In the intricate dance of modern commerce, where transactions span continents and services are rendered with increasing complexity, the clarity of financial expectations is paramount. Businesses, freelancers, and consultants alike frequently grapple with misunderstandings, late payments, or outright disputes arising from vaguely defined payment arrangements. Without a robust framework guiding financial interactions, even the most promising partnerships can sour, leading to lost time, strained relationships, and significant financial setbacks. This is precisely where a robust payment terms agreement template becomes invaluable, serving as the bedrock for clear, enforceable, and mutually understood financial commitments.

This essential document is far more than mere boilerplate; it’s a strategic asset for anyone engaging in business transactions. It provides a definitive blueprint for how and when money will exchange hands, safeguarding the interests of both the service provider/seller and the client/buyer. For US businesses navigating the nuances of contract law and striving for operational efficiency, understanding, utilizing, and customizing such a template is not just good practice—it’s a critical component of risk management and sustainable growth.

The Imperative of Documented Financial Arrangements

In today’s fast-paced business environment, relying on verbal agreements or casual emails for payment terms is a gamble no professional should take. The complexities of transactions, coupled with evolving legal landscapes, necessitate a formal, written record of all financial understandings. This documentation provides a clear audit trail, offering undeniable proof of agreed-upon conditions should any questions or disagreements arise.

A comprehensive agreement minimizes ambiguity, ensuring that all parties are explicitly aware of their financial obligations and rights. It sets a professional tone from the outset, signaling a commitment to transparency and adherence to agreed-upon terms. This proactive approach significantly reduces the likelihood of costly legal disputes, preserving valuable business relationships and resources that would otherwise be spent on mediation or litigation.

Unlocking Clarity and Protection with a Robust Framework

The strategic use of a well-structured agreement template offers a multitude of benefits, extending far beyond simply stating "when to pay." It acts as a comprehensive shield, protecting your business interests while fostering trust with your clients. By clearly outlining all financial aspects, it mitigates the risk of late payments, which can severely impact cash flow and operational stability.

Furthermore, a well-defined document provides legal enforceability, giving you recourse if a client fails to uphold their end of the bargain. It establishes the groundwork for handling unforeseen circumstances, delineating responsibilities and expectations in a systematic manner. In essence, a well-structured payment terms agreement template goes beyond mere formality; it’s a proactive measure that underpins financial security and operational predictability.

Adapting Your Agreement for Diverse Business Needs

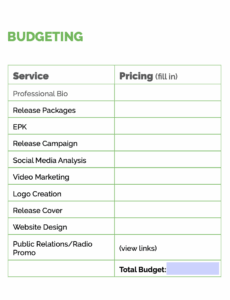

One of the most significant advantages of utilizing a template is its inherent adaptability. While a core structure remains consistent, the specifics of payment terms can vary dramatically across industries and business models. A freelancer might require an upfront deposit and milestone payments, whereas a product-based business may rely on Net-30 or Net-60 terms for wholesale orders.

The versatility of a good payment terms agreement template allows for easy customization to fit these diverse scenarios. Whether you’re a marketing agency, a software developer, a manufacturer, or a consultant, the template serves as a dynamic starting point. You can adjust clauses relating to payment schedules, late fees, scope changes, and deliverables to align precisely with your unique services, product offerings, and client expectations, ensuring the document remains relevant and effective.

Core Components of a Comprehensive Payment Agreement

Every robust payment agreement, irrespective of industry, should contain certain fundamental clauses to ensure clarity and legal soundness. These essential sections form the backbone of your financial understanding:

