Navigating the complexities of financial obligations, especially when facing challenging circumstances, often leads to the critical need for debt settlement. This process, where a debtor and creditor agree to resolve a debt for a lesser amount than originally owed, offers a viable pathway to financial recovery for many businesses and individuals. However, the success and enforceability of such an arrangement hinge entirely on its clarity, specificity, and legal robustness. Without a well-structured document, both parties expose themselves to significant risks, potential misunderstandings, and future disputes.

This is where a meticulously crafted debt settlement agreement becomes indispensable. It serves as the bedrock of the entire resolution, laying out the terms, conditions, and expectations in an undeniable, legally binding format. For entrepreneurs, legal professionals, financial advisors, and anyone grappling with substantial debt, understanding and utilizing a reliable free debt settlement agreement template can be a game-changer. It provides not just a starting point, but a comprehensive framework designed to protect interests, ensure compliance, and streamline the path toward a mutually beneficial resolution.

The Imperative for Clear, Written Agreements

In today’s intricate legal and business landscape, the adage "get it in writing" has never been more relevant. Oral agreements, no matter how sincere or well-intentioned, are notoriously difficult to prove and enforce. They are susceptible to misinterpretation, forgotten details, and conflicting recollections, often leading to costly and protracted legal battles. When it comes to debt settlement, the stakes are particularly high, involving significant financial liabilities and the credit standing of the parties involved.

A comprehensive written agreement eliminates ambiguity, providing an unalterable record of the agreed-upon terms. It clarifies the rights and obligations of both the debtor and the creditor, setting clear expectations for payment schedules, amounts, and the final resolution of the debt. This foundational document is not merely a formality; it is an essential safeguard, mitigating risks for both parties by establishing a clear, legally defensible framework should any disagreements arise in the future.

Unlocking the Benefits of a Structured Template

Utilizing a high-quality, pre-designed template for your debt settlement needs offers a multitude of advantages beyond just providing a written record. It represents a significant time-saver, eliminating the need to draft complex legal language from scratch. For businesses and legal practitioners managing multiple cases, this efficiency can translate into substantial operational savings and faster resolutions.

Beyond mere convenience, a reliable template ensures that no critical element is overlooked. It acts as a professional checklist, guiding users through the necessary clauses and considerations to create a comprehensive and legally sound agreement. This built-in structure helps prevent common pitfalls, reduces the likelihood of errors, and enhances the overall professionalism of the documentation. Access to a free debt settlement agreement template specifically empowers individuals and small businesses who may not have immediate access to extensive legal resources, providing them with a robust tool to navigate complex financial negotiations with confidence and precision. Such a document offers peace of mind, knowing that the settlement terms are clearly articulated and enforceable.

Tailoring Your Settlement Document

While a template provides a robust foundation, effective debt settlement often requires customization to fit the unique nuances of each situation. Debts can vary widely, from unsecured credit card balances and personal loans to more complex business liabilities or specific types of collateralized loans. Each scenario may necessitate distinct terms and conditions within the agreement.

For instance, a settlement involving a business loan might require specific clauses addressing ongoing business relationships, intellectual property, or guarantees from specific individuals within the company. Conversely, a personal credit card debt settlement might focus more on consumer protection laws and an individual’s ability to pay. A versatile free debt settlement agreement template allows for easy adaptation. Users can modify sections to reflect the specific types of debt, the payment structure (lump sum vs. installment), any specific conditions for the release of liability, or unique state-specific legal requirements. This flexibility ensures that the final agreement is perfectly tailored to the specific circumstances, enhancing its enforceability and relevance to all parties involved.

