In today’s fast-paced world, managing your finances can often feel like an uphill battle. With countless expenses, unexpected costs, and ambitious savings goals, it’s easy to feel overwhelmed and unsure of where your money is actually going. Yet, gaining control over your finances isn’t about deprivation; it’s about clarity, intention, and empowerment. It’s about transforming vague anxieties into a clear, actionable plan.

Imagine waking up each month knowing exactly what your income is, what your essential bills are, and how much you have available for savings, investments, or even a little fun. This isn’t just a dream for financial gurus; it’s an attainable reality for anyone willing to dedicate a little time and effort to understanding their money. A well-structured personal spending plan is the compass that guides you through your financial landscape, helping you navigate toward your goals with confidence.

Why a Budget Isn’t Just for Accountants

Many people shy away from budgeting, perceiving it as a restrictive, complicated, or even boring task. The truth is, a personal financial template isn’t about telling you "no"; it’s about helping you say "yes" to your most important priorities. It’s a strategic tool that brings transparency to your income and expenses, allowing you to make informed decisions rather than relying on guesswork. For US readers grappling with everything from student loans to housing costs, a clear financial tracking tool is invaluable for setting priorities and achieving financial peace of mind.

This structured approach helps you identify areas where you might be overspending, pinpoint opportunities for savings, and allocate funds towards what truly matters to you, whether that’s an emergency fund, a down payment on a home, or a well-deserved vacation. It shifts your financial perspective from reactive to proactive, turning your monthly take-home pay into a powerful resource aligned with your long-term aspirations. It’s an empowering step towards financial freedom, giving you the knowledge and control you need to steer your own economic ship.

Understanding the Core Elements of Your Income & Expenses

Before you can build an effective financial planning framework, you need a clear picture of your complete financial situation. This involves meticulously documenting all sources of income and categorizing every expenditure. While this might sound tedious, it’s the bedrock upon which all sound financial management is built, offering invaluable insights into your spending habits. Without this baseline data, any attempt at creating a sustainable money management system will be based on assumptions rather than facts.

Start by gathering all your financial statements: pay stubs, bank statements, credit card bills, and any other records of money coming in or going out. This process, while revealing, is crucial for an accurate assessment. Once you have this information, you can begin to populate your personalized spending blueprint, laying the groundwork for greater financial control and intentional decision-making.

