In the intricate world of cultural institutions, where history, art, and science converge to enrich public understanding, effective financial stewardship is not merely a formality—it is the bedrock of sustainability. Museums, regardless of their size or focus, operate on a delicate balance of public service, educational outreach, and often, razor-thin margins. To navigate this complex landscape successfully, a robust and adaptable financial framework is absolutely essential for every institution aiming to thrive and fulfill its mission.

A well-crafted Museum Budget Template offers more than just a spreadsheet; it provides a comprehensive roadmap for allocating resources, forecasting future needs, and ensuring accountability to stakeholders, donors, and the community. It’s a vital instrument for executive directors, finance committees, board members, and department heads, enabling them to make informed decisions that safeguard collections, support staff, and deliver impactful programming for years to come. This proactive approach to financial planning transforms potential challenges into opportunities for growth and resilience.

The Unsung Hero: Why Financial Planning Matters for Museums

Museums face a unique set of financial pressures that differentiate them from typical for-profit businesses. Their core mission isn’t about profit generation, but rather preservation, education, and community engagement. This often means relying heavily on a diverse mix of funding sources, including donations, grants, membership fees, ticket sales, and endowment returns, all of which can fluctuate unpredictably. A dynamic financial planning tool is critical for maintaining stability amidst these variances.

Beyond simply tracking income and expenses, sophisticated museum budgeting allows institutions to strategically align their financial resources with their long-term vision. It helps prioritize projects, from exhibit development and collection conservation to educational programs and facility maintenance. Without a clear financial blueprint, even the most well-intentioned efforts can lead to overspending in one area and underfunding in another, jeopardizing the institution’s overall health and mission.

Navigating the Fiscal Labyrinth: Unique Budgetary Challenges for Museums

The operational realities of museums present distinct financial hurdles that demand careful consideration within any financial plan. Long-term collection care, for instance, involves specialized environmental controls, secure storage, and expert conservation staff, all of which represent significant, ongoing costs. These expenses often do not directly generate revenue but are fundamental to the museum’s existence and mandate.

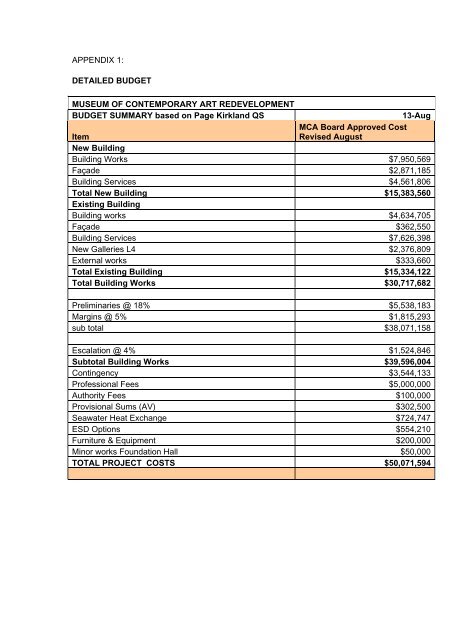

Furthermore, capital improvement projects—such as building expansions, gallery renovations, or technological upgrades—require substantial, often multi-year, funding campaigns. Human resources, from highly specialized curators and conservators to visitor services staff and educators, represent a significant portion of an institution’s operational outlay. Crafting an effective financial model means accounting for these fixed, variable, and often specialized costs while simultaneously exploring avenues for growth and sustained funding.

Unlocking Efficiency and Sustainability: Benefits of a Structured Financial Plan

Implementing a comprehensive museum financial planning tool delivers a multitude of advantages that extend far beyond simple accounting. Firstly, it enhances transparency, allowing all relevant parties to understand where funds are coming from and how they are being utilized. This fosters trust and accountability, both internally and externally with donors and grantors.

Secondly, a well-structured budgetary framework enables proactive decision-making. Instead of reacting to financial crises, leaders can anticipate challenges, plan for contingencies, and make strategic investments in advance. This foresight is invaluable for long-term projects, endowment growth, and emergency preparedness. Ultimately, a robust financial plan supports the institution’s overall sustainability, ensuring its ability to serve future generations.

