The electric buzz of a crowd, the perfect harmony of sound and light, the unforgettable shared experience – live music concerts are magical. Yet, behind every flawless performance lies a mountain of meticulous planning, and perhaps no single element is more critical to success than the financial blueprint. Without a robust and detailed approach to managing funds, even the most artistically brilliant event can quickly spiral into a financial quagmire, leaving organizers with stress instead of triumph.

This is where a dedicated financial framework becomes your most valuable ally. For event organizers, promoters, artists, and venues alike, understanding where every dollar goes – and where it needs to go – is paramount. A comprehensive Music Concert Budget Template serves as your guiding star, transforming abstract ideas into concrete financial projections and ensuring that the show not only goes on but also flourishes without breaking the bank. It’s the foundational document that empowers informed decisions, secures resources, and ultimately, delivers an unforgettable experience for both audience and organizers.

Why a Meticulous Concert Budget is Non-Negotiable

Embarking on the journey of organizing a live music event without a clear financial plan is akin to navigating uncharted waters without a map. The risks are substantial, ranging from unexpected overspending to outright financial loss, which can damage reputations and stifle future opportunities. A detailed concert budget planning tool, however, transforms this risky venture into a controlled, strategic operation. It provides a crystal-clear overview of all potential revenues and expenditures, enabling proactive decision-making rather than reactive problem-solving.

This proactive approach is crucial for several reasons. Firstly, it offers vital financial control, allowing organizers to allocate funds efficiently to different departments – from artist fees to marketing – ensuring no area is neglected or excessively funded. Secondly, it acts as a powerful risk mitigation tool. By anticipating costs, event planners can identify potential financial shortfalls early, allowing time to adjust strategies, seek additional funding, or negotiate better deals. Lastly, a well-structured financial management tool for concerts builds confidence. It assures investors, sponsors, and partners that their contributions are managed responsibly, making it easier to secure funding and build lasting relationships for future endeavors.

Key Categories in Your Event Financial Plan

Creating an effective music event financial plan means breaking down the complex ecosystem of a concert into manageable, trackable components. Each category represents a significant area of expenditure or potential income, demanding careful estimation and diligent tracking. While the specifics might vary based on the scale and type of event, these core elements form the backbone of any robust show budget outline.

Here are the essential categories you’ll need to consider:

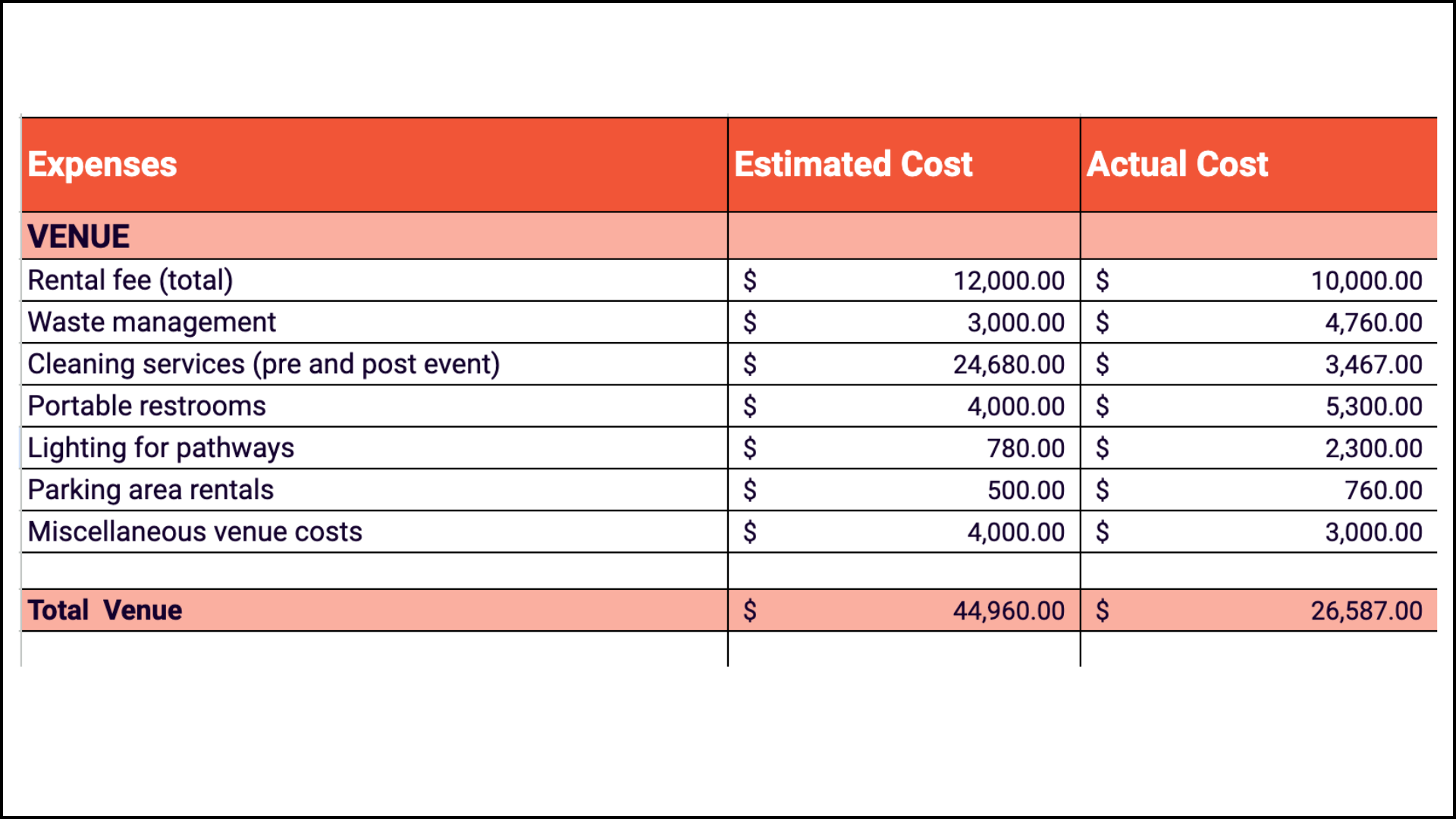

- **Venue Costs:** This encompasses the rental fee for the performance space itself, which can range from a small club to a large arena. Don’t forget about associated expenses like **site insurance**, security deposits, and any necessary **permits** or licenses from local authorities.

- **Artist Fees & Production:** This is often the largest single expense. It includes the **talent fees** for the artists or bands, their specific **rider requirements** (hospitality, technical needs), and the costs for essential production elements such as **sound engineering**, lighting design, staging, backline equipment rental, and stage management.

- **Marketing & Promotion:** Getting the word out is vital. This category covers expenses for **advertising campaigns** (digital, print, radio), public relations, social media marketing, graphic design for posters and digital assets, and potentially fees associated with **ticketing platforms**.

- **Staffing & Crew:** A concert requires a dedicated team beyond the artists. Budget for **security personnel**, ushers, box office staff, clean-up crews, medical staff, stagehands, technical support, and any other personnel required for smooth operation and safety.

- **Logistics & Hospitality:** This covers everything needed to get people and equipment to the event and keep them comfortable. Think **artist travel** (flights, ground transportation), accommodation, catering for artists and crew, and any special equipment transportation.

- **Contingency Fund:** This is arguably the most critical and often overlooked category. Always allocate a percentage (typically **10-15%**) of your total budget for unforeseen expenses. Equipment malfunctions, last-minute travel changes, or unexpected regulatory fees can quickly derail a budget without this cushion.

- **Miscellaneous & Administrative:** Smaller, yet necessary costs often fall here. Examples include office supplies, communication expenses, waste management services, merchandising setup fees, and any **administrative overheads** not covered elsewhere.

Leveraging a Concert Budget Blueprint for Success

A comprehensive event financial framework is more than just a list of numbers; it’s a dynamic tool that, when used effectively, can guide every decision throughout the event planning lifecycle. It empowers organizers to make strategic choices, negotiate confidently, and maintain financial stability from conception to curtain call.

Firstly, start early and research thoroughly. The accuracy of your show budget outline depends heavily on the quality of your initial estimates. Get multiple quotes for every service – venue rental, sound equipment, security – and don’t be afraid to negotiate. Understanding market rates and potential vendor discounts can save significant funds. Secondly, track expenses in real-time. Don’t wait until the end of the month or the event to reconcile your spending. Implement a system, whether it’s a dedicated spreadsheet or accounting software, to log every invoice and payment as it happens. This immediate insight allows for quick adjustments if spending deviates from the plan.

Moreover, use your financial management tool for concerts as a communication tool. Share relevant sections with team members, vendors, and sponsors to foster transparency and align expectations. It clarifies what funds are available for marketing, production, or artist hospitality, preventing misunderstandings and ensuring everyone works towards common financial goals. Finally, review and adjust regularly. Budgets are not static. Market conditions change, unexpected costs arise, and opportunities for savings may appear. Schedule regular budget reviews – weekly or bi-weekly – to assess progress, reallocate funds if necessary, and ensure you remain on track.

Customizing Your Financial Framework

While the core categories of a concert budget planning tool remain consistent, the level of detail and specific line items will naturally fluctuate based on the scale and nature of your music event. A small, intimate acoustic performance at a local café demands a different financial approach than a multi-day festival featuring international headliners. The beauty of a flexible event financial framework lies in its adaptability.

