In the intricate dance of modern business, effective written communication remains an indispensable skill. From securing new clients to managing existing relationships, the clarity, professionalism, and timeliness of your correspondence can significantly impact outcomes. While digital tools have transformed how we connect, the formal letter—whether delivered electronically or via traditional mail—continues to hold a distinct weight, especially when conveying critical information or making important requests.

For businesses dealing with overdue payments, the challenge lies in crafting messages that are both firm and respectful, encouraging prompt action without alienating valuable customers. This is precisely where a meticulously designed past due letter template becomes an invaluable asset. It serves as more than just a pre-written message; it’s a strategic communication tool that standardizes your approach, maintains professionalism, and optimizes your collection efforts, benefiting everyone from small business owners to large financial departments.

The Enduring Importance of Professional Correspondence

In an age dominated by instant messages and casual emails, the well-structured and professionally formatted letter stands out. It conveys a level of seriousness and attention to detail that can sometimes be lost in less formal channels. This applies across the board, from formal job applications and detailed project proposals to the delicate nature of financial reminders.

A carefully composed document reflects directly on your organization’s professionalism and reliability. It demonstrates respect for the recipient and the gravity of the message being conveyed. When dealing with sensitive matters like a past due account, this elevated level of communication is not just good practice, it’s essential for maintaining positive relationships while effectively addressing outstanding issues.

The Strategic Advantage of Ready-Made Structures

Embracing the use of a reliable letter template offers a multitude of practical benefits for any business. First and foremost, it’s a significant time-saver. Instead of composing each communication from scratch, you can quickly populate a pre-designed structure with specific details, dramatically reducing the effort involved. This efficiency is particularly valuable for recurring tasks like sending out payment reminders.

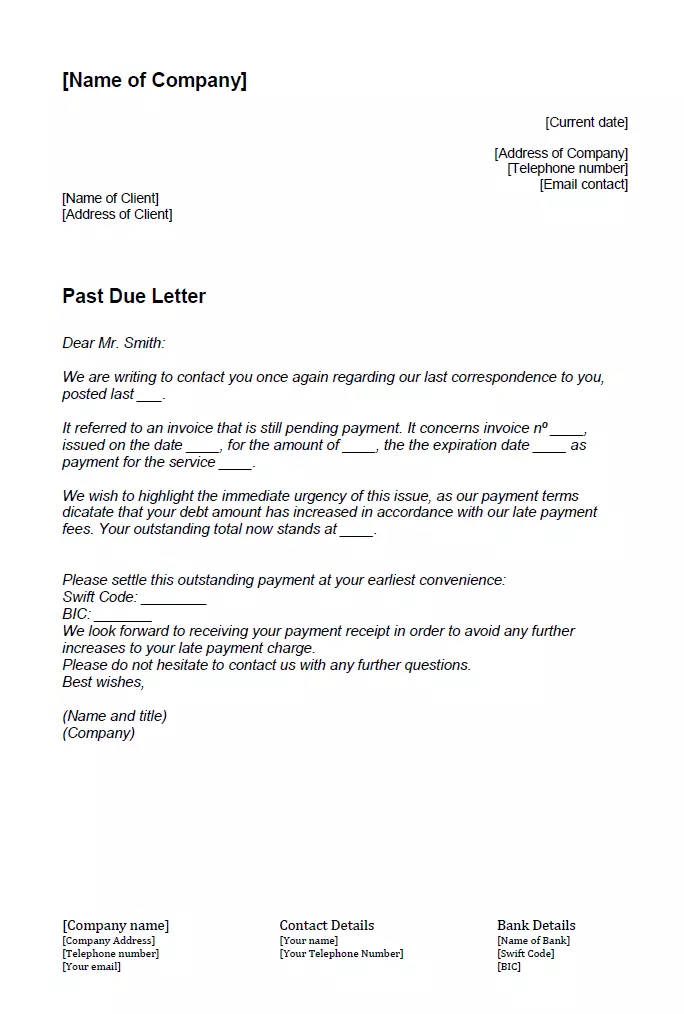

Beyond saving time, using a template ensures consistency in your messaging and branding. Every correspondence will reflect a uniform tone, style, and professional layout, reinforcing your company’s image. It also minimizes the risk of overlooking crucial information or making embarrassing grammatical errors, as the core framework is already vetted and perfected. A robust past due letter template, for instance, guarantees that all necessary legal and financial details are consistently included, reducing potential disputes and clarifying expectations.

