Embarking on an office relocation is a significant undertaking, one that can be as exhilarating as it is daunting. Beyond the excitement of a fresh start and a new environment, lies a labyrinth of logistics, decision-making, and, perhaps most critically, financial management. Without a clear financial roadmap, even the most meticulously planned move can quickly veer off course, leading to unexpected expenses, budget overruns, and undue stress for your business.

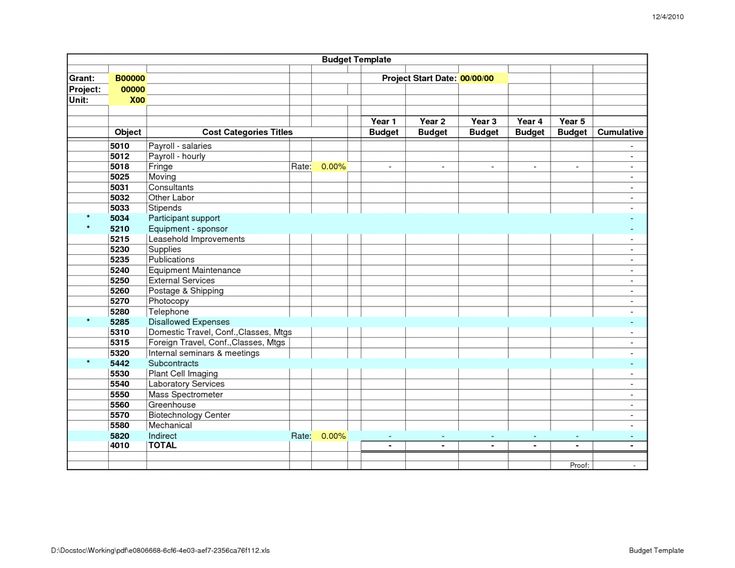

This is where proactive financial planning becomes not just beneficial, but absolutely essential. A well-structured spending plan acts as your strategic anchor, providing clarity and control over every dollar spent. It transforms a complex series of expenditures into a manageable, transparent process, ensuring that your company’s resources are allocated wisely and efficiently. For any business contemplating such a transition, this comprehensive Office Relocation Budget Template serves as your financial compass, guiding you through the intricate journey of moving your operations seamlessly and cost-effectively.

The Indispensable Role of a Relocation Financial Plan

An office move is far more complex than simply packing boxes and hiring movers. It involves numerous stakeholders, intricate timelines, and a broad spectrum of expenses that can easily be overlooked without a detailed plan. A robust relocation financial plan ensures that every potential cost, from the obvious to the obscure, is accounted for. This proactive approach helps businesses avoid common pitfalls like underestimating the total cost, running out of funds mid-project, or having to cut corners that might impact employee morale or operational efficiency.

By laying out all expected expenditures in advance, a clear financial plan empowers your organization to make informed decisions throughout the relocation process. It provides a baseline for negotiations with vendors, a benchmark for tracking actual spending, and a crucial tool for communicating financial expectations to leadership and teams. Ultimately, this detailed expenditure template for office transition fosters financial discipline and minimizes the risk of budget surprises, allowing your focus to remain on the strategic benefits of your new location.

Key Benefits of Utilizing a Structured Financial Blueprint

Implementing a structured financial blueprint for your office move offers a multitude of advantages that extend beyond mere cost tracking. It transforms the financial aspect of relocation from a reactive scramble into a proactive, strategic advantage. The benefits are far-reaching, impacting everything from operational efficiency to stakeholder confidence.

Firstly, it provides unparalleled transparency. Every penny allocated and spent is visible, allowing for real-time monitoring and accountability. Secondly, it grants control over your spending, enabling you to identify potential areas for cost savings or reallocation before they become problematic. Thirdly, a well-defined financial framework significantly reduces risk, mitigating the likelihood of unforeseen expenses derailing your project timeline or financial health. Moreover, it empowers you with stronger negotiation power when dealing with moving companies, contractors, and service providers, as you have a clear understanding of your budget limitations. Finally, it builds stakeholder confidence by demonstrating a professional and organized approach to a major business change, assuring everyone involved that the move is being managed responsibly and efficiently.

