statement or personal balance sheet, becomes crucial. It’s a statement of what you own (assets) versus what you owe (liabilities), with the difference being your net worth. This figure is the real barometer of your financial progress over time.

Why a Personal Balance Sheet is a Game-Changer

Think of your personal balance sheet as your financial GPS. It shows you exactly where you are, making it easier to plot a course to where you want to be. It complements your budget by providing context, helping you understand how your monthly financial decisions impact your overall wealth accumulation.

This powerful financial health tool offers unparalleled clarity. It can highlight areas where you might be asset-rich but cash-poor, or conversely, show how high debt levels are eroding your net worth. Understanding these dynamics is the first step toward making informed decisions about investments, debt repayment, and long-term financial planning.

Key Components of Your Financial Well-being Tool

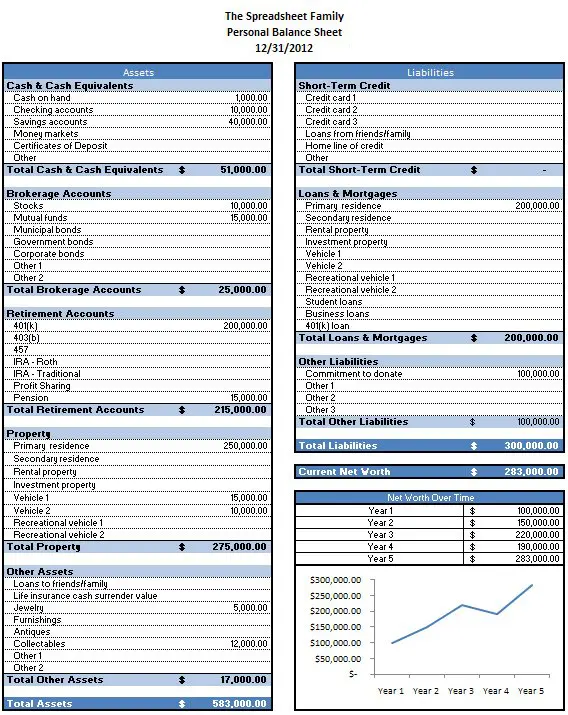

A personal balance sheet template typically organizes your financial information into two primary categories: assets and liabilities. The beauty of a well-designed spreadsheet template is its ability to automatically calculate your net worth once these figures are entered.

Your assets are everything you own that has monetary value. These can be broken down further:

- Liquid Assets: Easily convertible to cash, such as checking accounts, savings accounts, and money market funds.

- Investment Assets: Holdings intended to grow over time, including stocks, bonds, mutual funds, retirement accounts (401k, IRA), and brokerage accounts.

- Real Estate: The fair market value of your primary residence, vacation homes, or investment properties.

- Personal Property: Valuables like vehicles, jewelry, art, and other significant possessions. While it’s tempting to overvalue these, a realistic assessment is key.

Your liabilities represent everything you owe to others. These too can be categorized:

- Short-Term Liabilities: Debts due within a year, such as credit card balances, medical bills, and personal loans.

- Long-Term Liabilities: Debts due beyond a year, predominantly mortgages, student loans, and auto loans.

The difference between your total assets and total liabilities is your net worth. A positive net worth indicates that you own more than you owe, while a negative net worth means the opposite.

Leveraging the Spreadsheet Template for Practical Use

Implementing a personal balance sheet spreadsheet template for budget monitoring and overall financial assessment is surprisingly straightforward. The template acts as a structured framework, guiding you through the process of compiling your financial data systematically.

Here’s a practical approach to using this financial planning tool:

- Gather Your Data: Collect statements for all bank accounts, investment portfolios, credit cards, loans, and any other financial accounts. Estimate the fair market value of real estate and significant personal property.

- Populate the Template: Enter each asset and liability into its corresponding category within the personal financial statement spreadsheet. Be as accurate as possible.