Your Income Stream

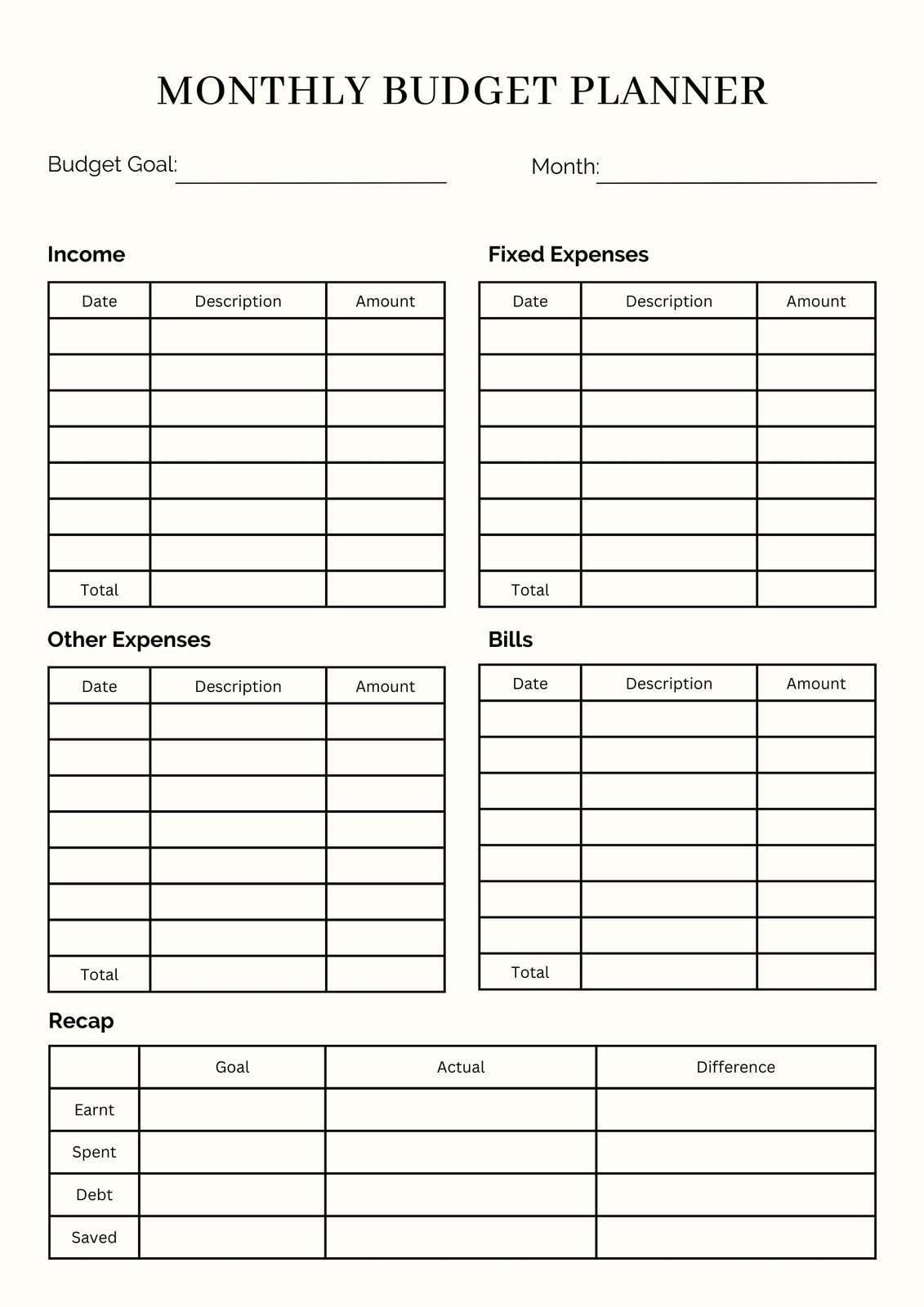

The first step in populating your Monthly Salary Budget Template is to identify all sources of income. This typically includes your primary salary, but don’t overlook other regular inflows.

- Net Pay (Take-Home Pay): This is the most crucial figure – what actually hits your bank account after taxes, health insurance premiums, retirement contributions, and other deductions.

- Secondary Income: Include any consistent side hustle earnings, freelance payments, rental income, or alimony.

- Investment Income: If you receive regular dividends or interest, factor those in as well.

It’s vital to use your net income, not gross, for budgeting purposes, as this is the actual money you have available to allocate. Being realistic about your available funds ensures your budget is practical and sustainable.

Fixed vs. Variable Expenses

Categorizing your expenses is where the real insights begin to emerge. Understanding the difference between fixed and variable costs is fundamental to creating a flexible yet stable financial guide.

- Fixed Expenses: These are costs that typically remain the same each month and are often contractual. They are predictable and essential for financial planning.

- Rent/Mortgage: Your primary housing cost.

- Loan Payments: Car loans, student loans, personal loans.

- Insurance Premiums: Health, auto, renter’s/homeowner’s.

- Subscription Services: Streaming, gym memberships, internet, cell phone.

- Variable Expenses: These costs fluctuate from month to month and offer the most flexibility for adjustment. This is where most overspending often occurs and where you have the greatest opportunity to save.

- Groceries: Essential, but quantities and choices can vary.

- Utilities: Electricity, gas, water (can fluctuate based on usage/season).

- Transportation: Gas, public transit, ride-shares.

- Dining Out/Entertainment: Discretionary spending that’s easy to adjust.

- Personal Care: Haircuts, toiletries.

- Shopping: Clothing, personal items.

Crafting Your Personalized Spending Plan

With your income and expenses clearly laid out, the next step is to actually build your monthly budget plan. This isn’t about depriving yourself; it’s about allocating every dollar you earn to a specific purpose, whether that’s a bill, savings, or a personal indulgence. Think of it as giving each dollar a job, ensuring no money is unaccounted for. This disciplined approach fosters a sense of control and intentionality.

Many individuals find the "50/30/20 Rule" to be a helpful starting point, though it’s merely a guideline to be adapted to your unique circumstances. This popular budgeting methodology suggests allocating:

- 50% of your net income to Needs: These are your essential fixed and variable expenses required for survival – housing, utilities, groceries, transportation, insurance, minimum loan payments. These are the non-negotiables that keep your life running smoothly.

- 30% to Wants: This category includes discretionary spending that improves your quality of life but isn’t strictly necessary – dining out, entertainment, shopping, vacations, hobbies, upgraded streaming services. This is where you can find room to cut back if needed.

- 20% to Savings & Debt Repayment: This is crucial for financial growth and security – building an emergency fund, contributing to retirement accounts, investing, or aggressively paying down high-interest debt beyond minimums.

While the 50/30/20 rule offers a solid framework, feel free to adjust these percentages to better suit your current financial situation, income level, and immediate goals. For instance, if you’re aggressively paying off debt, your savings/debt repayment percentage might be higher. The key is to make it work for you.

Putting Your Budget into Action

Having a beautifully crafted income and expense sheet is only half the battle; the real magic happens when you actively use and track it. A budget is a living document, not a static spreadsheet you glance at once a month. Consistent engagement is what transforms a simple template into a powerful financial roadmap. This ongoing interaction allows you to see the real-time impact of your spending choices.

Here’s how to effectively integrate your financial guide into your daily and weekly routines:

- **Choose Your Tool:** Decide whether you’ll use a digital spreadsheet (Google Sheets, Excel), a dedicated budgeting app (Mint, YNAB, EveryDollar), or a physical notebook. The best tool is the one you’ll actually use consistently.

