Understanding Financial Hardship

Financial hardship can strike anyone, regardless of their income level or background. Unexpected events like job loss, medical emergencies, or unforeseen expenses can quickly derail even the most carefully planned budgets.

When to Write a Financial Hardship Letter

A financial hardship letter is a formal document explaining your current financial situation to a creditor, landlord, or other entity. It’s crucial to write this letter when:

Facing Difficulty Making Payments: You’re struggling to meet your monthly obligations, such as rent, mortgage, loan payments, or credit card bills.

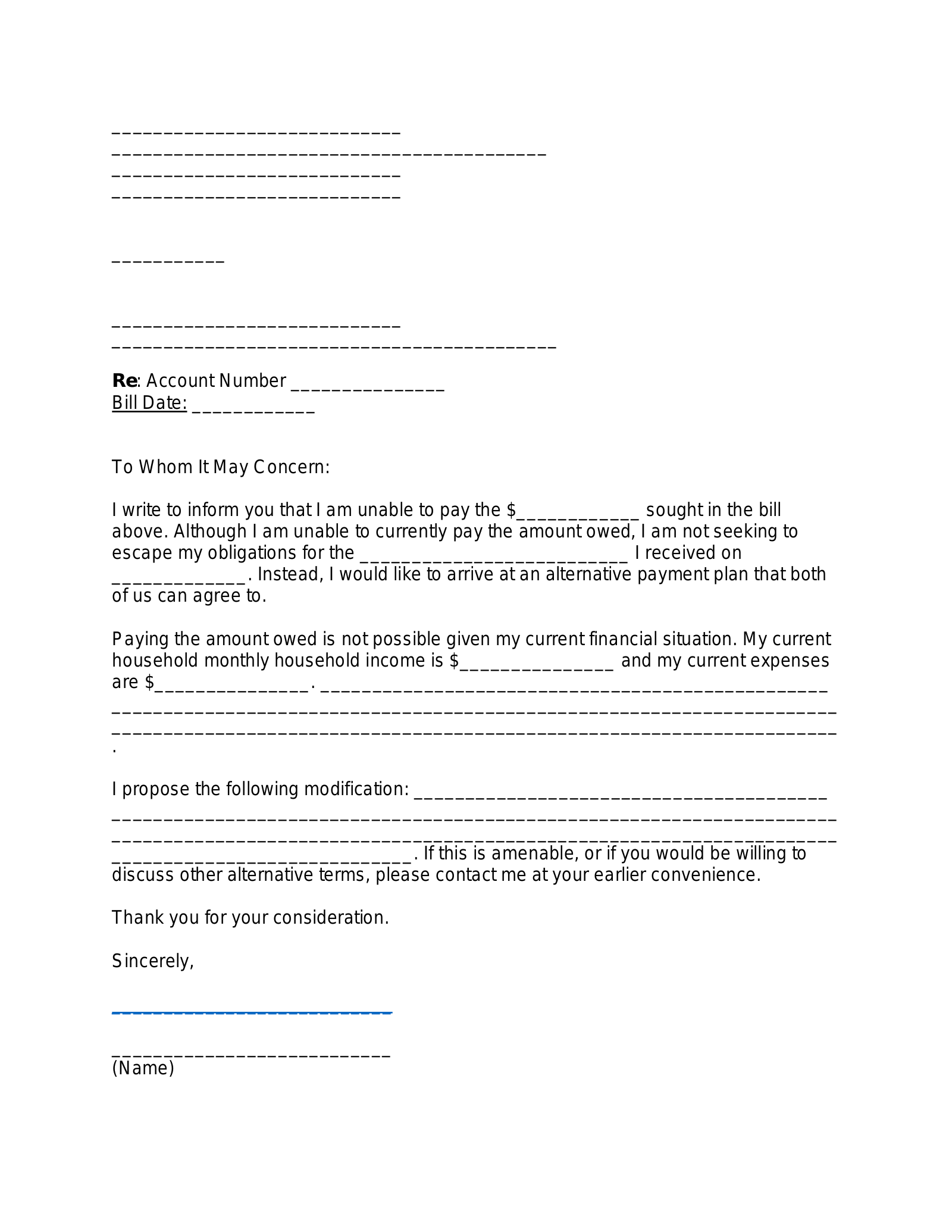

Image Source: eforms.com

Key Elements of a Strong Financial Hardship Letter

A well-written financial hardship letter should include the following:

Your Contact Information: Your full name, address, phone number, and email address.

Financial Hardship Letter Example (Casual English)

[Your Name]

[Your Address]

[Your Phone Number]

[Your Email Address]

[Date]

[Recipient Name]

[Recipient Address]

Subject: Request for Payment Plan – [Account Number]

Dear [Recipient Name],

This letter is to formally request a payment plan for my account number [Account Number]. I am writing to you today to explain my current financial hardship and request your assistance in resolving this matter.

[Explain your situation in detail. Be honest and concise. For example:]

“I recently lost my job due to company-wide layoffs and am currently actively seeking employment. My income has significantly decreased, making it extremely difficult to meet my monthly financial obligations.”

[Explain the impact of the hardship on your ability to make payments. For example:]

“Due to the loss of income, I am unable to make my full monthly payments on my [account type, e.g., mortgage, loan, credit card] as agreed.”

[Propose a solution. Be realistic and offer a specific plan. For example:]

“I propose a revised payment plan of [amount] per month for the next [number] months.”

[Include supporting documentation. For example:]

“I have attached a copy of my recent pay stubs as proof of income.”

I understand the importance of fulfilling my financial obligations and I am committed to resolving this situation as quickly as possible. I appreciate your understanding and willingness to work with me during this difficult time.

Thank you for your time and consideration.

Sincerely,

[Your Typed Name]

[Your Signature]

Conclusion

Remember, a financial hardship letter is a crucial step in navigating difficult financial times. By clearly and honestly communicating your situation and proposing a viable solution, you can increase your chances of reaching a mutually beneficial agreement with your creditor or landlord.

FAQs

What should I avoid in my financial hardship letter?

Making excuses or blaming others for your situation.

Using overly emotional or dramatic language.

Threatening legal action.

Providing false or misleading information.

Being disrespectful or unprofessional.

How long should my financial hardship letter be?

Your letter should be concise and to the point. Aim for a length of one to two pages, depending on the complexity of your situation.

What if my request is denied?

If your initial request is denied, don’t give up.

Resubmit your letter with additional documentation.

Explore other options, such as credit counseling or debt consolidation.

Contact your creditor or landlord directly to discuss your options further.

Can I use a template for my financial hardship letter?

Using a template can be helpful, but it’s essential to personalize it to your specific situation.

Avoid generic templates that may not accurately reflect your unique circumstances.

Use a template as a guide and tailor it to your specific needs.

What if I am unable to resolve my financial hardship?

If you are unable to resolve your financial hardship on your own, seek professional help.

Consult with a credit counselor or financial advisor.

Explore government assistance programs or non-profit organizations that can provide financial assistance.

I hope this comprehensive guide assists you in crafting an effective financial hardship letter.

Disclaimer: This information is for general guidance only and does not constitute legal or financial advice.

Financial Hardship Letter Example