In today’s complex financial landscape, clarity, compliance, and commitment form the bedrock of any successful business relationship. For enterprises, investors, and individuals engaging with the principles of Islamic finance, the need for robust legal documentation is paramount. Unlike conventional interest-based loans, transactions adhering to Sharia law operate under distinct ethical and contractual frameworks, demanding specialized agreements that reflect these unique requirements. A precisely crafted islamic loan agreement template serves as an indispensable tool, ensuring that all parties operate within the bounds of Islamic jurisprudence while maintaining legal enforceability in conventional jurisdictions.

This article delves into the critical elements of such a document, exploring its utility for anyone involved in Sharia-compliant financial dealings—from nascent startups seeking ethical funding to established financial institutions expanding their Islamic finance offerings, and legal professionals drafting bespoke contracts. Understanding the structure and essential clauses of an effective template empowers users to navigate the intricacies of Islamic finance with confidence, mitigating risks and fostering trust among all stakeholders. It provides a foundational blueprint that supports equitable and transparent financial engagements, aligning commercial objectives with deeply held religious and ethical values.

The Indispensable Role of Formal Documentation

In an era defined by rapid transactions and diverse global partnerships, the importance of a clear, written agreement cannot be overstated. Verbal agreements, while sometimes legally binding, are notoriously difficult to enforce and often lead to disputes arising from misunderstandbed intentions or memory lapses. A formal document meticulously outlines the rights, responsibilities, and expectations of each party, leaving no room for ambiguity. This clarity is crucial not only for day-to-day operations but also for providing a definitive reference point should disagreements arise.

For transactions governed by Islamic finance principles, this need for formal documentation is even more pronounced. Sharia-compliant contracts are structured to avoid forbidden elements like usury (riba), excessive uncertainty (gharar), and gambling (maysir). Therefore, explicitly stating the underlying asset, the profit-sharing mechanism, or the specific service being provided is vital for establishing the contract’s validity under Islamic law and demonstrating its adherence to ethical standards. A written agreement transforms abstract principles into concrete, actionable terms, offering both moral and legal assurance.

Safeguarding Your Interests with a Structured Blueprint

Utilizing a pre-drafted islamic loan agreement template offers a multitude of advantages, significantly protecting the interests of all involved parties. Primarily, it ensures legal compliance. These templates are typically designed with an understanding of both Sharia principles and the conventional legal requirements of the jurisdiction in which they will be enforced, often in the US context. This dual compliance is critical for the agreement to hold up in court while remaining true to its Islamic roots.