Adapting Your Letter for Diverse Situations

While the focus here is on the specific utility of a past due letter template, the principles of template customization are broadly applicable across various business communication needs. Whether you’re drafting a request for information, extending a job offer, or penning a letter of recommendation, the core structure provides a solid foundation. The key lies in understanding how to adapt that framework to suit the unique context and recipient.

For a formal notice, such as a past due letter, customization involves precise details like invoice numbers, original due dates, outstanding balances, and specific payment instructions. In contrast, a template for a thank-you note would require personalization with names, specific actions to appreciate, and a warm, grateful tone. The power of a template isn’t just its existence, but its inherent flexibility to be molded for different purposes while retaining its core professional integrity.

Anatomy of Effective Written Communication

Every impactful letter, regardless of its specific purpose, shares a common set of essential components. Understanding these key parts ensures clarity, completeness, and professionalism in all your correspondence. When constructing a payment reminder or any other formal message, ensure these elements are consistently present:

- Sender’s Contact Information: Your complete business name, address, phone number, and email.

- Date: The exact date the letter is issued.

- Recipient’s Contact Information: The full name, title, and address of the individual or company receiving the letter.

- Salutation: A formal and respectful greeting (e.g., "Dear Mr. Smith," or "To Whom It May Concern").

- Subject Line (Optional but Recommended): A concise summary of the letter’s purpose, especially useful for formal notices like a past due letter template.

- Opening Paragraph: Clearly state the letter’s purpose and reference any relevant previous communication or documents (e.g., invoice numbers, service dates).

- Body Paragraphs: Provide all necessary details, explanations, or requests. For a past due notice, this includes the outstanding amount, original due date, and any late fees incurred.

- Call to Action/Next Steps: Clearly specify what action the recipient needs to take and by when (e.g., "Please remit payment by [New Date]").

- Closing Paragraph: Reiterate your willingness to assist or resolve issues, and express appreciation for prompt attention.

- Formal Closing: A professional sign-off (e.g., "Sincerely," "Regards," "Best regards").

- Signature: Your handwritten signature (for printable versions) or a digital signature (for electronic documents).

- Typed Name and Title: Your full name and professional title printed below the signature.

- Enclosures (if applicable): Note any additional documents attached (e.g., a copy of the original invoice).

Mastering Presentation and Tone

The impact of your written communication is not solely dependent on its content, but also on its presentation and the tone it conveys. For documents like a past due letter template, striking the right balance between firm and respectful is crucial. The tone should always remain professional, clear, and unambiguous, avoiding any language that could be perceived as aggressive or overly apologetic. A direct yet polite approach typically yields the best results, fostering cooperation rather than confrontation.

Formatting plays an equally vital role. For digital versions, ensure the layout is clean, with appropriate line spacing and clear headings that enhance readability. Use professional fonts and maintain consistent formatting throughout. If the letter is to be printed, consider using quality paper and, if applicable, your company letterhead. For electronic distribution, always consider saving your documents as PDFs to preserve the original layout and prevent unintended edits by the recipient. Paying attention to these details reinforces the importance of your message and your organization’s commitment to professionalism.

In the fast-paced world of business, efficiency and clarity are paramount. A well-constructed past due letter template is more than just a convenient tool; it’s an essential element of sound financial management and customer relations. It empowers businesses to handle sensitive situations with confidence, ensuring that critical messages are delivered effectively, consistently, and professionally.

By leveraging such a template, you streamline your collection process, reduce administrative burdens, and maintain a respectful dialogue with clients, even when addressing difficult topics. It transforms a potentially awkward interaction into a structured, professional exchange. Ultimately, adopting a reliable past due letter template not only saves valuable time but also enhances your company’s image as an organized and diligent entity, committed to both its bottom line and its business relationships.