In an increasingly interconnected and collaborative business landscape, financial arrangements often extend beyond individual accounts. Whether managing shared business expenses, co-investing in ventures, handling family trusts, or simply streamlining household finances, joint accounts offer a practical solution. However, the convenience of shared access can quickly turn into a source of contention if the terms of engagement are not clearly defined from the outset. This is where a robust and well-crafted joint account agreement template becomes not just useful, but indispensable.

A comprehensive agreement serves as the foundational blueprint for how funds will be managed, accessed, and ultimately, distributed. It provides a crystal-clear understanding for all parties involved, mitigating ambiguity and pre-empting potential disputes that could arise from differing expectations or unstated assumptions. For legal professionals, financial advisors, business partners, or even family members pooling resources, leveraging such a template is a proactive step towards establishing financial harmony and safeguarding interests. It transforms vague understandings into concrete, legally sound commitments, offering peace of mind and a clear path forward.

The Imperative for Formalized Financial Understandings

In today’s complex financial and legal environment, informal arrangements, even among trusted parties, carry inherent risks. Verbal agreements are notoriously difficult to enforce and often lead to costly disagreements down the line. Regulatory scrutiny and the increasing prevalence of litigation emphasize the need for meticulous documentation in all financial dealings.

A written agreement provides undeniable proof of the terms agreed upon by all signatories. It acts as a reference point for responsibilities, entitlements, and dispute resolution mechanisms. This level of clarity is vital not only for maintaining healthy relationships but also for complying with potential audit requirements or legal obligations, ensuring all parties are operating from the same precise understanding.

Unlocking the Advantages of a Standardized Document

Utilizing a high-quality joint account agreement template offers a multitude of benefits that extend beyond mere documentation. It provides a structured approach to a potentially intricate financial setup, ensuring that no critical aspects are overlooked. Such a template is an invaluable asset for anyone entering into a shared financial commitment.

The key advantages include:

- Clear Delineation of Responsibilities: Explicitly states who is responsible for what, from initial contributions to ongoing maintenance and withdrawals.

- Dispute Prevention: By addressing potential conflict areas upfront, the agreement significantly reduces the likelihood of future misunderstandings and disagreements.

- Legal Enforceability: A well-drafted document provides a legally sound basis for enforcement should disputes escalate, offering protection to all parties involved.

- Financial Transparency: Promotes open communication about financial expectations, contributions, and expenditures, fostering trust and accountability.

- Time and Cost Savings: Saves significant time and legal fees by providing a ready-made framework, eliminating the need to draft a custom agreement from scratch.

- Flexibility for Future Changes: Includes provisions for how the agreement can be amended or terminated, allowing for adaptation as circumstances evolve.

Adapting Your Shared Account Framework

One of the greatest strengths of a robust joint account agreement template lies in its adaptability. While core principles remain consistent, the specific needs of a business partnership differ greatly from those of a shared family trust or a couple managing household expenses. The template provides a solid base that can be meticulously tailored to fit unique circumstances, industries, or personal arrangements.

For instance, a template used for a business venture might include specific clauses related to equity distribution, capital calls, and business dissolution. Conversely, a template for a family account could focus more on expense categories, withdrawal limits for minors, or provisions for end-of-life planning. The ability to customize elements such as contribution schedules, spending authorizations, and dispute resolution methods makes the template universally applicable, yet specifically effective for any given scenario.

Essential Clauses for Your Financial Arrangement

Every effective joint account agreement, regardless of its specific application, must contain certain fundamental clauses to ensure comprehensive coverage and legal soundness. These sections form the backbone of the agreement, outlining the rights, responsibilities, and operational procedures for all parties. Carefully considering each of these components is paramount to creating a watertight document.