Anatomy of an Effective Museum Financial Blueprint

A truly effective financial model for a cultural institution is more than just a list of numbers; it’s a living document that captures the full financial picture. It must be detailed enough to provide granular insight yet flexible enough to adapt to changing circumstances. Developing this tool requires a systematic approach to categorizing both incoming resources and outgoing expenditures.

Revenue Streams: Funding Your Mission

Understanding and forecasting diverse income sources is paramount. This section of your institutional financial guide should meticulously detail every avenue through which funds enter the museum.

- **Earned Revenue:** This includes income directly generated by museum operations, such as **admission fees**, membership dues, gift shop sales, venue rentals, and café proceeds.

- **Contributed Revenue:** This category encompasses philanthropic support, including individual donations, corporate sponsorships, foundation grants, government grants, and planned giving.

- **Investment Income:** For institutions with endowments, this represents the returns generated from invested funds, often a crucial component of long-term stability.

- **Other Income:** Miscellaneous revenue streams like licensing fees, program fees, or unexpected gifts.

Expenditure Categories: Where the Money Goes

Tracking expenses meticulously is just as important as monitoring income. An effective financial plan breaks down costs into logical, manageable categories to provide clarity and facilitate cost control.

- **Personnel Costs:** Salaries, wages, benefits (health insurance, retirement contributions), and payroll taxes for all staff members. This is often the **largest single expense**.

- **Program & Exhibit Expenses:** Costs associated with developing and presenting exhibitions, educational programs, public events, and collection care. This includes **materials, shipping, insurance**, and contractual services.

- **Facilities & Operations:** Utilities (electricity, heating, water), maintenance, repairs, security, cleaning services, and building insurance. These are often **fixed costs**.

- **Marketing & Communications:** Advertising, public relations, website maintenance, graphic design, and printing costs.

- **Administrative & General:** Office supplies, technology (software licenses, IT support), professional development, legal and accounting fees, and board expenses.

- **Debt Service:** Payments on any outstanding loans or mortgages.

Capital Projects and Endowment Management

Beyond annual operating funds, a robust museum financial model also needs to account for larger, long-term financial considerations. Capital projects, such as a new wing or a major HVAC system overhaul, require dedicated funding often raised through specific campaigns, and their financing and timeline must be integrated into the overall financial outlook. Similarly, the endowment—a fund established to provide a permanent income stream—requires strategic management and a clear spending policy, which directly impacts the annual operating budget. Effectively planning for these long-range financial elements ensures the institution’s physical infrastructure and long-term financial health.

Customizing Your Museum Budget Framework

While a general financial template for museums provides an excellent starting point, true effectiveness comes from tailoring it to your institution’s specific needs, size, mission, and operational complexity. No two museums are exactly alike, and their financial planning tools should reflect those unique characteristics.

Starting with a Standard Model

Many organizations, especially smaller ones, benefit from beginning with a basic, widely accepted budget structure. This foundational framework typically includes common revenue and expenditure categories, ensuring that no major financial area is overlooked. It provides a common language for financial discussions and can be an invaluable teaching tool for new board members or staff unfamiliar with museum finance. This initial structure saves time and provides a reliable template to build upon, rather than starting from scratch.

Adapting for Your Institution’s Scale and Scope

Once you have a standard model, the customization process begins. A large art museum with a multi-million dollar endowment and extensive international exhibitions will require a far more detailed and complex financial model than a small, local historical society. Consider your institution’s specific departments, unique programming, and any specialized facilities. For example, a natural history museum might have significant research and fieldwork expenses, while a children’s museum might have extensive programming for specific age groups. Adjust categories, add sub-categories, and refine the level of detail to accurately reflect your operational reality. The goal is to create a budgeting guide for museums that is both comprehensive and precisely aligned with your organization’s strategic goals.

