Every small business owner dreams of growth, innovation, and lasting success. Yet, amidst the daily hustle of serving customers, managing staff, and developing products, one critical area often gets relegated to the back burner: consistent financial planning. Without a clear roadmap for your money, even the most promising ventures can struggle to navigate unpredictable market conditions or capitalize on growth opportunities. A robust financial strategy isn’t just about avoiding pitfalls; it’s about proactively shaping your future.

This is where a dedicated monthly budget becomes an indispensable tool. It transforms abstract financial data into actionable insights, providing a snapshot of your company’s fiscal health at any given moment. Far more than just a ledger of income and expenses, it’s a strategic document that empowers you to make informed decisions, allocate resources wisely, and forecast with greater accuracy. Embracing a structured approach to your finances can be the differentiator between merely surviving and truly thriving in today’s competitive landscape.

Why Every Small Business Needs a Monthly Budget

For many entrepreneurs, the thought of creating a budget conjures images of restrictive limitations. In reality, a well-crafted monthly financial plan is quite the opposite. It’s a liberation, offering clarity and control over your business’s financial destiny. It allows you to understand where every dollar comes from and where it goes, turning vague assumptions into concrete figures.

This level of insight is crucial for several reasons. It helps identify potential cash flow shortages before they become crises, enabling you to take preventative measures. It highlights areas where you might be overspending or underutilizing resources, guiding more efficient operational adjustments. Furthermore, having a clear financial blueprint makes it easier to set realistic goals, apply for loans, and even attract investors who appreciate fiscal responsibility.

