Securing grant funding often feels like navigating a complex maze, where every detail matters and a single misstep can derail an otherwise brilliant proposal. Among the myriad components that make up a successful application, the budget stands as a critical pillar, often underestimated in its power to persuade or dissuade funders. It’s more than just a list of numbers; it’s a financial narrative that tells the story of how your project will wisely utilize resources to achieve its stated goals.

A well-constructed budget instills confidence, demonstrates financial acumen, and proves that your project is not only innovative but also feasible and sustainable. This is where a robust framework becomes indispensable, streamlining a daunting task into a manageable process. Having a clear and comprehensive approach to this crucial section can be the difference between a project that gets funded and one that merely catches an eye.

The Cornerstone of a Compelling Grant Application

The budget section of any grant proposal serves as the financial blueprint for your entire project. It breaks down all anticipated costs, showing funders exactly where their money will go and how it aligns with the proposed activities. Far from being a mere formality, it acts as a direct reflection of your planning capabilities and your understanding of the resources required to execute your vision effectively. A precise and well-justified budget translates your project’s ambitions into concrete, actionable steps that can be financially evaluated.

For many organizations, especially those with limited resources or experience in grant writing, developing a comprehensive and compliant budget can be one of the most challenging aspects of the application process. This is precisely why a structured approach, like utilizing a tailored Grant Proposal Grant Budget Template, becomes an invaluable asset. It provides a logical framework, guiding you through the necessary categories and considerations, ensuring that no critical expense is overlooked and that your financial request is both realistic and defensible.

Why a Standardized Budget Framework Matters

Adopting a standardized budget framework brings numerous advantages to the grant writing process, extending beyond mere compliance. It fosters consistency, transparency, and strategic foresight, qualities highly valued by grant-making organizations. Funders appreciate proposals that clearly articulate costs, as it simplifies their review process and assures them of the applicant’s professionalism and organizational capacity.

A well-designed budget planning tool helps you categorize expenses logically, identify potential gaps, and project costs accurately, even for multi-year projects. It encourages meticulous financial planning from the outset, which can prevent unexpected shortfalls or overspending once the project is underway. Moreover, it serves as an excellent internal communication tool, allowing various team members to contribute to and understand the financial implications of the project.

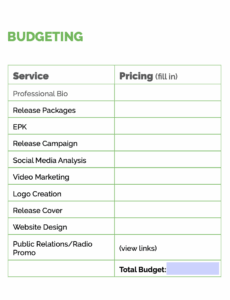

Essential Components of a Robust Grant Budget

Every comprehensive grant budget needs to account for a variety of cost categories, ensuring that all aspects of your project are covered. While specific line items will vary based on your project’s nature, certain overarching categories are universally recognized and expected by funders. Understanding these components is critical for building a complete and compelling financial request.

- **Personnel Costs:** This includes salaries, wages, and fringe benefits (health insurance, retirement contributions, etc.) for all staff directly working on the project. Be sure to specify the **percentage of effort** each person dedicates to the grant.

- **Operating Expenses:** These are the day-to-day costs required to run your project, such as rent, utilities, office supplies, communication tools, and internet services.

- **Equipment:** Any significant non-consumable items purchased specifically for the project, like computers, specialized machinery, or software licenses. Funders often have limits on what qualifies as equipment versus supplies.

- **Supplies:** Consumable items necessary for project activities, ranging from laboratory materials to educational handouts or art supplies.

- **Travel:** Costs associated with project-related travel, including airfare, accommodation, per diem for meals, and local transportation.

- **Consultant Fees/Contractual Services:** Payments to external experts or organizations hired for specific tasks, such as evaluators, trainers, or specialized service providers.

- **Subawards/Subcontracts:** Funds allocated to partner organizations that will carry out a distinct portion of the project under their own management.

- **Other Direct Costs:** Any other project-specific expenses that don’t fit neatly into the above categories but are essential for the project’s success. This might include marketing materials, dissemination costs, or specific permits.

