Securing grant funding is often a make-or-break moment for non-profits, researchers, educators, and community organizations. While a compelling narrative of your project’s impact is crucial, the financial blueprint—how you plan to spend the requested funds—is equally, if not more, critical. A meticulously planned and clearly presented budget doesn’t just list numbers; it tells a story of responsible stewardship and realistic project execution. It assures funders that their investment will be managed effectively and achieve tangible results.

Many aspiring grant recipients grapple with the complexity of budget formulation, often feeling overwhelmed by the myriad categories, justifications, and compliance requirements. This is where a structured approach becomes invaluable, transforming a daunting task into a manageable process. Having a clear, adaptable framework can demystify the financial planning stage, allowing organizations to present their needs with precision and confidence, ultimately increasing their chances of securing vital support.

The Indispensable Role of a Strategic Budget in Grant Applications

In the competitive world of grant funding, a well-articulated budget is far more than a simple accounting document; it’s a persuasive argument for your project’s viability and your organization’s financial acumen. Funders scrutinize budgets to ensure that the proposed activities are adequately resourced, that costs are reasonable, and that the organization has a clear understanding of its operational needs. A sloppy or unrealistic budget can quickly derail an otherwise promising proposal, signaling to reviewers a lack of planning or an inability to manage funds effectively.

A robust financial blueprint provides transparency, demonstrating exactly how every dollar will be allocated to achieve the stated objectives. It builds trust, reassuring grantors that their money will be used wisely and for its intended purpose. Beyond securing funds, a thoughtfully developed budget also serves as an internal planning tool, helping project managers anticipate costs, track expenditures, and ensure the project stays on track once funding is secured. It is the backbone of financial accountability for any grant-funded initiative.

Understanding the Core Components of a Project Budget

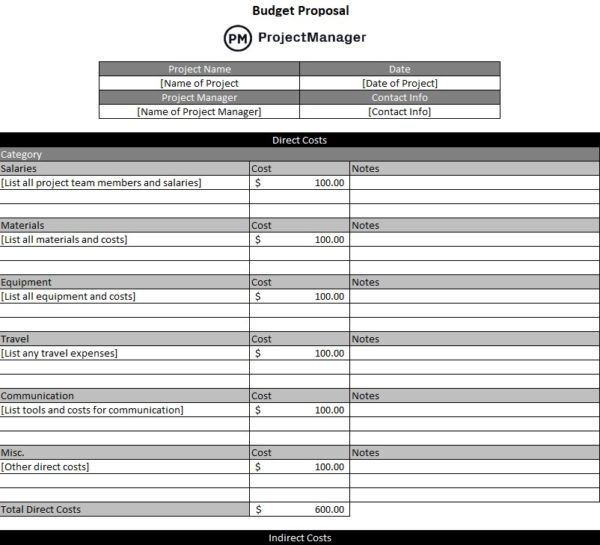

A comprehensive project budget framework typically encompasses several key categories, each requiring detailed breakdown and justification. These categories are designed to cover all aspects of project implementation, from personnel to indirect costs. Ignoring any one of these can lead to significant shortfalls or unexpected expenses, jeopardizing the entire project.

By systematically addressing each element, organizations can build a complete and persuasive financial story. This systematic approach ensures that no stone is left unturned and that all potential expenditures are accounted for. It’s about building a fortress of financial detail that can withstand rigorous scrutiny from grant reviewers.

Essential Budget Line Items to Consider:

- Personnel Costs: Detail salaries, wages, and fringe benefits (health insurance, retirement contributions) for all staff directly involved in the project. Specify their role, time commitment (e.g., FTE, percentage of time), and hourly or annual rates. This is often the largest single expense category.

- Travel Expenses: Include costs for project-related travel, such as airfare, lodging, per diem, and local transportation. Justify each trip’s purpose in relation to project goals. Adhere to any specific per diem rates or travel policies set by the grantor.

- Equipment: List any specific equipment necessary for the project, providing detailed justifications for its purchase or lease. Differentiate between new purchases and existing equipment usage. This might include anything from specialized lab instruments to computers.

- Supplies: Account for consumable materials directly used in project activities, such as office supplies, research materials, educational tools, or programmatic supplies. Group similar items and estimate their total cost.

- Contractual/Consultant Services: If your project requires external expertise, outline the services, hourly or daily rates, and the number of hours or days for each contractor or consultant. Clearly define their scope of work.

- Other Direct Costs: This catch-all category can include items like communication costs, publication fees, venue rentals, data collection expenses, printing, and specific software licenses. Be specific and justify each item.

- Indirect Costs (F&A – Facilities & Administrative): These are costs that are not directly attributable to a single project but are necessary for the general operation of the organization (e.g., utilities, rent, administrative staff salaries, IT infrastructure). They are usually calculated as a percentage of direct costs, often based on a negotiated rate with a federal agency.