Key elements that should be present in any such agreement include:

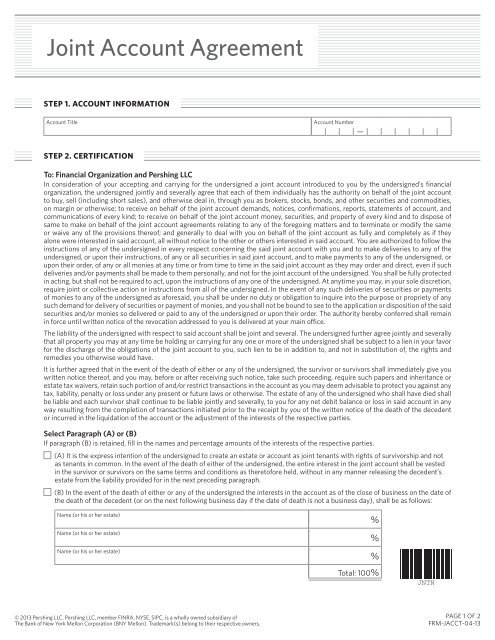

- Identification of Parties: Full legal names, addresses, and contact information for all individuals or entities entering the agreement.

- Account Details: Specifics of the joint account, including bank name, account number, and type of account (e.g., checking, savings, investment).

- Purpose of the Account: A clear statement outlining the primary objective for which the joint account is being established (e.g., shared living expenses, business operating funds, investment vehicle).

- Contribution Schedule: Detailed explanation of how each party will contribute funds to the account, including amounts, frequency, and methods (e.g., equal contributions, proportional to income, initial lump sum).

- Withdrawal and Spending Authorization: Stipulations on how funds can be withdrawn or spent, including any limits, approval processes, or requirements for co-signatures on transactions above a certain threshold.

- Liability for Debts/Overdrafts: Clear allocation of responsibility for any debts, overdrafts, or fees incurred by the account, specifying whether liability is joint, several, or proportionate.

- Dispute Resolution: Procedures for resolving disagreements, which might include mediation, arbitration, or other legal avenues, before resorting to court action.

- Account Termination: Conditions under which the account can be closed, including notice periods, distribution of remaining funds, and handling of outstanding liabilities.

- Governing Law: Specification of the jurisdiction whose laws will govern the agreement, typically the state where the account is opened or where the parties reside.

- Amendments and Modifications: A clause detailing the process for making changes to the agreement, usually requiring written consent from all parties.

- Confidentiality: If applicable, provisions for maintaining the privacy of financial information related to the account.

- Signatures and Dates: Spaces for all parties to sign and date the agreement, affirming their consent and understanding of its terms.

Ensuring Clarity and Accessibility in Documentation

The effectiveness of any legal document, including a joint account agreement template, hinges not only on its content but also on its presentation. A well-formatted, easy-to-read document enhances usability and reduces the chance of misinterpretation, whether it’s used in print or digital format. Practical tips for creating an optimal user experience are crucial.

Consider using clear headings and subheadings to break up complex information, making it scannable. Employ a professional, legible font (e.g., Arial, Times New Roman, Calibri) with an appropriate size (10-12pt for body text). Utilize ample white space around paragraphs and sections to avoid a cluttered appearance. For digital use, ensure the document is easily searchable and can be converted to PDF for secure sharing. Numbered paragraphs or sections can also aid in referencing specific clauses during discussions or in case of dispute. Proofread meticulously for any grammatical errors or typos, as these can undermine the document’s professional credibility.

Creating a definitive shared financial roadmap doesn’t have to be an arduous task. By leveraging a meticulously designed joint account agreement template, individuals and businesses can confidently navigate the complexities of shared financial responsibilities. This proactive approach not only clarifies expectations but also fortifies relationships, providing a robust legal framework that withstands the test of time and changing circumstances.

Ultimately, opting for a comprehensive joint account agreement template is a testament to professionalism and foresight. It’s an investment in clarity, protection, and the long-term success of any collaborative financial endeavor. Such a tool empowers all parties with a shared understanding, transforming potential points of conflict into clear pathways for mutual benefit and financial stability.