Embarking on the intricate journey of acquiring a business is a monumental decision, fraught with excitement and significant financial implications. The initial, yet arguably most crucial, step often involves presenting a formal offer. This critical document, frequently referred to as an offer to purchase business agreement template, serves as the foundational blueprint for the entire transaction, outlining the buyer’s intentions and proposed terms. It’s more than just a proposal; it’s a commitment to engage in serious negotiations, signaling readiness to move forward with a substantial investment.

For entrepreneurs eyeing expansion, investors seeking new opportunities, or individuals aiming to fulfill a lifelong dream of business ownership, understanding and utilizing a robust template is invaluable. This article aims to demystify the complexities surrounding these essential agreements, providing a comprehensive guide for US readers navigating the business and legal documentation landscape. Whether you are a first-time buyer, a seasoned acquisition professional, or a business owner preparing to sell, a clear, well-structured offer document is your best advocate, ensuring clarity, mitigating risks, and streamlining the path to a successful acquisition.

The Indispensable Role of Formalized Proposals in Modern Transactions

In today’s fast-paced business environment, where deals can be made or broken on the strength of initial proposals, the importance of a clear and written agreement cannot be overstated. Verbal agreements, while sometimes a starting point, are notoriously difficult to enforce and often lead to misunderstandings, disputes, and protracted legal battles. A formal written offer establishes a concrete record of the proposed terms, expectations, and conditions from the outset.

This documentation serves as a mutual reference point for both the prospective buyer and the seller. It prevents misinterpretations regarding critical elements like purchase price, payment schedules, and assets included in the sale. Without a meticulously drafted offer to purchase business agreement template, both parties expose themselves to significant legal and financial peril, risking wasted time, resources, and potential litigation should the deal unravel. It instills confidence and professionalism, setting a serious tone for subsequent negotiations.

Unlocking Value: Benefits of a Structured Acquisition Document

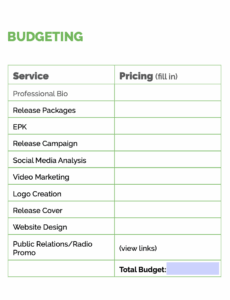

Leveraging a robust offer to purchase business agreement template streamlines this initial phase of business acquisition significantly. One of its primary benefits is providing a standardized framework that ensures no critical elements are overlooked. This reduces the likelihood of costly omissions or ambiguities that could derail the deal or lead to future disagreements. It acts as a checklist, guiding the buyer through the essential components necessary for a comprehensive proposal.

Beyond ensuring completeness, a well-designed template offers substantial time and cost savings. Instead of drafting a complex legal document from scratch, which can be expensive and time-consuming, parties can utilize a pre-existing structure. This allows them to focus their resources on due diligence, valuation, and strategic negotiation rather than on legal drafting. Furthermore, a professional and coherent proposal enhances credibility, signaling to the seller that the buyer is serious, organized, and understands the gravity of the transaction. It also provides a strong starting point for legal counsel to review and refine, further optimizing the negotiation process.

Tailoring Your Acquisition Proposal for Unique Scenarios

While a template provides a solid foundation, the diverse nature of businesses and industries necessitates significant customization. An offer to purchase business agreement template must be flexible enough to accommodate various scenarios, whether it’s the acquisition of a small local retail operation, a tech startup with intellectual property as its primary asset, or a manufacturing plant with extensive physical assets and inventory. The nuances of each business—its legal structure, industry regulations, customer base, and operational intricacies—must be reflected in the agreement.

Customization involves adjusting clauses related to asset specificity (e.g., including or excluding real estate, intellectual property, customer lists), payment structures (e.g., all cash, seller financing, earn-outs), and indemnification for industry-specific risks. For instance, a template for a restaurant acquisition might focus heavily on inventory, leases, and liquor licenses, whereas an IT company acquisition would prioritize software licenses, data privacy, and non-compete clauses for key personnel. Whether you’re acquiring a small local shop or a multi-million dollar enterprise, a versatile offer to purchase business agreement template is a cornerstone for effective negotiations, ensuring the document accurately reflects the unique commercial understanding between parties.

