Embarking on a shared financial journey is one of the most significant steps a married couple takes. From pooling incomes to planning for future dreams, managing money together requires transparency, communication, and a clear strategy. While the idea of budgeting might sound daunting, it’s actually a powerful tool for achieving financial harmony and building a secure future. It’s not about restriction; it’s about informed decision-making and aligning your spending with your shared values and goals.

Many couples find themselves navigating their finances without a clear roadmap, leading to stress, misunderstandings, and missed opportunities. This is where a structured approach becomes invaluable. A well-designed framework can transform financial discussions from potential arguments into productive planning sessions, ensuring both partners feel heard and understood. It provides a tangible way to track income, manage expenses, and save for everything from daily necessities to long-term aspirations like a down payment on a home or a comfortable retirement.

Why a Joint Financial Plan is Essential for Couples

For married individuals, merging lives often means merging finances. This isn’t just about combining bank accounts; it’s about developing a unified financial philosophy. A shared financial strategy fosters a sense of partnership and mutual responsibility. It ensures that both individuals are aware of the household’s financial standing, including income, debts, and savings, preventing surprises and promoting open dialogue about money matters.

Without a clear plan, it’s easy for expenses to spiral out of control, or for one partner to carry a disproportionate amount of the financial burden. A joint financial roadmap allows couples to identify common financial goals, whether that’s paying off student loans, saving for a family vacation, or building an emergency fund. It transforms individual financial ambitions into collective targets, strengthening the marital bond through shared accomplishment.

Moreover, having a consistent system helps prevent money-related stress, which is often cited as a major contributor to marital discord. When finances are transparent and managed cooperatively, the likelihood of arguments over spending habits or unexpected bills significantly decreases. It creates a foundation of trust and accountability, essential ingredients for any successful marriage.

The Core Benefits of Using a Shared Financial Framework

Adopting a structured approach to managing your finances offers a multitude of advantages for married couples. It moves beyond simply tracking numbers and delves into fostering financial literacy and teamwork within the relationship. The benefits extend far beyond just balancing the books; they touch upon the very quality of your shared life and future.

Firstly, a comprehensive household spending plan provides unparalleled **clarity** regarding where your money goes. Many couples are surprised to discover how much they spend on discretionary items once they begin tracking every dollar. This transparency is the first step towards identifying areas for potential savings and reallocating funds towards more meaningful goals.

Secondly, it empowers couples to make **informed decisions** together. Instead of impulsive purchases or uncoordinated savings efforts, every financial choice becomes a joint decision aligned with established priorities. This collaborative approach ensures both partners are invested in the outcomes and feel ownership over their financial trajectory.

Thirdly, it acts as a powerful tool for **goal achievement**. Whether your goal is to eliminate debt, save for a child’s education, or retire early, a detailed couple’s budgeting guide helps you break down large objectives into manageable steps. Seeing progress visually reinforces commitment and motivates continued discipline.

Finally, a robust financial management tool for couples significantly **reduces financial stress**. When you have a clear understanding of your income, expenses, and savings, the uncertainty surrounding money diminishes. This peace of mind allows you to focus on other aspects of your relationship and life, knowing your financial house is in order.

Key Elements of an Effective Couple’s Budget

A truly effective budget for two isn’t just a ledger; it’s a dynamic financial blueprint tailored to your unique circumstances. While specific categories may vary, certain core elements are universally crucial for any married couple monthly budget template to be successful. Understanding these components is the first step toward building a robust and sustainable financial plan.

