Embarking on a journey towards financial freedom often feels like navigating a complex maze, where every turn presents a new challenge or an unexpected expense. For many, the first step to gaining control over their money is creating a budget. However, the idea of staring at a blank spreadsheet or trying to formulate a comprehensive financial plan from scratch can be daunting. This is where the power of visual aids and community resources comes into play, making the prospect of managing your money not just achievable, but genuinely engaging.

Enter Pinterest, a treasure trove of creative inspiration and practical solutions, where an abundance of ready-to-use tools simplifies the budgeting process significantly. Imagine transforming the abstract concept of financial planning into a tangible, aesthetically pleasing guide that you actually look forward to using. This platform offers an accessible entry point for anyone, from budgeting novices to seasoned financial planners, looking for a fresh approach to managing their monthly income and expenses. Finding the perfect Monthly Budget Planner Template Pinterest can be a game-changer, transforming a chore into an empowering routine that puts you firmly in charge of your financial destiny.

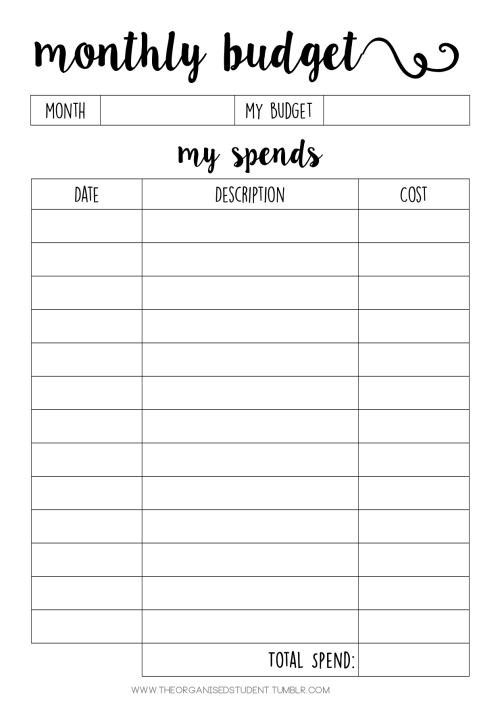

The Power of Visual Budgeting: Why Pinterest?

Pinterest stands out as a unique resource for financial planning tools because of its inherently visual nature. Unlike a dry search through a document library, Pinterest allows you to browse countless budget templates, each presented with vibrant designs, clear layouts, and practical features. This visual appeal can significantly reduce the intimidation factor often associated with personal finance. Users can quickly grasp the layout and functionality of various spending plans before even downloading them, ensuring a better fit for their individual preferences and financial goals.

The platform’s strength lies in its ability to connect users with a diverse range of creators, from professional financial coaches to fellow budget enthusiasts. This means you’re not just getting generic templates; you’re accessing a spectrum of ideas, strategies, and designs tailored to different budgeting philosophies. Whether you’re seeking a minimalist monthly spending plan, a detailed household expense tracker, or a creative debt repayment visual, Pinterest offers an unparalleled selection that caters to every taste and financial situation, making the search for the ideal financial planning tool both efficient and enjoyable.

Unlocking Your Financial Potential with a Monthly Budget Planner

Adopting a systematic approach to your finances through a monthly budget planner is arguably the most critical step towards achieving financial stability and realizing your long-term goals. It provides a clear snapshot of your income versus your outgoings, highlighting where your money is truly going. This awareness is the foundation upon which all sound financial decisions are built, enabling you to identify areas for saving, optimize spending, and strategically allocate funds towards investments or debt reduction.

Beyond simply tracking numbers, a well-implemented personal budget worksheet fosters a sense of control and reduces financial stress. When you understand your financial landscape, unexpected expenses become less daunting, and saving for significant life events, like a down payment on a home or a dream vacation, transitions from a distant wish to a concrete plan. Utilizing a pre-designed budget template from Pinterest eliminates the initial hurdle of setup, allowing you to dive straight into the practical application of managing your money, thereby accelerating your journey towards financial empowerment.

