In the dynamic world of non-profit organizations, where every dollar raised and every cent spent directly impacts mission fulfillment, robust financial management isn’t just a best practice—it’s a necessity. From securing vital grants to demonstrating accountability to donors and beneficiaries, a clear financial roadmap is the backbone of sustainable operations. Without it, even the most passionate efforts can falter, jeopardizing the very causes they strive to serve.

This is precisely where a well-crafted Non Profit Organization Budget Template becomes an invaluable asset. Far more than a mere spreadsheet, it represents a strategic framework designed to bring clarity, discipline, and foresight to your organization’s financial journey. It’s a tool that empowers leaders to make informed decisions, allocate resources wisely, and ultimately, amplify their impact on the communities they serve.

The Indispensable Role of a Structured Budget in Non-Profit Success

For non-profits, finances are a unique beast. Unlike for-profit entities driven by shareholder returns, charitable organizations operate under the dual mandate of fiscal responsibility and mission impact. Every financial decision must align with the organization’s core purpose, whether that’s feeding the hungry, protecting the environment, or advancing education. A structured budget acts as the primary tool for ensuring this alignment.

It transforms vague aspirations into concrete, measurable financial plans. By itemizing anticipated revenues and expenditures, a comprehensive budget helps non-profit leaders understand their financial capacity, identify potential shortfalls, and proactively plan for future initiatives. This level of foresight is critical for maintaining stability and pursuing growth, allowing the organization to focus on its mission without constant financial anxieties. Moreover, a transparent budget is a powerful communication tool, clearly articulating how donor contributions are utilized and demonstrating the organization’s commitment to sound stewardship.

Unpacking the Benefits of a Dedicated Financial Blueprint

Leveraging a specialized budget framework offers a multitude of advantages tailored to the specific needs of charitable organizations. It moves beyond generic financial planning, addressing the unique complexities of grant cycles, restricted funds, and program-specific accounting. The right budgeting solution serves as a cornerstone for operational excellence.

Clarity and Transparency

A detailed financial plan provides unparalleled clarity regarding your organization’s financial health. It delineates where funds are coming from and where they are going, offering a snapshot of financial flows. This transparency is vital for internal governance and external reporting, fostering trust among your board, staff, and the public.

Strategic Decision-Making

With a clear budget, leaders can make data-driven decisions about programs, staffing, and fundraising strategies. It highlights areas of overspending or underspending, allowing for timely adjustments and better allocation of precious resources. This strategic tool enables the organization to adapt to changing circumstances while staying true to its long-term goals.

Accountability and Grant Reporting

Many grants and funding opportunities require precise financial reporting, often categorizing expenses by program, administrative overhead, and fundraising efforts. A well-organized budget facilitates accurate tracking against these categories, simplifying the grant application and reporting processes. It demonstrates fiscal responsibility, which is crucial for securing continued funding.

Improved Resource Allocation

By meticulously detailing both income and expenses, a comprehensive budget ensures that resources are allocated efficiently to achieve maximum impact. It helps prevent misdirection of funds and ensures that core programs receive the necessary support. This optimization leads to better outcomes and a stronger fulfillment of the mission.

Risk Management

Understanding your financial position through a clear budgeting solution helps identify potential financial risks before they become crises. It allows organizations to build reserves, plan for contingencies, and navigate economic uncertainties with greater confidence. Proactive financial management safeguards the organization’s future. The application of a Non Profit Organization Budget Template can dramatically enhance an organization’s ability to manage these critical areas.

