Embarking on the lifelong journey of marriage is an exciting adventure, filled with shared dreams, laughter, and sometimes, unexpected challenges. Among the most common hurdles couples face, financial disagreements often rank high, capable of casting a shadow over even the most loving relationships. Yet, proactively addressing finances doesn’t have to be a source of stress; instead, it can be a powerful tool for strengthening your bond and building a secure future together. This is precisely where a well-crafted Marriage Budget Template becomes an indispensable asset, transforming potential conflict into collaborative planning.

Imagine a future where both partners feel confident and clear about their financial standing, where goals like buying a home, saving for retirement, or planning dream vacations are not just fantasies but achievable milestones. A shared financial framework isn’t just about tracking expenses; it’s about fostering transparency, trust, and teamwork. It provides a clear roadmap for your combined income and expenditures, allowing you to make informed decisions and work cohesively towards your collective aspirations. For any couple serious about laying a robust foundation for their shared life, understanding and implementing such a financial tool is not merely an option, but a crucial step.

Why Financial Harmony Starts with a Plan

Money conversations can often feel daunting, bringing up anxieties about scarcity, past financial missteps, or differing priorities. Without a structured approach, these discussions can devolve into blame or avoidance, which only exacerbates underlying issues. A structured financial planning guide for spouses provides a neutral ground, shifting the focus from individual spending habits to collective financial health. It’s about recognizing that your finances are intertwined, and success for one is success for both.

Establishing a joint spending guide helps to illuminate where your money is going, identify areas for optimization, and highlight opportunities for saving and investing. This transparency cultivates a sense of shared responsibility and mutual respect. When both partners actively participate in creating and adhering to a household financial blueprint, they gain a deeper understanding of each other’s financial perspectives and priorities, paving the way for more meaningful conversations and compromise. It replaces ambiguity with clarity, empowering couples to tackle financial decisions as a united front.

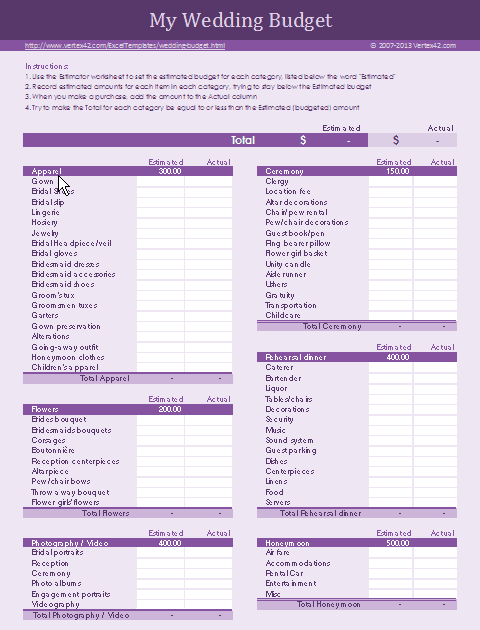

Decoding the Core Elements of a Couple’s Budget

A comprehensive budget for newlyweds or established couples isn’t just a simple tally of income versus outflow; it’s a dynamic reflection of your lifestyle, values, and future goals. To truly harness the power of a shared financial framework, you need to understand its fundamental components. These elements provide the structure necessary for effective money management, ensuring that every dollar has a purpose and contributes to your shared vision. Ignoring any of these aspects can lead to an incomplete picture and hinder your progress.

At its heart, any robust marital financial planning tool should account for:

- **Total Combined Income:** This includes salaries, bonuses, passive income, and any other regular earnings from both partners. It’s the starting point for all your financial planning.

- **Fixed Expenses:** These are costs that typically remain consistent month-to-month and are often contractual. Examples include **rent or mortgage payments**, loan repayments (student loans, car loans), insurance premiums, and subscription services.

- **Variable Expenses:** Unlike fixed costs, these fluctuate. Groceries, dining out, entertainment, utilities (which can vary seasonally), and clothing fall into this category. Managing these is often where the most flexibility and opportunity for savings lie.

- **Savings & Investments:** Critical for future security and achieving long-term goals. This includes contributions to retirement accounts (401k, IRA), emergency funds, down payments for a home, or college savings for children. Make these a **non-negotiable line item**, just like bills.

- **Debt Repayment:** Beyond minimum payments on loans, dedicating extra funds to high-interest debt (like credit cards) can significantly improve your financial health and free up cash flow for other goals.

- **Discretionary Spending:** This is your “fun money”—funds allocated for personal hobbies, spontaneous purchases, or individual treats. Allocating a specific amount can prevent guilt and foster a sense of individual financial freedom within the joint structure.

Building Your Customized Marriage Budget Template

The beauty of a financial template for couples lies in its adaptability. While a basic structure provides guidance, the most effective tool is one that is tailored precisely to your unique financial situation, personalities, and aspirations. There isn’t a one-size-fits-all solution, and exploring different budgeting philosophies can help you find what resonates best with both of you. The key is to find a system that feels sustainable, easy to manage, and supports your mutual goals.