How to Find and Select Your Ideal Budgeting Template

Your quest for the ideal Monthly Budget Planner Template Pinterest begins with understanding your personal needs and preferences. With an overwhelming number of options available, a focused approach will save you time and ensure you find a tool that genuinely works for you. Start by considering your budgeting style: are you a meticulous tracker who thrives on detail, or do you prefer a simpler, more glanceable overview of your finances? Do you need specific categories for business expenses, childcare, or student loan tracking?

Once you have a clearer picture, navigate to Pinterest and utilize specific search terms such as "monthly budget planner," "printable budget template," "digital budget spreadsheet," or "no-spend challenge tracker." Explore the results, paying close attention to:

- **Layout:** Is it intuitive and easy to follow?

- **Categories:** Does it include relevant categories for your income and expenses, or can they be easily customized?

- **Aesthetics:** Does the design appeal to you? A visually pleasing template can boost motivation.

- **Format:** Is it a PDF for printing, a spreadsheet for digital use, or an interactive template?

- **Inclusions:** Does it offer sections for savings goals, debt trackers, or annual summaries?

Pinning a few favorites to a dedicated board can help you compare and contrast before making your final selection, ensuring the budget template Pinterest you choose aligns perfectly with your financial aspirations.

Key Elements of an Effective Monthly Spending Plan

Regardless of its aesthetic or digital format, any effective monthly budget planner must incorporate several core components to provide a comprehensive overview of your financial health. These elements are crucial for understanding where your money comes from, where it goes, and how you can optimize its flow to meet your goals. A good template acts as a structured framework, guiding you through the essential aspects of your financial life.

Here are the fundamental sections you should look for in any robust budgeting resource:

- **Income Sources:** A clear breakdown of all money coming in each month, whether from a primary salary, side gigs, or other investments. This helps you understand your total disposable income.

- **Fixed Expenses:** These are costs that typically remain the same month-to-month, such as rent/mortgage payments, loan installments, insurance premiums, and subscription services. Recognizing these ensures you always allocate funds for non-negotiable outflows.

- **Variable Expenses:** This category includes costs that fluctuate, such as groceries, dining out, entertainment, utilities, and transportation. Tracking these closely is vital for identifying areas where you can cut back if needed.

- **Savings Goals:** Dedicated sections for short-term and long-term savings, encouraging you to “pay yourself first.” This could include funds for an emergency fund, a down payment, or retirement.

- **Debt Repayment Plan:** If you have debts, a specific section to track payments and progress towards becoming debt-free can be highly motivating.

- **Actual vs. Planned Spending:** This critical comparison allows you to see how well you’re sticking to your budget and where adjustments might be necessary for the following month.

- **Monthly Summary/Reflection:** A space to review your financial performance, identify successes, and plan for improvements in the coming month.

Ensuring your chosen personal budget worksheet includes these core elements provides a holistic view of your financial organization and empowers informed decision-making.

Customizing Your Pinterest Budget Template for Personal Success

While a pre-made budget template provides an excellent starting point, its true effectiveness blossoms when you customize it to genuinely reflect your unique financial landscape and personal habits. No two individuals or households have identical spending patterns or financial objectives, making personalization an essential step in sustainable budgeting. Think of your chosen template as a foundation upon which you build a financial system perfectly suited to your life.

Begin by adjusting categories to match your actual spending. If you have a specific hobby that incurs regular costs, create a dedicated line item for it rather than lumping it into a generic "miscellaneous" category. Similarly, eliminate categories that don’t apply to you. Experiment with different tracking methods; perhaps color-coding expenses helps you visualize spending more clearly, or adding a small notes section for each category provides valuable context. For digital templates, leverage spreadsheet functions for automatic calculations, while printable versions offer the tactile satisfaction of writing things down and adorning your financial planner with stickers or doodles that motivate you. The goal is to transform a general financial planning tool into a highly personalized and motivating system that you look forward to engaging with each month.

