In today’s data-driven landscape, the security of sensitive information is paramount for any organization. Among the myriad data points a business handles, payroll information stands out as exceptionally delicate, encompassing not just financial figures but also personal employee data that, if exposed, could lead to severe consequences. Protecting this information isn’t merely good practice; it’s a fundamental obligation that underpins trust, maintains legal compliance, and safeguards the financial and reputational integrity of a company. The proper management of payroll data requires robust policies and enforceable agreements, which is where a well-crafted payroll confidentiality agreement template becomes an indispensable tool.

For HR professionals, business owners, and legal teams alike, having a reliable framework to ensure the privacy of payroll data is a non-negotiable aspect of operational security. This document serves as a clear statement of expected conduct, outlining the responsibilities of anyone with access to such sensitive details. By clearly defining what constitutes confidential information and the obligations of those handling it, businesses can proactively mitigate risks, prevent unauthorized disclosures, and establish a culture of discretion within the workplace. Understanding the nuances and critical components of such an agreement is key to building a resilient data protection strategy.

The Imperative of Documented Understanding in Modern Business

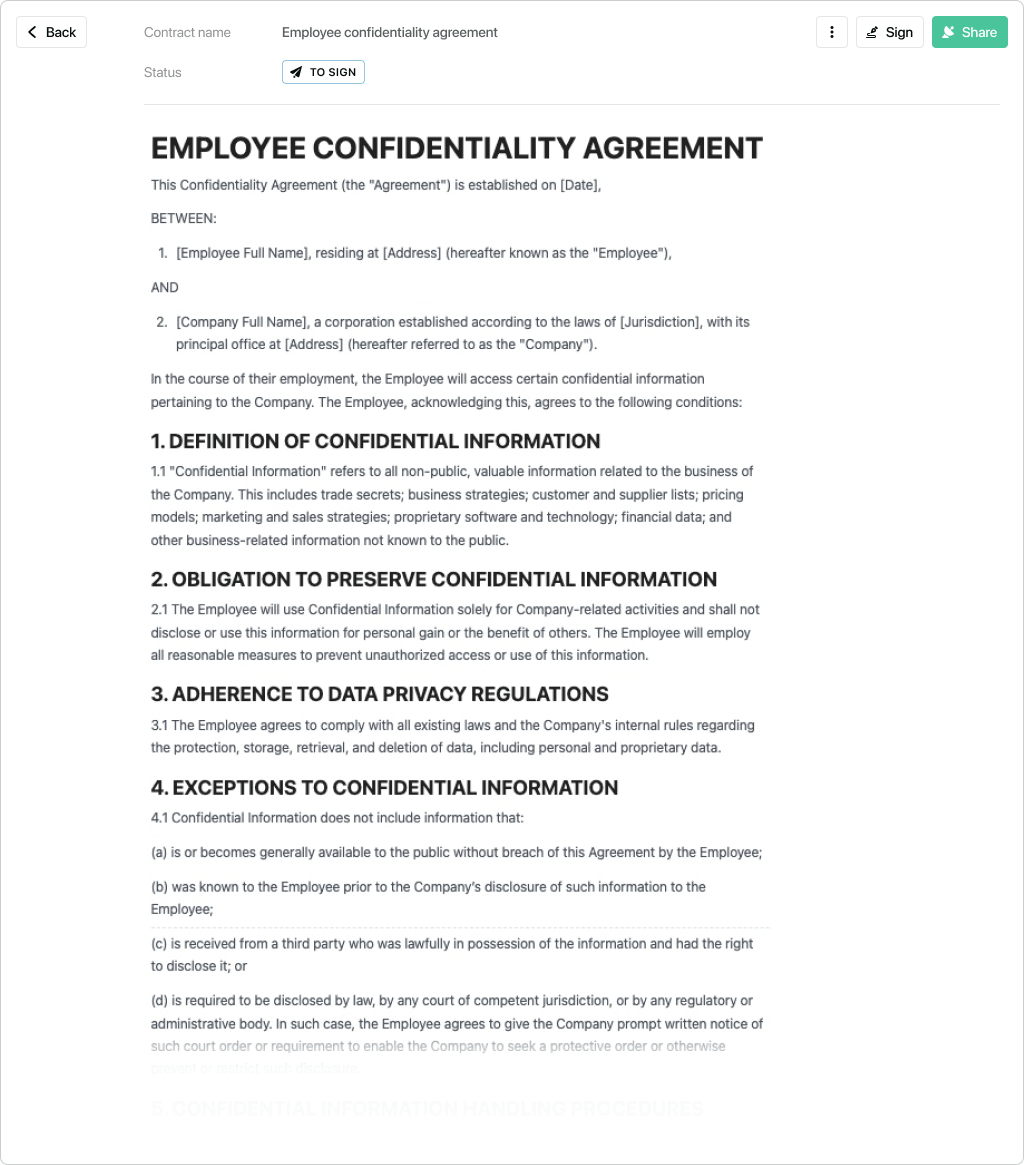

The pace of modern business, coupled with an increasingly remote workforce and complex digital infrastructures, has amplified the need for explicit, written agreements. Verbal understandings, however well-intentioned, simply don’t offer adequate protection when it comes to sensitive data like payroll. Legal landscapes are constantly evolving, with stricter data privacy regulations (such as those concerning personally identifiable information, or PII) making businesses more accountable than ever before. A clear, written agreement provides an unambiguous reference point, minimizing misinterpretations and leaving no room for doubt regarding confidentiality obligations.

Beyond legal compliance, a formalized document establishes a professional standard within the organization. It signals to employees the seriousness with which the company treats sensitive information and the importance of their role in its protection. This isn’t just about safeguarding the company; it’s also about protecting employees themselves from potential identity theft or financial fraud that could arise from a data breach. In an era where data breaches can lead to astronomical fines, loss of consumer trust, and significant reputational damage, relying on a comprehensive and written payroll confidentiality agreement is not just an option, but a critical necessity for any forward-thinking enterprise.

Safeguarding Interests: Benefits of a Structured Agreement

