Navigating the ebb and flow of personal finances can often feel like steering a ship through a perpetual fog. Without a clear map or compass, it’s easy to drift off course, leaving you feeling anxious about where your hard-earned money is actually going. For many, the idea of budgeting conjures images of restrictive deprivation, endless spreadsheets, or complex calculations that seem more intimidating than helpful. Yet, the reality is far from this misconception.

Imagine, instead, a tool that provides clarity, empowers your financial decisions, and acts as a beacon guiding you toward your goals. This isn’t about rigid rules designed to stifle your enjoyment; it’s about intentional spending, conscious saving, and gaining a profound sense of control over your financial destiny. A well-constructed monthly household budget template can transform your relationship with money, turning confusion into confidence and dreams into achievable realities.

Why a Monthly Budget is Your Financial North Star

At its core, a robust monthly budget serves as your personal financial roadmap. It illuminates your income streams and tracks your expenditures, providing an unbiased snapshot of your financial health. This clarity is the first step towards making informed decisions, whether you’re aiming to pay down debt, save for a down payment, or simply understand where every dollar goes. It removes the guesswork and replaces it with data-driven insights, allowing you to allocate your resources effectively.

Beyond mere tracking, a structured financial plan offers profound psychological benefits. The knowledge that you have a system in place can significantly reduce financial stress and anxiety. It shifts your mindset from reacting to financial surprises to proactively planning for them. This proactive approach empowers you to align your spending with your values and long-term aspirations, making your money work harder for you.

Decoding the Anatomy of an Effective Budget

Before you dive into creating your own financial blueprint, understanding its fundamental components is key. A comprehensive budgeting system isn’t just about subtracting expenses from income; it’s about categorizing, prioritizing, and allocating funds with purpose. Most successful budgeting strategies incorporate several crucial elements that paint a complete financial picture.

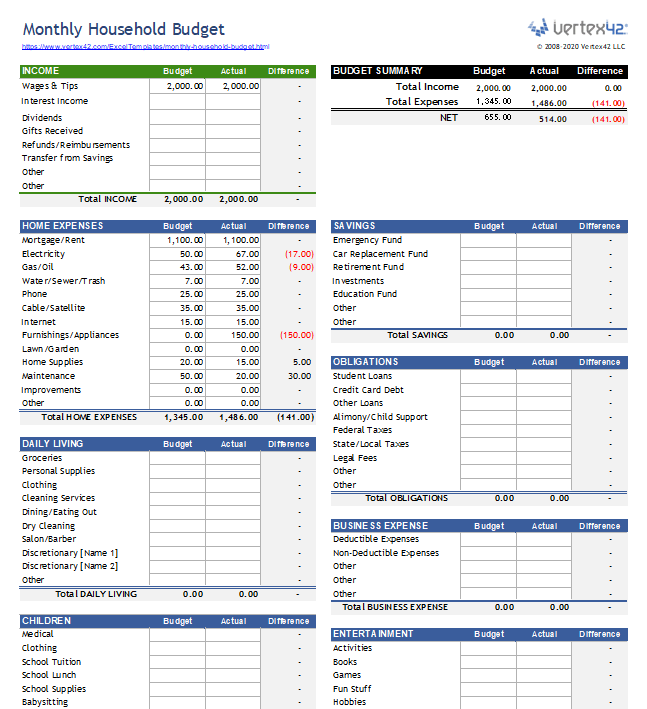

An effective household budget typically begins with a clear understanding of your net income—the money you actually receive after taxes and deductions. From there, expenses are usually divided into fixed and variable categories, allowing for flexible adjustments. Incorporating dedicated lines for savings and debt repayment ensures these crucial financial goals are not overlooked.

Here are the key categories commonly found in an effective budgeting system:

- **Income:** Your total net earnings from all sources (salaries, freelance work, benefits, etc.).

- **Fixed Expenses:** Regular payments that typically don’t change month-to-month.

- Rent/Mortgage

- Loan Payments (car, student, personal)

- Insurance Premiums (health, auto, home)

- Subscriptions (streaming services, gym memberships)

- **Variable Expenses:** Costs that fluctuate each month, requiring careful tracking.

- Groceries and Dining Out

- Utilities (electricity, gas, water – though some can be semi-fixed)

- Transportation (gas, public transit, car maintenance)

- Personal Care (haircuts, toiletries)

- Entertainment and Hobbies

- Clothing

- **Savings & Investments:** Funds allocated towards future goals.

- Emergency Fund

- Retirement Contributions

- Down Payment Savings (home, car)

- Investment Accounts

- **Debt Repayment (Extra):** Any additional payments made beyond minimums.

- Credit Card Debt

- Personal Loans

Crafting Your Personalized Spending Plan

Creating your own budget template is less about finding a one-size-fits-all solution and more about customizing a system that genuinely reflects your financial reality and aspirations. The process begins with gathering your financial data and extends to regularly reviewing and adjusting your plan. A good monthly household budget template provides a flexible framework that adapts to life’s inevitable changes.

