In the complex landscape of personal and business finance, certain documents stand as critical junctures, pivotal to transactions, and absolutely essential for clarity and closure. Among these, the payoff letter holds a uniquely significant position. It is far more than just a piece of correspondence; it’s a definitive statement of an outstanding debt, detailing the precise amount required to satisfy an obligation in full on a specific date. Whether you’re refinancing a home, selling a vehicle, consolidating loans, or simply aiming to achieve financial freedom by clearing a specific debt, obtaining an accurate payoff letter is a non-negotiable step.

The seemingly straightforward request for this information can sometimes be fraught with potential pitfalls if not handled correctly. An improperly requested or misunderstood payoff amount can lead to costly delays, additional interest charges, or even legal complications. This is why having a reliable framework—a meticulously structured payoff letter template—becomes an invaluable asset for borrowers, lenders, escrow officers, real estate professionals, and anyone navigating significant financial transactions. It ensures that all necessary information is requested, conveyed clearly, and understood unambiguously by all parties involved, paving the way for smooth and successful debt resolution.

The Imperative of Precision in Financial Correspondence

In today’s fast-paced digital and financial world, the stakes for accurate and professional communication have never been higher, especially when dealing with financial obligations. Errors or ambiguities in documents like a payoff letter can have far-reaching consequences, from jeopardizing a real estate closing to impacting credit scores or incurring unexpected fees. A poorly structured or incomplete request might delay a lender’s response, or worse, result in an inaccurate payoff amount, leading to further complications down the line.

Clarity, conciseness, and accuracy are paramount. Professionalism in written communication reflects reliability and attention to detail, which are highly valued traits in any business transaction. For financial correspondence, this isn’t just about good manners; it’s about minimizing risk and ensuring legal and financial integrity. A well-crafted request helps ensure the recipient understands precisely what is needed, facilitating a prompt and correct response.

Advantages of a Standardized Financial Request Document

Utilizing a pre-designed payoff letter template offers a multitude of benefits that streamline the often-stressful process of settling debts. First and foremost, it significantly reduces the likelihood of crucial omissions. A robust template acts as a checklist, ensuring that all necessary details—such as account numbers, borrower information, and the specific date for which the payoff amount is required—are included in the initial request. This proactive approach minimizes back-and-forth communication, saving valuable time for both the sender and the recipient.

Beyond mere completeness, a standardized document promotes consistency. For businesses or individuals who frequently need to request payoff figures, a consistent format projects an image of professionalism and efficiency. It also simplifies internal processes, allowing for quicker generation of requests and easier tracking. Moreover, a well-structured template can help mitigate legal risks by ensuring that the request conforms to common industry standards and clearly articulates the intent and parameters of the payoff. This foundation of clarity and consistency makes the entire process smoother, faster, and less prone to costly mistakes.

Adapting Your Request for Different Financial Scenarios

While the core purpose of a payoff letter template remains consistent—to accurately determine the outstanding balance of a debt—its application can vary significantly depending on the specific financial instrument and the transaction’s context. Customizing your template ensures that your request is perfectly tailored to the unique demands of each situation, leading to a more efficient and accurate response from the financial institution.

For instance, requesting a mortgage payoff letter for a home sale or refinance will require specific details related to escrow companies, closing dates, and potentially wire transfer instructions for the new lender. An auto loan payoff, on the other hand, might focus more on vehicle identification numbers (VINs) and instructions for releasing the lien to the new owner or directly to the borrower. A personal loan or credit card payoff may simply need the account number and the desired payoff date. The template can be adjusted to include fields for:

- Loan Type Specifics: Adding prompts for VINs for auto loans, property addresses and legal descriptions for mortgages, or specific credit card numbers.

- Transaction Purpose: Clearly stating if the payoff is for a sale, refinance, early settlement, or consolidation, as this might influence the lender’s response process.

- Recipient of Funds: Specifying whether the payoff funds will come from an escrow company, a new lender, or the borrower directly, and providing the relevant contact information for the entity making the payment.

- Delivery Instructions: Indicating if the payoff statement should be sent via email, postal mail, fax, or made available through an online portal, and to whom.

By customizing the payoff letter template, you ensure that every detail relevant to your unique situation is communicated effectively, preventing delays and ensuring a precise final figure.