Decoding the Essential Elements of a Small Business Budget

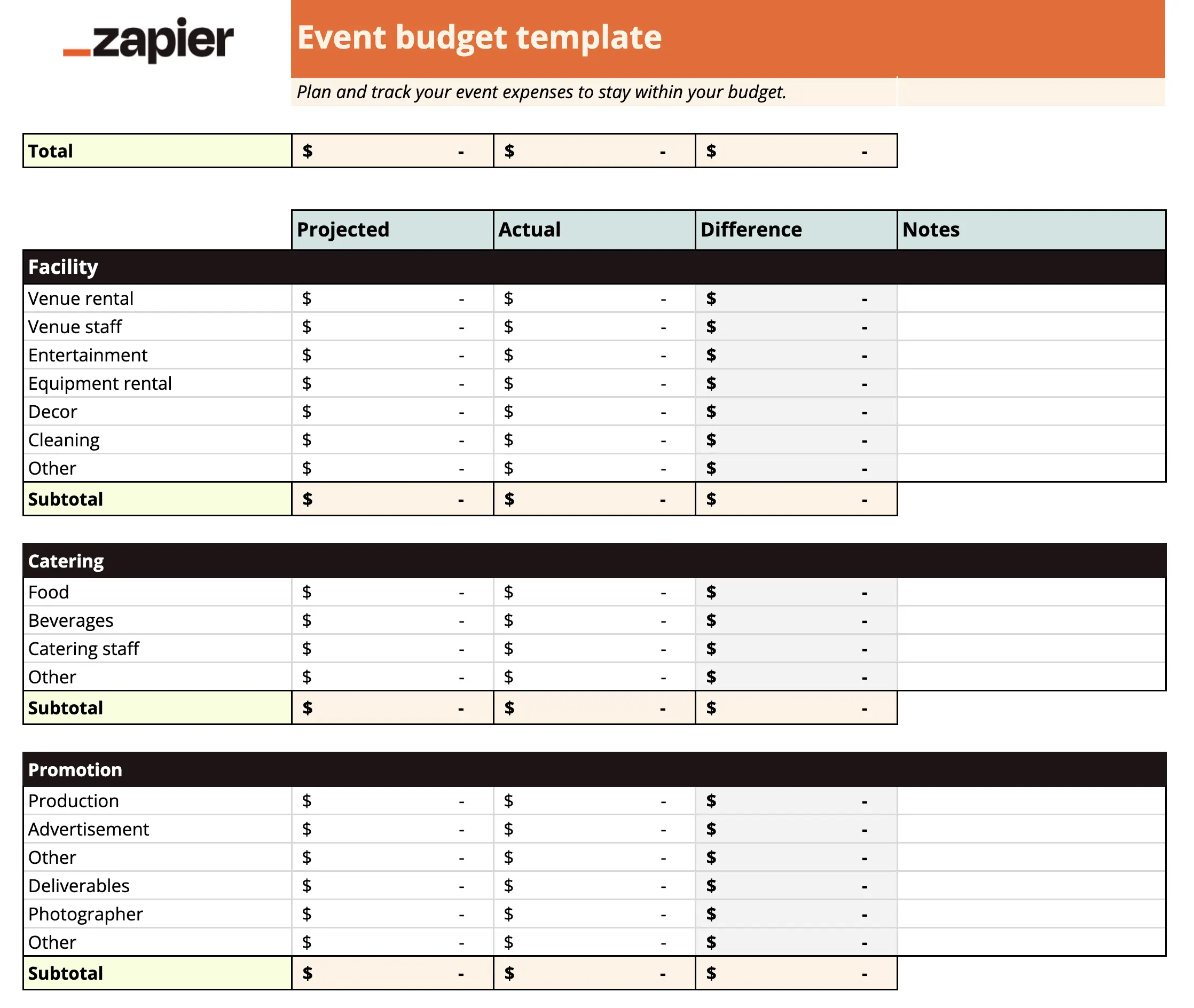

A truly effective financial management template isn’t just a basic spreadsheet; it’s a comprehensive overview of your financial world. While specific categories will vary based on your industry and business model, there are core components that every business spending blueprint should include. Understanding these elements is the first step towards building a budget that works for you.

At its heart, any robust small business budgeting tool must track both inflows and outflows of money. This means carefully categorizing all transactions to gain a granular understanding of your financial movements. Without this detailed breakdown, you’ll miss opportunities for optimization and risk making uninformed decisions.

Here are the key sections and line items you should consider for your monthly financial plan:

- **Projected Revenue:** This is your best estimate of money coming into the business from all sources.

- **Sales of Goods/Services:** Primary income from your core offerings.

- **Other Income:** Royalties, advertising revenue, interest, grants, etc.

- **Fixed Expenses:** Costs that generally remain the same each month, regardless of business activity.

- **Rent/Mortgage:** Office space, warehouse, retail location.

- **Insurance:** Business liability, property, health insurance for employees.

- **Loan Payments:** Scheduled repayments on business loans.

- **Salaries (fixed):** Regular pay for salaried employees.

- **Software Subscriptions:** Essential tools like CRM, accounting software, project management.

- **Variable Expenses:** Costs that fluctuate based on your business volume or activity.

- **Cost of Goods Sold (COGS):** Materials, labor directly tied to production.

- **Utilities:** Electricity, gas, water (can fluctuate with usage).

- **Marketing & Advertising:** Campaign costs, ad spend, promotional materials.

- **Supplies:** Office supplies, packaging materials, cleaning supplies.

- **Commissions:** Sales commissions based on performance.

- **Hourly Wages:** Pay for hourly employees, which varies with hours worked.

- **One-Time or Irregular Expenses:** Costs that don’t occur every month but are important to anticipate.

- **Equipment Purchases:** New machinery, computers, vehicles.

- **Consulting Fees:** Legal, accounting, or marketing consultants for specific projects.

- **Training & Development:** Employee workshops, courses.

- **Maintenance & Repairs:** Unexpected or scheduled repairs for property or equipment.

- **Taxes:** Essential and often overlooked.

- **Payroll Taxes:** Employer contributions.

- **Sales Tax:** Collected and remitted.

- **Estimated Income Tax:** Setting aside funds for federal and state income taxes.

- **Cash Flow Summary:** A calculation that shows your net cash position.

- **Net Cash Flow:** Revenue minus all expenses for the month.

- **Opening & Closing Balances:** Cash on hand at the start and end of the period.

Choosing and Customizing Your Budget Template

The beauty of a budget template lies in its adaptability. While a generic spreadsheet might offer a starting point, the most effective Monthly Budget Template For Small Business is one that is tailored to your unique operations. There are numerous resources available, from free online templates offered by accounting software providers to robust, customizable spreadsheets found on marketplaces. The key is to find one that resonates with your comfort level and grows with your business.

When selecting a template, consider its ease of use. Is it intuitive? Does it allow for easy input and clear visualization of data? Look for templates that are designed to handle both simple and complex financial structures, so you don’t outgrow it too quickly. Customization is paramount; you should be able to add or remove expense categories, adjust reporting periods, and even integrate specific project tracking if needed. Don’t be afraid to experiment with different formats until you find one that truly supports your business’s financial planning needs.

Implementing Your Budget: Tips for Success

Creating a budget is just the beginning; its true value comes from consistent implementation and regular review. Budgeting for small businesses requires discipline and a commitment to understanding your financial flow. By following a few best practices, you can ensure your operational budget guide becomes a dynamic tool rather than a static document gathering digital dust.