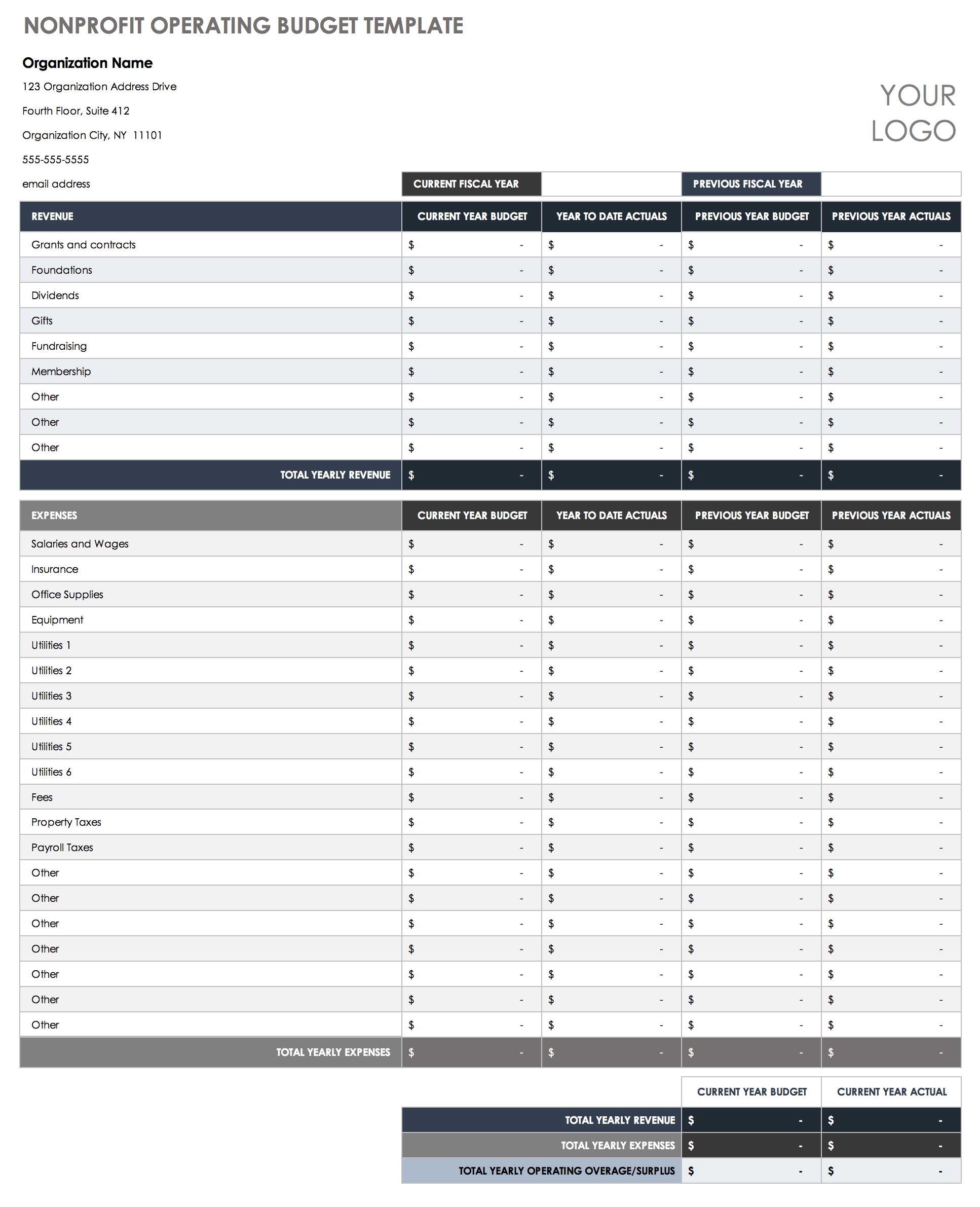

Key Components of an Effective Non-Profit Budget

A robust financial plan for a non-profit is meticulously structured to capture the nuances of its operations. It typically comprises several essential sections that, when combined, offer a holistic view of the organization’s financial landscape. Understanding these components is the first step toward building a budget that truly serves your mission.

Revenue Streams

This section details all anticipated income sources. For non-profits, revenue streams are often diverse and can fluctuate significantly.

Typical categories include grants (government, foundation, corporate), individual donations (one-time, recurring), corporate sponsorships, special event fundraising, earned income (e.g., program fees, merchandise sales), and investment income. Each source should be estimated based on historical data, fundraising projections, and confirmed commitments.

Expenditure Categories

This outlines how funds will be spent, usually broken down into distinct functional areas. Non-profit accounting standards (such as GAAP for non-profits) typically require expenses to be categorized by function, primarily program services, management and general (administrative), and fundraising.

- Program Costs: Direct expenses related to delivering your mission-specific services. This includes salaries for program staff, materials for projects, direct aid to beneficiaries, travel for program delivery, and specific event costs.

- Administrative Costs: Overhead expenses necessary to operate the organization but not directly tied to a specific program. This covers executive salaries, office rent, utilities, insurance, legal fees, accounting services, and general office supplies.

- Fundraising Costs: Expenses incurred to solicit contributions and raise awareness. This includes salaries for fundraising staff, marketing and communication materials for appeals, event costs for fundraisers, and donor database management.

- Personnel Costs: Often the largest expenditure, encompassing salaries, wages, benefits (health insurance, retirement contributions), payroll taxes, and professional development for all staff members across all functions.

Cash Flow Projections

Beyond just income and expenses, cash flow projections map out when money is expected to come in and when it will go out. This is crucial for ensuring liquidity, especially for organizations with seasonal funding or grant cycles that don’t align perfectly with expenditure schedules. Positive cash flow management prevents operational disruptions.

Restricted vs. Unrestricted Funds

Non-profits frequently receive donations that come with specific stipulations from the donor. These are known as restricted funds, meaning they can only be used for particular programs or purposes. Unrestricted funds, conversely, can be used for any legitimate purpose that advances the organization’s mission. A robust budget must clearly differentiate between these two types of funds to ensure compliance and proper financial reporting.

Customizing Your Budget Framework: Practical Steps

While a comprehensive budget framework provides a solid foundation, its true power lies in its adaptability to your organization’s specific context. No two non-profits are exactly alike, and therefore, no single financial model will perfectly fit every situation. Customization is key to ensuring that the template serves your unique strategic needs and operational realities.