- **Track Every Expense:** This is non-negotiable. Whether you manually enter transactions or link your accounts, accurately categorize every dollar you spend. This step is critical for identifying spending patterns and staying within your allocated amounts.

- **Schedule Regular Check-ins:** Don’t wait until the end of the month. A weekly review (e.g., Sunday morning) helps you see where you stand, make small adjustments, and avoid overspending before it becomes a problem.

- **Adjust as Needed:** Life happens. An unexpected bill, a bonus, or a change in priorities means your budget needs to be flexible. Don’t be afraid to tweak categories and allocations throughout the month or in subsequent months.

- **Automate Savings:** Set up automatic transfers from your checking to your savings or investment accounts immediately after payday. Treat your savings like a non-negotiable bill.

Customizing Your Financial Framework

No two financial journeys are identical, and your personal finance template should reflect your unique goals, income, and lifestyle. While the core structure of a Monthly Salary Budget Template remains consistent, its strength lies in its adaptability. This customization is what transforms a generic spreadsheet into a truly effective personal spending plan tailored specifically to your aspirations. Don’t be afraid to make it your own.

Consider adding specific categories that resonate with your life. Do you have a pet? Create a "Pet Care" category. Are you saving for a specific trip? Include a "Vacation Fund" line item. The more granular and relevant your categories are, the easier it will be to track your spending and see where your money is truly going. Perhaps you have a particularly high student loan burden; you might create a distinct section for "Accelerated Debt Repayment" to highlight your focus on that goal. The goal is to make your budgeting worksheet a reflection of your financial reality and ambitions, not just a generic form.

For instance, if you’re a gig worker, your income might be less predictable. In this case, you might budget based on your lowest expected income, saving any excess during good months. If you’re a single parent, your budget might prioritize childcare and educational expenses. Your financial planning framework should serve as a dynamic tool, evolving as your life circumstances and goals change. It’s not just about managing money; it’s about managing your life through your money.

The Power of Regular Review and Adjustment

A budget is not a one-and-done task; it’s an ongoing dialogue with your money. The most successful financial managers understand that their budgeting methodology is a living document, requiring regular review and nimble adjustments. This continuous engagement ensures your personal spending plan remains relevant and effective, propelling you towards your financial objectives year after year. Without this iterative process, even the most meticulously crafted initial budget can quickly become outdated.

Take time at the end of each month, or even quarterly, to sit down and analyze your actual spending against your planned budget. Where did you excel? Where did you fall short? What unexpected expenses arose? What goals did you make progress on? This reflective practice provides invaluable insights, helping you refine your categories, reallocate funds, and set more realistic expectations for the future. Perhaps you consistently underspent on groceries but overspent on dining out; this feedback allows you to adjust your allocations for the following month. This active process of reviewing and adjusting your financial roadmap is what truly solidifies your financial control and builds lasting healthy money habits.

Frequently Asked Questions

How often should I update my Monthly Salary Budget Template?

Ideally, you should review and update your budget weekly to track spending and make small adjustments. A more comprehensive review and adjustment should be done monthly, comparing actual spending to your plan, and making larger changes if needed for the next month’s budget.

What if my expenses exceed my income in my budget?

If your initial income and expense sheet shows a deficit, it’s a clear signal to identify areas for reduction. Start with variable expenses (wants like dining out, entertainment, subscriptions) and look for ways to cut back. If that’s not enough, explore options to increase income or re-evaluate fixed costs.

Is it okay to have “fun money” in my budget?

Absolutely! A sustainable personal spending plan includes an allocation for discretionary “fun money” or personal allowance. Depriving yourself entirely can lead to burnout or impulsive overspending. Budgeting for enjoyment helps keep you motivated and ensures your financial management system is balanced and realistic.

What’s the difference between a budget and tracking expenses?

Budgeting is about *planning* where your money will go before you spend it. Expense tracking is about *recording* where your money actually went after you’ve spent it. Both are crucial: the budget gives you a roadmap, and tracking tells you if you’re following it, allowing for adjustments.

How long does it take to get used to using a personal finance template?

It typically takes about three months to truly get into the rhythm of budgeting and tracking your finances effectively. The first month is often a learning curve, the second month you’ll start seeing patterns, and by the third month, it often becomes a more natural part of your routine. Consistency is key during this period.

Embracing a robust Monthly Salary Budget Template is more than just an exercise in numbers; it’s a commitment to your financial well-being and future. It’s the clarity that empowers you to make conscious choices, the foundation that supports your long-term goals, and the confidence that comes from knowing exactly where you stand. By dedicating a bit of time each month to this vital practice, you transform guesswork into strategy, anxiety into control, and dreams into actionable steps.

So, take the leap. Start building your personalized spending blueprint today. The initial effort will pay dividends in peace of mind, financial stability, and the freedom to pursue the life you truly desire. Your future self will thank you for taking the reins and guiding your money towards your aspirations.