In the impactful world of nonprofit organizations, every dollar tells a story of purpose, dedication, and the collective effort to create positive change. Managing these vital resources effectively isn’t just a matter of good bookkeeping; it’s a strategic imperative that directly influences an organization’s ability to achieve its mission and sustain its operations. A well-crafted budget serves as the financial blueprint, guiding decisions, ensuring accountability, and providing clarity to stakeholders from board members to donors.

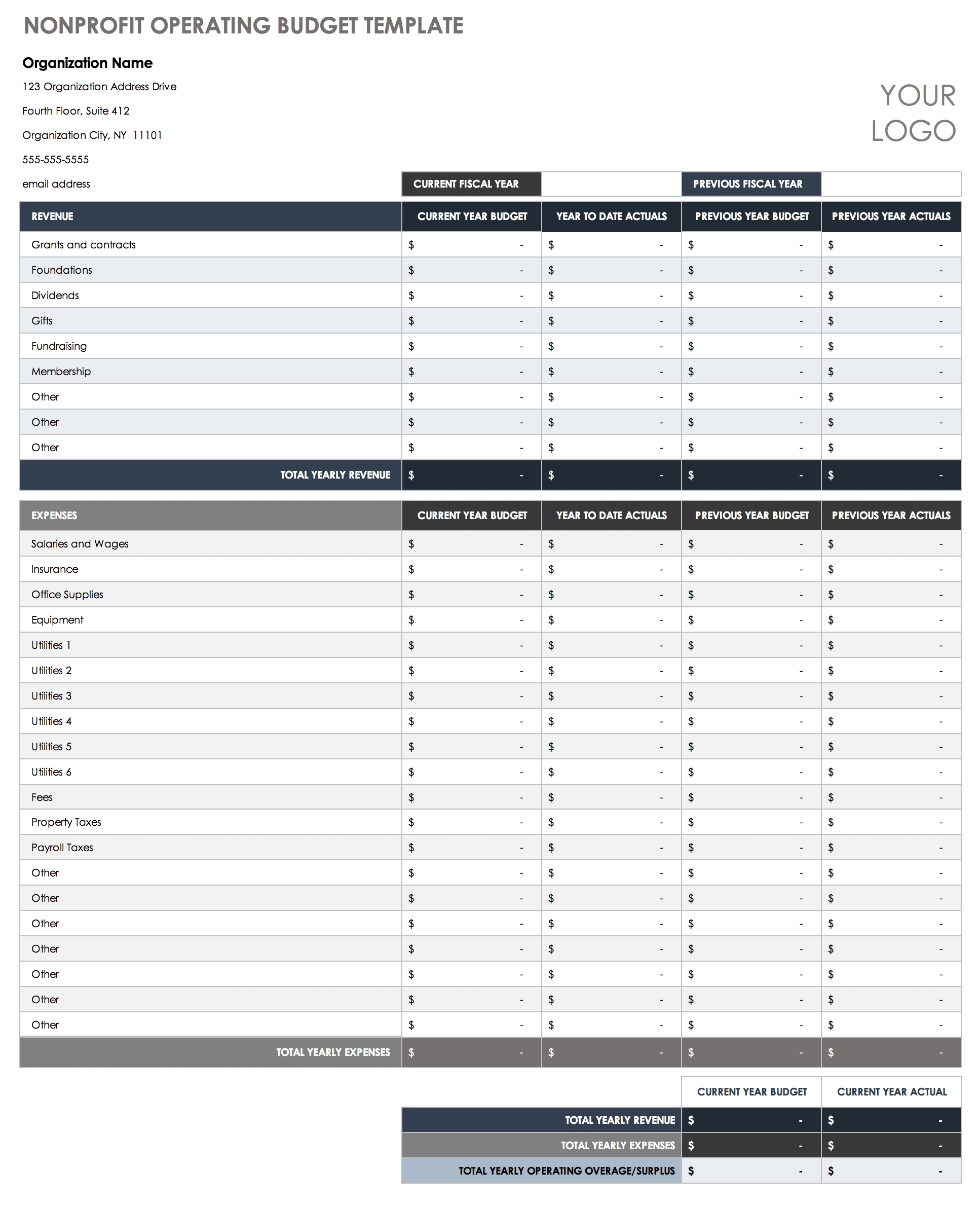

For many nonprofits, however, the process of developing and maintaining a robust financial plan can feel daunting, particularly given the unique complexities of grant cycles, donor restrictions, and the imperative to maximize every contribution. This is where an Operating Budget Nonprofit Budget Template becomes an invaluable asset, offering a structured, professional framework that demystifies financial planning and empowers organizations to manage their funds with precision and foresight. It transforms a potentially overwhelming task into a manageable and strategic exercise, ensuring your charity’s financial health and long-term viability.

