We all dread that moment: the arrival of the monthly bills. Rent, utilities, groceries, subscriptions – the list seems endless. But fear not, fellow bill-payers! This guide will equip you with a simple yet effective monthly bills template to conquer your finances and achieve financial freedom.

1. Gather Your Bills

The first step is to gather all your monthly bills. This includes:

Rent or Mortgage

Utilities (electricity, gas, water)

Internet and Phone

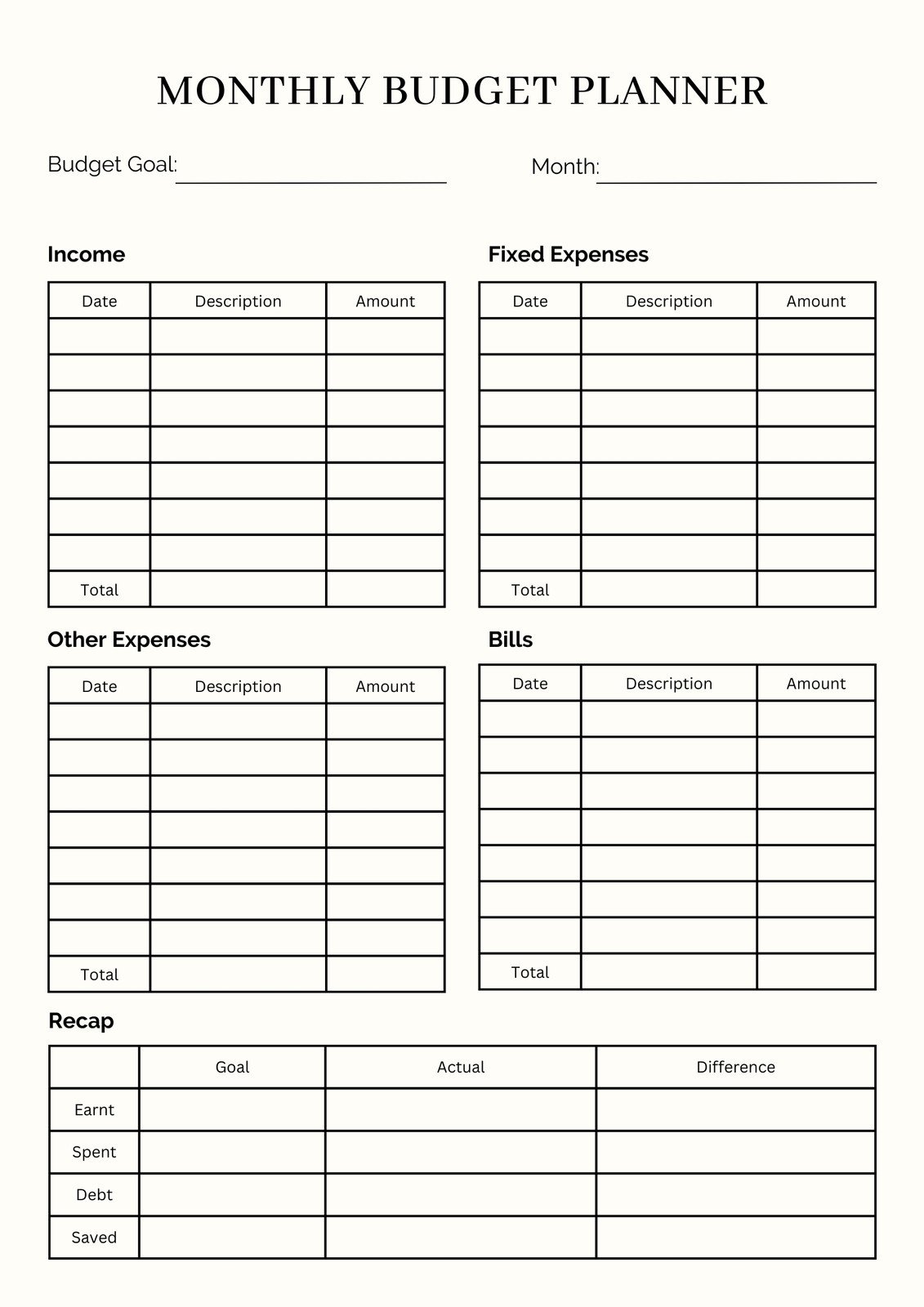

Image Source: canva.com

Groceries

Transportation (gas, public transport, car payments)

Insurance (health, car, home)

Subscriptions (streaming services, gym memberships)

Loans (student loans, personal loans)

Credit Card Payments

2. Create Your Template

Now, let’s create your monthly bills template. You can use a spreadsheet program like Google Sheets or Excel, or even a simple notebook. Here’s a basic structure:

Date: This column tracks the due date for each bill.

3. Input Your Bill Information

Once you have your template, input all your monthly bill information. Be as accurate as possible. If you have recurring bills, you can automate some of this process by importing data from your bank statements or online bill portals.

4. Track Your Spending

Regularly update your template with your actual payments. This will help you track your spending and identify any areas where you might be overspending.

5. Analyze Your Spending

Analyze your spending data to identify any areas where you can cut back. Are you spending too much on entertainment? Can you negotiate lower rates for your utilities? Can you find cheaper alternatives for groceries or transportation?

6. Set a Budget

Based on your spending analysis, set a monthly budget. This will help you prioritize your expenses and ensure you have enough money to cover all your essential bills.

7. Automate Payments

Automate as many of your bill payments as possible. This will help you avoid late fees and ensure your bills are paid on time.

8. Review and Adjust

Review your monthly bills template regularly. Your financial situation may change over time, so it’s important to adjust your budget and spending habits accordingly.

9. Celebrate Your Successes

Celebrate your successes along the way. Every time you pay off a debt or achieve a financial goal, take a moment to acknowledge your progress.

10. Stay Motivated

Staying motivated can be challenging, but it’s crucial for long-term financial success. Find a way to stay motivated, whether it’s setting small, achievable goals, rewarding yourself for your progress, or finding an accountability partner.

Conclusion

By using a monthly bills template and following these tips, you can gain control of your finances, reduce stress, and achieve your financial goals. Remember, consistency is key. By diligently tracking your spending and making conscious financial decisions, you can build a strong financial foundation and enjoy a more secure future.

FAQs

How often should I review my monthly bills template?

It’s a good idea to review your monthly bills template at least once a month. This will help you stay on top of your spending and make any necessary adjustments to your budget.

What if I don’t have time to create a detailed template?

Even a simple spreadsheet or notebook can be helpful. Start with the basics and gradually add more details as you become more comfortable with the process.

How can I automate my bill payments?

Many companies offer online bill pay options or allow you to set up automatic payments. You can also use third-party apps to manage and automate your bill payments.

How can I reduce my monthly expenses?

There are many ways to reduce your monthly expenses, such as:

What are some other benefits of using a monthly bills template?

In addition to helping you save money, a monthly bills template can also:

I hope this article helps you on your journey to financial freedom!

Monthly Bills Template