Essential Components of Your Office Moving Cost Plan

A thorough office moving cost plan encompasses a wide range of categories, each crucial to the overall success and financial health of your relocation. Overlooking even a single area can lead to significant unexpected expenses down the line. A robust office relocation budget template provides a comprehensive checklist, ensuring every potential cost is considered. Here are the primary categories you should include:

- **Real Estate and Lease-Related Costs:**

- **New Lease Deposit:** Security deposits, first month’s rent.

- **Broker Fees:** Commissions for commercial real estate agents.

- **Leasehold Improvements:** Costs for fitting out the new space to your specifications (e.g., painting, flooring, minor construction).

- **Old Lease Exit Costs:** Break clauses, dilapidation costs, cleaning fees for the previous space.

- **Physical Relocation Services:**

- **Professional Movers:** Cost of moving companies, including packing, loading, transportation, and unloading.

- **Packing Supplies:** Boxes, tape, bubble wrap, labels.

- **Specialized Equipment Moving:** Transport for sensitive or heavy equipment (e.g., servers, machinery).

- **Moving Insurance:** Coverage for goods in transit.

- **Disposal Fees:** Costs for disposing of unwanted furniture, electronics, or hazardous waste.

- **IT and Technology Infrastructure:**

- **Network Setup:** Installation of new cabling, Wi-Fi access points.

- **Server Migration:** Professional services for relocating and reconfiguring servers.

- **Telecommunications:** Installation of new phone lines, internet service, VoIP setup.

- **New Hardware/Software:** Upgrades or purchases needed for the new space.

- **Downtime Costs:** Potential loss of productivity during the IT transition.

- **Furniture and Fixtures:**

- **New Furniture Purchases:** Desks, chairs, filing cabinets, reception area furniture.

- **Furniture Disassembly/Reassembly:** Services for taking apart and putting back together modular furniture.

- **Ergonomic Assessments:** Costs for ensuring the new setup meets employee needs.

- **Utilities and Services:**

- **Setup Fees:** Electricity, water, gas, waste management setup.

- **Security Systems:** Installation of alarms, access control, cameras.

- **Cleaning Services:** Professional cleaning before move-in and after move-out.

- **Permits, Legal, and Administrative:**

- **Business Licenses:** Any new permits or licenses required for the new location.

- **Legal Fees:** Review of new lease agreements, contractor contracts.

- **Change of Address Fees:** Updating business registrations, stationery, marketing materials.

- **Mail Forwarding:** Postal service fees for redirecting mail.

- **Employee-Related Expenses:**

- **Communication:** Announcements, internal meetings, information packets.

- **Temporary Housing/Travel:** For employees assisting with the move, if necessary.

- **Welcome Event/Amenities:** Costs for making the new office welcoming.

- **Contingency Fund:**

- **Unforeseen Expenses:** Crucial buffer (typically **10-20%** of total budget) for unexpected issues like minor repairs, delays, or additional purchases.

Crafting and Customizing Your Spending Plan

While a general project budget for office move provides an excellent framework, true success lies in tailoring it to your specific organizational needs and the nuances of your relocation. Start by populating the template with initial estimates for each line item. This often involves getting preliminary quotes from potential vendors for services like moving, IT setup, and leasehold improvements. Don’t be afraid to research average costs for various services in your new geographical area, as these can vary significantly.

Once you have your initial figures, categorize them by department or phase of the move (e.g., pre-move, move day, post-move). This allows for better tracking and accountability. Continuously review and update your spending plan as you gather more accurate quotes and solidify your plans. Flexibility is key; a good financial planning for office move isn’t set in stone but evolves with the project. Regularly compare estimated costs with actual expenditures to identify variances early and adjust accordingly, ensuring your commercial move financial framework remains a living, breathing document that accurately reflects your financial reality.