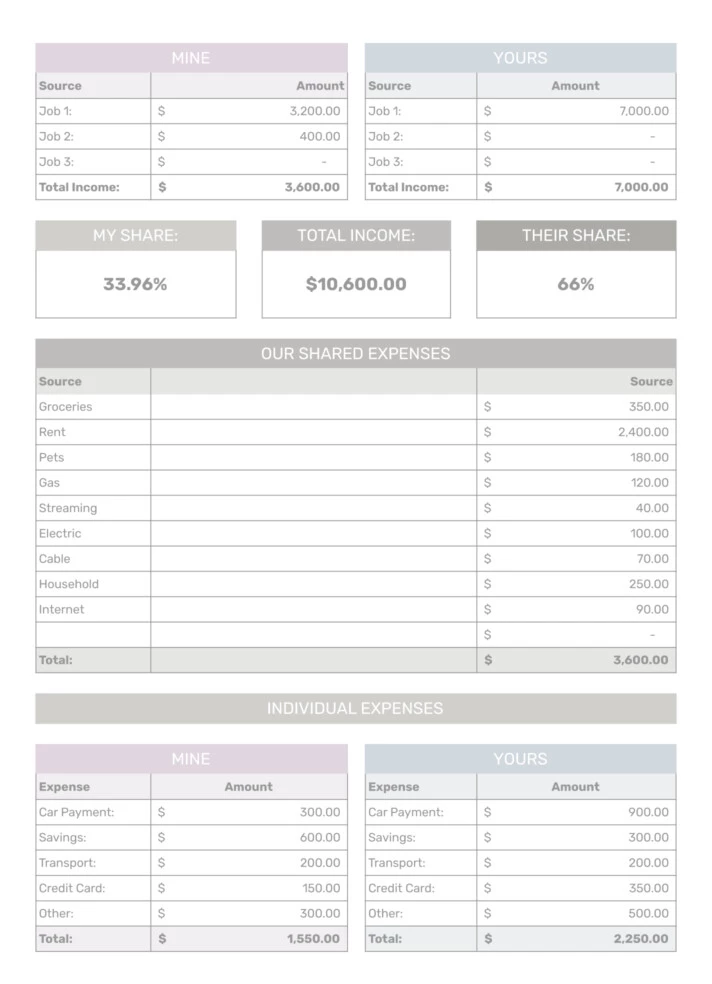

- Income Sources: Clearly list all net income streams for both partners. This includes salaries, freelance work, rental income, or any other regular inflow of money. Knowing your total combined income is the foundation of your spending plan.

- Fixed Expenses: These are recurring costs that typically remain the same each month. Examples include **rent or mortgage payments**, car loans, insurance premiums, subscriptions, and student loan payments. These are often the easiest to track as they are predictable.

- Variable Expenses: These costs fluctuate from month to month. This category requires careful attention and tracking. Common examples include **groceries**, utilities (which can vary), gas, dining out, entertainment, and personal care items. Setting realistic limits here is key.

- Savings & Investments: Dedicate specific line items for savings goals. This might include an **emergency fund**, retirement contributions (401k, IRA), down payments for a home, or a college fund for children. Treat these as non-negotiable “expenses” that you pay yourselves first.

- Debt Repayment: Beyond fixed loan payments, allocate funds specifically for aggressively paying down high-interest debt, such as **credit card balances**. This category is crucial for improving your overall financial health.

- Discretionary Spending: This covers “wants” rather than “needs.” It includes money for hobbies, personal shopping, or spontaneous outings. Allocating a reasonable amount for this ensures the budget doesn’t feel overly restrictive and allows for individual enjoyment.

- Miscellaneous/Buffer: Always include a small buffer for unexpected minor expenses that don’t fit neatly into other categories. This helps prevent derailing the entire budget when small, unforeseen costs arise.

Getting Started: Steps to Implement Your Household Budget

Implementing a new combined household budget can seem overwhelming at first, but by breaking it down into manageable steps, you and your partner can establish a sustainable system. The goal is to create a financial roadmap that feels empowering, not restrictive, and one that you both can adhere to consistently.

First, **gather all financial information**. This includes bank statements, credit card statements, loan documents, pay stubs, and any other income or expense records for the past 1-3 months. Having a clear picture of your current financial reality is paramount before you begin making any changes or setting targets.

Next, **schedule a dedicated “money date”** with your spouse. This should be a regular, no-distraction meeting where you discuss your finances. Start by reviewing your combined income and outlining all your fixed and variable expenses. Be honest and open about individual spending habits and financial anxieties. Use a shared financial strategy or a budgeting template for two to guide your discussion.

Then, **set realistic financial goals together**. What do you want your money to do for you? Short-term goals might include building an emergency fund or paying off a small debt. Long-term goals could involve saving for a house, retirement, or a major vacation. Having joint goals provides motivation and a clear direction for your spending plan.

