The landscape of Software as a Service (SaaS) is a vibrant, fast-evolving ecosystem where innovation meets recurring revenue. While the promise of predictable income streams is alluring, navigating the financial complexities of a SaaS venture requires meticulous planning and a keen eye on operational costs. Without a clear financial roadmap, even the most groundbreaking solutions can falter, underscoring the critical need for robust financial management.

For founders, CFOs, and financial strategists in the SaaS space, understanding where every dollar comes from and where it goes isn’t just good practice—it’s foundational to sustainable growth. A well-crafted monthly SaaS business budget template serves as this essential blueprint, transforming abstract financial data into actionable insights that drive strategic decisions and secure your company’s future. It’s the difference between merely operating and truly thriving in a competitive market.

Why a Dedicated Monthly Budget is Non-Negotiable for SaaS

SaaS businesses operate under a unique financial model characterized by high upfront customer acquisition costs, deferred revenue recognition, and the constant pressure to innovate while retaining subscribers. Unlike traditional businesses with more straightforward sales cycles and cost structures, SaaS requires a specific approach to financial planning. A general business budget simply won’t cut it.

A detailed monthly financial plan provides unparalleled clarity into your company’s cash flow, empowering you to anticipate future needs and identify potential pitfalls before they become crises. This proactive stance is invaluable, enabling you to allocate resources effectively, make informed hiring decisions, and optimize your spending across all departments, from development to marketing. It’s about building a financial model that mirrors the dynamic nature of your subscription-based service.

Key Components of an Effective SaaS Financial Plan

Developing a comprehensive software business financial plan involves more than just listing expenses; it’s about projecting, analyzing, and strategizing. Each element plays a crucial role in providing a holistic view of your financial health and future trajectory. Understanding these components is the first step towards mastering your economic landscape.

Here are the essential categories every robust recurring revenue budget framework should include:

- **Revenue Streams**: Detail all sources of income, including subscription tiers, one-time setup fees, consulting services, and potential upsells. Accurately forecasting monthly recurring revenue (MRR) and annual recurring revenue (ARR) is paramount.

- **Cost of Goods Sold (COGS)**: For SaaS, this typically includes direct costs associated with delivering your service. This could be cloud hosting expenses (AWS, Azure, GCP), third-party API costs, customer support salaries, and maintenance of infrastructure.

- **Operating Expenses (OpEx)**:

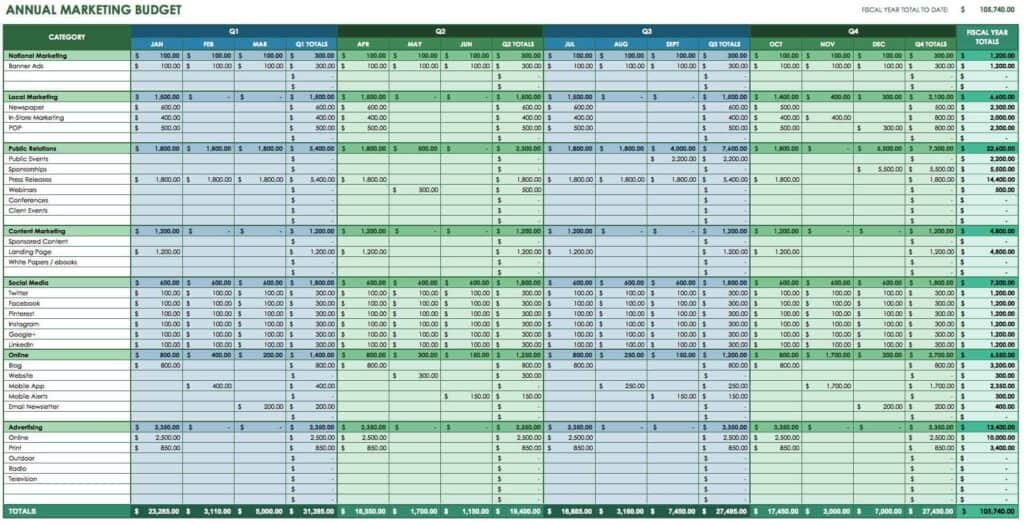

- **Sales & Marketing**: Salaries for sales teams, marketing campaign spend, CRM subscriptions, content creation, ad spend, and event sponsorships.

- **Research & Development (R&D)**: Developer salaries, software licenses, testing tools, and any costs associated with improving or expanding your product.

- **General & Administrative (G&A)**: Executive salaries, administrative staff, office rent, legal and accounting fees, insurance, and other overheads not directly tied to product development or sales.

- **Capital Expenditures (CapEx)**: While less common for pure SaaS, this might include significant hardware purchases, office build-outs, or substantial one-time investments that benefit the business for more than one year.

- **Cash Flow Projections**: Beyond simple income and expenses, understanding the timing of cash inflows and outflows is critical. This includes managing payment terms with vendors and anticipating when subscription renewals will hit your bank account.