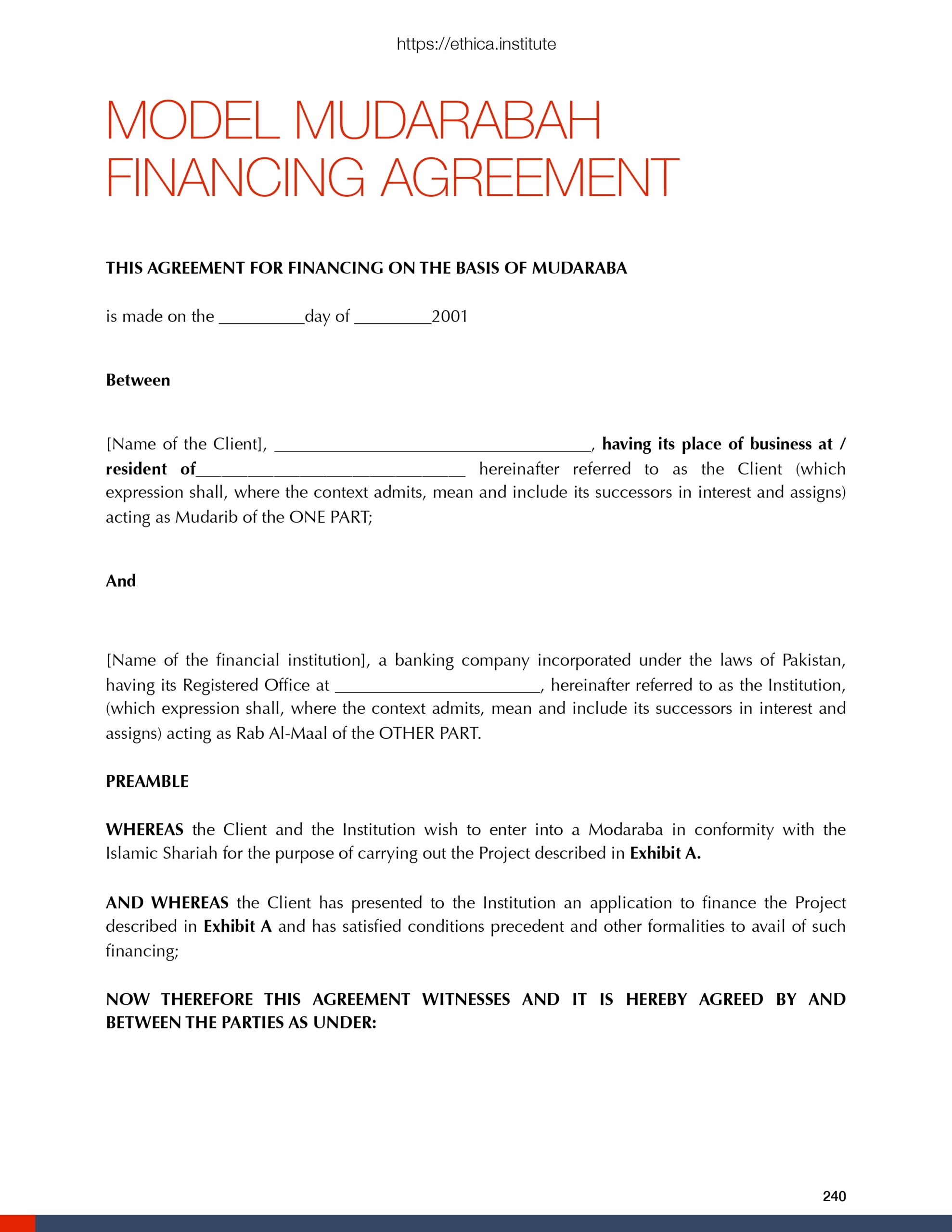

Beyond compliance, such a template provides consistency and reduces transactional risk. By systematizing the documentation process, it minimizes the chances of critical omissions or errors that could invalidate an agreement or lead to costly disputes. Parties benefit from built-in protections, standard clauses addressing default, dispute resolution, and force majeure, all tailored to the specific nature of Islamic financial contracts like Murabaha (cost-plus financing), Mudarabah (profit-sharing partnership), or Ijarah (leasing). This structured approach saves considerable time and legal fees compared to drafting each agreement from scratch, offering a cost-effective and reliable solution for businesses and legal practitioners alike.

Tailoring the Contract to Your Specific Needs

While a standard islamic loan agreement template provides a solid foundation, its true value lies in its adaptability. Modern business operations are incredibly diverse, spanning various industries from real estate and trade finance to technology and infrastructure development. Each sector, and indeed each specific transaction, may present unique requirements that necessitate customization of the core template. For instance, a Murabaha agreement for purchasing inventory will differ significantly from a Musharakah (joint venture) agreement for a long-term property development project.

The template should be flexible enough to accommodate these variations. Users should be able to easily modify clauses pertaining to the asset description, payment schedules, profit calculation methodologies, and specific performance metrics. Businesses might need to integrate industry-specific jargon, regulatory requirements (e.g., environmental clauses for construction projects), or unique risk mitigation strategies. The ability to fine-tune the document without undermining its Sharia compliance or legal integrity ensures that the agreement remains relevant and effective, truly serving the bespoke needs of the parties involved.

Anatomy of a Robust Sharia-Compliant Contract

Crafting a comprehensive islamic loan agreement template requires careful attention to specific clauses that ensure both legal enforceability and adherence to Islamic principles. While the precise terms will vary based on the specific type of Islamic finance contract (e.g., Murabaha, Mudarabah, Ijarah, Musharakah, Wakalah), several essential sections are universally critical:

- Parties and Definitions: Clearly identifies all parties involved (e.g., financier, beneficiary, guarantor) and defines key terms used throughout the agreement, ensuring a shared understanding.

- Purpose and Nature of the Transaction: Explicitly states the Sharia-compliant contract type (e.g., "This is a Murabaha facility for the purchase of X asset") and outlines the specific purpose for which the financing is being provided, establishing its legitimate and ethical basis.

- Asset Description and Acquisition (if applicable): For asset-backed transactions, a detailed description of the underlying asset, its specifications, and the process of its acquisition by the financier (if applicable, e.g., in Murabaha) is crucial.

- Terms and Conditions of Financing/Investment: Details the amount, the agreed-upon profit rate (not interest), repayment schedule, installment amounts, and any other financial parameters. In profit-sharing models like Mudarabah or Musharakah, it would specify the profit and loss sharing ratios and management responsibilities.