Understanding your organization’s size, program complexity, and funding model is paramount. A small, volunteer-led charity will require a simpler budgeting approach than a large, multi-program organization with diverse funding streams. The goal is to create a living document that is both detailed enough for accountability and flexible enough to accommodate unforeseen changes or new opportunities.

Integrating your budgeting practices with existing accounting software can streamline data entry and reconciliation, reducing administrative burden. The process of adapting your budget solution should be collaborative, involving key staff members who understand the intricacies of different programs and operations. This ensures buy-in and accuracy across all departments.

Here are some practical steps to tailor your financial planning tool:

- Start with your mission: Ensure every budget line item, both revenue and expense, can be directly tied back to your **core objectives**.

- Gather historical data: Analyze past financial statements to understand **spending patterns** and revenue trends, informing future projections.

- Project future needs: Anticipate **upcoming initiatives**, new programs, personnel changes, and potential growth areas when forecasting.

- Engage stakeholders: Involve **program managers**, development directors, and board members in the budgeting process for realistic input and shared ownership.

- Review and revise regularly: Remember that budgets are **living documents**. Schedule regular reviews (monthly or quarterly) to compare actuals against projections and make necessary adjustments.

By thoughtfully adapting a Non Profit Organization Budget Template, you transform it from a generic tool into a powerful, customized instrument for achieving your mission.

Implementing and Monitoring Your Financial Plan

Creating a detailed budget is just the first step; its true value emerges through diligent implementation and continuous monitoring. A budget is not a static document to be filed away, but a dynamic tool that guides daily operations and strategic decisions. Effective oversight ensures that your organization stays on course and remains fiscally sound.

Regular reviews are essential. At least monthly, leadership and finance teams should compare actual revenues and expenditures against the budgeted amounts. This comparison helps identify variances—areas where spending is higher or lower than planned, or where revenue projections are not being met. Understanding the reasons behind these variances is critical for making informed adjustments. Perhaps a fundraising event exceeded expectations, or a program cost less than anticipated; equally, a grant might have been delayed, or a vendor’s prices increased.

Leveraging financial software or even simple spreadsheets can help track these actuals efficiently. The goal is to maintain clear, up-to-date records that provide an accurate picture of your organization’s financial standing at all times. This real-time data allows for proactive decision-making, enabling your team to reallocate funds, adjust spending, or intensify fundraising efforts before minor issues escalate into major problems.

Finally, consistent and transparent reporting to the board of directors and funders is non-negotiable. Board members rely on budget vs. actual reports to fulfill their fiduciary duties, ensuring the organization is well-managed and financially stable. For funders, these reports demonstrate accountability and reinforce trust, crucial for cultivating long-term partnerships and securing future support. A well-implemented and monitored financial blueprint underpins the credibility and long-term viability of your non-profit.

Frequently Asked Questions

1. Why can’t I just use a general business budget template?

Non-profits have unique funding sources (grants, individual donations) and specific reporting requirements (program vs. administrative expenses, restricted funds) that generic business templates often don’t adequately address. A specialized template accounts for these nuances, ensuring compliance with non-profit accounting standards and enabling better strategic oversight aligned with your mission.

2. How often should our organization review and update its budget?

While an annual budget is standard, it’s crucial to review and monitor actual performance against the budget at least monthly or quarterly. This allows for timely adjustments, identifies potential shortfalls or surpluses, and ensures the organization remains on track with its financial goals and mission, adapting to real-world changes.

3. What’s the biggest challenge non-profits face with budgeting?

A significant challenge is often the unpredictability of funding, especially for grant-dependent organizations, making revenue forecasting complex. Another common hurdle is accurately allocating indirect or administrative costs across various programs while maintaining a low administrative overhead ratio for donor appeal. Robust financial planning and a flexible budgeting solution help mitigate these challenges.

4. Can a budget template help with grant applications?

Absolutely. Many grant applications require detailed budget breakdowns, often aligning with program-specific costs, administrative overhead, and personnel expenses. A well-structured budget framework can be directly adapted for grant proposals, demonstrating financial prudence, aligning with funder expectations, and significantly increasing your chances of securing vital funding.

5. Is this solution only for large non-profits, or can small organizations benefit too?

This financial tool is invaluable for organizations of all sizes. For small non-profits, it provides essential structure and discipline, helping to maximize limited resources and lay a strong foundation for growth. For larger organizations, it offers the robustness needed for complex operations, multiple programs, and diverse funding streams, fostering transparency and accountability across a broader scope.

Ultimately, a diligently managed budget transcends its role as a mere financial document; it becomes a powerful expression of your non-profit’s commitment to its mission. It’s a testament to transparency, accountability, and the strategic foresight that inspires confidence in donors, galvanizes your team, and assures beneficiaries that your programs are sustainable and effective. Embracing a structured approach to financial planning is not just about balancing books; it’s about safeguarding the future of your cause.

By proactively managing your finances, you empower your organization to navigate challenges, seize opportunities, and continuously grow its impact. Investing time in developing and maintaining a thoughtful budget framework is an investment in your mission itself, ensuring that your passion translates into lasting, positive change in the world.