In the dynamic world of entrepreneurship, where innovation and passion often drive daily operations, the foundational pillars of financial stability can sometimes be overlooked. Many small business owners, fueled by their vision, find themselves navigating a complex landscape of fluctuating revenues and unforeseen expenses without a clear financial roadmap. This lack of precise fiscal visibility can lead to missed opportunities, cash flow crunches, and even the premature end of promising ventures.

Imagine your business as a ship sailing the open seas. Without a compass, a map, and a detailed understanding of your provisions, you’re at the mercy of the currents. A robust Monthly Small Business Budget Template serves as that essential navigation system, providing clarity on where your money comes from, where it goes, and crucially, where it should go to propel your business forward. It’s not merely a numbers exercise; it’s a strategic tool designed to empower you with control, foresight, and the confidence to make informed decisions that impact your profitability and long-term sustainability.

The Indispensable Role of a Monthly Financial Plan

For any small business, understanding its financial pulse is non-negotiable for survival and growth. A well-structured monthly financial plan provides a comprehensive overview of your financial health, allowing you to anticipate challenges and seize opportunities. It transforms abstract financial data into actionable insights, enabling you to move beyond reactive spending to proactive financial management. This consistent review of income and expenditures fosters a deeper understanding of your operational costs and revenue streams.

Implementing a consistent Monthly Small Business Budget Template helps in identifying spending patterns, both good and bad. It brings to light areas where expenses might be creeping up unchecked or where revenue generation isn’t meeting expectations. This clarity is paramount for businesses aiming to scale, secure funding, or simply maintain a healthy cash reserve. Without this tool, critical decisions about hiring, inventory, marketing campaigns, or even pricing strategies are often made on gut feeling rather than solid data.

