The vibrant green of a well-maintained lawn is a testament to care and precision. For a lawn care business, however, the real green that matters most often lies in its financial health. Many entrepreneurs in the green industry find themselves swept up in the day-to-day operations, only to realize that their bank account balance doesn’t quite reflect the hard work put in. Without a clear financial roadmap, even the most dedicated professionals can struggle to turn their passion into a sustainably profitable venture.

This is where a robust financial planning document becomes an indispensable tool. It’s not just about tracking expenses; it’s about strategic forecasting, understanding profitability, and making informed decisions that drive growth. Whether you’re just starting your journey in residential lawn care or looking to scale a commercial landscaping operation, having a structured approach to your finances is the bedrock of long-term success.

Why a Solid Financial Plan is Non-Negotiable for Your Lawn Care Business

Operating a successful lawn service company requires more than just skilled labor and reliable equipment; it demands astute financial management. A comprehensive budgeting tool for lawn care companies acts as your business’s financial compass, guiding you through seasons of high demand and periods of leaner activity. It allows you to anticipate cash flow, prepare for significant investments, and identify areas for cost optimization.

Without a detailed operational budget for a lawn service company, you’re essentially flying blind. You might be busy, but are you profitable? Are you charging enough for your services? Can you afford that new zero-turn mower you’ve been eyeing, or should you wait? These are questions a well-constructed financial framework for your landscaping enterprise answers with clarity, empowering you to make data-driven decisions that propel your business forward.

Key Components of Your Lawn Care Business Budget Template

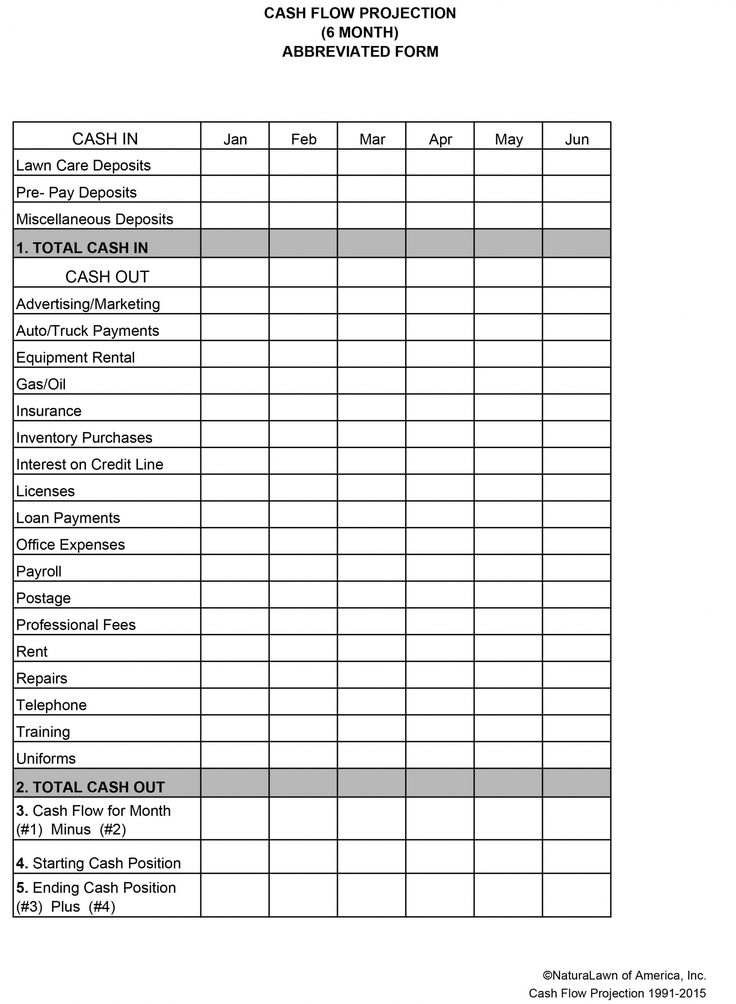

A truly effective profit planning spreadsheet for outdoor service providers isn’t just a simple list of income and expenses. It’s a dynamic instrument designed to provide a holistic view of your financial landscape. Understanding its core elements is the first step toward mastering your business finances and leveraging a Lawn Care Business Budget Template to its fullest potential.