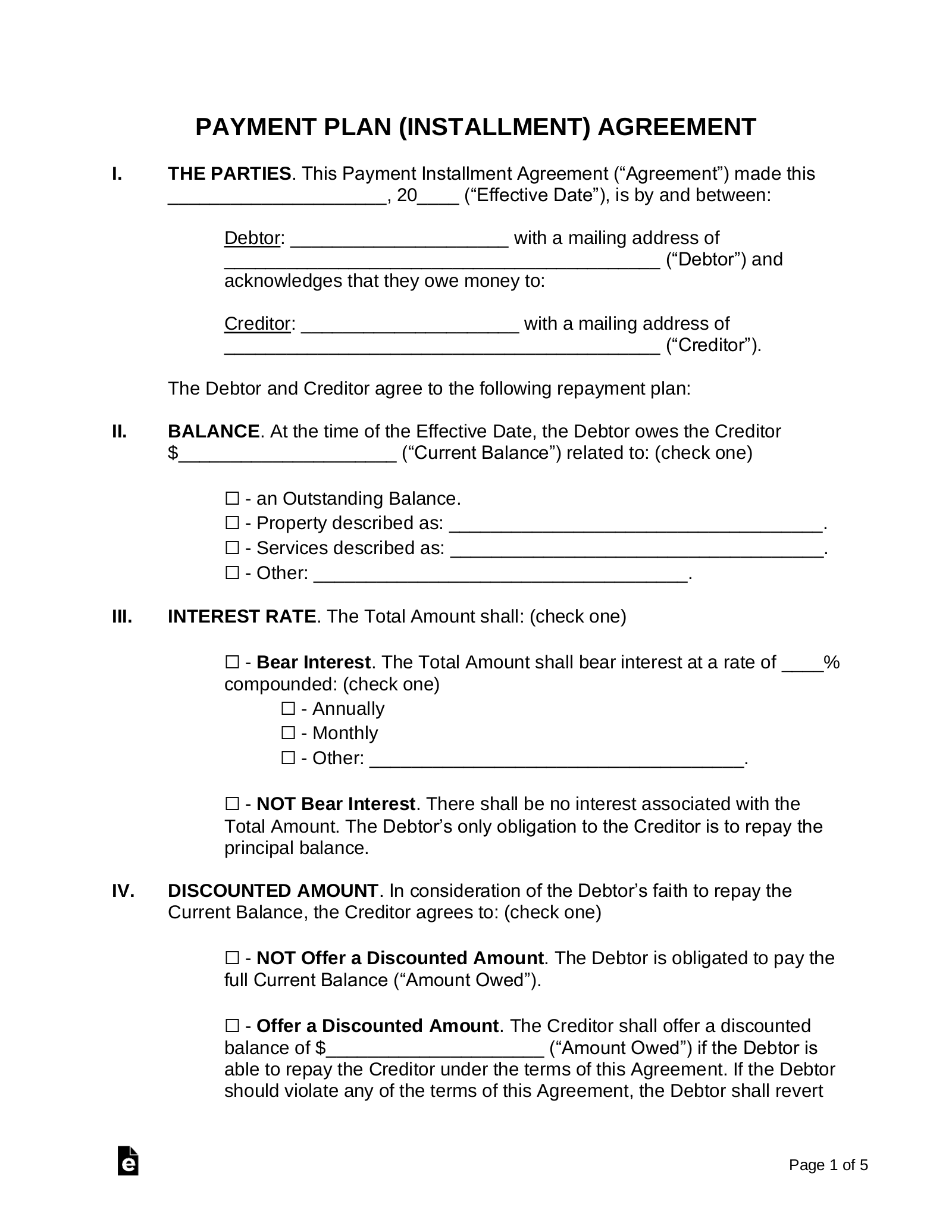

- Identification of Parties: Clearly state the full legal names, addresses, and contact information of all entities involved in the agreement. This ensures there’s no ambiguity about who is bound by the terms.

- Description of Services or Products: Precisely detail what is being provided. This section should leave no room for misinterpretation regarding the scope of work, deliverables, or items being sold, often referencing an attached Statement of Work or project proposal.

- Payment Amount and Calculation: Clearly specify the total cost, hourly rates, project fees, or product prices. If the payment structure involves contingencies, milestones, or recurring fees, these must be explicitly defined.

- Payment Schedule and Due Dates: Outline when payments are expected. This could include upfront deposits, milestone payments tied to specific deliverables, recurring monthly fees, or a "Net X days" policy (e.g., Net 30 for payment due 30 days after invoice).

- Late Payment Penalties and Interest: Detail the consequences of overdue payments. This typically includes a percentage-based late fee, a fixed penalty, or interest accrued daily/monthly, all compliant with state usury laws.

- Invoicing Procedures: Explain how and when invoices will be issued, acceptable payment methods (e.g., bank transfer, credit card, check), and who to contact for billing inquiries.

- Dispute Resolution: Establish a clear process for resolving disagreements. This might include negotiation, mediation, or arbitration before resorting to litigation, specifying the jurisdiction for any legal action.

- Governing Law: Specify which state or federal laws will govern the interpretation and enforcement of the agreement. This is crucial for legal compliance and clarity.

- Force Majeure: Include a clause that addresses unforeseen circumstances (e.g., natural disasters, acts of war) that might prevent a party from fulfilling their obligations, outlining how such events impact the agreement.

- Confidentiality: If applicable, outline provisions for protecting sensitive information exchanged during the course of the business relationship, specifying what constitutes confidential information and how it should be handled.

- Entire Agreement Clause: State that the written document constitutes the entire agreement between the parties, superseding all prior oral or written communications. This prevents reliance on extraneous discussions.

- Signatures: Ensure all parties sign and date the document, affirming their acceptance of the terms. Digital signatures are generally acceptable and legally binding in most jurisdictions.

Enhancing User Experience and Practical Application

Even the most legally sound agreement can fall short if it’s not user-friendly. Practical considerations for formatting, usability, and readability are paramount, whether the document is intended for print or digital use. Clear and concise language is key; avoid overly complex legal jargon where simpler terms suffice. The goal is to ensure that anyone reading the document, regardless of their legal background, can readily understand their obligations.

Employ ample white space, use legible fonts, and organize content with clear headings and subheadings to break up large blocks of text. Bullet points, such as those used for the essential clauses, greatly enhance readability and make complex information easier to digest. For digital use, ensure the document is easily shareable as a PDF, compatible with e-signature platforms, and perhaps even interactive. Regularly reviewing and updating your agreement is also crucial to ensure it remains compliant with current laws and reflective of your evolving business practices. Employing a thoroughly developed payment terms agreement template can significantly enhance your operational efficiency and client relations.

In the fast-evolving landscape of business, securing your financial future and maintaining strong client relationships hinge on clear communication and enforceable agreements. A well-crafted payment terms agreement template is not merely a formality; it is a strategic investment in the stability and professionalism of your operations. It provides a robust, legally sound framework that anticipates potential issues, clarifies expectations, and offers a clear path for recourse, allowing you to focus on your core business activities with peace of mind.

By embracing the power of a customizable, comprehensive payment terms agreement template, businesses can foster an environment of trust, transparency, and accountability. It’s a proactive step towards mitigating financial risks, streamlining administrative processes, and ultimately, building enduring and profitable relationships. Choose reliability, choose clarity, and let a meticulously designed template be the foundation for your successful business endeavors.