Tips for Effective Cost Management During Your Move

Managing the finances of a business relocation expenditure guide effectively goes beyond just filling out a spreadsheet. It requires strategic thinking, diligent tracking, and proactive communication. Here are some actionable tips to ensure your move stays within budget:

Firstly, seek multiple quotes for every major service. Don’t settle for the first offer; competitive bidding can lead to significant savings. Clearly define the scope of work when requesting quotes to ensure accurate comparisons. Secondly, negotiate aggressively but fairly. There’s often room for flexibility in pricing, especially if you’re a desirable client or can offer flexibility in your timeline. Be prepared to walk away if the terms aren’t right.

Thirdly, communicate clearly and frequently with all vendors and internal teams. Misunderstandings can lead to costly delays or rework. Ensure everyone understands their responsibilities and budget allocations. Fourthly, track expenses religiously. Assign a dedicated person or team to monitor actual spending against your budget template. Use financial software or detailed spreadsheets to log every transaction. Finally, involve key personnel from relevant departments (finance, IT, operations, HR) in the budgeting and decision-making process. Their insights are invaluable for identifying potential costs and ensuring the budget is realistic and comprehensive.

Leveraging Technology for Your Relocation Finances

In today’s digital age, relying solely on paper and pen for your business relocation expenditure guide is inefficient and prone to error. Leveraging technology can significantly streamline your expense tracking for business move and improve overall financial management. Spreadsheets, like Microsoft Excel or Google Sheets, are readily available tools that offer robust capabilities for creating a detailed budget. They allow for easy categorization, formula-driven calculations, and visual representation of data through charts and graphs, making it simpler to compare estimated vs. actual costs.

For more complex moves or larger organizations, dedicated project management software often includes features for financial tracking and resource allocation. These platforms can integrate your spending plan with project timelines, task assignments, and communication tools, providing a holistic view of your relocation project. Cloud-based solutions also facilitate collaboration among team members, allowing multiple stakeholders to access and update the budget in real-time, ensuring everyone is working with the most current financial data. Regardless of the tool chosen, the goal is to create an accessible, dynamic, and accurate financial record that supports informed decision-making throughout your office transition.

Frequently Asked Questions

Why can’t I just estimate costs without a template?

Estimates are often prone to human error and bias, leading to overlooked expenses or underestimated figures. A structured budget template forces you to consider every potential cost category, providing a comprehensive framework that ensures no critical financial aspect of your move is forgotten, thereby minimizing surprises.

How much should I allocate for contingency in my office relocation budget?

It’s generally recommended to allocate between 10% and 20% of your total estimated costs for contingency. This crucial buffer covers unexpected expenses, delays, or additional requirements that inevitably arise during a complex project like an office move, ensuring you have the flexibility to adapt without derailing your finances.

Who should be involved in creating the office move budget?

A collaborative approach is best. Key stakeholders should include your finance department (for financial oversight and accurate cost tracking), a dedicated project manager (to manage the overall move), IT department (for technology-related expenses), HR (for employee-related costs), and facilities management (for physical move logistics and build-out costs).

What’s the biggest hidden cost in an office move?

Often, the biggest hidden costs are related to **IT downtime** and **unforeseen leasehold improvements** in the new space. The loss of productivity during technology transitions can be substantial, and renovation needs frequently exceed initial estimates once work begins. Thorough planning and professional assessments can help mitigate these.

Can a small business benefit from a detailed budget template?

Absolutely. For small businesses, every dollar counts, and overspending on a relocation can have a more significant impact on their bottom line. A detailed budget template provides the same level of control and foresight as it does for larger corporations, helping small businesses manage their limited resources more effectively and avoid costly mistakes.

Navigating the financial complexities of an office relocation doesn’t have to be a source of anxiety. With a robust financial framework in place, your business can approach this significant transition with confidence and clarity. The ability to forecast, track, and manage every expenditure provides an invaluable advantage, transforming a potential financial burden into a strategically controlled investment in your company’s future.

By diligently utilizing a comprehensive financial tool, you ensure that your move is not only successful in terms of logistics but also a resounding financial success. This commitment to detailed financial planning frees up valuable resources and mental energy, allowing your team to focus on the operational aspects of the move and, ultimately, on a seamless transition to your new, productive workspace.