- **Indirect Costs (F&A – Facilities & Administrative Costs):** These are expenses that are not easily attributable to a specific project but are necessary for the general operation of the organization (e.g., administrative salaries, utilities for the entire building, general office management). Funders often have specific caps or negotiated rates for these costs.

Crafting Your Narrative Through Numbers: Budget Justification

Simply listing expenses isn’t enough; every line item in your financial proposal template needs to be justified. The budget justification is your opportunity to explain *why* each cost is necessary and *how* it directly contributes to achieving your project’s objectives. This narrative transforms a dry list of numbers into a persuasive argument for funding.

For instance, instead of just stating "$5,000 for training materials," your budget justification would elaborate: "Funds are requested for the development and printing of culturally sensitive training manuals and participant workbooks for 150 community members. These materials are essential for delivering the evidence-based curriculum outlined in Goal 2, ensuring participants receive standardized and accessible information." This level of detail connects the financial request directly to your project’s programmatic impact. A strong budget justification reinforces your organization’s credibility and the feasibility of your project plan.

Strategic Tips for Budget Development and Presentation

Developing a winning project budget guide requires more than just filling in numbers; it demands strategic thinking and meticulous attention to detail. Approaching this section thoughtfully can significantly enhance your grant application’s overall strength.

One key tip is to always align your budgetary blueprint with the project narrative. Every expense listed should directly support an activity or outcome described in the programmatic sections of your proposal. Funders actively look for this congruence, as it signals a well-thought-out and integrated project plan. Discrepancies between the narrative and the budget can raise red flags and undermine confidence in your application.

Another crucial strategy is to research and adhere to the funder’s specific budget guidelines. Grant-making organizations often have detailed instructions regarding allowable costs, format requirements, and direct versus indirect cost limitations. Failing to follow these instructions can lead to immediate disqualification. Pay close attention to any maximum or minimum funding amounts, matching requirements, or prohibitions on certain types of expenses, ensuring your funding application budget structure is perfectly aligned.

Finally, always build in a contingency if allowed by the funder, or be conservative in your initial estimates. While a detailed cost breakdown for grant applications aims for precision, unforeseen circumstances can arise. Being prepared for slight variations in costs demonstrates foresight and responsible financial planning. Regularly review and update your project budget guide as the proposal evolves to ensure all figures remain accurate and reflective of the latest project plan.

Customizing Your Financial Blueprint for Success

While a general budget construction for grant proposals provides an excellent starting point, true success lies in its customization. No two projects are identical, and therefore, no two budgets should be. The strength of any financial planning document for grant seekers comes from its adaptability to your unique program goals, organizational capacity, and the specific requirements of the funding opportunity.

Think of a general grant budget framework not as a rigid form, but as a flexible scaffold upon which you construct your project’s financial story. You’ll need to tailor line items to reflect your actual needs, adjust percentages for personnel effort, and factor in local costs. For instance, an educational program might emphasize curriculum development and outreach, while a research project would heavily feature equipment and personnel for data analysis. The key is to make your project budget guide speak directly to the needs and scope of your proposed work.

This iterative process often involves collaboration across different departments within your organization—program staff for activity costs, human resources for personnel figures, and finance for indirect cost rates. By engaging all relevant stakeholders, you can ensure that your fiscal planning tool is comprehensive, accurate, and reflects a shared understanding of the project’s financial landscape. A thoughtfully customized budget not only answers the funder’s questions but also serves as a robust operational plan for your organization should the grant be awarded.

Frequently Asked Questions

What is the difference between direct and indirect costs?

Direct costs are expenses directly tied to and easily identifiable with a specific project, such as staff salaries, equipment, and supplies used solely for that project. Indirect costs (also known as Facilities & Administrative or F&A costs) are general organizational expenses that support multiple projects and are not easily allocated to one, like utility bills for the entire building or administrative staff salaries that support the whole organization.

How detailed should my budget be?