Implementing a robust confidentiality agreement offers a multitude of benefits, extending protection to the company, its employees, and even third-party vendors who might handle payroll data. Firstly, it creates a legally enforceable framework that deters unauthorized disclosure. Employees or contractors who sign such an agreement are fully aware of the consequences should they breach its terms, providing a strong incentive for compliance. This proactive measure helps prevent data leaks before they occur, saving businesses from potentially catastrophic financial and legal repercussions.

Moreover, a standardized payroll confidentiality agreement template helps maintain consistency across the organization. Every individual with access to payroll data, regardless of their role or tenure, operates under the same defined terms and conditions. This uniformity simplifies training, ensures equitable treatment, and streamlines enforcement should a breach occur. It also protects the company’s proprietary information, such as salary structures, bonus schemes, or benefits packages, which could be exploited by competitors if revealed. Ultimately, such an agreement strengthens the company’s overall security posture, reinforcing trust among employees and stakeholders while providing a clear recourse in the unfortunate event of a breach.

Tailoring the Template for Diverse Operational Needs

One of the significant advantages of using a well-designed payroll confidentiality agreement template is its inherent adaptability. While the core principles of confidentiality remain universal, the specific details and scope of protection may need to vary considerably depending on the industry, the size of the organization, and the particular roles involved. A small startup, for instance, might have different concerns than a large multinational corporation. Similarly, the agreement for an HR manager with full access to all payroll records will differ from that of a temporary contractor processing only specific data sets.

The template should be flexible enough to accommodate these nuances. Businesses in highly regulated sectors, such as healthcare or finance, may need to incorporate specific clauses related to industry-specific data protection acts (e.g., HIPAA for healthcare). Companies dealing with international employees might need to consider cross-border data transfer implications. Customization can involve adding specific examples of confidential information relevant to the business, adjusting the duration of the confidentiality obligations, or specifying different dispute resolution mechanisms. This ensures that the agreement is not just a generic document, but a precise tool tailored to the unique operational and legal landscape of each organization, maximizing its effectiveness and relevance.

Core Components: Essential Clauses for Every Agreement

A comprehensive payroll confidentiality agreement must contain several key clauses to be effective and legally sound. These elements define the scope, obligations, and consequences, providing a clear roadmap for all parties involved.

