Navigating the complexities of personal finance can often feel like an uphill battle. Tracking income, managing expenses, and saving for future goals requires discipline and, often, the right tools. While countless apps promise to simplify your financial life, sometimes the most powerful solutions are those already integrated into the technology you use daily. For iPhone users, Apple’s Numbers application stands out as a remarkably versatile and accessible platform for personal budgeting, especially when leveraging its robust template system.

Imagine having a clear, organized view of your finances right in your pocket, updated in real-time as your financial landscape shifts. This isn’t just a dream; it’s a practical reality made achievable through the thoughtful design of Apple Numbers on your iPhone. It bridges the gap between complex spreadsheet software and intuitive mobile applications, offering a sweet spot for those who appreciate both control and convenience in their financial management journey.

Embracing the Power of Numbers for Your Finances

Apple Numbers isn’t just a spreadsheet application; it’s a powerful and intuitive tool designed to make data organization and analysis approachable, even for those who might shy away from traditional spreadsheets. Its clean interface and user-friendly features translate beautifully to the smaller screen of an iPhone, allowing you to manipulate complex data with surprising ease. The beauty lies in its accessibility – no need for desktop software when you can manage your money anytime, anywhere.

The integration with the Apple ecosystem is a significant advantage. Your budgeting sheets can sync seamlessly across your iPhone, iPad, and Mac via iCloud, ensuring that your financial data is always up-to-date and available on any device you pick up. This constant accessibility means you’re never far from your financial overview, enabling quick updates and informed decisions whether you’re at home, at work, or on the go. This level of synchronization empowers you to stay on top of your money without extra effort.