The Benefits of Utilizing a Standardized Budget Framework

Adopting a standardized Grant Project Proposal Budget Template offers numerous advantages that extend beyond simply submitting a funding request. It streamlines the entire budgeting process, enhances accuracy, and significantly improves the clarity and professionalism of your submission. For organizations that frequently seek external funding, a consistent approach saves time and reduces the likelihood of errors.

A well-designed template provides a clear roadmap, guiding users through all the essential financial elements required by most funders. This consistency ensures that every proposal maintains a high standard, irrespective of who is preparing the budget. It becomes a valuable internal asset, fostering a culture of rigorous financial planning.

Key Advantages:

First, a structured funding request template enhances **clarity and consistency**. It ensures all vital financial information is presented in a uniform, easy-to-understand format, which is highly appreciated by busy grant reviewers. This consistency across different applications also helps your internal team maintain a cohesive financial planning strategy.

Second, it significantly improves **accuracy and completeness**. By prompting users to consider all potential expense categories, a comprehensive financial proposal structure reduces the risk of overlooking critical costs or miscalculating budget lines. This meticulous attention to detail prevents budget shortfalls down the line.

Third, a robust project budget framework facilitates **justification and narrative development**. Each line item in the template can be linked directly to project activities, making it easier to write persuasive budget narratives that explain *why* each expense is necessary and *how* it contributes to achieving project goals. This integrated approach strengthens the entire proposal.

Finally, using a common template aids in **compliance and audit readiness**. Many funders have specific budget requirements and formats. A template designed with common grant guidelines in mind helps ensure that your submission meets these expectations, making future reporting and auditing processes smoother and less burdensome.

Key Steps to Developing a Robust Budget

Crafting a compelling financial blueprint for grant applications involves more than just plugging numbers into a spreadsheet; it’s a strategic process that requires thoughtful planning and realistic projections. Approaching budget development systematically can prevent common pitfalls and strengthen your overall proposal. It ensures that your financial request is not only accurate but also persuasive and justifiable.

Consider your budget an integral part of your project narrative, where every expense tells a story of purposeful resource allocation. This meticulous process helps you demonstrate a deep understanding of your project’s needs and the financial realities of its implementation. A well-developed budget acts as a testament to your organization’s planning capabilities.

The initial step involves **understanding the funder’s guidelines**. Every grant maker has unique requirements regarding budget format, eligible expenses, and matching funds. Carefully review these guidelines before you begin, as they will dictate the structure and content of your detailed expenditure plan.

Next, **itemize all project activities and resources**. Work backward from your project goals and objectives. What specific tasks need to be completed? What personnel, equipment, supplies, or services are required for each task? This granular approach ensures no necessary component is overlooked in your cost breakdown for grants.

Then, **research and estimate costs accurately**. Don’t guess. Obtain quotes for major equipment, research typical salary ranges for project staff, and get estimates for travel and supplies. Over- or under-estimating can both be detrimental. Provide realistic and well-supported figures in your budget development guide.

After that, **draft the budget and develop a clear narrative**. Input your estimated costs into your chosen template. Crucially, accompany each significant line item with a brief, clear justification explaining its necessity and how the cost was derived. This financial planning document for proposals makes your budget transparent and defensible.

Finally, **review, revise, and seek feedback**. Have multiple team members, especially those with financial expertise, review the budget for accuracy, completeness, and alignment with the project narrative. Check for mathematical errors and ensure all categories are appropriately justified. An external review can often catch overlooked details.

Customizing Your Budget for Specific Grant Applications

While a general project financial strategy provides an excellent starting point, successful grant applications almost always require some degree of customization. No two funders are exactly alike, and tailoring your financial proposal structure to meet their specific priorities and preferred formats is crucial. This thoughtful adaptation demonstrates your attentiveness and respect for their guidelines.

Customization doesn’t mean reinventing the wheel each time; rather, it involves strategically adjusting your existing detailed expenditure plan to align perfectly with the nuances of each grant opportunity. It shows that you’ve done your homework and understand what the funder values most. This focused approach significantly strengthens your funding request document.

One of the primary aspects of customization involves **aligning with funder priorities**. Some grantors might prioritize direct program costs, while others may allow for a larger proportion of administrative expenses. Adjust your line item emphasis and narrative to highlight the aspects that resonate most with their mission.

Another key area is **adhering to specified budget categories and formats**. Many grant applications provide their own templates or mandate specific line item groupings. Be prepared to transfer your data into their preferred structure, ensuring all required information, such as indirect cost rates or matching funds, is clearly presented.

Furthermore, **justifying unique costs specific to the grant**. If the grant is for a specific type of innovation or a particular community, you might have unique costs that need extra explanation. Take the opportunity to elaborate on these special expenditures and connect them directly to the funder’s goals for the project.

