In the intricate world of business, especially for privately held corporations and startups, financial arrangements between the company and its shareholders are common. Whether a shareholder is injecting capital beyond equity investment or the company needs to borrow from its owners to navigate cash flow demands, these transactions require clarity and formal documentation. A shareholder loan agreement is not just a formality; it’s a critical tool that defines the terms, protects all parties, and prevents future misunderstandings that could jeopardize business relationships and financial stability.

Navigating the legal intricacies of such agreements can be daunting and costly, often requiring significant time and resources dedicated to legal counsel. This is precisely where a well-crafted, accessible resource like a free shareholder loan agreement template becomes invaluable. It empowers business owners, financial officers, and legal professionals to quickly establish clear, legally sound frameworks for these vital internal loans, ensuring compliance and peace of mind without the immediate burden of high legal fees.

The Indispensable Nature of Formal Documentation

In today’s fast-paced business environment, relying on verbal agreements or informal understandings is a recipe for disaster. This is especially true when it comes to financial transactions within a company. A clearly written agreement serves as a definitive record, outlining the intentions, obligations, and rights of both the company and the lending shareholder. It acts as a shield against potential disputes, misinterpretations, and memory lapses that can erode trust and lead to costly litigation.

Moreover, formal documentation is crucial for legal and accounting compliance. Tax authorities, auditors, and potential investors will scrutinize inter-company loans, and a robust agreement provides the necessary evidence that the transaction is legitimate, bona fide debt, not a disguised dividend or equity contribution. Without this, businesses risk facing penalties, reclassifications, and severe financial repercussions, underscoring why a comprehensive loan document is not merely good practice but an essential operational requirement.

Securing Interests and Mitigating Risks

The primary advantage of utilizing a standardized document like a free shareholder loan agreement template lies in its ability to protect the interests of both the borrowing company and the lending shareholder. For the company, it clearly defines repayment terms, interest rates, and any collateral involved, ensuring that the loan’s impact on its financial health is transparent and manageable. This structured approach helps maintain liquidity and avoids arbitrary demands that could strain company resources.

For the shareholder, the template provides assurance that their investment is treated as a debt, offering a clear path for repayment and potential interest earnings. In the event of company insolvency or dissolution, a properly documented loan positions the shareholder as a creditor, which is a significantly more favorable position than that of an equity holder. This clarity is vital for financial planning and risk management, offering a layer of security that informal arrangements simply cannot provide.

Adapting for Diverse Scenarios

While the core principles of a loan agreement remain consistent, the specific circumstances surrounding a shareholder loan can vary significantly across industries and business models. A well-designed free shareholder loan agreement template is built with flexibility in mind, allowing for easy customization to fit a wide array of unique situations. Whether the loan is for short-term working capital, a long-term capital investment, or bridging a specific project’s funding gap, the template provides a solid foundation.

Businesses can adapt clauses to reflect different interest rate structures (fixed, variable, or even zero-interest for specific scenarios), repayment schedules (lump sum, installments, or upon demand), and default provisions. Considerations such as subordination agreements, where the shareholder loan ranks below other creditors, can also be incorporated. This adaptability ensures that the agreement accurately reflects the specific intent and financial realities of the parties involved, making it a powerful tool for various corporate financial strategies.

Key Components of a Robust Loan Document

Every effective shareholder loan agreement, including a comprehensive free shareholder loan agreement template, must contain several essential clauses to ensure clarity, enforceability, and legal compliance. These components form the backbone of the agreement and delineate the rights and responsibilities of both the company and the shareholder.