Here are the essential sections you should include:

- **Projected Revenue**: This section estimates your income from various services like mowing, fertilizing, aeration, spring/fall cleanups, and snow removal. Break it down by service type and, if possible, by customer segment.

- **Fixed Costs**: These are expenses that generally don’t change regardless of how many lawns you service. Examples include **rent** for your office or shop, **insurance premiums**, vehicle lease payments, software subscriptions, and salaries for administrative staff.

- **Variable Costs**: These costs fluctuate directly with your level of activity. Think fuel for mowers and trucks, **fertilizer and chemicals**, equipment repairs for increased usage, hourly wages for field crews, and disposal fees.

- **One-Time or Capital Expenses**: This covers significant, infrequent purchases that boost your operational capacity. Examples include buying a **new commercial mower**, a landscape trailer, or investing in a new accounting software system.

- **Marketing and Sales**: Allocate funds for advertising, website maintenance, signage, and any lead generation efforts. This ensures you continuously attract new clients and retain existing ones.

- **Payroll and Benefits**: Beyond fixed salaries, this includes **employer taxes**, workers’ compensation, and any benefits offered to your team. It’s often the largest expense category.

- **Debt Service**: If you have loans for equipment or vehicles, this section tracks your monthly principal and interest payments.

- **Emergency Fund/Contingency**: Always set aside a portion of your budget for unexpected events, such as a major equipment breakdown during peak season or an economic downturn.

Building Your Budget: A Step-by-Step Guide

Creating your business financial blueprint might seem daunting, but by breaking it down into manageable steps, you can develop a comprehensive and accurate model. This structured approach will transform financial planning from a chore into a powerful strategic exercise for your green industry venture.

- Gather Historical Data: Start by compiling your financial records from previous years. Look at income statements, bank statements, and expense receipts. This data provides a realistic baseline for your projections. If you’re a new business, research industry averages and competitor pricing.

- Estimate Revenue Streams: Project your anticipated income for the upcoming period (usually annually, broken down by month or quarter). Consider factors like customer retention rates, new client acquisition targets, seasonal fluctuations, and potential price increases. Be realistic, even conservative, in your estimates.

- Identify and Categorize All Expenses: List every single expense, no matter how small. Group them into fixed, variable, and one-time costs as outlined above. This cost management tool for yard maintenance firms needs to be thorough to be effective. Don’t forget licenses, permits, and professional development.

- Allocate Funds for Each Category: Assign a monetary value to each expense category. For variable costs, calculate them based on your projected revenue (e.g., fuel might be X% of service revenue). For fixed costs, these are typically easier to estimate.

- Review and Adjust: Once you have an initial draft, review it carefully. Does it look realistic? Are there any obvious omissions or overestimates? This financial planning document is a living document, so be prepared to make adjustments as you gain more insight.

- Calculate Your Profit Margins: Subtract your total projected expenses from your total projected revenue. This will give you your estimated net profit. Analyze your gross profit margin (revenue minus cost of goods sold/direct costs) and your net profit margin (revenue minus all expenses).

- Monitor and Update Regularly: Your budget isn’t a set-it-and-forget-it document. Regularly compare your actual financial performance against your budgeted figures. Monthly reviews are ideal. This proactive monitoring allows you to identify discrepancies early and make necessary operational adjustments.

Leveraging Your Financial Blueprint for Growth

A well-crafted Lawn Care Business Budget Template is far more than just an expense tracker; it’s a strategic asset. By diligently following its guidelines and regularly analyzing its insights, you can unlock significant opportunities for expansion and efficiency within your lawn care operation. This financial framework empowers you to proactively plan your capital expenditures, rather than reactively buying equipment when it breaks down.

