In the whirlwind of daily life, it’s all too easy for finances to feel like a runaway train, with bills piling up and an unclear picture of where your hard-earned money is actually going. For many Americans, the idea of budgeting can feel overwhelming, restrictive, or just plain boring. However, taking control of your financial narrative doesn’t have to be a daunting task; it’s about establishing clarity, predictability, and ultimately, peace of mind.

Imagine a life where you never dread opening your mailbox or checking your online statements, because you already know what’s coming and have a plan for it. This isn’t a pipe dream; it’s the reality that a well-structured Monthly Bill Budget Template can create for you. This powerful yet simple tool acts as your personal financial roadmap, transforming ambiguity into understanding and helping you steer your money toward your goals, rather than merely reacting to incoming expenses.

Why a Dedicated Bill Organizer Matters

The modern financial landscape is complex, with an array of recurring expenses from mortgage payments and utilities to streaming subscriptions and student loan installments. Without a centralized system, these can easily become a tangled web, leading to missed payments, overdraft fees, and unnecessary stress. A dedicated bill organizer, like a comprehensive monthly spending plan, cuts through this chaos by bringing all your financial obligations into one clear view.

This proactive approach shifts your mindset from merely tracking what you’ve spent to planning where your money will go before it even leaves your bank account. It highlights potential shortfalls before they become crises and reveals opportunities for saving and investing that you might otherwise overlook. By having a clear financial overview document, you’re not just organizing bills; you’re organizing your financial future.

Key Benefits of Using a Structured Spending Plan

Adopting a robust financial planning tool offers a multitude of advantages that extend far beyond simply paying bills on time. It’s about building a healthier relationship with your money and fostering long-term financial stability.

One of the most immediate benefits is enhanced **financial clarity**. A comprehensive budget template demystifies your income and expenditures, showing you exactly how much money you have, how much you need for essentials, and what’s left for discretionary spending or savings. This transparency is the foundation of smart financial decisions.

Next, it significantly **reduces financial stress and anxiety**. Knowing that every bill is accounted for and that you have the funds to cover it removes a huge burden. No more last-minute scrambling or worrying about unexpected expenses; you’ll have a buffer and a plan.

A structured expense blueprint also unlocks **greater saving potential**. When you see where your money goes, you can identify areas for reduction and redirect those funds towards your savings goals, whether it’s an emergency fund, a down payment, or a dream vacation. It turns vague intentions into actionable steps.

Furthermore, it empowers **debt reduction strategies**. By clearly outlining all your debts and their associated payments, you can prioritize, allocate extra funds, and accelerate your journey to becoming debt-free. This visual representation of your obligations can be a powerful motivator.

Ultimately, using a regular expense management system helps you **achieve your financial goals faster**. Whether those goals are big or small, having a clear plan for your money ensures you’re consistently working towards them, rather than letting money slip through your fingers.