First, take the time to compile all your financial statements: bank statements, pay stubs, credit card bills, and loan statements for the past few months. This historical data will give you a realistic picture of your average income and spending habits. Next, categorize every transaction, assigning it to one of the sections outlined above. This step is crucial for identifying areas where you might be overspending or where there’s room to reallocate funds toward your goals.

Once you have a clear picture of your income and expenses, begin allocating funds. A popular guideline is the 50/30/20 rule: aim to spend 50% of your after-tax income on needs, 30% on wants, and 20% on savings and debt repayment. While this is a helpful starting point, feel free to adjust these percentages to suit your unique situation. Some prefer a zero-based budget, where every dollar is assigned a job until your income minus expenses equals zero. The key is to find a system that resonates with you and your household.

Essential Tools for Budgeting Success

While the core principles of budgeting remain constant, the tools available to manage your money have evolved significantly. From classic pen-and-paper methods to sophisticated digital platforms, there’s a solution for every preference and tech-savviness level. The best tool is ultimately the one you will consistently use.

For those who prefer a hands-on approach, a simple notebook and pen can be incredibly effective. The act of writing down each transaction often creates a stronger mental connection to your spending. Many find free online spreadsheet programs like Google Sheets or Microsoft Excel to be invaluable. These offer customizable templates where you can input your data, create formulas, and visualize your financial progress with charts and graphs. Their flexibility allows for granular control and tailored categorization.

For a more automated experience, a plethora of budgeting apps are available. Services like Mint, YNAB (You Need A Budget), and EveryDollar can link directly to your bank accounts, automatically categorizing transactions and providing real-time updates on your spending. These apps often include features for goal setting, bill reminders, and detailed reports, making it easier to stay on track. Regardless of your chosen tool, the discipline of regularly reviewing and updating your financial organizer is paramount to its success.

Making Your Budget a Living Document

A budget isn’t a static document you create once and forget; it’s a dynamic, living tool that evolves with your life. Financial circumstances change, unexpected expenses arise, and personal goals shift. Regularly reviewing and adjusting your spending framework is critical to its long-term effectiveness and your sustained financial health.

We recommend setting aside time at least once a month—perhaps at the end of the month or the beginning of the next—to reconcile your actual spending with your budgeted amounts. This review helps you identify discrepancies, understand where your plan worked well, and pinpoint areas that need tweaking. Did you consistently overspend on dining out? Perhaps that category needs a higher allocation, or you need to find ways to reduce those expenses. Did you come under budget in another area? You can then reallocate those surplus funds towards savings or debt.

It’s also important to involve all household members in the budgeting process. When everyone is aware of the family’s financial goals and limitations, cooperation naturally increases, fostering a shared sense of responsibility. Celebrate your milestones, whether it’s paying off a small debt or reaching a savings goal. These small victories reinforce positive financial habits and motivate you to continue your journey toward financial independence.

Frequently Asked Questions

How often should I update my budget?

Ideally, you should review and update your budget at least once a month. This monthly check-in allows you to reconcile your actual spending with your planned budget, make adjustments for the upcoming month, and keep your financial goals in sharp focus. Some people prefer weekly check-ins for more granular control.

What if my income is irregular?

Budgeting with irregular income requires a slightly different approach. Consider using a “bare bones” budget for your essential expenses, ensuring those are always covered. Then, prioritize saving and debt repayment with any additional income. Creating a “buffer” fund for leaner months is also highly recommended.

How do I track small cash expenses?

Tracking small cash expenses can be challenging but is crucial for an accurate budget. One effective method is to keep a small notebook or use a budgeting app’s quick-add feature to log cash transactions immediately. Alternatively, use the “envelope system” for cash spending, where specific amounts are allotted to physical envelopes for various categories.

Is it okay to spend on “wants” in my budget?

Absolutely! A sustainable budget is not about deprivation but about intentional spending. Allocating funds for “wants” like entertainment, hobbies, or dining out helps prevent burnout and makes your budget more enjoyable and realistic. The key is to balance wants with needs and savings, ensuring it aligns with your overall financial goals.

Your financial future is a canvas waiting for you to paint your ideal life, and a thoughtful monthly household budget template is the brush in your hand. It offers the power to transform vague aspirations into concrete plans, turning financial stress into a sense of calm and control. By understanding your money, you unlock the ability to make choices that truly serve your best interests and those of your household.

Embrace this opportunity to take charge. Start by examining your current financial landscape, build a budget that reflects your unique needs, and commit to reviewing it regularly. This isn’t just about numbers on a spreadsheet; it’s about building a foundation for security, growth, and the freedom to pursue the life you envision. The journey to financial empowerment begins with this single, powerful step.