Essential Components of a Comprehensive Purchase Offer

A truly effective offer to purchase business agreement template must be meticulously structured, incorporating several critical clauses to protect both buyer and seller. These sections lay out the fundamental terms and conditions that govern the proposed transaction.

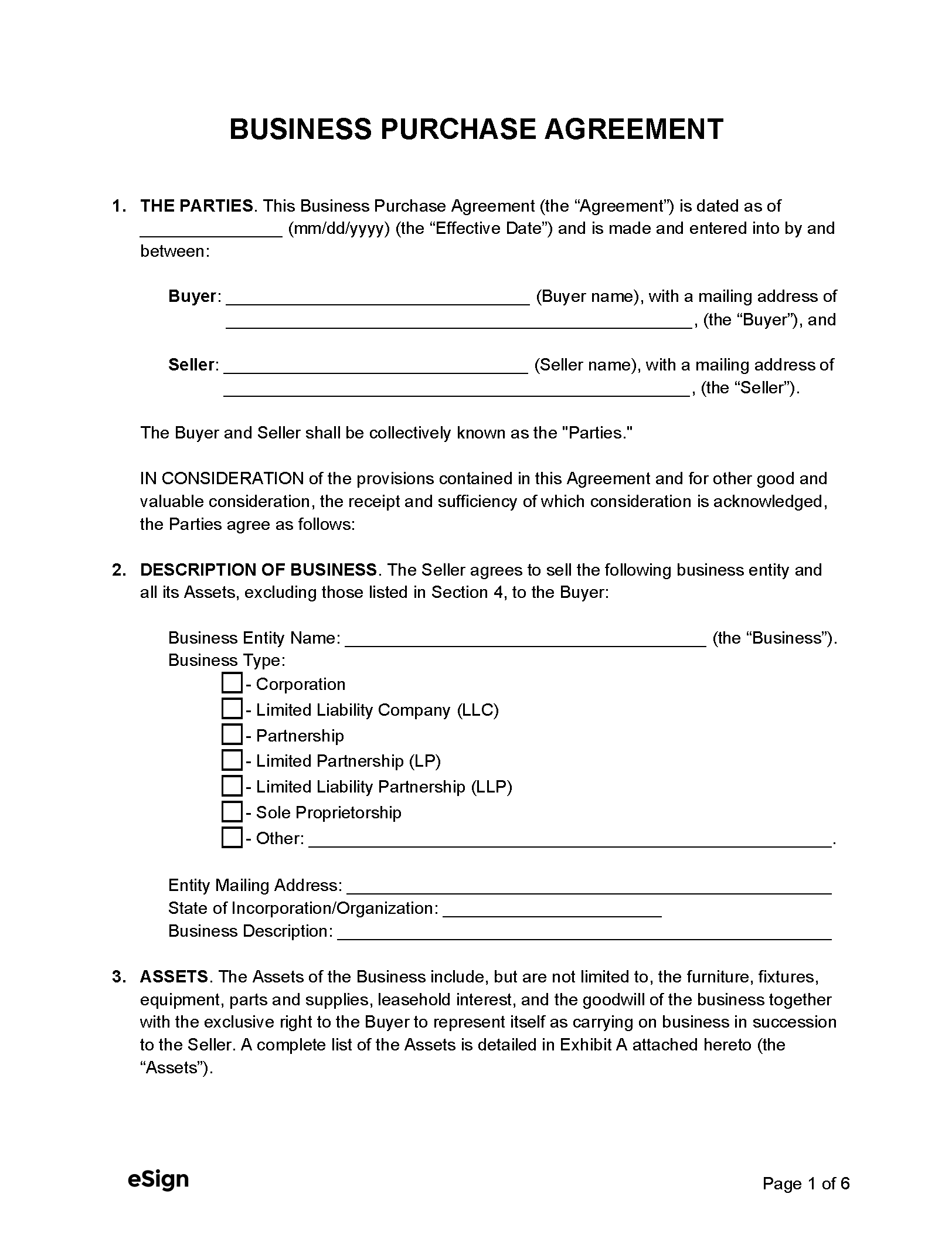

- Identification of Parties: Clearly state the full legal names and addresses of both the prospective buyer(s) and the seller(s) of the business.

