In the dynamic world of business, forming partnerships is often a cornerstone of growth and innovation. Whether you’re launching a startup, bringing in angel investors, formalizing a family business structure, or expanding an established enterprise, the collaboration among shareholders is critical. However, the enthusiasm of a new venture can sometimes overshadow the necessity of clearly defining roles, rights, and responsibilities, especially for those holding a smaller stake. This oversight can lead to significant friction, disputes, and even legal battles down the line, potentially jeopardizing the very future of the company.

This is where a robust and well-crafted agreement becomes indispensable. A comprehensive document serves as the foundational legal framework that governs the relationship between a company and its minority shareholders, as well as among all shareholders. It acts as a preemptive measure, establishing clear expectations and protective mechanisms before any disagreements arise. For entrepreneurs, legal professionals, and anyone involved in corporate governance, understanding and utilizing a solid minority shareholder agreement template is not just good practice—it’s essential for fostering stability, ensuring fairness, and securing the long-term viability of the business.

The Imperative for Formalized Shareholder Understanding

In today’s complex business environment, where investments can be significant and competition fierce, the need for clearly defined legal structures has never been more pressing. Ambiguity in shareholder relationships is a breeding ground for conflict, capable of undermining even the most promising ventures. Without a written understanding, companies expose themselves to the risks of misinterpretation, power struggles, and costly litigation that can drain resources and divert focus from core business objectives.

A formal, written agreement provides an undeniable reference point for all parties involved. It ensures that everyone understands their rights, obligations, and the agreed-upon procedures for various corporate actions, from routine operations to critical decision-making and eventual exit strategies. This clarity is not merely a legal nicety; it is a fundamental element of good governance that protects all shareholders, particularly those with a minority interest whose voices might otherwise be marginalized.

Benefits and Protections Offered by a Standardized Framework

Leveraging a standardized framework offers a multitude of advantages, primarily centered on safeguarding the interests of minority shareholders while promoting overall corporate stability. A well-structured document, such as a robust minority shareholder agreement template, acts as a critical shield against potential abuses of power by majority shareholders. It ensures that the contributions and investments of those holding a smaller stake are recognized and respected within the corporate structure.

Key benefits include the establishment of specific voting rights on crucial matters, restrictions on share transfers to prevent unwanted changes in ownership, and mechanisms for fair valuation in the event of a buy-out. This proactive approach minimizes the likelihood of disputes, as common points of contention are addressed and agreed upon in advance. Moreover, it provides a clear roadmap for resolving disagreements, should they occur, avoiding protracted and expensive legal battles. By setting these parameters early, the agreement fosters an environment of trust and transparency, essential for long-term business success and investor confidence.

Customizing the Framework for Unique Situations

While a well-designed template provides an excellent starting point, its true value lies in its adaptability. No two businesses or investor relationships are identical, meaning that any standard agreement must be carefully tailored to fit the specific nuances of a company, its industry, and its shareholder dynamics. A template should serve as a comprehensive foundation upon which custom clauses and conditions can be built, ensuring the final document accurately reflects the unique needs and agreed-upon terms of all parties.

Consider, for example, a tech startup seeking venture capital versus a long-standing family business bringing in a new generation of minority owners. The former might require specific clauses regarding intellectual property rights, future funding rounds, and accelerated exit provisions, while the latter might focus more on succession planning, family employment policies, and maintaining generational control. The framework should be flexible enough to incorporate these distinct requirements, allowing for modifications to share valuation methods, dispute resolution processes, and even board representation rules. Engaging experienced legal counsel to assist with this customization is paramount, ensuring that all modifications comply with relevant state and federal laws and effectively address the specific risks and opportunities pertinent to your situation.