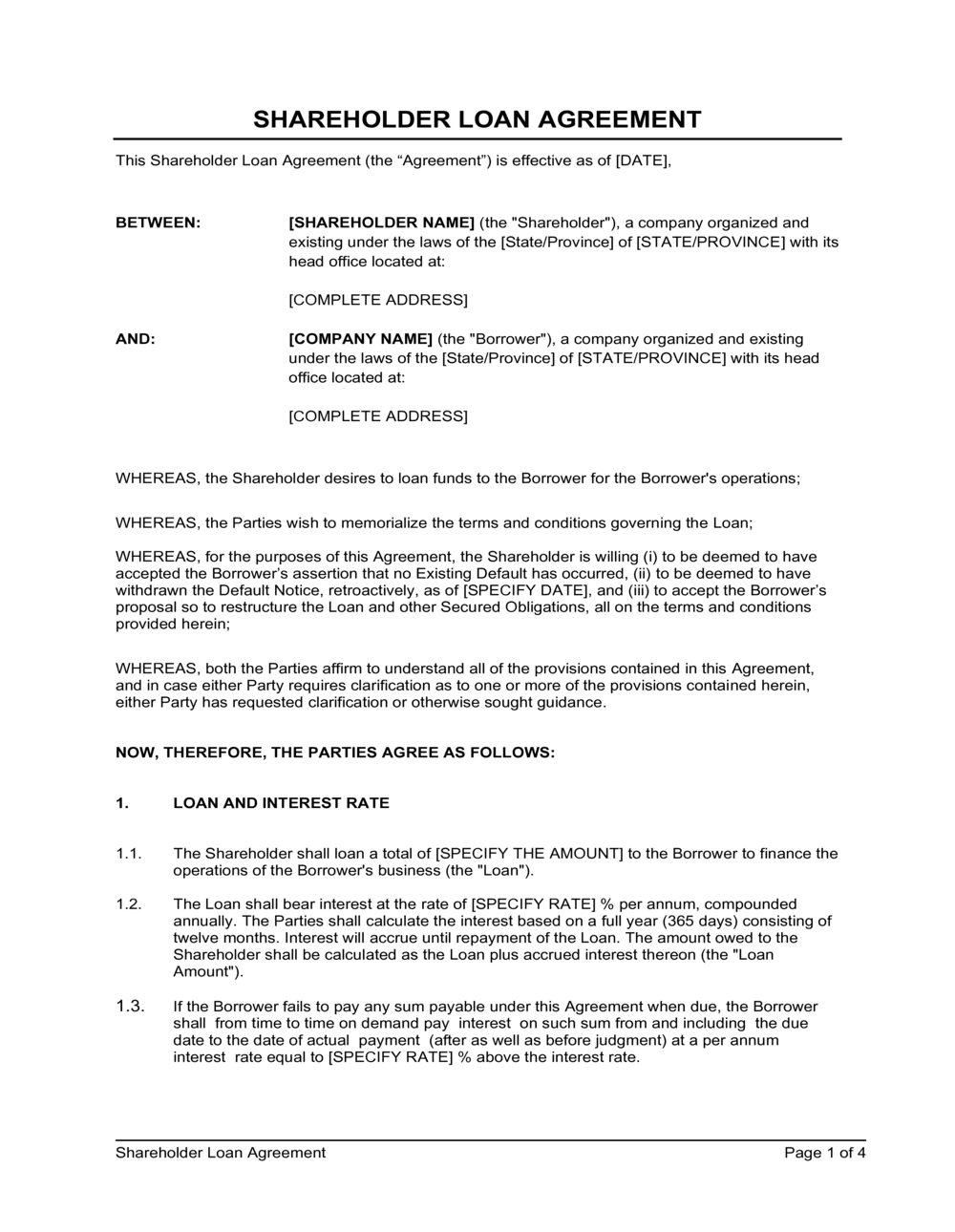

- Identification of Parties: Clearly states the full legal names and addresses of the borrowing company and the lending shareholder.

- Loan Amount and Disbursement: Specifies the exact principal amount of the loan and how and when the funds will be disbursed to the company.

- Interest Rate: Defines whether interest will be charged, the specific interest rate (fixed or variable), how it accrues, and its calculation method. If no interest is charged, this should be explicitly stated.

- Repayment Schedule: Outlines the terms of repayment, including dates for principal and interest payments, installment amounts, or conditions for a single lump-sum repayment.

- Maturity Date: The specific date by which the entire principal and any accrued interest must be repaid.

- Default Provisions: Details what constitutes an event of default (e.g., failure to make payments, bankruptcy) and the remedies available to the lending shareholder in such a scenario.

- Security/Collateral (if any): Describes any assets of the company pledged as collateral for the loan, providing the shareholder with a secured interest.

- Representations and Warranties: Statements made by both parties affirming their legal capacity to enter into the agreement and the accuracy of disclosed information.

- Governing Law: Specifies the jurisdiction whose laws will govern the interpretation and enforcement of the agreement (typically the state where the company is incorporated or operates).

- Assignment: Determines whether the loan can be assigned or transferred to another party.

- Amendments: Stipulates that any modifications to the agreement must be made in writing and signed by both parties.

- Entire Agreement: Confirms that the document constitutes the complete and sole agreement between the parties, superseding all prior discussions or understandings.

- Signatures: Includes spaces for the authorized representatives of the company and the shareholder to sign and date the agreement, ideally with witnesses or notarization for added validity.

Ensuring Usability and Professional Presentation

Beyond its legal content, the practical utility of any contractual document, including a free shareholder loan agreement template, hinges on its formatting, usability, and readability. A well-presented agreement instills confidence and simplifies understanding for all parties involved, whether it’s viewed digitally or in print. Clear, concise language is paramount; avoid excessive legal jargon where simpler terms suffice, but ensure precision where necessary.

Use consistent formatting throughout, including headings, subheadings, and bullet points, to break up text and improve flow. Ample white space around paragraphs and sections prevents visual clutter and makes the document less intimidating. For digital use, ensure the template is compatible with common word processing software and can be easily edited and saved in various formats (e.g., PDF for final execution). For print, consider font size and margins for comfortable reading. These practical tips enhance the document’s professionalism and ensure that its critical information is readily accessible and understandable to everyone involved.

Utilizing a comprehensive free shareholder loan agreement template offers an unparalleled advantage for businesses seeking to formalize internal financial arrangements. It provides a robust, legally sound framework that protects all parties, minimizes risks, and fosters transparent communication. This professional resource streamlines the complex process of documenting shareholder loans, saving valuable time and resources while ensuring regulatory compliance.

Ultimately, adopting a well-structured free shareholder loan agreement template is a proactive step toward robust financial governance. It’s a testament to good business practice, offering the clarity and security necessary for sustained growth and harmonious shareholder relations. Embrace this invaluable tool to establish clear financial boundaries and build a more resilient and transparent business future.