- Description of the Business: Provide a precise and comprehensive description of the business being acquired, including its legal name, entity type, and primary operations.

- Assets or Stock Being Acquired: Specify whether the buyer is acquiring the business’s assets (e.g., equipment, inventory, intellectual property, goodwill) or the seller’s stock/membership interests. This distinction has significant legal and tax implications.

- Purchase Price: Clearly state the proposed purchase price in numerical and written form, along with the currency.

- Payment Terms and Structure: Detail how the purchase price will be paid, including any down payments, earnest money deposits, financing contingencies, installment plans, or earn-out provisions.

- Conditions Precedent to Closing: Outline specific conditions that must be met before the sale can be finalized, such as successful due diligence, obtaining necessary third-party consents (e.g., landlord, franchisor), securing financing, or regulatory approvals.

- Representations and Warranties: These are statements of fact made by both parties about the business and their authority to enter into the agreement. For the seller, these often cover financial health, legal compliance, absence of undisclosed liabilities, and ownership of assets.

- Covenants: Commitments by both parties to perform certain actions or refrain from others between the signing of the offer and the closing date. This might include operating the business in the ordinary course, providing access for due diligence, or not soliciting employees.

- Due Diligence Period: Specify the timeframe during which the buyer will conduct their thorough investigation into the business’s financial, legal, operational, and environmental aspects. This is a critical protection for the buyer.

- Confidentiality: A clause ensuring that both parties maintain the confidentiality of sensitive information exchanged during the negotiation and due diligence phases.

- Non-Compete and Non-Solicitation: Often included to prevent the seller from competing with the acquired business or soliciting its employees/customers for a specified period after the sale.

- Indemnification: Provisions outlining how losses or damages arising from breaches of representations, warranties, or covenants will be compensated.

- Governing Law and Jurisdiction: Identify the state laws that will govern the interpretation and enforcement of the agreement and the courts that have jurisdiction over any disputes.

- Dispute Resolution: Outline the preferred method for resolving disagreements, such as mediation or arbitration, before resorting to litigation.

- Closing Date and Location: The target date and place for the final execution of the sale documents and transfer of ownership.

- Expiration Date of Offer: Crucially, state a deadline by which the seller must accept the offer, after which it becomes null and void.

Optimizing Readability and Usability for Key Stakeholders

Beyond the legal substance, the presentation of your business acquisition proposal significantly impacts its effectiveness. Practical considerations for formatting, usability, and readability are paramount, whether the document is intended for print or digital use. A well-formatted agreement is easier to understand, reduces errors, and projects professionalism.

Employ clear, concise language, avoiding excessive legal jargon where simpler terms suffice. Use consistent terminology throughout the document to prevent confusion. Break down complex ideas into shorter paragraphs and sentences. Incorporate ample white space, distinct headings (like

for subsections within a clause), and bullet points or numbered lists to improve scannability. For digital use, ensure the document is easily searchable and compatible with common software platforms. Consider using a table of contents for longer agreements, allowing readers to quickly navigate to relevant sections. Finally, always review the document meticulously for typos, grammatical errors, and logical flow. A professional appearance reinforces the serious intent behind the offer.

Ultimately, the strategic deployment of a comprehensive offer to purchase business agreement template empowers buyers to make compelling, legally sound proposals, while providing sellers with clear terms for evaluation. It acts as a vital tool in safeguarding the interests of both parties, minimizing misunderstandings, and setting a firm foundation for successful negotiations. By carefully customizing and structuring this initial document, businesses can streamline the often-complex acquisition process.

Embracing the professionalism and clarity offered by a well-crafted template is not merely a formality; it’s a strategic advantage. It saves invaluable time and resources, allowing legal professionals to focus on fine-tuning rather than foundational drafting. This approach ensures that the path from initial interest to a successfully closed deal is as efficient, transparent, and secure as possible, culminating in a transaction that benefits all involved stakeholders.