Navigating the complexities of financial transactions, whether in a bustling business environment or through individual dealings, often requires a structured approach to payment collection. When a lump sum payment isn’t feasible or desired, an installment plan offers a flexible solution, allowing debtors to pay off their obligations over time. This arrangement, however, necessitates precise documentation to protect all parties involved, ensuring clarity, enforceability, and a clear understanding of the agreed-upon terms.

For anyone extending credit, selling goods or services on deferred payment, or managing debt repayment, a robust legal framework is indispensable. Freelancers, small business owners, landlords, and even individuals loaning money benefit immensely from having a professional, legally sound document that outlines the repayment schedule, consequences of default, and other critical stipulations. Leveraging an installment payment agreement template free of charge can serve as an invaluable starting point, providing a foundational structure that ensures no vital detail is overlooked.

The Indispensable Value of Written Agreements

In today’s fast-paced business landscape, where verbal agreements can quickly lead to misunderstandings and disputes, the importance of a clear, written contract cannot be overstated. A meticulously drafted installment agreement serves as undeniable proof of the terms agreed upon by both the debtor and the creditor. It eliminates ambiguity, provides a reference point for any questions that may arise, and most critically, offers a pathway for legal recourse should a party fail to uphold their obligations.

Without a formal document, businesses risk financial losses, strained relationships, and costly litigation that could otherwise be avoided. A written payment plan formalizes the expectations of each party, detailing payment amounts, due dates, and the specific terms under which the debt will be satisfied. This level of professionalism not only safeguards your financial interests but also builds trust and credibility with your clients or customers.

Safeguarding Your Interests: Benefits of a Structured Template

Employing a well-crafted template for your payment arrangements offers numerous benefits beyond merely formalizing an agreement. It acts as a comprehensive checklist, ensuring that all necessary legal and practical considerations are addressed before signing. Such a document provides crucial protections, clearly defining the rights and responsibilities of both the payer and the payee, thereby significantly mitigating potential risks.

Firstly, a structured template offers legal enforceability, giving you a solid foundation to pursue payment if a default occurs. It also standardizes your agreements, leading to consistency across all your payment plans and reducing the likelihood of errors or omissions. Furthermore, by clearly outlining late fees, default provisions, and dispute resolution mechanisms, the template acts as a deterrent against non-compliance and provides a roadmap for handling adverse situations efficiently. This proactive approach saves time, resources, and emotional distress in the long run.

Adapting the Agreement to Your Unique Needs

One of the greatest advantages of using a well-designed payment plan template is its inherent flexibility. While a general installment payment agreement template free provides a solid legal framework, it is designed to be highly customizable to suit a wide array of industries and specific scenarios. Whether you are a creative agency offering deferred payments for a large project, a retail business managing customer financing, or an individual formalizing a personal loan repayment, the core structure can be adapted to fit your unique requirements.

For instance, a template for a service-based business might include clauses specific to project milestones, while one for a product sale might detail warranties or return policies. Landlords could integrate terms related to property damage or lease renewal into an installment agreement for past-due rent. The key is to understand the core elements of the template and then tailor the language and specific clauses to reflect the nuances of your particular transaction, ensuring it accurately represents the unique agreement between the parties involved.

Key Provisions for a Robust Payment Plan

A comprehensive and legally sound payment agreement must contain several essential clauses to ensure clarity, enforceability, and protection for all parties. A good installment payment agreement template free of charge will typically include these critical sections, allowing for easy customization. Carefully reviewing and understanding each provision is vital before execution.

