A General Power of Attorney (GPOA) is a legal document that gives someone else (your “agent” or “attorney-in-fact”) the authority to act on your behalf in most legal and financial matters. Think of it as giving someone else temporary control over your life, but only for specific purposes and within the limits you set.

Why would you need a GPOA?

There are many situations where a GPOA can be incredibly helpful:

If you become incapacitated

If you’re traveling or unavailable

Whether you’re on a long trip, living abroad, or simply too busy to deal with day-to-day matters, a GPOA allows someone to handle things like:

For business purposes

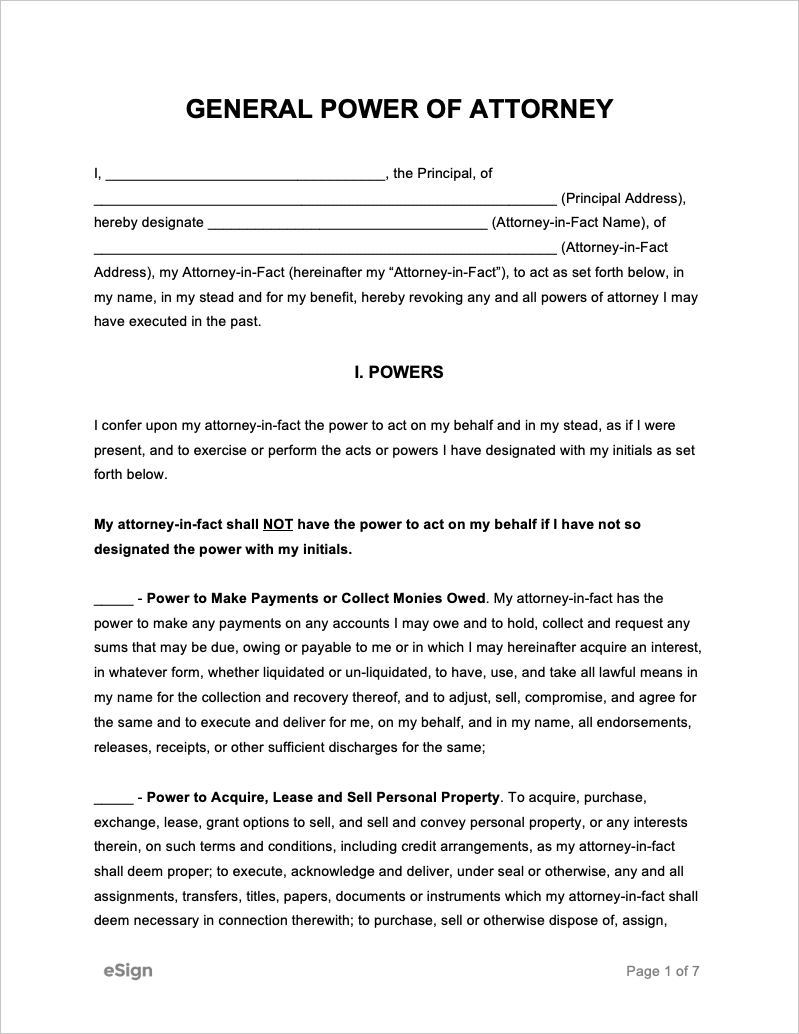

Image Source: esign.com

If you’re a business owner, a GPOA can empower a trusted employee or partner to:

What does a General Power of Attorney typically include?

The specific powers granted in a GPOA can vary greatly depending on your individual needs and the state where you live. However, most GPOAs will cover a broad range of powers, including:

Financial Powers

Banking: Accessing and managing bank accounts, withdrawing funds, and making deposits.

Legal Powers

Signing contracts: Entering into and signing legal agreements.

Important Considerations:

Choose your agent wisely: Select someone you trust completely and who understands your wishes.

General Power of Attorney Example (Simplified)

Here’s a very basic example of how a GPOA might be worded (please note: this is a simplified example and should not be considered legal advice):

> “I, [Your Name], hereby appoint [Agent’s Name] as my attorney-in-fact to act on my behalf in all matters, including but not limited to:

This authority shall remain in effect until [Date] or until I revoke this power of attorney in writing.”

Conclusion

A General Power of Attorney is a valuable legal tool that can provide peace of mind and ensure that your affairs are handled effectively if you become incapacitated or unavailable. By carefully considering your needs and choosing a trustworthy agent, you can create a GPOA that protects your interests and gives you the freedom to live your life without undue worry.

FAQs

1. Is a General Power of Attorney the same as a Healthcare Power of Attorney?

No, they are different documents. A Healthcare Power of Attorney specifically addresses medical decisions, while a General Power of Attorney covers a broader range of legal and financial matters.

2. Can I limit the powers granted in a GPOA?

Yes, you can absolutely limit the powers granted to your agent. You can specify which powers you want to include and which you want to exclude.

3. What if I want to revoke my GPOA?

You can revoke your GPOA at any time by providing written notice to your agent.

4. Do I need an attorney to create a GPOA?

While you can sometimes create a basic GPOA yourself using a template, it’s highly recommended to consult with an attorney to ensure your document is legally sound and meets your specific needs.

5. Can I use a GPOA for business purposes?

Yes, GPOAs can be very useful for business purposes, such as authorizing an employee to sign contracts or manage company finances.

Disclaimer: This information is for general knowledge and informational purposes only and does not constitute legal advice. You should consult with a qualified attorney for advice on specific legal matters.

General Power Of Attorney Example