Why a Solid Operating Budget is Non-Negotiable for Nonprofits

An operating budget is far more than a simple listing of income and expenses; it’s a dynamic strategic tool that encapsulates your organization’s aspirations and operational realities for a given fiscal year. For nonprofits, its significance is amplified by the inherent public trust placed in their financial stewardship. Donors, grantmakers, and the community expect transparency and efficiency in how funds are utilized to advance the mission.

A comprehensive annual budget framework provides the clarity needed for effective decision-making. It helps leadership understand where resources are allocated, identify potential shortfalls or surpluses, and pivot strategies as circumstances evolve. Without this foundational document, organizations risk operating in the dark, jeopardizing their programs, reputation, and ultimately, their mission. It acts as a beacon, illuminating the path to sustainable impact and responsible resource management.

What Your Nonprofit Operating Budget Should Encompass

A truly effective nonprofit operating budget template extends beyond basic revenue and expenditure columns, incorporating elements critical to the sector. It must differentiate between various funding types and reflect the specific financial reporting standards required of charitable organizations. Understanding these components ensures a complete and accurate financial picture.

Key elements of a robust organizational financial plan include:

- Revenue Projections: Detail all anticipated income sources, such as individual contributions, corporate sponsorships, government grants, foundation grants, program service fees, and in-kind donations. It’s crucial to categorize these by their nature and potential restrictions.

- Program Expenses: These are costs directly related to delivering your mission-driven programs. Examples include salaries for program staff, direct client services, educational materials, and logistical support for outreach efforts. Transparently allocating these costs showcases impact.

- Administrative Expenses: Also known as management and general expenses, these cover the overhead necessary to run the organization. This typically includes executive salaries, office rent, utilities, insurance, accounting fees, and general office supplies.

- Fundraising Expenses: Costs associated with securing financial support, such as development staff salaries, fundraising event costs, donor cultivation activities, and marketing materials aimed at soliciting donations. Differentiating these is key for accountability ratios.

- Net Asset Changes: Unlike for-profit companies, nonprofits focus on net assets. The budget should project how the year’s operations will impact the organization’s unrestricted, temporarily restricted, and permanently restricted net assets, ensuring compliance with donor intent.

- Cash Flow Projections: While not always a primary budget component, a good template will encourage consideration of cash flow throughout the year, especially for organizations with seasonal income or delayed grant disbursements. This prevents liquidity crises.

Leveraging a Nonprofit Budget Tool for Strategic Impact

Utilizing a structured nonprofit budget template isn’t just about organizing numbers; it’s about transforming financial data into actionable insights that drive your organization forward. This type of budgeting guide simplifies complex financial modeling, making it accessible even to those without extensive accounting backgrounds. It offers a standardized format that fosters consistency and accuracy across different reporting periods.

A well-designed charity financial management tool empowers boards and leadership teams to conduct scenario planning, exploring the financial implications of different strategic choices or economic shifts. For instance, you can model the impact of securing a new major grant, expanding a program, or facing unexpected reductions in funding. This proactive approach allows for informed decision-making rather than reactive problem-solving. It also streamlines the reporting process for grant applications and donor stewardship, demonstrating fiscal responsibility and effective resource allocation.

Building Your Budget: A Step-by-Step Guide

Creating an annual financial plan requires a systematic approach to ensure accuracy, buy-in from stakeholders, and alignment with your mission. A budget template provides the framework, but the input and process are equally vital.

Here’s how to build your organization’s budget effectively:

- Review Historical Data: Start by analyzing your past several years of actual financial performance. This provides a realistic baseline for projecting future revenues and expenses. Look for trends, seasonal variations, and one-time events.

- Project Revenue Conservatively: Estimate all expected income for the upcoming fiscal year. Be realistic, especially with grants and donations, perhaps building in a contingency buffer for unexpected shortfalls. Over-optimistic revenue projections can lead to significant problems.

- Detail Program and Operational Expenses: Work with program managers and department heads to itemize every anticipated expense. Consider both fixed costs (rent, salaries) and variable costs (program supplies, travel). Employ a zero-based budgeting approach for new programs, justifying every expense from scratch.

- Allocate Joint Costs: For expenses that benefit multiple programs or departments (e.g., shared administrative staff, office space), develop a fair and consistent methodology for allocation. This ensures accurate program costing and appropriate reporting for grants.