Essential Components of an Effective Agreement

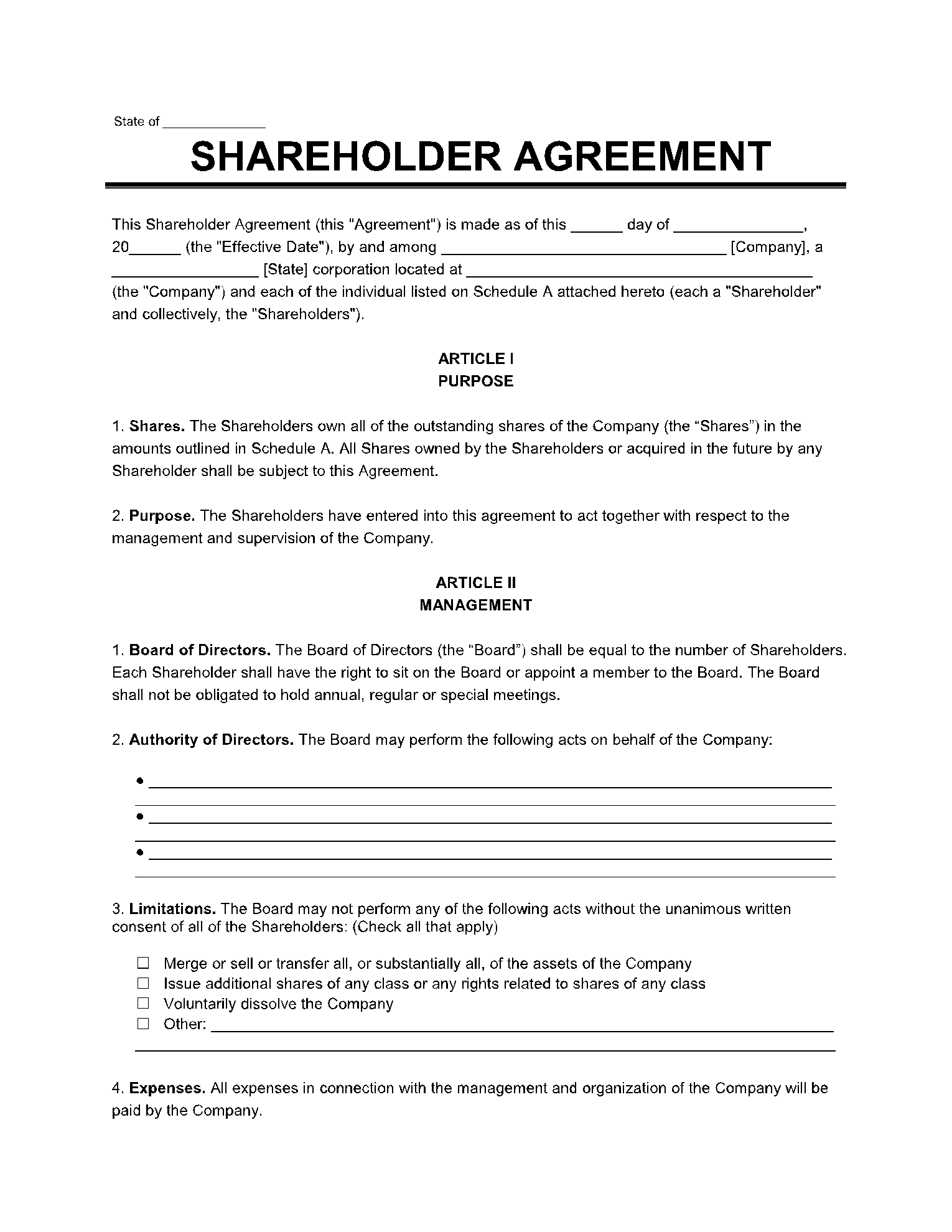

An effective shareholder agreement is a detailed roadmap for governance and protection. While the specific content will vary, certain clauses are universally critical for safeguarding all parties, particularly minority investors. Here are the essential sections every comprehensive agreement should contain:

- Identification of Parties: Clearly lists all shareholders involved, their contact information, and their respective shareholdings (class, number, percentage).

- Share Capital Structure: Details the authorized, issued, and outstanding shares, including different classes of shares (e.g., common, preferred) and their associated rights and preferences.