- **Key Performance Indicators (KPIs)**: Integrate financial KPIs like Customer Acquisition Cost (CAC), Lifetime Value (LTV), Churn Rate, MRR Growth, and Net Revenue Retention (NRR) directly into your budget analysis to measure performance against financial goals.

Leveraging Your Software Business Budget for Growth and Strategy

A well-constructed SaaS operating budget is far more than a historical record of spending; it’s a dynamic strategic tool. By consistently reviewing and adjusting your financial blueprint, you gain a powerful lens through which to view your business’s trajectory and make proactive decisions. This continuous feedback loop is vital for agility in the fast-paced tech world.

This monthly financial planning for SaaS allows you to identify trends, optimize spending, and forecast future performance with greater accuracy. It becomes a critical asset when making decisions about scaling operations, pursuing new market segments, or even during fundraising rounds. Investors rely heavily on sound financial projections, and a detailed budget showcases your company’s fiscal discipline and potential for profitability. It’s the cornerstone of effective resource allocation and strategic foresight.

Practical Steps to Implement Your Monthly SaaS Budget

Transitioning from recognizing the need for a budget to actually implementing one can seem daunting. However, breaking it down into manageable steps makes the process accessible and effective. The goal is to establish a routine that provides clarity without becoming an overwhelming burden.

Begin by gathering historical financial data for the past 6-12 months. This provides a baseline for understanding your typical revenue and expense patterns. Next, identify all current recurring costs and project future revenue based on your sales pipeline and existing subscriptions. Categorize these according to the components listed earlier, ensuring every dollar has a home. Set realistic targets for each category and assign ownership for tracking different budget lines. Regular review meetings—monthly or even weekly for fast-growing startups—are crucial to discuss variances, adjust projections, and ensure alignment with your strategic goals.

Tips for Customizing and Optimizing Your SaaS Financial Model

Every SaaS business is unique, with its own operational nuances, growth stage, and market dynamics. Therefore, a generic budget template, while a good starting point, needs to be tailored to reflect your specific reality. Customization transforms a standard document into a truly powerful and relevant financial blueprint for software companies.

Don’t hesitate to add or remove categories that are specific to your business. For instance, if you rely heavily on affiliate marketing, create a dedicated line item for commissions. If your product involves hardware components, ensure those costs are accurately accounted for. Regularly solicit input from department heads; they have the closest understanding of their team’s spending and needs. Utilize cloud-based spreadsheet tools or specialized budgeting software to automate data entry and reporting, freeing up time for analysis. Finally, embrace scenario planning. What if churn increases? What if you land a major enterprise client? Modeling these possibilities helps you prepare for various outcomes and make your recurring revenue budget framework more resilient.

Frequently Asked Questions

What is the primary benefit of a monthly budget for a SaaS company?

The primary benefit is gaining clear, actionable insight into your financial health and cash flow. It allows SaaS companies to proactively manage expenses, forecast revenue, and make informed strategic decisions to ensure sustainable growth and profitability, crucial for managing the unique subscription-based financial model.

How often should a SaaS budget be reviewed and updated?

While it’s a “monthly” budget, it should ideally be reviewed at least once a month. For fast-growing or early-stage SaaS businesses, more frequent check-ins (e.g., weekly or bi-weekly) might be beneficial to quickly identify and address any significant variances or emerging trends.

Can a Monthly Saas Business Budget Template help with fundraising?

Absolutely. A detailed and well-managed monthly financial plan demonstrates fiscal discipline and a clear understanding of your business’s economics to potential investors. It provides the necessary data to build strong financial projections and instills confidence in your company’s ability to manage growth and achieve profitability.

What are some common pitfalls to avoid when creating a SaaS budget?

Common pitfalls include underestimating customer acquisition costs (CAC), failing to account for churn, neglecting to regularly update the budget with actuals, over-optimistic revenue projections, and not involving key department heads in the budgeting process. It’s also crucial to differentiate between fixed and variable costs.

How does a monthly budget differ from an annual budget for SaaS?

An annual budget provides a high-level overview and strategic direction for the entire year, setting broad targets. A monthly SaaS business budget template, conversely, breaks down those annual goals into more granular, actionable segments. It allows for more frequent adjustments, closer tracking of cash flow, and quicker responses to changes in market conditions or operational performance, offering a more dynamic and responsive financial tool.

Mastering your monthly financial planning for SaaS is not merely about balancing books; it’s about empowering your vision. It provides the clarity and control needed to navigate the challenges of the subscription economy, enabling you to make data-driven decisions that propel your company forward. This financial blueprint becomes a living document, evolving with your business and guiding every strategic move.

By embracing a robust recurring revenue budget framework, you equip your SaaS venture with the tools for resilience and sustained success. It’s an investment in understanding your economic landscape, optimizing your operations, and ultimately, achieving the growth and profitability you envision. Start taking control of your financial destiny today and watch your SaaS business flourish.