The power of any financial management template lies in its consistent application. Regularly updating and reviewing your budget isn’t just about adherence; it’s about learning, adapting, and making smarter decisions as your business evolves. Treat it as a living document that informs and empowers your strategic growth.

Here are some tips to integrate your financial planning template effectively:

- **Be Realistic:** Don’t sugarcoat your projections. Overestimating income or underestimating expenses will lead to an unrealistic budget and potential disappointment. Aim for conservative estimates.

- **Track Everything Diligently:** Every transaction, no matter how small, needs to be recorded. Use accounting software or dedicate time daily/weekly to enter all income and expenses into your customizable budget spreadsheet.

- **Categorize Carefully:** Ensure you’re consistently assigning transactions to the correct categories. This precision is vital for accurate reporting and analysis.

- **Review Regularly:** Don’t just set it and forget it. Schedule monthly reviews to compare your actual performance against your budgeted figures. This comparison is critical for identifying trends and making timely adjustments.

- **Be Flexible:** Your budget is a guide, not a rigid constraint. Market conditions, unexpected opportunities, or unforeseen challenges might require adjustments. Be prepared to adapt your plan as circumstances change.

- **Build an Emergency Fund:** Always allocate a portion of your budget to a contingency fund. This financial cushion is invaluable for handling unexpected costs or downturns without derailing your entire financial plan.

- **Separate Business and Personal Finances:** This might seem obvious, but it’s crucial. Mixing funds makes tracking business expenses and income management incredibly difficult and can lead to tax complications.

- **Seek Professional Advice:** If you find yourself overwhelmed or unsure, consult with an accountant or financial advisor. They can provide tailored guidance and help optimize your financial health for entrepreneurs.

Beyond the Numbers: Strategic Benefits of Financial Tracking

While the immediate benefit of using a budget template for small business is clear financial oversight, its impact extends far beyond mere number crunching. A well-maintained budget is a powerful strategic asset, offering insights that can shape your business’s direction and enhance its long-term viability. It transforms financial data into a narrative of your business’s performance and potential.

Understanding your tracking business expenses and income patterns allows for proactive decision-making. You can identify seasonal trends, anticipate peak demand, and plan for slower periods. This foresight enables better inventory management, staffing adjustments, and marketing campaign timing. Ultimately, consistent financial planning cultivates a culture of fiscal responsibility and strategic thinking throughout your organization, driving sustainable growth and ensuring the robust financial health for entrepreneurs.

Frequently Asked Questions

What is the primary benefit of using a monthly budget for a small business?

The primary benefit is gaining clear visibility and control over your business’s financial flow. It allows you to understand where your money is coming from and going, helping you make informed decisions, identify areas for improvement, and prevent cash flow surprises before they occur.

How often should I review my small business budget?

While it’s a “monthly” budget, you should aim to review and update your financial management template at least once a month. Some businesses might benefit from weekly check-ins, especially during periods of rapid growth or significant operational changes, to ensure accuracy and responsiveness.

Can a budget template help with tax preparation?

Absolutely. By diligently tracking and categorizing all your income and expenses throughout the year using a detailed budget spreadsheet, you’ll have organized records that significantly simplify tax preparation. This can save time, reduce stress, and help ensure you claim all eligible deductions.

Is it okay to adjust my budget throughout the year?

Yes, it’s not just okay, it’s encouraged! A business budget should be a dynamic document. As market conditions change, new opportunities arise, or unexpected challenges emerge, you should be prepared to adjust your monthly financial plan to reflect the current reality of your business. Flexibility is key to effective budgeting.

What if my actual spending consistently differs from my budgeted amounts?

Consistent discrepancies indicate that your budget might be unrealistic or that there are underlying operational issues. Use this as an opportunity to analyze why the differences occur. Are your estimates inaccurate? Are there unexpected costs? Is there an area where you can reduce spending? Adjust your budget to be more realistic or implement strategies to bring spending in line with your goals.

Mastering your small business finances doesn’t have to be an overwhelming task. With the right tools and a disciplined approach, you can transform uncertainty into clarity, and reactive responses into proactive strategies. A well-utilized monthly budget template becomes your most trusted advisor, guiding you through every financial decision, big or small.

Embrace the power of knowing your numbers. By consistently engaging with your business’s financial health, you’re not just managing money; you’re building a stronger, more resilient foundation for your future success. Take the step today to implement or refine your financial planning, and watch as your business confidently moves towards its strategic goals.