In the intricate dance of modern business and personal transactions, trust is the bedrock upon which successful relationships are built. Yet, even with the strongest intent, the unforeseen can arise, creating a need for formal assurance. This is where a letter of guarantee steps in – a powerful document that provides security, clarity, and peace of mind to all parties involved. Whether you’re a startup securing a line of credit, a contractor assuring project completion, or an individual offering a commitment, understanding how to construct a robust and legally sound guarantee is paramount.

Navigating the nuances of formal communication can be daunting, especially when the stakes are high. A well-crafted letter isn’t just a formality; it’s a testament to your professionalism and a vital safeguard against potential misunderstandings or financial liabilities. For US readers in the business and communication niche, mastering this form of correspondence can elevate your credibility and streamline complex negotiations. This article will delve into the utility of a reliable letter of guarantee template, guiding you through its essential components and offering practical advice to ensure your assurances are always clear, compelling, and legally sound.

The Enduring Significance of Professional Correspondence

In today’s fast-paced digital landscape, the art of written communication remains a cornerstone of trust and accountability. A meticulously drafted document, particularly one that offers a guarantee, speaks volumes about the sender’s integrity and attention to detail. In an era where miscommunications can quickly escalate into costly disputes, a clear, unambiguous letter serves as an invaluable reference point, minimizing ambiguity and setting expectations. From financial institutions seeking collateral to project managers requiring performance bonds, the reliance on formal, written assurances is unwavering.

Beyond simply conveying a message, the professionalism of your correspondence reflects directly on your brand or personal reputation. A sloppily written or poorly formatted guarantee could inadvertently undermine confidence, leading recipients to question the commitment or reliability of the sender. Conversely, a polished and precise letter reinforces trustworthiness, demonstrating a serious approach to obligations. This focus on high-quality communication isn’t just good practice; it’s a strategic imperative that can differentiate you in competitive markets and foster stronger, more reliable partnerships.

Maximizing Efficiency with a Pre-Structured Document

The complexities of drafting legal or formal documents from scratch can be time-consuming and prone to error. This is where leveraging a pre-designed structure, like a well-researched letter of guarantee template, proves immensely beneficial. Such a template acts as a reliable framework, providing all the necessary sections and standard phrasing required for a comprehensive guarantee. It eliminates the guesswork, allowing you to focus on the specific details of your situation rather than the overall layout and legal jargon.

The primary advantage of using a ready-made layout is the significant boost in efficiency. Instead of spending hours researching legal stipulations or ensuring correct formatting, you can quickly populate the template with your unique information. This consistency also reduces the risk of overlooking critical clauses or disclosures, which can have severe legal or financial repercussions. Furthermore, using a standard format enhances readability for the recipient, ensuring that the key terms and conditions are easily identifiable and understood, thereby streamlining the entire communication process.

