The journey to homeownership is often a thrilling, yet complex, endeavor. For many aspiring homeowners, particularly first-time buyers navigating today’s competitive housing market, financial assistance from family or close friends can be a pivotal factor in making their dreams a reality. This generous support, often in the form of a monetary gift for a down payment or closing costs, plays a critical role in bridging the gap between aspiration and acquisition. However, for these funds to be recognized and accepted by mortgage lenders, they must be properly documented, demonstrating their legitimate source and intent.

This is precisely where a robust mortgage gift letter template becomes an indispensable tool. Far from being a mere formality, this document serves as a legally binding declaration from the gift-giver, confirming that the funds are a true gift with no expectation of repayment. For both the donor and the recipient, as well as the mortgage lender, having a clear, concise, and professionally formatted letter is essential. This article will delve into the critical aspects of such a template, guiding professionals in the business and communication niche through its effective utilization and customization, ensuring a seamless and transparent financial transaction for all involved.

The Imperative of Precise Documentation

In the rigorous world of mortgage lending, precision and transparency are not just preferred; they are absolutely essential. Every financial detail is scrutinized to ensure regulatory compliance, mitigate risk, and prevent potential fraud. When a portion of a home purchase is funded by a gift, lenders require explicit documentation to verify that these funds are indeed a gift and not a disguised loan that could impact the borrower’s debt-to-income ratio or overall financial stability. A poorly written or incomplete letter can cause significant delays, or even rejection, of a mortgage application.

For financial institutions, a meticulously crafted gift letter serves as a cornerstone in their due diligence process. It provides concrete evidence of the transaction’s nature, protecting all parties involved. From the perspective of the borrower and donor, it solidifies their agreement in a formal, unambiguous manner. In an era where communication must be both efficient and unimpeachable, the clarity and authority conveyed by a well-structured document are paramount, ensuring that the generosity intended to help achieve homeownership doesn’t inadvertently create bureaucratic roadblocks.

Advantages of a Pre-Structured Document

The core advantage of using a dedicated mortgage gift letter template lies in its ability to streamline a potentially complicated requirement. Instead of starting from scratch, which can be time-consuming and prone to errors, a template provides a professional framework that ensures all necessary information is included from the outset. This not only saves valuable time for the sender but also guarantees that the recipient – the mortgage lender – receives a complete and compliant document, reducing back-and-forth communication and accelerating the approval process.

Beyond efficiency, a ready-made template also guarantees consistency and professionalism. It helps maintain a uniform layout and tone, reflecting positively on the sender’s attention to detail and understanding of formal correspondence. For individuals in the business and communication niche, presenting polished, error-free documents is a hallmark of their expertise. Furthermore, a template acts as a checklist, ensuring no critical details are overlooked, thereby minimizing the risk of lender questions or demands for additional information, which can often lead to frustrating delays.

Tailoring Your Gift Affidavit for Specifics

While a mortgage gift letter template provides a solid foundation, its true utility comes from its capacity for customization. No two financial gift scenarios are exactly alike, and the ability to adapt the template to specific situations is key. Personalizing your template means adjusting it to reflect the unique details of the donor, recipient, property, and gift amount, as well as any specific requirements from the mortgage lender.

For instance, you might need to modify fields for the donor’s relationship to the borrower (e.g., parent, grandparent, sibling), the exact dollar amount being gifted, and the specific property address for which the funds are intended. Some lenders might also require additional clauses, such as a statement that the donor has no ownership interest in the property, or that the funds have been seasoned in the donor’s account for a certain period. The template should be flexible enough to incorporate these nuanced details without compromising its overall structure or clarity. This personalization ensures the letter precisely addresses the requirements of the particular transaction, making it fully compliant and effective.

Essential Components of the Letter

Every effective gift letter, whether for a mortgage or other significant financial transaction, must contain certain key pieces of information to be considered complete and valid. These sections ensure that the intent of the gift is clear, the parties involved are properly identified, and the funds are accounted for transparently.

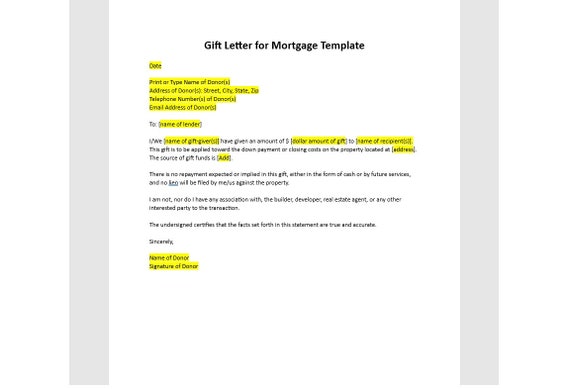

The fundamental parts of a comprehensive mortgage gift letter typically include:

- Donor’s Full Contact Information: This includes their legal name, current address, phone number, and email.

- Recipient’s Full Contact Information: The legal name, current address, and phone number of the borrower receiving the gift.

- Property Address: The complete address of the property being purchased, for which the gift funds are intended.

- Gift Amount: The precise dollar amount of the gift, clearly stated in both numerical and written form.

- Statement of No Repayment: A clear and unequivocal declaration from the donor that the funds are a gift and require no repayment whatsoever, nor is there any expectation of future interest or ownership in the property.

- Source of Funds: An indication of where the gift funds originated (e.g., "from my personal savings account"). Lenders often require bank statements from the donor to corroborate this.

- Relationship to Recipient: A clear statement of the donor’s relationship to the borrower (e.g., "my daughter," "my brother," "my grandson").

- Date: The date the letter is written and signed.

- Donor’s Signature: The legal signature of the gift-giver.

- Notary Public Acknowledgment (if required): Space for a notary to authenticate the donor’s signature, which some lenders may mandate for added legal weight.

Mastering Presentation and Tone

Beyond the content, the presentation and tone of your correspondence play a significant role in how it is received. A mortgage gift letter, while formal, doesn’t need to be overly stiff or robotic. The tone should be professional, respectful, and clear, reflecting the serious nature of the financial commitment being documented. Using direct language, avoiding jargon where possible, and maintaining a polite demeanor contributes to a positive impression with the lender.

In terms of formatting, consistency is key. Utilize a clean, readable font (e.g., Arial, Calibri, Times New Roman) in a standard size (10-12pt). Ensure adequate spacing between paragraphs and sections for easy readability. For digital versions, saving the document as a PDF is standard practice, as it preserves the layout and prevents unintended edits. When a printable version is required, use high-quality paper and ensure the printer output is clear and legible. If electronic signatures are permitted by the lender, ensure they are legally compliant and securely applied. Otherwise, a wet signature, potentially notarized, will be necessary. Attention to these details demonstrates a high level of professionalism and diligence, reinforcing the trustworthiness of the document and the parties involved.

Leveraging a well-designed mortgage gift letter template transforms a potentially daunting requirement into a straightforward task. By providing a structured framework, it ensures all critical information is accurately conveyed, adheres to lender standards, and reflects the professionalism expected in significant financial transactions. This efficiency not only saves time for busy individuals but also minimizes the stress often associated with complex paperwork, contributing to a smoother and more positive experience for everyone involved in the home-buying process.

Ultimately, a polished and comprehensive mortgage gift letter template acts as an indispensable communication tool, building trust and clarity between the donor, recipient, and the mortgage lender. It underscores the importance of precise documentation in the business world, ensuring that acts of generosity are recognized and processed efficiently, paving the way for individuals to achieve their homeownership dreams with confidence and ease.