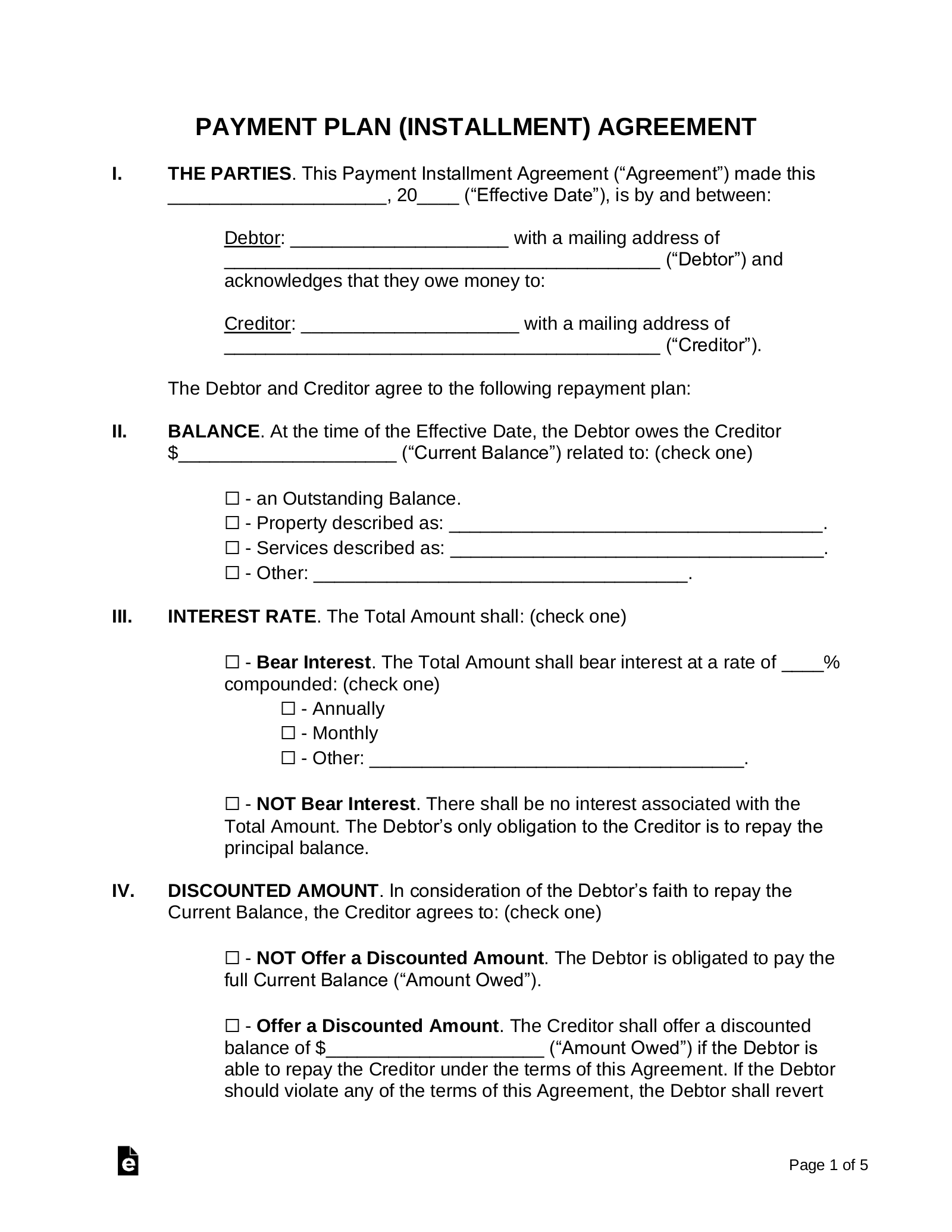

- Identification of Parties: Clearly state the full legal names and addresses of both the creditor (payee) and the debtor (payer). Include any business entities and their official registration details.

- Original Debt Amount: Explicitly state the total amount of money owed before any installment plan takes effect. This establishes the baseline for all subsequent payments.

- Payment Schedule: Detail the exact amount of each installment, the specific due dates (e.g., monthly, weekly, bi-weekly), and the total number of payments required to satisfy the debt. Specify the final payment date.

- Payment Method: Outline the acceptable methods for making payments (e.g., direct deposit, check, online portal, cash) and where payments should be sent.

- Late Payment Penalties: Clearly define any fees or interest that will be assessed if a payment is not received by its due date. State how these penalties will be calculated and applied.

- Default Clause: Specify what constitutes a default (e.g., missing a certain number of payments, bankruptcy) and the immediate consequences, such as the entire outstanding balance becoming immediately due and payable.

- Acceleration Clause: A provision that allows the creditor to demand the full remaining balance immediately if the debtor breaches the agreement terms, typically related to default.

- Interest on Outstanding Balance: If applicable, state the annual interest rate that will accrue on the remaining unpaid balance, especially in cases of default.

- Governing Law: Indicate which state’s laws will govern the interpretation and enforcement of the agreement. This is crucial for legal compliance and dispute resolution.

- Dispute Resolution: Outline the process for resolving disagreements, such as mediation or arbitration, before resorting to litigation.

- Entire Agreement Clause: States that the written document constitutes the complete and final agreement between the parties, superseding all prior oral or written understandings.

- Modification Clause: Specifies that any changes to the agreement must be made in writing and signed by both parties.

- Signatures and Date: Space for the dated signatures of all parties involved, including any witnesses or notaries if required by local law or preference.

Enhancing Usability: Design and Readability Tips

Beyond the legal substance, the presentation and usability of your installment agreement are paramount for effective communication and compliance. A well-formatted document is easier to read, understand, and therefore, more likely to be adhered to by all parties. Consider both print and digital applications when designing your agreement.

Firstly, use clear, concise language, avoiding excessive legal jargon where simpler terms suffice. Employ a professional and legible font, such as Arial or Times New Roman, at a comfortable size (e.g., 11 or 12 points). Utilize ample white space, proper paragraph breaks, and bullet points for lists (as demonstrated above) to improve readability. Headings and subheadings should be used to organize information logically, making it easy for readers to navigate the document and quickly locate specific clauses. For digital use, ensure the document is accessible and can be easily signed electronically, if applicable, and saved in a standard format like PDF. Consistent formatting throughout the agreement conveys professionalism and attention to detail.

Developing a robust system for managing payment agreements is a cornerstone of responsible financial practice, whether for a burgeoning enterprise or personal arrangements. The clarity, protection, and professional image conveyed by a well-structured agreement are invaluable assets in fostering trust and ensuring smooth transactions. By clearly articulating expectations and obligations, you mitigate potential disputes and create a predictable framework for financial interactions.

An installment payment agreement template free of charge empowers users to quickly generate comprehensive documents without the prohibitive cost or time investment often associated with legal drafting. It serves as a powerful tool for streamlining operations, maintaining legal compliance, and securing your financial interests. Embrace the simplicity and reliability this resource offers, transforming complex payment arrangements into straightforward, manageable processes for everyone involved.