Essential Clauses for Your Agreement

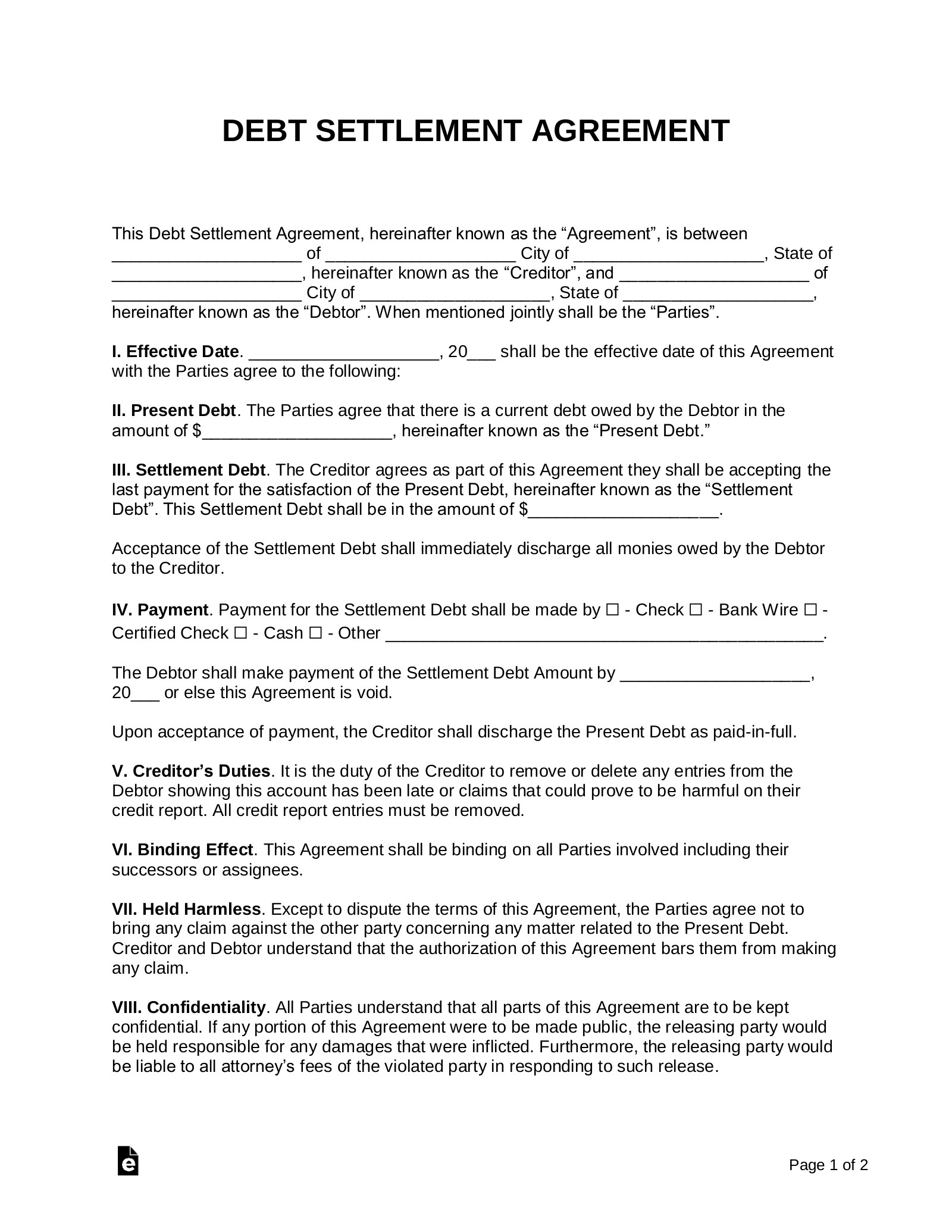

A robust debt settlement agreement is built upon a series of fundamental clauses that define the scope and enforceability of the settlement. These elements ensure clarity, protect all parties, and outline the exact terms of the debt resolution. When working with a free debt settlement agreement template, ensure the following critical components are present and accurately completed:

- Identification of Parties: Clearly state the full legal names and addresses of both the debtor(s) and the creditor(s). If applicable, include the names of any legal representatives or attorneys involved.

- Original Debt Details: Provide precise information about the original debt, including the original amount, account numbers, loan dates, and any associated collateral. This establishes the context for the settlement.

- Settlement Amount and Terms: Explicitly state the agreed-upon reduced amount that will fully satisfy the debt. Detail whether this is a lump-sum payment or an installment plan, including payment dates and methods.

- Payment Schedule: If payments are to be made in installments, outline the exact schedule, including due dates, amounts, and the total number of payments.

- Release of Liability: A critical clause stating that upon successful completion of the settlement terms, the creditor releases the debtor from any further obligation regarding the original debt. This ensures the debt is considered fully satisfied.

- Governing Law: Specify the state or jurisdiction whose laws will govern the interpretation and enforcement of the agreement. This is crucial for legal compliance and dispute resolution.

- Confidentiality (Optional but Recommended): If desired, include a clause restricting either party from disclosing the terms of the settlement to third parties, protecting sensitive financial information.

- Default Clause: Clearly outline the consequences should the debtor fail to meet the agreed-upon payment schedule or other terms. This might include the original debt being reinstated or other legal recourse.

- Waiver of Rights: Sometimes, parties may waive certain rights (e.g., the right to pursue further legal action) as part of the settlement. Ensure these waivers are clearly stated and understood.

- Entire Agreement Clause: A standard legal provision stating that this document represents the complete and final agreement between the parties, superseding any prior discussions or understandings.

- Signatures and Dates: Provide designated spaces for the dated signatures of all parties involved, acknowledging their acceptance and understanding of the terms. If applicable, include spaces for witness signatures or notarization.

Maximizing Usability and Readability

Even the most legally sound document is ineffective if it’s difficult to read or understand. For any free debt settlement agreement template, attention to formatting and presentation is paramount, ensuring both print and digital usability. Prioritizing readability enhances clarity, reduces the chance of misinterpretation, and makes the agreement accessible to all parties, regardless of their legal expertise.

Start by using clear, concise language, avoiding overly complex legal jargon where simpler terms suffice. Employ ample white space throughout the document to prevent it from appearing cluttered and overwhelming. Utilize headings and subheadings (like those in this article) to break up long sections of text, guiding the reader through the various clauses and making specific information easy to locate. Consistent font choices, such as a professional sans-serif font like Arial or a serif font like Times New Roman, along with an appropriate font size (10-12 points for body text), are crucial for legibility. For digital use, ensure the document is easily convertible to PDF format for universal accessibility and protection against unauthorized modifications. Consider features like fillable fields if the template is to be used repeatedly, streamlining the data entry process. Numbered paragraphs or sections also greatly aid in referencing specific terms during discussions or in legal proceedings.

Ultimately, a free debt settlement agreement template is more than just a document; it’s a strategic tool designed to bring resolution and clarity to challenging financial situations. Its value extends far beyond its "free" aspect, encompassing a robust framework for legal compliance, risk mitigation, and clear communication. By leveraging such a professionally designed and customizable resource, individuals and businesses can approach debt negotiations with confidence, securing terms that are mutually beneficial and legally sound.

This invaluable resource serves as a cornerstone for fair and transparent financial resolution, allowing both debtors and creditors to move forward with certainty. Embrace the power of a well-structured free debt settlement agreement template to streamline your processes, protect your interests, and achieve a clear, enforceable path to financial closure.