- Share Transfer Restrictions: Prevents shareholders from selling or transferring their shares without prior approval or offering them to existing shareholders first. This often includes rights of first refusal (ROFR) and rights of co-sale (tag-along rights).

- Pre-emptive Rights: Gives existing shareholders the right to purchase a proportionate number of any new shares issued by the company before they are offered to external parties, protecting their ownership percentage.

- Drag-Along Rights: Allows majority shareholders to force minority shareholders to sell their shares if a third party makes an offer to buy the entire company, ensuring a clean acquisition.

- Tag-Along Rights (Co-Sale Rights): Protects minority shareholders by allowing them to join in a sale of shares by a majority shareholder, ensuring they receive the same terms and price.

- Board Representation: Specifies the composition of the board of directors, including any rights for minority shareholders to appoint or nominate directors.

- Reserved Matters (Veto Rights): Outlines specific corporate actions (e.g., major asset sales, issuing new shares, amending articles, taking on significant debt) that require unanimous consent or a supermajority vote, giving minority shareholders a powerful check on majority decisions.

- Valuation Methodology: Establishes a clear process and criteria for determining the fair market value of shares in various scenarios, such as buy-backs, transfers, or exit events.

- Dispute Resolution: Defines the steps to be taken if disagreements arise, often including mediation or arbitration before resorting to litigation, saving time and resources.

- Confidentiality and Non-Compete Clauses: Protects proprietary information and prevents shareholders from competing directly with the company during or for a specified period after their involvement.

- Deadlock Provisions: Specifies procedures to resolve situations where shareholders or directors are unable to agree on critical decisions, preventing operational paralysis.

- Exit Provisions (Buy-Sell Agreements): Details mechanisms for shareholders to exit the company, including buy-back clauses, put/call options, or procedures for a company sale, often triggered by specific events like death, disability, or retirement.

- Governing Law: Specifies the jurisdiction whose laws will govern the interpretation and enforcement of the agreement.

- Amendments and Waivers: Sets forth the process for modifying the terms of the agreement.

Practical Guidance for Document Presentation

The efficacy of any legal document is not solely dependent on its content but also on its clarity and usability. A meticulously drafted agreement can lose its impact if it’s poorly organized or difficult to read. For a document like a minority shareholder agreement template, attention to formatting, structure, and accessibility is crucial, whether it’s intended for print or digital distribution. The goal is to ensure that all parties can easily understand their rights and obligations without needing constant legal interpretation.

Begin by employing clear, concise language, avoiding unnecessary legalese where simpler terms suffice. Use consistent terminology throughout the document to prevent confusion. Headings and subheadings should be used liberally to break up long sections of text, making the document scannable and easier to navigate. A table of contents is invaluable for longer agreements, allowing quick access to specific clauses. Incorporate bullet points and numbered lists for items such as rights, obligations, or procedural steps, as these enhance readability significantly. For digital use, ensure the document is easily searchable and compatible across various platforms. Consider using a professional layout with adequate white space to reduce visual fatigue. Finally, meticulous proofreading is essential to eliminate any grammatical errors or typos that could undermine the document’s professionalism and legal standing.

Utilizing a comprehensive minority shareholder agreement template is more than just fulfilling a legal requirement; it’s a strategic investment in the future stability and success of your business. It provides a robust framework that anticipates potential issues, codifies shareholder relationships, and protects all parties, especially those with smaller equity stakes. By clearly outlining rights, responsibilities, and dispute resolution mechanisms from the outset, companies can minimize conflicts, foster trust, and maintain focus on their core objectives.

In a rapidly evolving business landscape, the proactive adoption of such a detailed and adaptable document offers invaluable peace of mind. It streamlines the complex process of corporate governance, acting as a professional, time-saving solution that empowers businesses to navigate challenges effectively. While a template provides an excellent foundation, remember to always consult with legal professionals to tailor the final agreement to your specific circumstances, ensuring it is legally sound and fully reflective of your unique business needs.