- Definition of Confidential Information: This is perhaps the most critical clause. It explicitly defines what constitutes "confidential payroll information," leaving no ambiguity. This typically includes salaries, bonuses, commissions, employee benefits, tax information, social security numbers, bank account details, performance-related pay, and any other non-public personal or financial data related to employees.

- Obligations of the Recipient: This section outlines the specific duties of the individual receiving or accessing the confidential information. It usually includes commitments to keep the information strictly confidential, not to disclose it to unauthorized third parties, to use it only for approved business purposes, and to take reasonable measures to protect it from unauthorized access or disclosure.

- Exclusions from Confidentiality: It’s important to specify what information is not considered confidential, such as information already publicly known, independently developed by the recipient, or legally required to be disclosed (e.g., by court order or government regulation). This protects the recipient from liability for information that doesn’t genuinely require protection.

- Duration of Confidentiality: This clause specifies how long the confidentiality obligations last. It may be for the duration of employment and for a specified period thereafter, or, for extremely sensitive data, perpetually.

- Return or Destruction of Confidential Information: Upon termination of employment or the cessation of access, this clause mandates the return or certified destruction of all confidential payroll information, including physical and digital copies.

- Remedies for Breach: This section details the consequences of breaching the agreement. It often includes provisions for injunctive relief (to stop further unauthorized disclosure), monetary damages, and attorney’s fees. It may also state that a breach could result in disciplinary action up to and including termination of employment.

- Governing Law: This specifies which state’s laws will govern the interpretation and enforcement of the agreement, typically the state where the company is headquartered or where the employee primarily works.

- Severability: This clause ensures that if any part of the agreement is found to be unenforceable, the remaining provisions will still stand.

- Entire Agreement: This states that the document constitutes the entire agreement between the parties regarding confidentiality, superseding any prior discussions or understandings.

Optimizing Presentation for Accessibility and Clarity

Beyond the legal substance, the practical presentation and layout of the agreement play a crucial role in its effectiveness. An agreement that is difficult to read or understand is less likely to be fully absorbed, increasing the risk of unintended non-compliance. Therefore, practical tips for formatting, usability, and readability are essential, whether the document is for print or digital use.

- Clear and Concise Language: Avoid overly complex legal jargon where possible. The language should be precise but accessible, ensuring that individuals from various educational backgrounds can understand their obligations without needing legal interpretation.

- Logical Structure and Headings: Use clear headings and subheadings (like the clauses listed above) to break up the text. This improves navigability and allows readers to quickly locate specific provisions. Numbered paragraphs or bullet points enhance readability, especially for lists of obligations or definitions.

- Adequate White Space: Don’t cram too much text onto a page. Ample white space around paragraphs and sections makes the document less intimidating and easier on the eyes.

- Legible Font and Size: Choose a professional, easy-to-read font (e.g., Arial, Calibri, Times New Roman) in a size that is comfortable for most readers (10-12 point for body text).

- Consistent Formatting: Maintain consistent use of bolding, italics, and paragraph spacing throughout the document. Consistency lends a professional appearance and helps readers track information.

- Digital Accessibility: If the agreement will primarily be distributed digitally, ensure it is in a common, accessible format like PDF. Consider adding a table of contents with clickable links for longer documents to improve navigation.

- Signature Lines: Provide clear signature lines for all parties involved, including spaces for printed names, titles, and dates. This formality underscores the agreement’s legal weight.

In an environment where data breaches are increasingly common and the repercussions more severe, a well-implemented payroll confidentiality agreement template is more than just a piece of paper; it’s a foundational pillar of an organization’s security infrastructure. It provides a clear, legally sound framework that protects the sensitive financial and personal information of employees, while simultaneously safeguarding the company’s own proprietary data and reputation.

Leveraging a thoughtfully designed payroll confidentiality agreement template allows businesses to quickly deploy robust data protection policies without reinventing the wheel. It represents a professional, time-saving solution that ensures consistency, minimizes legal risks, and fosters a culture of trust and responsibility regarding sensitive information. By investing in such a crucial document, companies are not just complying with regulations; they are proactively building a more secure and resilient future for their operations and their people.