- Involve Key Stakeholders: Engage department heads, program managers, and the development team in the budgeting process. Their input ensures accuracy and fosters a sense of ownership over the financial plan.

- Board Review and Approval: Present the proposed budget to your board of directors for thorough review, discussion, and formal approval. The board’s endorsement signifies their commitment to the financial plan and provides essential oversight.

- Establish Monitoring and Review Protocols: A budget is a living document. Outline how often actual financial performance will be compared against the budget, who is responsible for monitoring, and the process for making necessary adjustments throughout the year.

Best Practices for Budget Management and Oversight

Simply creating an Operating Budget Nonprofit Budget Template isn’t enough; continuous management and diligent oversight are paramount for its effectiveness. A budget should be a dynamic instrument, regularly revisited and adjusted to reflect changing circumstances and strategic priorities. This ongoing engagement ensures that your financial plan remains relevant and supports your organization’s mission throughout the fiscal year.

Effective budget management involves:

- Regular Financial Reviews: Conduct monthly or quarterly reviews where actual revenues and expenses are compared against the budget. Identify variances, understand their causes, and make informed decisions on how to address them.

- Contingency Planning: Always include a reserve fund or contingency line item in your budget for unexpected expenses or revenue shortfalls. This financial cushion provides stability and prevents minor issues from becoming major crises.

- Clear Roles and Responsibilities: Define who is responsible for tracking income, managing expenses, approving purchases, and reporting on financial performance. Clear accountability minimizes errors and ensures smooth operations.

- Integration with Accounting Software: If possible, integrate your budget template with your accounting software. This can automate tracking, reduce manual data entry, and provide real-time financial insights, making budget-to-actual comparisons much more efficient.

- Communication and Transparency: Share budget information transparently with your board, staff, and key stakeholders. Explain financial decisions and demonstrate how resources are being used to achieve the mission, fostering trust and engagement.

- Embracing Flexibility: While adherence to the budget is important, rigidity can be detrimental. Be prepared to make amendments and reforecast if significant, unforeseen events occur. Document all budget revisions and the rationale behind them.

Frequently Asked Questions

What is the primary difference between an operating budget and a capital budget for a nonprofit?

An operating budget covers the day-to-day revenues and expenses for a specific fiscal year, focusing on recurring costs and ongoing program delivery. A capital budget, in contrast, plans for significant, long-term investments like purchasing land, constructing a building, or acquiring major equipment, which are typically non-recurring and have a useful life of more than one year.

How often should a nonprofit organization update its budget?

While the operating budget is typically approved annually, it should be reviewed at least monthly or quarterly to compare actual performance against the plan. Significant variances or changes in operational circumstances might necessitate mid-year adjustments or a full reforecast, which should also be formally approved by the board.

Can a very small nonprofit with limited staff truly benefit from a detailed budget template?

Absolutely. Even the smallest nonprofits benefit immensely from a detailed financial plan. It forces clarity on resource allocation, helps secure grants by demonstrating fiscal responsibility, and provides a roadmap for growth. A template simplifies the process, making it manageable even for organizations with limited financial expertise.

How do restricted funds impact the creation and management of a nonprofit operating budget?

Restricted funds (e.g., grants for specific programs or donor-designated donations) must be budgeted and tracked separately from unrestricted funds. Your budget template should have mechanisms to clearly delineate these, ensuring that funds are spent only for their intended purpose, which is crucial for compliance and donor trust.

What are some common pitfalls nonprofits encounter when managing their annual budget?

Common pitfalls include overly optimistic revenue projections, underestimating administrative or fundraising costs, failing to regularly monitor actual spending against the budget, and a lack of flexibility when unforeseen circumstances arise. Neglecting to involve key staff in the budgeting process can also lead to unrealistic plans and lack of ownership.

A well-constructed and diligently managed operating budget is the cornerstone of financial health and programmatic success for any nonprofit organization. It is more than just a financial tool; it’s a living document that translates your mission into measurable financial targets and tracks your progress towards impactful outcomes. By providing a clear, transparent, and strategic framework, it empowers your team to make informed decisions, build trust with stakeholders, and secure the resources needed to fulfill your vital work.

Embracing the structure and guidance offered by a robust financial planning template allows your nonprofit to navigate complex financial landscapes with confidence and clarity. It transforms budgeting from a compliance chore into a strategic advantage, ensuring every dollar is maximized in service of your mission. Invest in a strong annual budget framework, and you invest directly in the sustainability and profound impact of your organization.