Key Elements of an Effective Small Business Budget

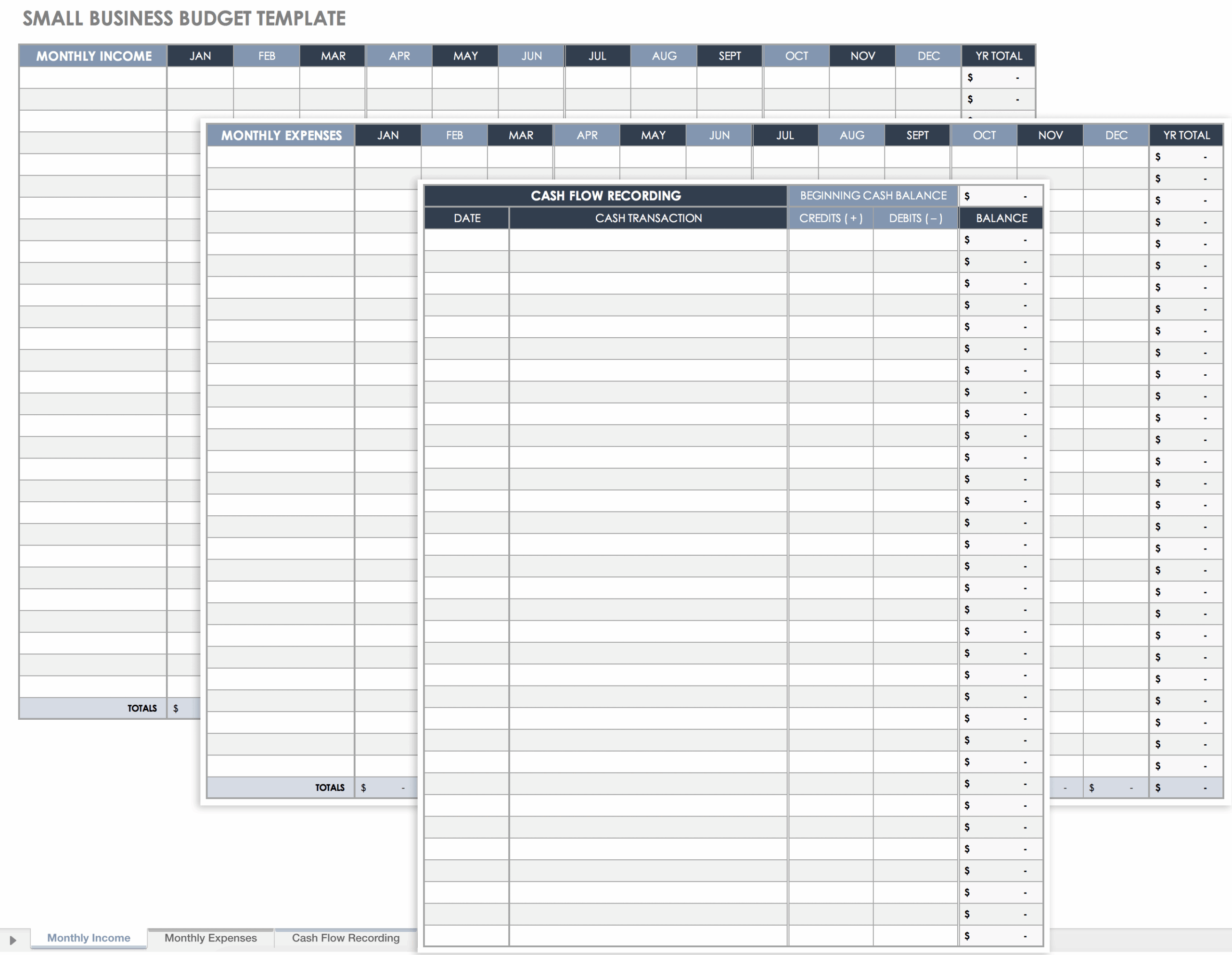

A comprehensive financial blueprint for your business needs to account for all money flowing in and out. Breaking down your financial picture into distinct categories ensures that no stone is left unturned, providing a crystal-clear view of your financial standing. This segmentation allows for more precise analysis and better decision-making regarding resource allocation.

- **Projected Income:** This is the forecast of all revenue your business expects to generate within the month. It should include sales of products or services, subscription fees, rental income, and any other sources of money flowing into your business. Be realistic and consider historical data and upcoming sales initiatives.

- **Fixed Expenses:** These are costs that remain relatively constant each month, regardless of your sales volume. Examples include **rent or mortgage payments**, insurance premiums, loan repayments, software subscriptions, and salaries for permanent staff.

- **Variable Expenses:** Unlike fixed costs, these fluctuate based on your business activity. They might include **raw materials for products**, utility bills (which vary with usage), marketing and advertising spend (which can be adjusted), shipping costs, and hourly wages for temporary staff.

- **One-Time or Irregular Expenses:** Occasionally, your business will incur costs that aren’t monthly regulars but are important to account for. This could be **equipment purchases**, annual software renewals, professional development courses, or unforeseen repairs. It’s wise to have a contingency fund for these.

- **Profit and Savings Targets:** Beyond covering expenses, a healthy business aims for profitability and builds a financial cushion. This section outlines your desired profit margin and allocates funds for savings, **debt reduction**, or future investments.

- **Cash Flow Projections:** Understanding when money comes in and when it goes out is vital. This isn’t just about total income and expenses but the timing. Positive cash flow ensures you always have enough liquid funds to meet your obligations.

Getting Started: Customizing Your Budget Framework

The beauty of a well-designed financial planning tool is its adaptability. While a generic template provides a solid foundation, its true power is unlocked when you tailor it to your specific business model and operational nuances. Think of it as a skeleton that needs to be fleshed out with the unique details of your enterprise.

The first step is to gather all your financial data from previous months. This includes bank statements, expense reports, sales records, and payroll information. This historical data is crucial for making accurate projections. Next, sit down and categorize every single income stream and expense your business incurs. Don’t be afraid to create specific subcategories that reflect your operations. For instance, if you’re a restaurant, "food costs" might be too broad; you might need "produce," "meat," "dairy," and "beverages."

Regularly reviewing and adjusting your financial blueprint is key to its effectiveness. A budget isn’t a static document; it’s a living tool that needs to evolve with your business. Economic shifts, market changes, or new business opportunities will all necessitate revisions. Make it a monthly habit to compare your actual performance against your budgeted figures. This comparison will highlight discrepancies and offer valuable insights into your financial forecasting accuracy.