Lastly, consider **the total requested amount and project duration**. While your internal resource allocation plan might project a certain amount, the grant opportunity might have a cap or suggest a specific funding range. Adjust your project scope or timeline as needed to fit within these parameters, always ensuring realism and impact.

Common Pitfalls to Avoid in Grant Budgeting

Even with a robust template for grant budgets, certain missteps can undermine an otherwise strong proposal. Being aware of these common pitfalls can help organizations avoid them, ensuring their financial requests are as compelling and error-free as possible. Attention to detail and a critical eye are paramount throughout the budgeting process.

Avoiding these issues will not only improve your chances of securing funding but also foster greater financial discipline within your organization. A clean, accurate, and well-justified financial plan speaks volumes about your organization’s professionalism and capability. It is a critical component of successful financial planning for proposals.

One frequent error is **unjustified or vague expenses**. Funders need to understand the rationale behind every cost. Simply listing “miscellaneous” or providing lump sums without breakdown or explanation raises red flags. Every expense in your budget development guide should be clearly tied to a project activity and have a clear calculation.

Another common mistake is **inaccurate calculations or mathematical errors**. Simple addition or multiplication errors can instantly erode reviewer confidence. Always double-check your figures, and if possible, use spreadsheet software with formulas to minimize manual calculation mistakes in your resource allocation plan.

**Unrealistic projections** can also be a significant issue. Under-budgeting suggests a lack of understanding of actual project costs, potentially leading to project failure. Over-budgeting, conversely, can make your proposal appear greedy or inefficient. Strive for realistic and well-supported cost estimates.

Failing to **address indirect costs appropriately** is another frequent oversight. If your organization has a federally negotiated indirect cost rate, use it. If not, understand the funder’s policy on administrative costs and adhere to any caps or guidance they provide. This is a critical element of any project expense breakdown.

Lastly, **not aligning the budget with the narrative** creates a disconnect that can confuse reviewers. Your financial plan should directly support and reflect the activities and goals described in your project narrative. If your budget includes an expense not mentioned in the narrative, or vice versa, it signals a lack of coherence.

Frequently Asked Questions

How often should I update my Grant Project Proposal Budget Template?

Your core budget framework should be a living document, updated annually or whenever significant changes occur in personnel costs, equipment prices, or organizational overhead rates. For specific grant applications, always customize and refine it to match the funder’s guidelines and the project’s unique scope, ensuring it reflects the most current and accurate financial data.

What if my organization doesn’t have a negotiated indirect cost rate?

If you don’t have a federally negotiated indirect cost rate, many funders allow a de minimis rate (often 10% of modified total direct costs, or MTDC), or they may have their own specific caps or policies on indirect costs. Always consult the grant guidelines first. If no specific guidance is given, research what is generally accepted for similar grants or consult with an accountant.

Can I include in-kind contributions in my budget?

Yes, in-kind contributions (non-cash donations of goods or services, like volunteer time, donated space, or equipment use) are often encouraged or even required as matching funds by some grantors. While they are not part of the cash request, they demonstrate community support and increase the project’s overall value. List them separately, provide a fair market value, and clearly explain their contribution to the project.

How detailed should my budget narrative be?

The budget narrative should provide clear, concise justifications for every significant line item. It explains *how* you arrived at your cost estimates and *why* each expense is necessary for the project’s success. For example, for personnel, state the role, percentage of time, and calculation (e.g., “Project Manager, 50% FTE, $70,000 annual salary = $35,000”). The level of detail will depend on the funder’s requirements, but clarity is always key.

What if the grant award is less than my requested budget?

It’s not uncommon for funders to award less than the full requested amount. If this happens, you’ll need to revisit your project scope and budget. Prioritize essential activities, seek alternative funding for deferrable items, or potentially reduce the scale of your project to fit the awarded amount. Proactive planning for potential budget cuts can involve identifying “tiered” project activities or optional expenses during the initial budgeting phase.

The journey to securing grant funding is multifaceted, requiring a compelling vision, meticulous planning, and clear communication. At its heart lies the budget—a document that translates your project’s aspirations into tangible financial commitments. By embracing a structured approach to your project expense breakdown, organizations can not only simplify this often-complex task but also significantly enhance their credibility and appeal to potential funders.

Think of your budget as a critical piece of storytelling, a narrative woven with numbers that convinces grantmakers of your project’s feasibility, your organization’s capability, and the profound impact their investment will yield. A well-crafted financial proposal structure is an affirmation of your professionalism and a testament to your commitment to responsible resource management. Invest the time in developing a thorough and justifiable budget, and you’ll lay a strong foundation for your project’s success and unlock new opportunities for growth and impact.