Best Practices for Implementing Your Museum Financial Tool

An effective Museum Budget Template is only as good as its implementation. To maximize its utility and ensure it genuinely supports your institution’s financial health and strategic objectives, adhere to these key practices:

- **Engage All Stakeholders:** Financial planning should not be limited to the finance department. Involve **department heads**, program managers, and even board members in the budgeting process to foster ownership and gather accurate data.

- **Review Regularly:** A budget is not a static document. Schedule **monthly or quarterly reviews** to track actual performance against projections, identify variances, and make necessary adjustments.

- **Be Realistic with Projections:** Err on the side of caution when forecasting revenue, and be thorough when estimating expenses. **Overly optimistic projections** can lead to significant financial shortfalls.

- **Build in Flexibility:** Include a contingency fund or “unrestricted operating reserve” to cover **unexpected expenses or revenue shortfalls**. The museum world is dynamic, and adaptability is key.

- **Align with Strategic Goals:** Ensure your resource allocation for museums directly supports your institution’s mission, vision, and **long-range strategic plan**. Every dollar spent should ideally move the museum closer to its objectives.

- **Utilize Technology:** Consider financial software or advanced spreadsheet functions that can automate calculations, generate reports, and facilitate **scenario planning**.

- **Document Assumptions:** Keep a clear record of the assumptions made when creating the budget (e.g., projected attendance, grant success rates, inflation rates). This helps in future planning and understanding deviations.

Frequently Asked Questions

How often should a museum budget be reviewed and updated?

While an annual budget is standard, a museum’s financial plan should be reviewed at least quarterly by the finance committee and executive leadership. This allows for timely adjustments based on actual performance, unforeseen expenses, or changes in revenue streams. Major updates to the comprehensive financial model should occur annually during the strategic planning cycle.

What are the biggest challenges museums face in their financial planning?

Museums often grapple with unpredictable funding sources, particularly fluctuating grant cycles and donor generosity. Other significant challenges include managing aging infrastructure, escalating collection care costs, retaining specialized staff in a competitive job market, and balancing mission-driven programming with financial sustainability. The diverse nature of their revenue and expense categories requires robust tracking and forecasting.

Can a small museum benefit from a detailed financial plan?

Absolutely. Small museums, perhaps even more than larger ones, benefit immensely from a detailed financial blueprint. With often fewer resources and smaller endowments, every dollar counts. A comprehensive financial plan helps small institutions prioritize limited funds, apply for grants more effectively, and ensure long-term stability by clearly outlining income and expenditure, preventing reactive financial decisions.

Should endowments be included in the annual operating budget?

Generally, the principal of an endowment fund is not included in the annual operating budget, as it is designed for long-term growth and stability. However, the spending policy—the portion of the endowment’s returns that can be drawn down for operational or specific programmatic use—should be clearly factored into the revenue section of the annual operating budget. Separate financial reporting for the endowment fund is crucial.

What is the difference between an operating budget and a capital budget for a museum?

An **operating budget** covers the day-to-day revenues and expenses required to run the museum for a fiscal year, including salaries, utilities, program costs, and general administration. A **capital budget**, in contrast, plans for significant, long-term investments in physical assets, such as building renovations, major equipment purchases, or new exhibit construction. These projects typically have a multi-year scope and are funded through specific campaigns or designated reserves rather than regular operating revenue.

In an era of dynamic economic shifts and evolving visitor expectations, robust financial management is not just a necessity for museums—it is a competitive advantage. The deliberate creation and disciplined application of a tailored financial framework empower institutions to safeguard their priceless collections, inspire their communities, and secure their legacy for generations to come. It transforms an intimidating task into a strategic tool for growth and impact.

By adopting a thoughtful and adaptive approach to financial planning, museums can move beyond mere survival to truly thrive. This foundational work ensures that the invaluable contributions of cultural institutions to education, art, and history continue to enrich society, demonstrating that responsible financial stewardship is indeed the greatest patron of all. Take the proactive step to build or refine your institution’s financial guide and chart a course for sustained success.