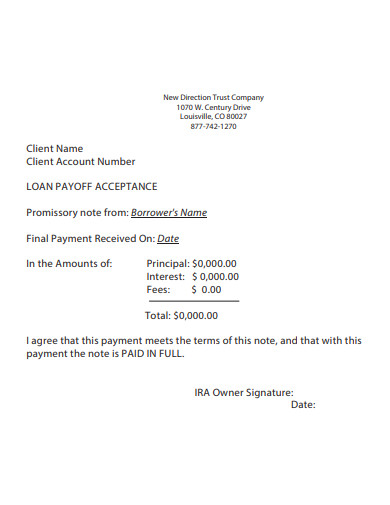

Essential Elements of a Comprehensive Payoff Request

To ensure your request for a payoff letter is unambiguous and yields all the necessary information, certain key components must always be included. Omitting even one critical detail can lead to delays or an incomplete response, impacting your financial transaction. A robust payoff letter template will incorporate dedicated sections for each of these elements:

- Sender’s Contact Information:

- Your full legal name

- Current mailing address

- Phone number

- Email address

- Date of Request:

- The exact date the letter is being written.

- Recipient’s Contact Information:

- The financial institution’s full name (e.g., bank, credit union, loan servicer).

- The correct department (e.g., "Payoff Department," "Loan Servicing").

- Their full mailing address.

- Subject Line:

- A clear and concise subject line, such as "Request for Payoff Letter – Account # [Your Loan Account Number]".

- Borrower’s Details:

- Full legal name(s) as they appear on the loan agreement.

- Loan account number(s).

- Any other identifying information (e.g., Social Security Number, last four digits; property address for mortgage loans; VIN for auto loans).

- Specific Payoff Date:

- Crucially, the exact future date for which you require the payoff amount to be calculated. This accounts for accrued interest.

- Purpose of Request (Optional but Recommended):

- Briefly state the reason for the payoff request (e.g., "to facilitate a refinance," "for the sale of the property," "to fully satisfy the loan").

- Required Information from Lender:

- The exact payoff amount for the specified date.

- Per diem interest amount (daily interest charge).

- Any unapplied funds, escrow balance, or late fees.

- Instructions for remitting the payoff funds (e.g., wire transfer details, mailing address for checks).

- Information regarding lien release procedures (e.g., how and when the lien will be released after payoff).

- Signature:

- Your physical signature (for printed versions) or an electronic signature (for digital submissions), followed by your typed name.

Crafting Clear and Professional Communication

Beyond the essential content, the tone, formatting, and overall presentation of your payoff letter significantly influence its effectiveness. A professional appearance instills confidence and ensures your request is taken seriously, whether you’re submitting it digitally or as a physical document.

When it comes to tone, aim for formal, polite, and direct language. Avoid colloquialisms or overly casual phrasing. The message should be clear, concise, and leave no room for misinterpretation. State your request explicitly, provide all necessary details, and maintain a respectful tone throughout. Remember, you are requesting critical information, so professionalism is key to fostering a cooperative response.

Formatting plays a vital role in readability. For both digital and printable versions, ensure a clean layout with adequate white space. Use a standard, easily readable font (e.g., Arial, Times New Roman, Calibri) at a comfortable size (10-12 points). Headings and subheadings can improve navigation, though in a concise letter, clear paragraph breaks often suffice. Use consistent spacing between paragraphs and before your signature block.

For digital submissions, save your document in a widely accessible format like PDF to preserve formatting across different systems. If sending via email, ensure the subject line is clear and descriptive, matching the subject line within your letter. For printable versions, use good quality paper and ensure the print is clear and legible. Always keep a copy of the sent letter for your records, along with any confirmation of delivery or response received. This meticulous attention to detail underscores the importance of the communication and supports a smooth transaction.

Navigating the complexities of financial transactions often hinges on the clarity and accuracy of foundational documents. The payoff letter template serves as an indispensable tool, transforming what could be a source of stress and delay into a streamlined, efficient process. By providing a structured framework, it empowers individuals and businesses to make precise requests, ensuring all critical data points are addressed from the outset.

The investment in using a well-designed payoff letter template pays dividends in saved time, reduced errors, and ultimately, greater peace of mind. It reinforces a commitment to professional communication and safeguards against financial missteps, enabling smoother closures on loans and successful progress toward financial goals. In an era where efficiency and accuracy are paramount, leveraging such a polished and reliable template is not just a convenience—it’s a strategic advantage in managing your financial future.