Embarking on a house flipping journey can be one of the most exciting and potentially lucrative ventures in real estate. The allure of transforming a neglected property into a sparkling gem, then selling it for a substantial profit, captivates many aspiring entrepreneurs. However, beneath the glamour of before-and-after photos lies a complex web of costs, timelines, and unforeseen challenges that can quickly derail even the most promising project without robust financial planning. This is precisely where a meticulously crafted House Flipping Budget Spreadsheet Template becomes not just a useful tool, but an indispensable foundation for your success.

In the fast-paced world of property renovation, where every dollar spent directly impacts your bottom line, having a clear, comprehensive financial roadmap is paramount. It serves as your compass, guiding every decision from acquisition to sale, ensuring you stay on track and avoid costly missteps. Whether you’re a seasoned investor juggling multiple projects or a first-time flipper taking your initial leap, leveraging a well-designed budget template will empower you to make informed choices, manage risks effectively, and ultimately maximize your return on investment.

Why a Meticulous Budget is Your Flipping Foundation

The real estate market is dynamic, and profit margins in house flipping can often be tight. Without a precise understanding of your financial landscape, you’re essentially flying blind. A detailed budget spreadsheet acts as your project’s command center, providing a transparent view of all anticipated income and expenses. This clarity allows you to set realistic expectations for your project’s profitability, making it easier to secure financing, negotiate with contractors, and confidently approach potential buyers.

Moreover, a well-structured property renovation budget helps mitigate one of the biggest risks in flipping: unexpected expenses. By categorizing every possible cost, from permits and materials to holding costs and closing fees, you create a buffer against surprises. It enables you to allocate funds wisely, prioritize expenditures, and make adjustments proactively rather than reactively, which can save thousands of dollars and prevent critical delays. Think of it as your financial armor against the unpredictable nature of renovation.