Practical Tips for Consistent Budgeting

Creating a budget is an excellent start, but consistent adherence is what truly drives financial progress. Many people struggle to maintain their budgeting efforts beyond the first few weeks, often due to unrealistic expectations or a lack of practical strategies. Incorporating simple, actionable habits into your routine can transform budgeting from a dreaded task into a seamless and rewarding part of your financial life.

Here are some practical tips to help you stay on track with your monthly financial overview:

- **Schedule Regular Check-ins:** Dedicate specific times each week or bi-weekly to review your spending and update your budget. This keeps you informed and allows for minor adjustments before issues become significant.

- **Be Realistic:** Avoid overly strict budgets that set you up for failure. Allocate reasonable amounts for discretionary spending to prevent burnout and make your budget sustainable.

- **Automate Savings:** Set up automatic transfers from your checking to your savings account immediately after you get paid. This ensures you prioritize paying yourself first, before other expenses.

- **Track Every Penny (Initially):** For the first month or two, meticulously track all your expenses. This provides invaluable insight into your actual spending habits, which can be eye-opening.

- **Review and Adjust Monthly:** Your financial situation is dynamic. At the end of each month, review your budget’s performance. What worked? What didn’t? Adjust categories and allocations for the upcoming month to optimize your financial organization.

- **Find an Accountability Partner:** Sharing your financial goals with a trusted friend or family member can provide encouragement and motivation to stick to your plan.

- **Celebrate Small Wins:** Acknowledge and celebrate reaching minor financial milestones, whether it’s staying within a tricky category or hitting a small savings target. Positive reinforcement keeps you engaged.

By integrating these habits, your household expense tracker becomes a living document, a powerful partner in your ongoing journey toward financial freedom.

Frequently Asked Questions

How often should I review my budget?

While a monthly budget planner suggests a monthly review, it’s highly recommended to do mini-reviews weekly. This allows you to catch overspending early, make small adjustments, and stay on top of your financial flow. A comprehensive review and planning session should still occur at the end of each month.

Is a digital or printable budget planner better?

The “better” option depends entirely on personal preference and lifestyle. Digital templates offer convenience, automatic calculations, and easy access from multiple devices. Printable versions provide a tactile experience, the satisfaction of writing things down, and often less screen time. Many people find success by combining both, using a digital tool for tracking and a printable summary for reflection.

Can I use these templates for variable income?

Absolutely. Budget templates can be adapted for variable income, though it requires a slightly different approach. Consider budgeting based on your lowest expected income, and then allocate any excess earnings (windfalls, bonuses) towards savings, debt repayment, or specific financial goals. Some templates on Pinterest are specifically designed with variable income in mind.

What if I consistently overspend in a category?

Consistently overspending in a category is a sign that your initial budget for that item was unrealistic or that your spending habits need adjustment. First, genuinely assess if the budget amount is too low for your lifestyle. If so, adjust it. If it’s a habit issue, try setting smaller, incremental goals for reducing spending in that area, or implement strategies like the “envelope system” for cash-based categories.

How do I start budgeting if I’ve never done it before?

Start simple. Begin by tracking all your income and expenses for one month without trying to change anything. This gives you a clear picture of your current financial habits. Then, select a basic budget template from Pinterest, input your actual numbers, and identify one or two small areas where you can make improvements. The key is to start small, learn, and gradually build up your budgeting skills.

Taking charge of your finances is a profoundly empowering act, and the journey toward financial clarity doesn’t have to be a solo, overwhelming endeavor. Resources like a well-chosen monthly budget planner template from Pinterest transform abstract financial concepts into actionable, manageable steps, providing a clear roadmap for your money. By leveraging the visual inspiration and practical tools available, you gain not just a budgeting system, but a personalized pathway to understanding your financial flow, achieving your savings goals, and building a more secure future.

Don’t let the complexity of traditional financial planning deter you any longer. Explore the vast world of budgeting resources on Pinterest today. Download, customize, and begin to actively manage your money with confidence and creativity. Your financial freedom is within reach, and with the right tools, you can confidently navigate your economic landscape, turning your financial aspirations into a tangible reality.