Beyond the Numbers: Maximizing Your Budget’s Impact

A small business budget isn’t merely an accounting exercise; it’s a strategic weapon. When used effectively, it empowers you to make smarter decisions, identify growth opportunities, and navigate potential financial pitfalls with greater confidence. It fosters a culture of financial accountability within your organization, even if it’s just you.

One of its most significant benefits is improved cash flow management. By meticulously tracking income and expenses, you can foresee periods of tight liquidity and plan accordingly, perhaps by delaying non-essential purchases or accelerating invoicing. It also acts as an early warning system, signaling when expenses are rising disproportionately to revenue, allowing you to take corrective action before a minor issue becomes a major crisis. Furthermore, a detailed budget supports your strategic planning. When considering new investments, expansion, or hiring, your financial framework provides the data needed to assess feasibility and potential return on investment. It transforms guesswork into calculated risk-taking.

Common Pitfalls and How to Avoid Them

Even with the best intentions, small business owners can fall into common traps when managing their finances. Being aware of these pitfalls can help you steer clear of them and maintain the integrity and usefulness of your financial management efforts.

- Unrealistic Projections: Overly optimistic revenue forecasts or underestimating expenses can quickly derail your financial plan. Base your projections on historical data, market research, and a healthy dose of conservatism. It’s better to be pleasantly surprised than financially stressed.

- Neglecting Regular Review: Creating a monthly financial blueprint once and then filing it away is akin to drawing a map but never looking at it during your journey. Set aside dedicated time each month to review actuals against your budget and make necessary adjustments.

- Ignoring Small Expenses: While big-ticket items are easy to spot, a multitude of small, recurring expenses can collectively drain your resources. These "death by a thousand cuts" items, like multiple unused software subscriptions or frequent small purchases, add up. Scrutinize every line item.

- Lack of Flexibility: Your business environment is constantly changing. A rigid financial plan that doesn’t adapt to new circumstances, market shifts, or unexpected events will quickly become obsolete. Build in some flexibility and a contingency fund.

- Not Involving Key Stakeholders: If you have employees, especially those with spending authority, involve them in the budgeting process or at least inform them of budget goals. This fosters a sense of ownership and responsibility for financial targets.

Frequently Asked Questions

How often should I update my small business budget?

While the goal is a “monthly” budget, you should ideally review your actual financial performance against your budget at least once a month. This monthly review allows you to catch discrepancies early, make necessary adjustments, and ensure your financial plan remains a relevant and effective tool for decision-making.

What if my actual expenses consistently exceed my budget?

If actual expenses consistently exceed your financial plan, it’s a clear signal that either your projections are unrealistic, or your spending needs to be reined in. First, re-evaluate your expense categories for areas where you might have underestimated costs. Second, identify where you can cut back or find more cost-effective solutions without compromising quality or service. This might involve renegotiating supplier contracts or optimizing operational processes.

Can a Monthly Small Business Budget Template help with tax preparation?

Absolutely. A well-maintained and detailed financial plan that categorizes all your income and expenses provides an organized record of your financial transactions throughout the year. This structured data significantly simplifies the process of tax preparation, making it quicker and less prone to errors, and ensuring you can identify all eligible deductions.

Is budgeting only for businesses struggling financially?

Not at all. While budgeting is crucial for businesses facing financial difficulties, it’s equally important—if not more so—for prosperous businesses. For growing companies, a budget helps to strategically allocate resources, identify opportunities for investment, manage expansion, and maintain profitability. It’s a tool for smart financial growth, not just damage control.

A comprehensive financial management framework isn’t just about tracking numbers; it’s about gaining clarity, confidence, and control over your business’s destiny. It provides the foresight necessary to navigate economic uncertainties, make informed strategic decisions, and allocate resources effectively for sustained growth. By embracing the discipline of regular financial planning, you’re not just managing money—you’re actively shaping the future of your enterprise.

Starting the journey toward robust financial health might seem daunting, but with the right tools and a commitment to consistency, it’s entirely achievable. Leverage the power of a detailed spending plan to transform your financial understanding from a fuzzy picture into a crystal-clear vision, paving the way for a more stable, profitable, and successful small business. Take the proactive step today to secure your financial future and empower your entrepreneurial vision.