Getting Started: Your Budgeting Journey with Apple Numbers

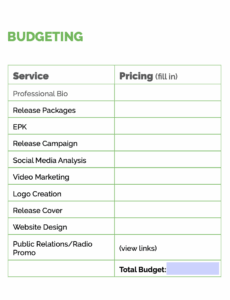

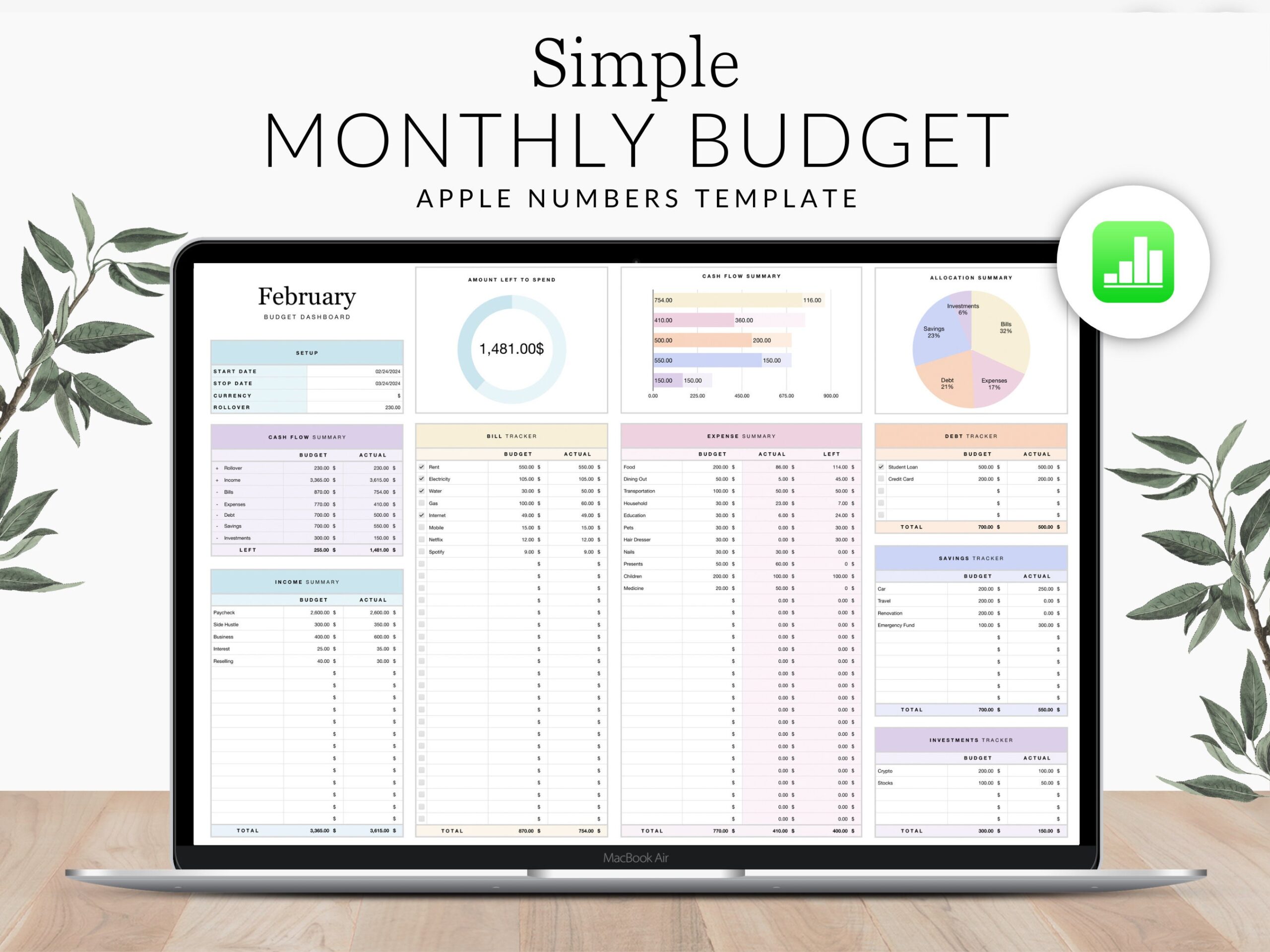

Diving into personal budgeting with Apple Numbers on your iPhone begins with identifying and utilizing the right starting point: a well-designed template. While you could build a budget from scratch, pre-built templates offer a significant head start, providing the foundational structure you need to track income, expenses, and savings goals effectively. Apple Numbers comes with several excellent financial templates, including those specifically for personal budgeting.

To begin, simply open the Numbers app on your iPhone. You’ll typically be presented with a template chooser. Look for categories like "Personal Finance" or "Money." Within these, you’ll find templates such as "Personal Budget," "Savings Tracker," or "Monthly Budget." Selecting one of these instantly creates a new spreadsheet pre-populated with common budgeting categories and formulas, saving you hours of setup time. This initial step transforms a daunting task into a manageable project.

- **Choose the Right Template:** Browse the available templates. The **Personal Budget** or **Monthly Budget** options are usually the best starting points for comprehensive financial tracking.

- **Rename Your File:** As soon as you open a new template, rename it something descriptive, like “2024 Personal Budget” or “My Monthly Finances.” This keeps your files organized.

- **Understand the Layout:** Take a moment to familiarize yourself with the template’s structure. Most will have sections for income, fixed expenses, variable expenses, and a summary.

Customizing Your Budget Template for Your Life

While pre-built templates are incredibly helpful, your personal finances are unique. The true power of using a Numbers Apple On Iphone Personal Budget Template comes from your ability to customize it to perfectly reflect your income, spending habits, and financial aspirations. This personalization ensures that your budget is not just a generic tracker but a precise reflection of your financial reality.

Start by adjusting the income section. Edit the placeholder text to reflect your actual income sources, such as "Salary," "Freelance Gigs," "Investment Dividends," or "Side Hustle." Input your expected monthly amounts. Next, move to expenses. Templates usually provide common categories like "Housing," "Utilities," "Groceries," "Transportation," and "Entertainment." Go through each and modify them to match your spending categories precisely. If you have unique expenses like "Pet Care" or "Subscription Services," add new rows for them.

The beauty of Numbers is how easily you can add or delete rows and columns, change category names, and even modify formulas (though for beginners, sticking to the template’s existing formulas is often best). Remember, your budget should be a living document. Don’t hesitate to refine categories as your spending habits evolve or as you identify areas that need more granular tracking. This iterative process is key to a truly effective personal budget.

Advanced Tips for Maximizing Your Budgeting Efforts

Once you’ve set up and customized your personal budgeting template on your iPhone, there are several strategies you can employ to make your financial tracking even more robust and effective. These tips go beyond basic data entry and aim to transform your budget from a simple record-keeper into a powerful financial planning tool.