Once goals are set, **categorize your expenses and allocate funds**. Using the elements outlined in an effective couple’s budgeting guide, assign a portion of your income to each category. Remember to be realistic about your spending habits, especially for variable expenses. It’s better to overestimate slightly than to constantly run out of money in a category.

Finally, **track everything and review regularly**. For the first few months, meticulously track every dollar spent. This can be done with apps, spreadsheets, or even a notebook. At your weekly or bi-weekly money dates, review your progress, adjust categories as needed, and celebrate small wins. Consistency and flexibility are crucial for long-term success with your monthly budget for married couples.

Customizing Your Financial Blueprint for Two

While the core principles of an effective budget remain consistent, the beauty of a well-designed financial management tool for couples lies in its adaptability. Your financial blueprint for two shouldn’t be a rigid, one-size-fits-all solution; it should evolve with your life stages, income changes, and shifting priorities. Personalization is key to ensuring it remains relevant and effective for both partners.

Consider your personal money philosophies. Are one of you a natural saver and the other a spender? A robust budgeting template for two should allow for compromise and understanding. Perhaps one partner manages the daily spending tracking, while the other focuses on long-term investment planning. Assigning specific financial roles can foster a sense of individual ownership within the shared structure.

Flexibility is paramount. Life happens, and your budget needs to accommodate it. A sudden job change, an unexpected medical bill, or the arrival of a new family member will necessitate adjustments. Build in a review process that allows for quarterly or annual overhauls, not just monthly check-ins. This ensures your household spending plan remains a living document that serves your current reality.

Furthermore, incorporate your unique financial goals and values. If international travel is a shared passion, ensure your couple’s budgeting guide reflects a dedicated savings category for adventures. If giving to charity is important, make it a line item. When your financial plan reflects what truly matters to you both, adherence becomes less of a chore and more of a natural extension of your shared aspirations.

Frequently Asked Questions

What is the best method for couples to budget?

The “best” method often depends on the couple’s preferences and financial habits. Popular methods include the 50/30/20 rule (50% needs, 30% wants, 20% savings/debt), the zero-based budget (every dollar assigned a job), or using budgeting apps. The key is to choose a method you both understand, agree on, and can consistently implement. What truly matters is consistent tracking and open communication.

Should married couples combine all their money?

There’s no single “right” answer, as it varies by couple. Some prefer to combine all income into joint accounts for all expenses, promoting complete transparency and shared responsibility. Others opt for a “three-account” system: a joint account for shared expenses and individual accounts for personal discretionary spending. A third option involves keeping all accounts separate but contributing a set percentage or amount to a joint account for household bills and savings. The most important aspect is clarity and agreement on how joint and individual funds will be managed.

How often should couples review their budget?

Ideally, couples should review their budget at least once a month. This monthly review allows you to track progress, make necessary adjustments, and ensure you’re staying on track with your goals. For the first few months, a weekly check-in might be beneficial to get a firm grasp of your spending patterns. Additionally, a more comprehensive review should be conducted quarterly or annually to account for larger life changes or evolving financial goals.

What if one partner is a spender and the other is a saver?

This is a common dynamic that can be effectively managed with a well-structured financial plan. The key is communication and compromise. Start by acknowledging and respecting each other’s natural tendencies. A detailed monthly budget for married couples can help by allocating specific amounts for discretionary spending for each partner, which can be spent guilt-free. The saver can find satisfaction in hitting savings goals, while the spender can enjoy their allocated “fun money.” Often, seeing the progress towards shared goals can help moderate spending habits.

Navigating the complexities of shared finances doesn’t have to be a source of conflict. Instead, it can become a powerful avenue for strengthening your partnership and realizing your shared dreams. By embracing a structured approach, like the invaluable resource of a well-designed Married Couple Monthly Budget Template, you lay the groundwork for a financially secure and harmonious future together.

The journey to financial wellness is ongoing, but with consistent effort, open dialogue, and the right tools, you can build a legacy of fiscal responsibility and achieve remarkable milestones as a team. Take the first step today towards creating a financial partnership that empowers both of you to thrive, confident in the knowledge that your money is working for your shared life and aspirations.