Start by gathering all your financial information: pay stubs, bank statements, credit card bills, and loan documents. This initial data collection phase is crucial for an accurate overview. Next, discuss and decide which budgeting method aligns with your preferences. The zero-based budget ensures every dollar is assigned a job, preventing unallocated funds. The 50/30/20 rule suggests allocating 50% to needs, 30% to wants, and 20% to savings and debt repayment, offering a more flexible framework. Alternatively, a cash envelope system can be highly effective for managing variable expenses, providing a tangible way to track spending in specific categories. Don’t be afraid to experiment; what works today might need adjustments as your lives evolve. The goal is to create a dynamic financial roadmap for marriage that you both feel ownership over.

Practical Tips for Budgeting Bliss Together

Creating a shared budget spreadsheet is just the first step; the true success lies in its consistent application and the communication it fosters. Integrating financial planning into your married life should feel empowering, not restrictive. Here are some actionable strategies to ensure your joint financial strategy strengthens your relationship and helps you achieve your dreams. These aren’t just tips for managing money, but for managing your financial relationship with grace and effectiveness.

- Schedule Regular "Money Dates": Set aside time weekly or bi-weekly to review your finances. This isn’t about finger-pointing but about celebrating wins, adjusting categories, and discussing upcoming expenses. Make it enjoyable – perhaps over coffee or a meal.

- Set Shared Financial Goals: Whether it’s saving for a down payment, a family vacation, or retirement, having joint objectives provides motivation and a unified direction for your budgeting efforts. Break larger goals into smaller, achievable milestones.

- Be Honest and Transparent: Openly discuss your spending habits, financial anxieties, and past mistakes without judgment. A strong financial partnership is built on trust and complete honesty from both sides.

- Automate Savings: Set up automatic transfers from your checking account to your savings and investment accounts on payday. "Pay yourselves first" ensures your goals are prioritized before discretionary spending.

- Plan for the Unexpected: An emergency fund, ideally covering 3-6 months of essential living expenses, is crucial. This financial safety net prevents unexpected costs from derailing your budget and causing undue stress.

- Allow for Individual Discretionary Spending: While joint accounts are important, giving each partner a set amount of "fun money" for personal spending (without needing approval) can prevent feelings of being controlled and foster individual financial freedom.

- Don’t Fear Adjustments: Life happens. Job changes, new expenses, or unexpected windfalls mean your budget will need occasional tweaks. Be flexible and willing to adapt your financial plan as circumstances evolve.

Beyond the Numbers: The Relationship Benefits

While the practical advantages of a robust money management system for partners are evident, the profound impact it has on the emotional and relational health of a marriage is often understated. Financial disagreements are a leading cause of marital strife, and by proactively addressing this area, couples can unlock deeper levels of intimacy and trust. A well-executed shared budget spreadsheet transcends mere accounting; it becomes a powerful instrument for relationship enhancement.

When couples work together on their finances, they are inherently practicing essential relationship skills: communication, compromise, shared problem-solving, and mutual support. This collaborative effort builds a stronger partnership, reducing stress and anxiety that often accompanies financial uncertainty. Achieving shared financial milestones, from paying off debt to purchasing a home, becomes a testament to your teamwork and commitment. Ultimately, a clear and agreed-upon financial roadmap fosters peace of mind, allowing couples to focus on what truly matters: building a joyful, secure, and loving life together, free from the burden of unmanaged money worries.

Frequently Asked Questions

How often should we review our joint finances?

Most experts recommend a weekly or bi-weekly “money date” for a quick check-in on spending and upcoming bills, with a more comprehensive review monthly to adjust categories and assess progress towards long-term goals. Consistency is more important than frequency.

What if one partner earns significantly more than the other?

In marriage, financial contributions are often viewed as a joint effort, regardless of individual income. Consider a “proportional” contribution system where each partner contributes a percentage of their income to shared expenses, or simply pool all income and treat it as “our” money. The key is to agree on a system that feels fair to both.

Should we combine all our accounts?

This is a personal choice. Many couples opt for a main joint checking account for shared expenses and a joint savings account for shared goals, while keeping individual checking accounts for personal discretionary spending. This approach offers both unity and individual autonomy.

What’s the best way to track our spending?

There are numerous effective methods. Digital budgeting apps (like Mint, YNAB, Personal Capital), custom spreadsheets, or even traditional pen-and-paper journals can work. Choose a method that is easy to use for both of you and that you’ll commit to regularly updating.

Is it ever too late to start a marriage budget?

Absolutely not. It’s never too late to gain control over your finances and align your money management. Starting today means taking a proactive step towards a more secure and harmonious financial future, regardless of how long you’ve been married.

Adopting a detailed and personalized Marriage Budget Template isn’t merely about managing money; it’s about investing in the long-term health and happiness of your relationship. It’s a proactive step that transforms potential conflict into a powerful catalyst for growth, understanding, and shared success. By working together to define your financial landscape, you create a sturdy foundation upon which you can build all your shared dreams, big and small.

Embrace this opportunity to foster deeper communication and collaboration with your partner. The peace of mind that comes from a clear financial picture, combined with the satisfaction of achieving your goals together, is an invaluable return on your investment of time and effort. Start today to shape a brighter, more secure financial future, hand-in-hand, for a marriage that truly thrives.