- Review Your Net Worth: Once all data is entered, the template will automatically calculate your total assets, total liabilities, and your net worth. This figure is your financial snapshot.

- Analyze and Strategize: Look at the trends. Is your net worth growing? Where are your biggest assets? Where is your most significant debt? This analysis informs your budgeting and investment decisions. For instance, you might decide to allocate more funds to paying down high-interest debt or increasing contributions to investment accounts.

- Regular Updates: Treat this as a living document. Updating it quarterly or at least annually is crucial to track progress and adjust your financial strategies.

Beyond simply tracking income and expenses, employing a robust Personal Balance Sheet Spreadsheet Template For Budget allows for a deeper, more strategic approach to financial well-being. It empowers you to see the aggregate effect of your financial decisions over time.

Customization and Maintenance: Making It Yours

One of the greatest advantages of a personal wealth management spreadsheet is its adaptability. You can customize the categories to fit your specific financial situation, adding or removing lines for particular types of assets or liabilities that are relevant to you. Perhaps you have a unique asset like intellectual property or a less common debt like a lien; a spreadsheet allows for easy modification.

Maintaining your financial health tracker requires consistency. While daily or weekly updates aren’t necessary for a balance sheet (that’s more for budgeting), a quarterly review is highly recommended. This allows you to:

- Track Progress: See how your net worth is changing over time. Are you getting closer to your financial goals?

- Identify Trends: Notice if certain assets are growing faster than others, or if your debt is accumulating unexpectedly.

- Make Adjustments: Use the insights to modify your budget, investment strategy, or debt repayment plan. Perhaps you realize you have too much cash sitting idle or too much high-interest credit card debt.

- Stay Accountable: Regular check-ins foster financial discipline and keep your long-term goals in focus.

This proactive engagement ensures that your financial snapshot remains an accurate and dynamic reflection of your wealth, rather than a static piece of data.

Frequently Asked Questions

What’s the difference between a budget and a balance sheet?

A budget is a forward-looking plan for your income and expenses over a specific period, typically a month, focused on cash flow. A personal balance sheet, conversely, is a snapshot of your financial position at a single point in time, detailing what you own (assets) and what you owe (liabilities) to calculate your net worth.

How often should I update my personal financial statement?

While a budget is usually updated monthly, a personal balance sheet can be updated less frequently. A quarterly update is ideal for tracking progress and making timely adjustments to your financial strategy, though annual updates are also beneficial for reviewing overall growth.

Do I need special software for this template?

Most personal balance sheet spreadsheet templates are designed for common spreadsheet programs like Microsoft Excel, Google Sheets, or Apple Numbers. You typically don’t need specialized financial software; these widely available applications are more than sufficient.

Can this tool help with long-term financial planning?

Absolutely. By consistently tracking your net worth, you gain a clear understanding of your financial trajectory. This insight is invaluable for setting long-term goals, such as saving for retirement, a down payment on a home, or funding education, and helps you assess your progress towards them.

What if my net worth is negative?

A negative net worth means your liabilities exceed your assets, which is common for younger individuals or those with significant student loan debt or a new mortgage. It’s a starting point, not a failure. The value of this financial reporting tool is to provide clarity so you can develop strategies to increase assets and decrease liabilities over time, moving towards a positive net worth.

Embracing a Personal Balance Sheet Spreadsheet Template For Budget is more than just an accounting exercise; it’s a strategic move toward financial empowerment. It shifts your perspective from merely managing monthly cash flow to actively building and monitoring your wealth. By regularly assessing your assets and liabilities, you gain the foresight needed to make astute financial decisions that align with your long-term aspirations.

This valuable financial instrument equips you with a powerful overview, highlighting your progress and pointing out areas needing attention. Whether you’re aiming to pay off debt, save for a major purchase, or grow your investment portfolio, a clear understanding of your net worth is your strongest ally. Start leveraging this tool today, and take a significant step toward achieving a more secure and prosperous financial future.