A paycheck stub, also known as an earnings statement, is a crucial document that provides employees with a detailed breakdown of their earnings and deductions for a specific pay period. While employers typically provide these, having a blank paycheck stub template can be incredibly helpful for various reasons, from personal budgeting to tracking income for tax purposes.

Why Use a Blank Paycheck Stub Template?

Budgeting and Financial Planning: A blank template allows you to accurately track your income and expenses, helping you create a realistic budget and make informed financial decisions.

Key Elements of a Paycheck Stub

A typical paycheck stub includes the following key elements:

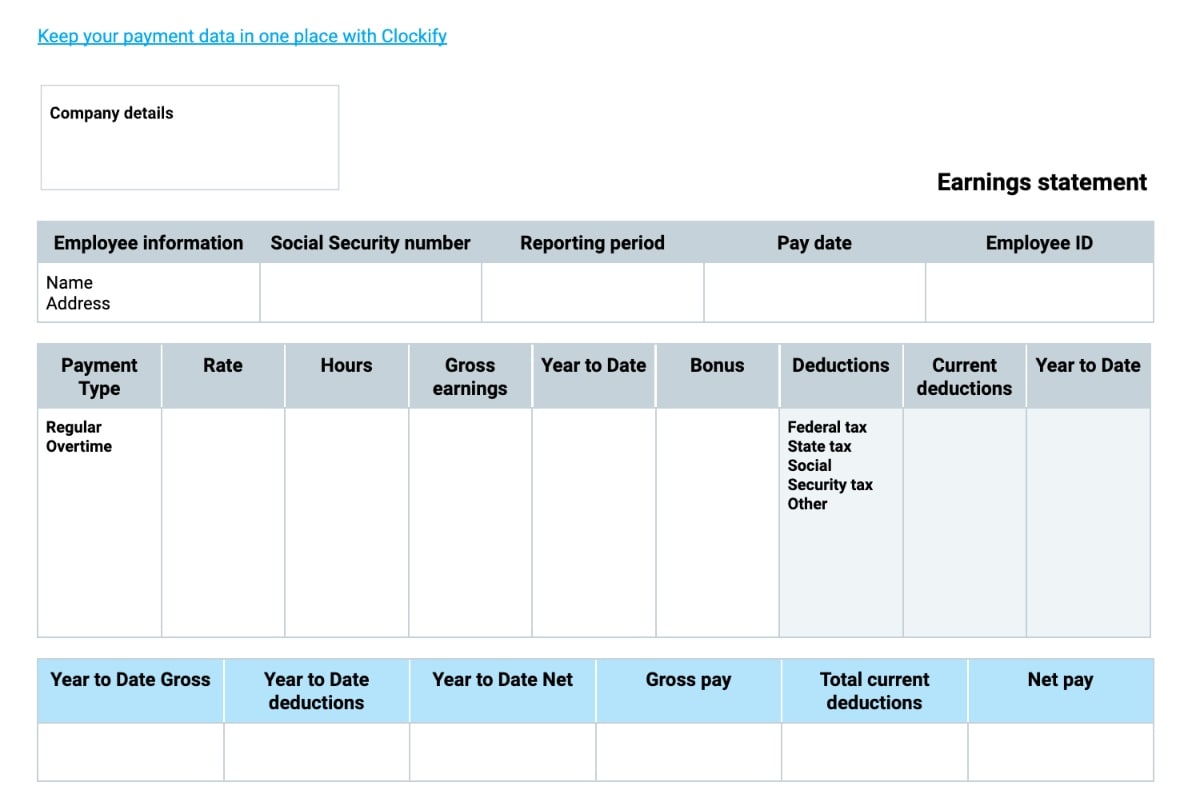

Image Source: clockify.me

Employee Information:

Creating Your Own Blank Paycheck Stub Template

You can easily create your own blank paycheck stub template using various methods:

Spreadsheet Software (like Excel or Google Sheets): This is a highly flexible option. You can easily customize the template to fit your specific needs and preferences. Simply create a spreadsheet and include the necessary fields mentioned earlier.

Tips for Using a Blank Paycheck Stub Template

Accuracy is Key: Ensure you accurately record all your earnings and deductions to maintain accurate financial records.

Conclusion

A blank paycheck stub template is a valuable tool for individuals and businesses alike. By using this template, you can effectively track your income and expenses, simplify tax preparation, and make informed financial decisions. Whether you create your own template or use a pre-designed one, this simple tool can significantly improve your financial organization and peace of mind.

FAQs

1. What is the difference between gross pay and net pay?

Gross pay is your total income before any deductions. Net pay is the amount of money you actually receive after all taxes and other deductions have been withheld.

2. Are there any legal requirements for employers regarding paycheck stubs?

Yes, most states have specific laws regarding the information that must be included on an employee’s paycheck stub. Familiarize yourself with the relevant laws in your state.

3. Can I use a blank paycheck stub template for tax purposes?

Yes, you can use a well-maintained record of your earnings and deductions to support your tax filings.

4. How often should I reconcile my paycheck stub with my bank statement?

It’s recommended to reconcile your bank statement with your paycheck stub as soon as you receive your paycheck to identify any discrepancies promptly.

5. Can I use a blank paycheck stub template if I am self-employed?

Absolutely! A blank paycheck stub template can be a valuable tool for tracking your income and expenses as a freelancer or independent contractor.

I hope this comprehensive guide on blank paycheck stub templates proves helpful!

Blank Paycheck Stub Template