Moreover, it provides the data necessary to evaluate the profitability of different service lines. Is your aeration service more profitable than basic mowing? Does snow removal justify its investment in equipment and labor during the off-season? An accurate income and expense tracker reveals these insights, helping you refine your service offerings and focus on the most lucrative areas, optimizing resource allocation for maximum return.

Common Pitfalls to Avoid in Your Lawn Care Business Financial Planning

Even with the best intentions, mistakes can happen when managing the finances of a landscaping enterprise. Being aware of common pitfalls can help you steer clear of them and ensure your financial roadmap remains accurate and effective. Avoiding these missteps is crucial for sustained profitability and growth.

One frequent error is underestimating variable costs. Many business owners focus heavily on fixed expenses but forget how quickly fuel, repairs, and seasonal staff wages can add up with increased client load. Another common issue is neglecting to budget for unexpected repairs or emergencies. Without a contingency fund, a sudden equipment breakdown can severely impact cash flow and disrupt operations, causing significant stress and potential financial strain.

Optimizing Your Operations with a Smart Financial Strategy

Your financial strategy should be integrated with your operational strategy, not treated as a separate entity. Using your budgeting tool for lawn care companies to analyze cost per service, for example, allows you to identify inefficiencies in your routes, crew assignments, or equipment usage. This granular level of detail is invaluable for making targeted improvements that directly impact your bottom line.

A dynamic financial planning document also supports strategic pricing decisions. When you know your exact costs, you can confidently set prices that cover your expenses, provide a healthy profit margin, and remain competitive in the market. This empowers you to avoid the common trap of underpricing services, which can severely hinder your ability to reinvest in the business and reward your hard-working team.

Frequently Asked Questions

How often should I update my lawn care business financial planning document?

Ideally, you should review and update your operational budget for a lawn service company at least monthly. This allows you to compare actual performance against your projections, identify variances, and make timely adjustments. A more comprehensive annual review is also essential for strategic long-term planning.

What’s the difference between a budget and a forecast?

A budget is a plan for what you expect to happen financially over a specific period, often set for the entire year. A forecast, on the other hand, is a prediction of what *will* happen based on current data and trends. While a budget is a fixed plan, a financial forecast is a more dynamic, rolling prediction that can be adjusted frequently.

How can a new lawn care business create an accurate budget without historical data?

New businesses should start by researching industry benchmarks, competitor pricing, and average costs for equipment, labor, and materials in their specific geographic area. Create conservative revenue projections and be generous with expense estimates initially. Track everything meticulously from day one to quickly build your own historical data.

Should I include my salary in the budget?

Absolutely. As the owner, your salary or owner’s draw is an expense of the business. Including it ensures that the business generates enough revenue to cover all operational costs, including your compensation, and accurately reflects true profitability. This also helps in separating personal and business finances.

What tools can I use to manage my lawn care business budget?

While a simple spreadsheet (like Excel or Google Sheets) can be an excellent starting point for a Lawn Care Business Budget Template, many businesses upgrade to dedicated accounting software like QuickBooks, Wave, or Xero. These platforms offer robust budgeting features, expense tracking, invoicing, and financial reporting capabilities that integrate seamlessly.

Embracing a systematic approach to your finances through a well-developed budgeting tool for lawn care companies is not just good practice—it’s a critical component of sustainable success. It shifts your perspective from merely reacting to financial situations to proactively shaping your company’s future. By understanding every dollar in and every dollar out, you gain an unparalleled clarity that empowers confident decision-making.

So, take the initiative to build and diligently utilize your business financial blueprint. It will serve as your most trusted advisor, helping you navigate the complexities of managing a profitable landscaping enterprise and ensuring that your green industry venture not only survives but truly thrives for years to come. Your financial health is just as important as the health of the lawns you meticulously maintain.