The Anatomy of a Robust Flipping Budget Template

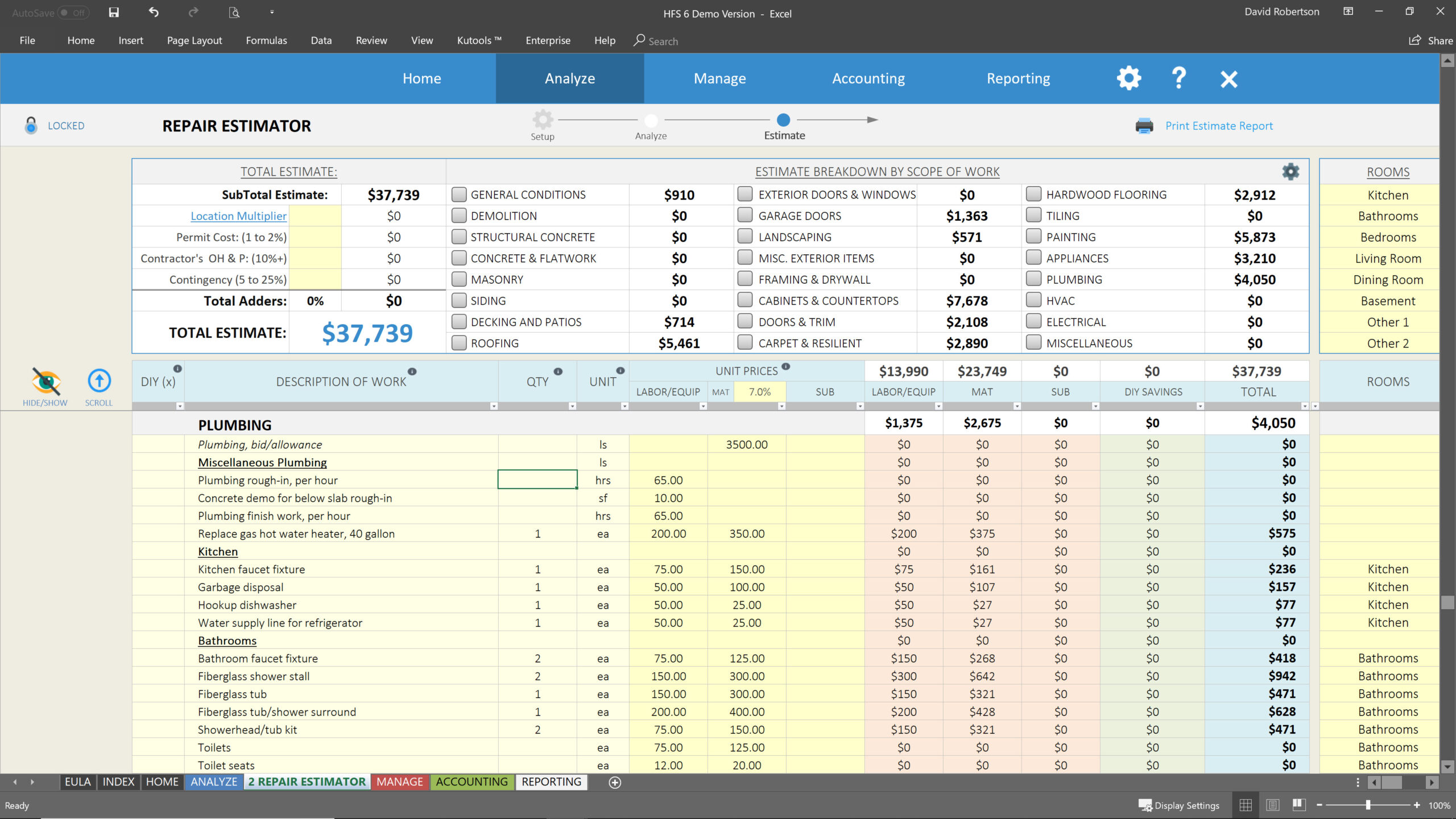

A high-quality budget template for property investment isn’t just a list of numbers; it’s a dynamic financial model that reflects the entire lifecycle of your flip. It starts long before the hammer even swings and continues until the final closing documents are signed. This comprehensive financial planner allows you to project your initial investment, track ongoing expenses, and estimate your eventual profit with accuracy. It should be designed for ease of use, enabling quick data entry and offering clear summaries.

The strength of any real estate investment budget tool lies in its ability to break down complex financial data into manageable, understandable components. This means having dedicated sections for acquisition costs, renovation expenses, holding costs, and selling costs, along with a clear section for projected revenue. Each of these broad categories should then be further itemized to capture every conceivable expenditure. A truly effective house flip financial model provides both a micro and macro view of your project’s finances.

Key Categories Every House Flipping Budget Spreadsheet Template Needs

To ensure comprehensive financial oversight, your project budget template for property renovation must include specific, detailed categories. Skipping even minor line items can quickly erode your profit margins. Here are the essential sections to consider:

- **Acquisition Costs**: This includes the purchase price of the property itself, as well as associated fees like **agent commissions** (if any for buyer), **appraisal fees**, **inspection fees**, **title insurance**, and **closing costs**.

- **Renovation Expenses**: The core of your project. This massive category should be broken down by trade and material. Think **demolition**, **framing**, **plumbing**, **electrical**, **HVAC**, **roofing**, **exterior siding**, **windows and doors**, **drywall**, **flooring**, **kitchen cabinets**, **countertops**, **appliances**, **bathroom fixtures**, **paint**, **landscaping**, and **permits and licenses**.

- **Holding Costs**: These are the ongoing expenses incurred while you own the property. Crucial items include **loan interest**, **property taxes**, **homeowner’s insurance**, **utilities** (water, electricity, gas), **HOA fees** (if applicable), and **security monitoring**.

- **Selling Costs**: The expenses associated with selling the property. This typically covers **real estate agent commissions** (for seller), **staging costs**, **marketing expenses**, **closing costs for seller**, and potentially **concessions to buyer**.

- **Contingency Fund**: Absolutely critical! A percentage (typically 10-15%) of your total renovation and holding costs set aside for **unforeseen issues** like unexpected structural problems, material delays, or permits taking longer than anticipated.

- **Projected Revenue**: Your estimated sale price, which will be based on comparable sales in the area (comps) and the projected after-repair value (ARV) of your upgraded property.

Leveraging Your Budget for Strategic Decision-Making

Once you have populated your renovation budget spreadsheet with initial estimates, its real power comes into play through ongoing monitoring and strategic analysis. This isn’t a set-it-and-forget-it tool; it’s a living document that you should revisit and update frequently. Regularly comparing actual expenses against your budgeted figures is crucial. This practice allows you to quickly identify any discrepancies, understand where you might be overspending, and take corrective action before minor issues become major financial drains.