- Obligations of the Parties: Clearly delineates the duties and responsibilities of each party, including delivery obligations, maintenance responsibilities, and reporting requirements.

- Security and Guarantees: Specifies any collateral, guarantees, or indemnities provided to secure the financing, ensuring they are Sharia-compliant and legally enforceable.

- Events of Default: Defines what constitutes a default by either party (e.g., non-payment, breach of covenants) and outlines the consequences and remedies available.

- Representations and Warranties: Standard contractual assurances provided by each party regarding their legal capacity, authority to enter into the agreement, and accuracy of information provided.

- Confidentiality: Clauses protecting sensitive information shared between the parties during the course of the agreement.

- Governing Law and Dispute Resolution: Specifies the jurisdiction whose laws will govern the agreement and outlines the process for resolving disputes, whether through arbitration (often preferred in Islamic finance, potentially with Sharia scholars as arbitrators) or litigation.

- Termination: Conditions under which the agreement can be terminated prematurely, including mutual consent, default, or force majeure events.

- Signatures and Execution: Provides spaces for the authorized representatives of all parties to sign and date the document, affirming their acceptance of its terms.

Ensuring Sharia Compliance in Core Clauses

Beyond the general structure, specific attention must be paid to how each clause adheres to Islamic finance principles. For example, instead of "interest rate," terms like "profit rate" or "rental rate" are used. In Murabaha, the contract clarifies that the financier first purchases the asset and then sells it to the client at a cost-plus profit. In Ijarah, it’s a leasing agreement, not a loan. These distinctions are critical and must be reflected meticulously in the wording of the template. Legal professionals specializing in Islamic finance can provide invaluable insights to ensure the template’s robustness in this regard.

Enhancing Document Clarity and Professionalism

Beyond the legal content, the presentation and usability of a contract template significantly impact its effectiveness. Practical tips for formatting, usability, and readability are essential for both print and digital use, ensuring the document is professional, easy to understand, and legally sound.

- Clear Headings and Subheadings: Use a logical hierarchy of headings (

<h2>,<h3>) to break down complex information into digestible sections. This improves navigation and allows readers to quickly locate specific clauses. - Concise Language: Avoid jargon where possible, and when necessary, ensure defined terms are used consistently. Sentences should be clear, direct, and unambiguous, minimizing potential for misinterpretation.

- Consistent Formatting: Maintain a uniform font, font size, line spacing, and paragraph indentation throughout the document. Professional appearance instills confidence and reflects attention to detail.

- Numbered Paragraphs and Bullet Points: Numbering paragraphs makes cross-referencing easier and ensures specific points can be cited accurately. Bullet points are excellent for listing items or conditions concisely, as demonstrated in the clauses section above.

- Table of Contents: For longer agreements, a dynamic table of contents (especially for digital use) allows users to jump directly to relevant sections, enhancing user experience.

- Ample White Space: Do not cram text. Adequate margins and spacing between paragraphs reduce visual fatigue and make the document more inviting to read.

- Print and Digital Readiness: Ensure the document is optimized for both print (e.g., suitable page breaks, no cutoff text) and digital viewing (e.g., searchable text, PDF compatibility, hyperlink functionality if applicable).

- Version Control: For templates that undergo revisions, implement a clear version control system (e.g., "Version 1.0," "Date: YYYY-MM-DD") to track changes and ensure the most current document is always used.

By adhering to these formatting and usability guidelines, an islamic loan agreement template transcends being merely a legal document; it becomes a professional, user-friendly tool that streamlines complex financial arrangements and fosters greater transparency.

In an increasingly interconnected global economy, having a reliable islamic loan agreement template empowers businesses, financial institutions, and legal professionals to engage in Sharia-compliant transactions with confidence and efficiency. It serves as more than just a piece of paper; it’s a strategic asset that codifies ethical financial practices into legally binding terms, bridging the gap between faith-based principles and modern commercial demands. By offering a robust framework that is both adaptable and compliant, it significantly reduces the time, cost, and legal risks associated with drafting such specialized contracts from scratch.

Ultimately, a well-developed islamic loan agreement template is a testament to professionalism and foresight. It not only safeguards the interests of all parties by clearly articulating their rights and obligations but also reinforces the integrity and transparency inherent in Islamic finance. Embracing such a standardized yet customizable solution allows organizations to focus on their core business objectives, secure in the knowledge that their financial agreements are sound, ethical, and legally enforceable.