Tailoring Your Assurance to Specific Scenarios

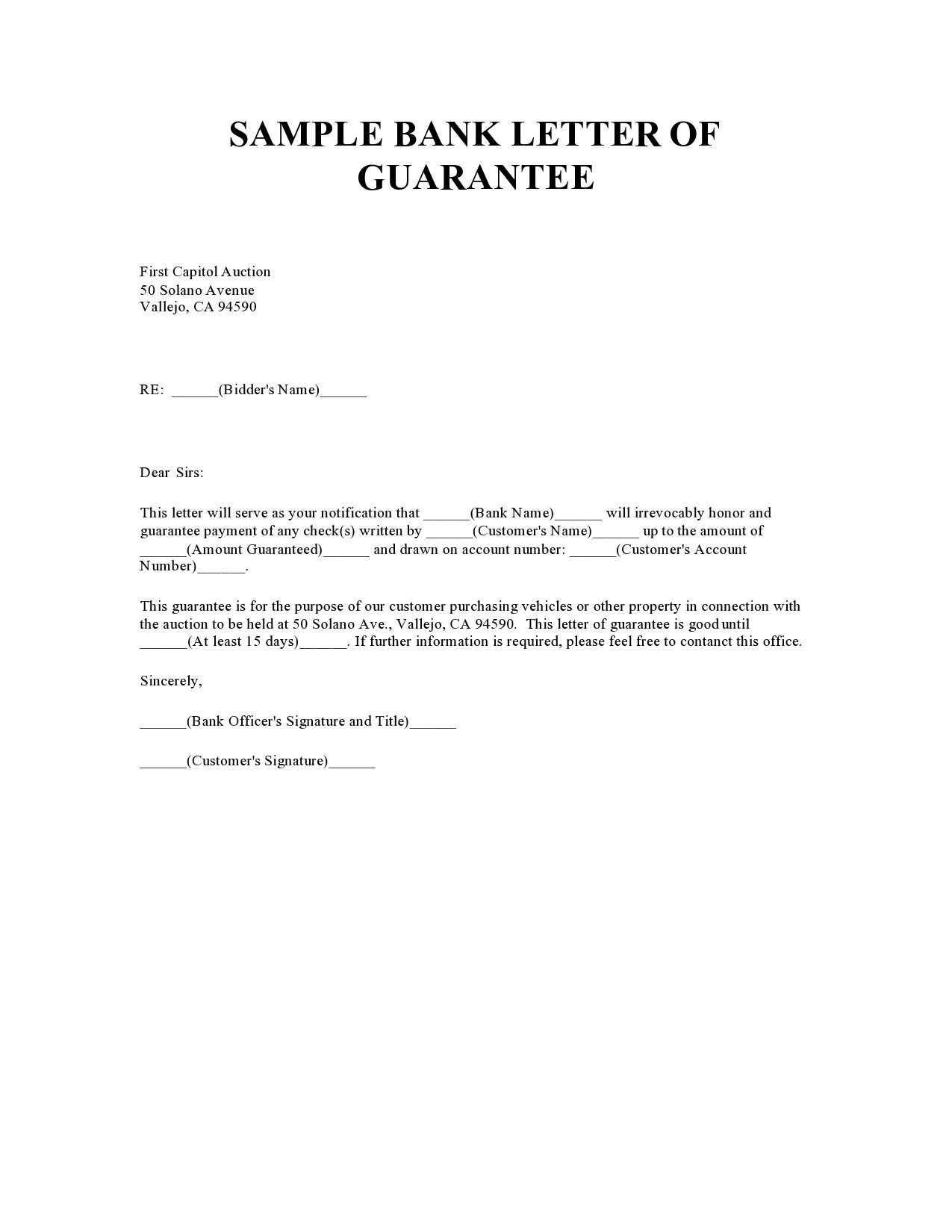

While the core purpose of a guarantee remains constant – to provide assurance – the specific context can vary widely. A versatile letter of guarantee template is designed to be adaptable, allowing you to customize its content to fit diverse situations, whether you’re guaranteeing financial performance, product quality, or contractual obligations. The key is to understand how to personalize the boilerplate language to reflect the unique requirements of your specific agreement or commitment.

For instance, a template used for a financial guarantee might focus on specific monetary limits, repayment schedules, and conditions for default. When adapting it for a performance guarantee, you would emphasize project milestones, delivery timelines, and penalties for non-compliance. Similarly, a product warranty guarantee would detail the scope of coverage, duration, and process for claims. The flexibility of a good template lies in its ability to serve as a robust foundation, which you then build upon with precise details, ensuring every clause aligns perfectly with the sender’s specific commitment and the recipient’s expectations. This personalization ensures the letter is not just a generic promise but a targeted and legally sound commitment.

Essential Elements of a Reliable Guarantee

Every effective guarantee letter, regardless of its specific purpose, shares a common set of critical components that ensure clarity, enforceability, and professionalism. Using a letter of guarantee template helps ensure none of these vital parts are overlooked.

- Date: The exact date the letter is issued, establishing a clear timeline.

- Sender’s Information: Full legal name, address, and contact details of the party issuing the guarantee.

- Recipient’s Information: Full legal name, address, and contact details of the party receiving the guarantee.

- Salutation: A formal greeting addressed to the recipient.

- Subject Line: A concise, clear statement indicating the purpose of the letter (e.g., "Letter of Guarantee for [Project Name/Loan Number]").

- Opening Statement: A clear and unequivocal statement that the sender is providing a guarantee.

- Specific Terms of Guarantee: This is the core of the letter. It must precisely outline:

- What exactly is being guaranteed (e.g., payment, performance, quality of goods).

- The amount or scope of the guarantee (e.g., a specific sum of money, completion of a particular task).

- The duration of the guarantee (e.g., for a specific period, until a certain event occurs).

- Any conditions or prerequisites that must be met for the guarantee to be valid or invoked.

- Any limitations or exclusions to the guarantee.

- Indemnification/Hold Harmless Clauses (if applicable): Provisions protecting one or both parties from certain liabilities.

- Governing Law: Specifies the jurisdiction whose laws will govern the interpretation and enforcement of the guarantee.

- Default and Remedy Provisions: Outlines what constitutes a default and the actions that can be taken by the guaranteed party in such an event.

- Closing: A professional closing (e.g., "Sincerely," "Respectfully").

- Signature: The original signature of the authorized representative of the guaranteeing party, along with their printed name and title.

- Witness Signatures (if required): Signatures of witnesses to the main signature.

- Enclosures (if applicable): Any supporting documents referenced in the letter.

Crafting Your Message: Tone and Presentation

Beyond the content itself, the tone, formatting, and overall presentation of your guarantee letter significantly impact its reception and effectiveness. Adopting a professional yet approachable tone is crucial. While the language must be formal and precise, it shouldn’t be overly convoluted or intimidating. Aim for clarity and directness, ensuring the recipient can easily understand the commitment being made without legal jargon obscuring the message.

When it comes to formatting, consistency and readability are key. Use a clean, standard business letter layout. This typically includes clear paragraph breaks, appropriate spacing, and a professional font (like Times New Roman or Arial) at a legible size (10-12 point). Ensure that all contact information for both sender and recipient is accurate and neatly presented. For digital versions, a PDF format is highly recommended as it preserves the layout, prevents unauthorized alterations, and ensures universal compatibility. If providing a printable version, use high-quality paper, and ensure the signature is an original wet ink signature unless a legally recognized electronic signature is being used. Paying attention to these details reinforces the seriousness and trustworthiness of the document, enhancing the overall professionalism of your communication.

Ultimately, a letter of guarantee serves as a critical bridge of trust in business and personal dealings. By leveraging a well-designed letter of guarantee template, you empower yourself to navigate these important communications with confidence and precision. Such a tool not only saves invaluable time but also ensures that every assurance you provide is clear, comprehensive, and fully compliant with expected standards.

Embracing a structured approach to drafting these documents elevates your communication from mere correspondence to a strategic asset. It protects your interests, fosters stronger relationships, and reinforces your commitment to professionalism. In a world that values efficiency and accuracy, the ability to produce polished, reliable guarantees with ease is an indispensable skill for any individual or organization striving for success.