Your budget should be as detailed as possible, providing enough information for the funder to understand how each dollar will be spent. Avoid vague categories like “miscellaneous.” Instead, break down costs into specific line items, and ensure each item is supported by a clear and concise justification explaining its necessity for the project’s success. Always refer to the funder’s specific guidelines, as they often dictate the level of detail required.

Can I include my organization’s existing staff salaries in the grant budget?

Yes, you can include portions of existing staff salaries if those staff members will be dedicating a specific percentage of their time directly to the grant-funded project. You must clearly state the percentage of effort allocated to the project for each individual and justify how their time contributes to the grant’s objectives. Ensure you don’t double-bill for time already covered by other funding sources.

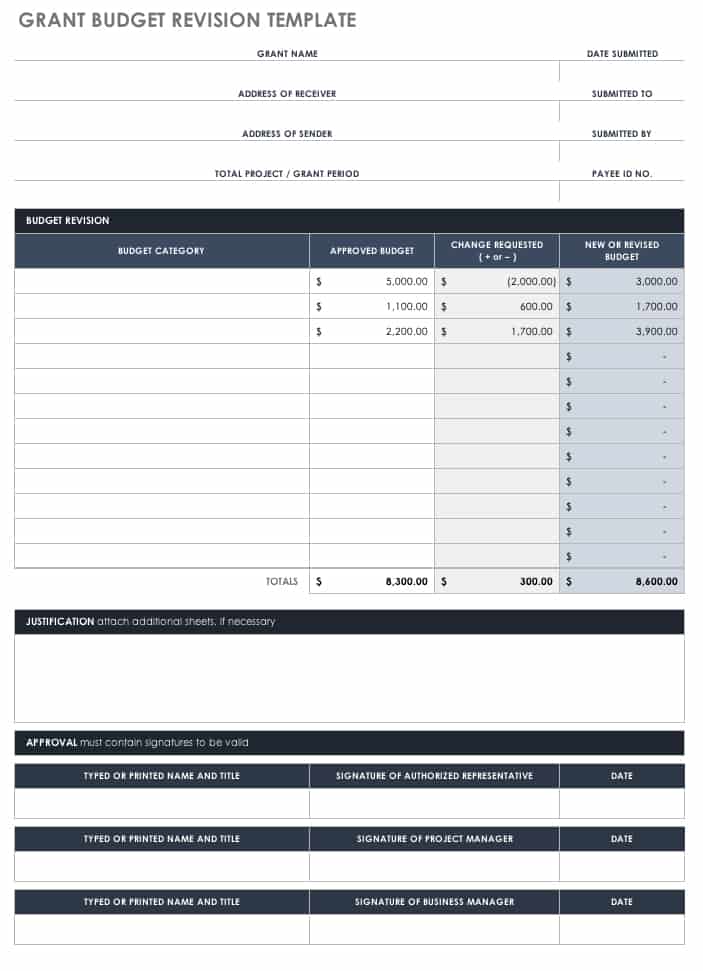

What if my actual project costs change after submitting the budget?

It’s common for project costs to fluctuate slightly. Most funders allow for minor budget modifications after an award is made, usually within a certain percentage (e.g., 10-15%) between line items, without needing prior approval. However, significant changes or changes to overall awarded amounts typically require formal notification and approval from the funder. Always review your grant agreement for specific terms regarding budget revisions.

A meticulously prepared and well-justified budget is far more than just a financial document; it is a powerful advocacy tool that underscores the professionalism and strategic foresight of your organization. It transforms abstract ideas into tangible, resource-backed plans, giving funders the confidence they need to invest in your vision. By leveraging a structured approach to your budgetary needs, you not only simplify a complex task but also significantly increase your chances of securing the funding that will bring your impactful projects to life.

Embrace the process of developing your financial plan not as a chore, but as an opportunity to articulate the true value and operational integrity of your proposed work. A thoughtful and transparent funding application budget structure speaks volumes about your organization’s capacity to deliver on its promises. It’s an essential step towards turning your grant aspirations into funded realities, paving the way for meaningful change and positive community impact.