For a smaller, local gig, your show budget outline might consolidate several categories. Artist fees could be a simple flat rate or door split, production might involve just a basic PA system, and marketing could be limited to social media and local flyers. The focus would be on minimizing overheads and ensuring break-even, often with a tighter contingency. Conversely, organizing a large-scale festival requires an incredibly granular level of detail. Here, the artist fees will be substantial and complex, production costs will involve intricate staging, elaborate lighting rigs, and professional sound systems. Marketing budgets will include national campaigns, and staffing will necessitate hundreds of personnel across various roles. Logistics will be a major expense, covering everything from artist transportation and accommodation to waste management and crowd control infrastructure. The key is to scale your detail to your event’s complexity, ensuring every significant cost is accounted for without getting bogged down in unnecessary minutiae for smaller projects. This adaptability ensures that your financial planning is always appropriate and effective.

Common Pitfalls and How to Avoid Them

Even with a robust music event financial plan, pitfalls can emerge, threatening to derail the most well-intentioned efforts. Recognizing these common mistakes and proactively building strategies to circumvent them is crucial for maintaining financial health. One of the most frequent errors is **underestimating costs**. It’s easy to overlook smaller, seemingly insignificant expenses that, when accumulated, can become substantial. Examples include hidden fees from vendors, unexpected surcharges for late bookings, or even the cost of basic supplies like batteries or gaffer tape. To avoid this, always err on the side of caution when estimating, and build in a little buffer beyond your contingency.

Another significant pitfall is ignoring or skimping on the contingency fund. Many organizers view this as wasted money if not spent, but it’s a vital safety net. Without it, a single unforeseen issue – a cancelled flight, a sudden equipment repair, or even a weather-related delay – can quickly lead to out-of-pocket expenses that throw the entire budget into disarray. Always allocate a realistic percentage for contingency, and treat it as a non-negotiable part of your event expenditure tracker.

Furthermore, a lack of real-time expense tracking can be detrimental. Waiting until the last minute to reconcile receipts means you lose the opportunity to make timely adjustments. This can lead to overspending in certain areas without realizing it until it’s too late. Implement a system for immediate expense logging. Finally, failing to get written quotes and contracts from all vendors can lead to disputes over pricing and services. Verbal agreements are notoriously unreliable; always ensure all financial arrangements are documented clearly in writing.

The Unseen Benefits of Detailed Financial Planning

While the immediate benefit of using a music concert budget template is evident in cost control and financial stability, the advantages extend far beyond the balance sheet. A meticulously crafted event financial framework fosters a culture of professionalism and strategic foresight that can elevate your entire event production process. One significant unseen benefit is **improved vendor relationships**. When you approach vendors with a clear understanding of your budget and needs, you present as a serious, organized partner, leading to more favorable negotiations and better service. This can build long-term relationships, securing preferred rates and priority service for future events.

Moreover, a strong show budget outline facilitates much more effective future planning. Every event becomes a learning opportunity. By meticulously tracking actual expenses against budgeted figures, you gain invaluable data. This historical financial data provides realistic benchmarks for future projects, enabling more accurate forecasting and smarter resource allocation. It also helps in identifying areas where cost efficiencies can be consistently achieved. Ultimately, this detailed approach enhances your professional reputation. Stakeholders, investors, sponsors, and even artists appreciate working with organizers who demonstrate fiscal responsibility and transparency. It signals reliability and competence, attracting more opportunities and talent, and solidifying your position as a trusted and successful event producer in the competitive live music industry.

Frequently Asked Questions

How often should I review my event financial plan?

For large-scale events, review your budget weekly, especially during the peak planning phase. For smaller events, bi-weekly reviews may suffice. The key is regular scrutiny to catch deviations early.

What’s a reasonable contingency percentage?

A general rule of thumb is to allocate 10-15% of your total estimated budget for contingency. For first-time organizers or particularly complex events, consider increasing this to 20%.

Can a concert budget planning tool help with sponsorship?

Absolutely. A detailed event financial framework demonstrates your professionalism and financial prudence to potential sponsors. It clearly outlines where their funds will be allocated, making a compelling case for investment.

Is a comprehensive show budget outline necessary for small local gigs?

Yes, even for small local gigs, a basic show budget outline is crucial. While less complex, it still helps track artist payments, venue costs, and marketing efforts, ensuring you don’t lose money and can plan future events effectively.

Embracing a comprehensive financial strategy is not just about avoiding monetary pitfalls; it’s about laying a solid foundation for unparalleled success. The intricate dance of organizing a live music event, from securing talent to ensuring every technical detail is perfect, hinges on a clear and actionable financial roadmap. By diligently utilizing a robust financial management tool for concerts, you transform potential chaos into an organized, profitable, and memorable experience for everyone involved.

Invest the time in crafting and consistently managing your event’s finances, and you’ll find that the rewards extend far beyond the balance sheet. It’s the peace of mind knowing you’ve accounted for every possibility, the confidence to negotiate with power, and the ultimate satisfaction of delivering an extraordinary live music event that resonates with both artists and audiences, all built on a bedrock of sound financial planning.