Understanding the Essential Elements of Your Spending Tracker

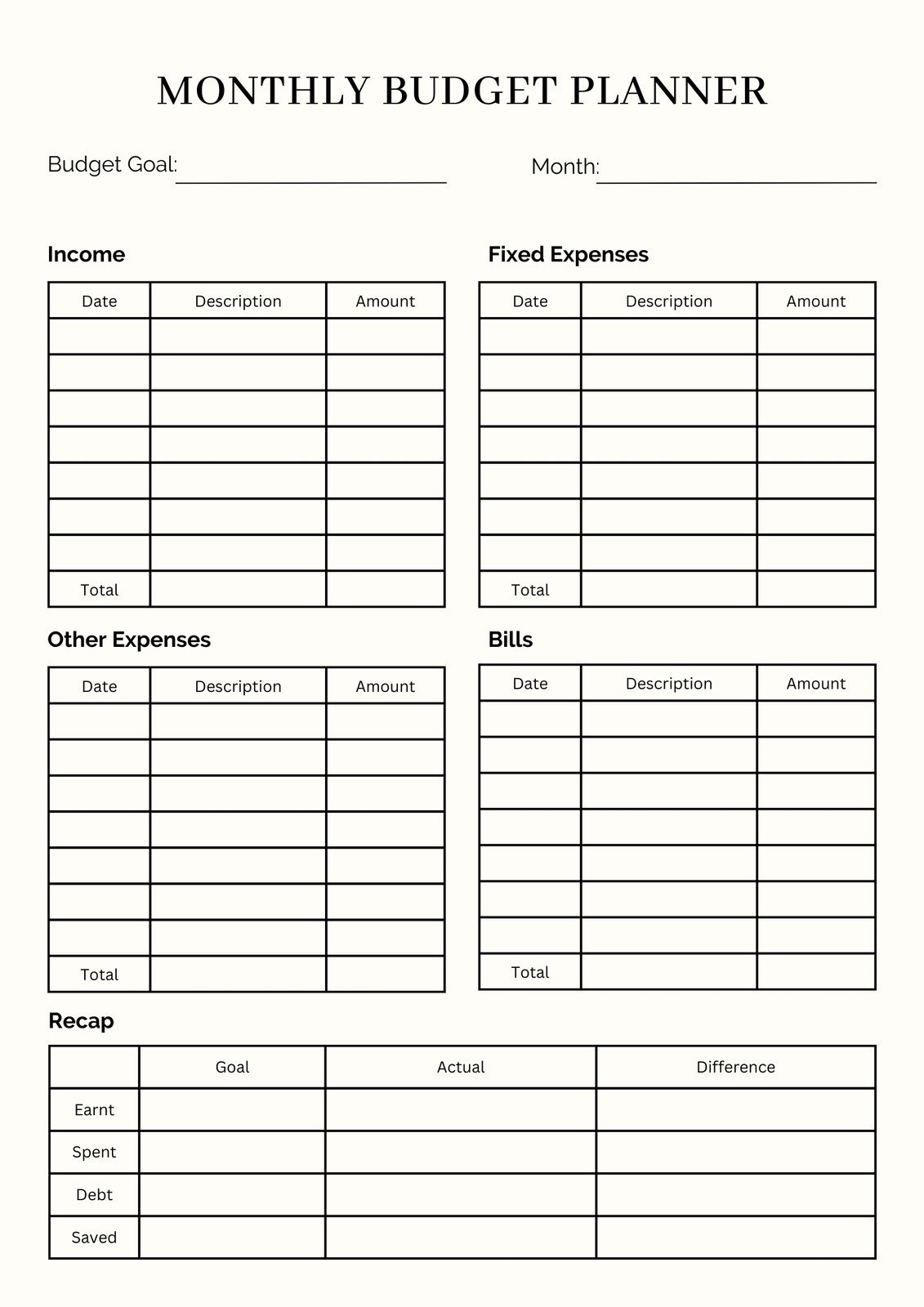

To be truly effective, your financial overview document needs to capture key pieces of information. While specific templates may vary, certain core components are universal for successful household spending plan.

- **Income Sources:** Detail all incoming money, including your net pay from your primary job, income from side gigs, rental income, or any other regular influx of cash. Be sure to account for when these funds are typically received.

- **Fixed Expenses:** These are costs that generally stay the same each month. Examples include your **rent or mortgage**, car loan payments, insurance premiums, and subscription services like Netflix or gym memberships. List the exact amount and the due date for each.

- **Variable Expenses:** Unlike fixed expenses, these costs fluctuate month-to-month. This category often includes **groceries**, utilities (electricity, gas, water), transportation costs (gasoline, public transit), dining out, and entertainment. Estimate these as accurately as possible, and track them closely.

- **Savings Goals:** Dedicate specific lines for money you’re setting aside. This could be for an **emergency fund**, a down payment on a house, retirement contributions, or even a vacation fund. Treat these as non-negotiable “payments to yourself.”

- **Debt Repayment:** Clearly list all your outstanding debts, such as **credit card balances**, student loans, and personal loans. Include the minimum payment due and the actual payment you plan to make.

- **Miscellaneous/Buffer:** Always include a small buffer for unexpected minor expenses. This prevents your budget from being derailed by small, unforeseen costs.

- **Notes and Due Dates:** A dedicated section for important reminders, such as when specific bills are due, or any upcoming annual expenses you need to save for. This helps avoid late fees.

How to Effectively Use Your Financial Overview Document

Once you have your expense blueprint, the real work—and the real rewards—begin. Using your financial planning tool effectively requires a consistent and honest approach.

First, **gather all your financial statements**. This includes bank statements, credit card statements, loan documents, utility bills, and pay stubs. You need an accurate picture of your current financial situation to start.

Next, **input all your income**. List every source of money coming into your household for the month. Be realistic about the net amount you expect to receive after taxes and deductions.

Then, methodically **list all your expenses**. Start with fixed expenses, as these are easiest to categorize and assign an exact amount. Follow this with your variable expenses, using past statements to estimate initial amounts. Don’t forget any annual or semi-annual bills; divide them by 12 or 6 respectively and set aside that amount monthly.

Crucially, **track your spending consistently**. This is where many budgets fall apart. Whether you use an app, a spreadsheet, or a simple notebook, make a habit of logging every dollar spent. This helps you stay within your variable expense categories and reveals spending habits you might not be aware of.

Finally, **review and adjust regularly**. At the end of each month, compare your planned spending to your actual spending. Where did you go over? Where did you save? Use these insights to refine your budget for the next month, making it an evolving and increasingly accurate reflection of your financial reality.

Customizing Your Expense Blueprint for Personal Success

While a generic **Monthly Bill Budget Template** provides an excellent starting point, its true power comes from its adaptability. Your financial situation, goals, and lifestyle are unique, and your budget should reflect that.