For instance, if your initial plumbing estimates are significantly higher than anticipated, your detailed cost tracking for property flips will flag this immediately. You can then investigate alternative suppliers, renegotiate with your contractor, or adjust other parts of your budget to compensate. This dynamic management ensures you maintain control over your investment property budget, allowing you to pivot and adapt to the inevitable challenges that arise during a house flip. Making data-driven decisions based on your spreadsheet for flip projects ensures you’re always moving towards profitability.

Customization: Making the Template Work for *Your* Project

While a general house flipping budget spreadsheet template provides an excellent starting point, its true value is unlocked through customization. Every property is unique, and every market has its own nuances. Your template should be flexible enough to adapt to the specific characteristics of your current project. This might involve adding extra line items for specialized repairs (e.g., historical restoration, septic system replacement), adjusting contingency percentages based on the age or condition of the property, or tailoring categories to align with local regulations or material costs.

Consider incorporating a section for different scenarios. What if the property sells faster or slower than expected? How would that impact your holding costs? What if material prices spike? A truly robust financial planning for house flips allows you to run different "what-if" analyses, giving you a clearer picture of potential risks and rewards. Don’t be afraid to add columns for "Actual vs. Budgeted" or "Variance" to easily track your performance. The more personalized your expense tracker for real estate projects, the more effective it will be in guiding your investment.

Common Pitfalls and How Your Budget Template Helps Avoid Them

House flipping is fraught with potential pitfalls, many of which can be mitigated with meticulous financial planning. One of the most common errors is underestimating renovation costs. What looks like a simple cosmetic fix can often hide deeper, more expensive structural or system issues. A comprehensive rehab budget sheet, with a generous contingency fund, directly addresses this risk. By forcing you to think through every possible expense, it reduces the likelihood of being caught off guard.

Another frequent mistake is overlooking holding costs. These seemingly small, recurring expenses can quickly accumulate, especially if the project takes longer than anticipated. Your budget template explicitly includes these line items, ensuring you’re aware of the financial burn rate. Similarly, a lack of accurate comparables can lead to overspending on renovations that won’t yield a proportionate return, or underestimating the final selling price. An effective budget framework encourages thorough market research for both acquisition and exit strategies, ensuring your financial model aligns with market realities.

Frequently Asked Questions

What is the most crucial part of a house flipping budget?

The most crucial part is the **contingency fund**. Renovation projects are notoriously unpredictable, and unexpected expenses will almost certainly arise. A robust contingency, typically 10-15% of your total estimated costs, acts as a financial buffer to absorb these surprises without derailing your entire project.

How often should I update my flipping budget template?

You should update your flipping budget template **regularly and frequently**. At minimum, review and update it weekly, especially during the active renovation phase. This allows you to track actual expenses against budgeted amounts, identify overruns early, and make necessary adjustments to stay on course.

Can a budget template help me secure financing for my flip?

Absolutely. A well-researched and detailed property flipping financial planner demonstrates your professionalism and understanding of the project’s financial scope to lenders. It shows them you’ve done your due diligence, calculated potential profits and risks, and have a clear plan for their investment, significantly increasing your chances of approval.

What if my actual expenses consistently exceed my budget?

If your actual expenses are consistently higher than budgeted, it’s a clear signal to **re-evaluate your estimates and processes**. This could mean your initial cost projections were too optimistic, your contractors are too expensive, or you’re encountering more issues than anticipated. Use this data to refine your estimates for future projects and to make immediate adjustments to current spending.

Should I include my time in the budget spreadsheet?

While often overlooked, you **should definitely account for your time** in some capacity, especially if you are actively managing or performing work yourself. While it might not be a direct cash expense for you personally, understanding the value of your labor helps you accurately assess the true profitability of the project and make better decisions about when to delegate tasks.

Ultimately, the journey of house flipping is a marathon, not a sprint, and preparation is your best competitive advantage. A carefully constructed and consistently utilized House Flipping Budget Spreadsheet Template isn’t just a financial document; it’s your strategic blueprint, your early warning system, and your unwavering guide through every twist and turn of a renovation project. It transforms uncertainty into clarity, allowing you to focus on what you do best: creating value and realizing substantial returns.

Don’t leave your profits to chance. Invest the time upfront to develop a detailed property budget template that truly serves your needs. By embracing this fundamental tool, you’ll gain the confidence and control required to navigate the complexities of real estate investment, turn distressed properties into desirable homes, and build a thriving, profitable house flipping business. Start building your financial fortress today, and watch your flipping ventures flourish.