First, regular review is paramount. Schedule a weekly or bi-weekly check-in with your budget. This isn’t just about entering new transactions; it’s about comparing your actual spending against your planned budget. Identifying discrepancies early allows you to make adjustments before small overspends become significant issues. Are you consistently going over budget in one category? Perhaps it’s time to re-evaluate that category’s allocation or find ways to reduce spending.

Secondly, consider future-proofing your budget with forecasting. Numbers allows you to easily duplicate sheets. Create a new sheet for the upcoming month and pre-populate it with your fixed expenses and estimated variable expenses. This gives you a forward-looking view, helping you anticipate financial demands and plan for larger irregular expenses, like annual insurance premiums or holiday gifts.

Thirdly, leverage Numbers’ functionalities for visualizing your financial data. Many templates include charts and graphs that automatically update as you input data. These visual representations can provide quick insights into your spending patterns, highlighting areas where you might be overspending or where you’re making excellent progress towards your savings goals. Seeing your financial picture in a digestible format can be incredibly motivating.

Beyond the Basics: Financial Wellness with Your iPhone

Your personal budget template on your iPhone is more than just a tool for tracking past spending; it’s a foundation for building comprehensive financial wellness. By consistently engaging with your financial data, you unlock opportunities to make smarter decisions about your money, leading to greater financial security and peace of mind.

One significant aspect is connecting your budget to your savings goals. Whether you’re saving for a down payment, a new car, retirement, or an emergency fund, integrate these goals directly into your Numbers budget. Create dedicated line items or even separate tabs to track your progress. Seeing your savings grow alongside your managed expenses provides tangible evidence of your financial discipline and motivates continued effort.

Another crucial benefit is debt management. If you have outstanding debts, include them in your budget. Track minimum payments, interest rates, and extra payments you might be making. Visualizing your debt reduction progress can be incredibly empowering and helps keep you accountable to your repayment plans. This proactive approach to debt is a cornerstone of financial health.

Ultimately, consistent use of your personalized financial spreadsheet strengthens your financial resilience. You gain a deeper understanding of your cash flow, identify potential financial vulnerabilities, and develop the habit of mindful spending. This awareness allows you to adapt quickly to unexpected financial changes, whether it’s a sudden expense or a change in income, fostering a sense of control over your financial destiny.

Frequently Asked Questions

Is Apple Numbers free to use on my iPhone?

Yes, Apple Numbers is free to download and use on all modern iPhones. It comes pre-installed on many new devices, or you can easily download it from the App Store at no cost, making it an accessible option for everyone in the Apple ecosystem.

Can I sync my budget across multiple Apple devices?

Absolutely. Your Apple Numbers spreadsheets, including your personal budget, can be seamlessly synced across all your Apple devices (iPhone, iPad, Mac) using iCloud. As long as you’re signed in with the same Apple ID and have iCloud Drive enabled for Numbers, your changes will update in real-time across all your devices.

What if I make a mistake or accidentally delete data in my budget?

Numbers has robust undo capabilities, allowing you to easily revert recent changes. Additionally, because your files are often saved to iCloud, there are usually previous versions available. You can typically browse and restore earlier versions of your document through the file management interface, providing a safety net for accidental deletions or errors.

How often should I update my personal budget in Numbers?

For most people, updating your budget at least once a week is a good practice to ensure accuracy and stay on top of your spending. Daily updates are ideal for those who prefer granular control, while a bi-weekly or monthly review might suffice if your income and expenses are highly stable. Consistency is more important than frequency.

Are there specific pre-built templates for personal budgeting available in Numbers?

Yes, Apple Numbers includes several excellent pre-built templates specifically designed for personal finance and budgeting. When you open Numbers and choose to create a new spreadsheet, you’ll find templates like “Personal Budget,” “Monthly Budget,” and “Savings Tracker” that provide a great starting point for your financial management.

Taking control of your finances doesn’t have to be an intimidating ordeal. With the powerful yet accessible combination of Apple Numbers and your iPhone, you have a robust tool at your fingertips to track, manage, and optimize your personal budget. By starting with a template, customizing it to your unique needs, and consistently engaging with your financial data, you’re not just creating a spreadsheet; you’re building a foundation for lasting financial health.

Embrace the convenience and capability that your iPhone offers. Let the Numbers Apple On Iphone Personal Budget Template be your guide to a clearer financial picture, empowering you to make informed decisions and achieve your monetary goals with confidence. Your journey to financial clarity and control is just a few taps away.