Consider adding categories specific to your life. Do you have a pet that requires special care? Are you saving for a specific hobby or passion? Create lines for these unique expenditures. You might also want to adjust the level of detail for certain categories. For instance, if dining out is a major expenditure, you might break it down into “restaurants,” “coffee shops,” and “fast food” to gain deeper insights.

If your income streams are complex, customize the income section to reflect multiple jobs, freelance work, or other revenue sources. You might add columns to track expected versus actual income. Similarly, if you’re tackling multiple debts, consider adding a debt snowball or avalanche tracker within your financial planning tool to visualize your progress.

Don’t be afraid to experiment with different formats. While a spreadsheet-based bill budget template is popular for its automation capabilities, a digital app might offer more on-the-go tracking, or even a simple paper-and-pen system might appeal to those who prefer a tactile approach. The best expense blueprint is the one you will actually use consistently.

Tips for Maintaining Your Regular Expense Management

Adherence is key to the long-term success of any budget. Here are some practical tips to help you stick to your household spending plan and make it a sustainable habit.

First, **set aside dedicated time each week** to review your finances. Even 15-30 minutes can make a significant difference in keeping you aligned with your financial goals. Treat this time as non-negotiable, just like any other important appointment.

Be completely **honest with yourself** about your spending. There’s no judgment when it comes to your personal finances, only data. Acknowledge your habits, even the less desirable ones, so you can address them effectively.

Where possible, **automate your savings and bill payments**. Set up automatic transfers to your savings accounts and automatic payments for fixed bills. This reduces the chance of missed payments and ensures you pay yourself first.

Remember to **track even the smallest expenses**. Those daily coffees or impulse purchases can quickly add up and derail your budget if left unrecorded. Every dollar counts when you’re working towards financial freedom.

Finally, **celebrate your small wins**. When you stick to your budget for a month, pay off a small debt, or hit a savings milestone, acknowledge your success. Positive reinforcement can be a powerful motivator to keep going.

Common Pitfalls and How to Avoid Them

Even with the best intentions, budgeting can present challenges. Being aware of common pitfalls can help you navigate them more effectively.

One common mistake is **ignoring variable expenses**. It’s easy to focus on fixed costs, but often it’s the fluctuating categories like groceries, entertainment, and personal care that lead to budget overruns. Dedicate extra attention to tracking these.

Another pitfall is **not reviewing your budget regularly**. A budget isn’t a set-it-and-forget-it tool. Life happens, and your financial situation can change. Consistent monthly reviews and adjustments are crucial for its effectiveness.

Being **too restrictive** can also lead to failure. If your budget feels like a straitjacket, you’re more likely to abandon it. Allow for some discretionary spending and “fun money” to make your budget sustainable and enjoyable.

Many people give up after **one or two mistakes**. Don’t let a single overspending incident or a missed payment derail your entire effort. Acknowledge it, learn from it, adjust, and move forward.

Lastly, **not involving household members** can create friction. If you share finances, ensure everyone who contributes to or spends from the household income is on board with the budget and understands its goals.

Frequently Asked Questions

Why can’t I just use a notebook for my bill budget?

While a notebook is a valid starting point for simple tracking, a dedicated financial planning tool, especially a digital one, offers advantages like automatic calculations, categorization, and the ability to easily modify and replicate for future months. It reduces manual effort and the chance of errors.

How often should I update my expense tracker?

Ideally, you should track your expenses daily or every few days to ensure accuracy and prevent overwhelm. A thorough review and adjustment of your overall monthly spending plan should happen at least once a month, typically before the start of a new billing cycle.

What if my income is irregular?

For irregular income, it’s best to budget based on your lowest expected income or an average over several months. Prioritize your fixed, essential expenses first. Any surplus income can then be allocated towards variable expenses, savings, or debt reduction, giving you a buffer for leaner months.

Is a Monthly Bill Budget Template only for people struggling financially?

Absolutely not. A robust financial overview document is a powerful tool for everyone, regardless of their income level. It helps you optimize your spending, accelerate wealth accumulation, achieve specific financial goals, and maintain financial peace of mind, whether you’re building savings or managing complex investments.

How do I choose the right financial planning tool for me?

Consider your comfort level with technology, your desire for detail, and how much automation you prefer. Options range from simple paper templates to complex spreadsheets, budgeting apps, and professional financial software. The “right” tool is the one you find easiest to use and commit to consistently.

Taking control of your finances doesn’t have to be a source of dread. It’s an empowering journey that begins with a single, crucial step: creating a clear, actionable plan for your money. By embracing a systematic approach to your income and expenditures, you are not just tracking numbers; you are actively shaping your financial future.

So, why wait to experience the clarity, confidence, and peace of mind that come with a well-managed financial life? Start today by implementing a personalized monthly spending plan. It’s an investment in yourself and your future, promising greater financial freedom and the ability to achieve the goals that matter most to you.