Navigating the financial landscape as a single mother can often feel like an intricate puzzle, with every piece representing a different responsibility – from childcare and housing to daily living expenses and future planning. The weight of being the sole provider and decision-maker for your family’s economic well-being is immense, often leaving little room for error or unexpected financial surprises. Yet, amidst the daily demands and the quest for stability, there’s a powerful tool that can bring clarity, control, and peace of mind: a well-structured budget.

Financial empowerment begins with understanding where your money comes from and where it goes. For many single mothers, the idea of sitting down to meticulously track every dollar can seem daunting, especially with limited time and energy. This is precisely why a specialized and accessible resource, like a Free Budget Template For Single Mom, can be a game-changer. It’s not just about numbers; it’s about creating a roadmap to financial security, identifying opportunities for savings, and ultimately building a more stable future for yourself and your children.

The Unique Financial Landscape for Single Mothers

The economic realities faced by single mothers are distinct and often more challenging than those of two-parent households. You are typically shouldering all household expenses, childcare costs, and daily necessities on a single income. This can lead to tighter budgets, less disposable income, and a greater vulnerability to unforeseen expenses like medical emergencies or car repairs, which can quickly derail financial stability.

Furthermore, managing finances as a single mom often involves balancing work schedules with school pickups, doctor’s appointments, and extracurricular activities, leaving precious little time for detailed financial planning. The emotional toll of constant financial worry can also be significant. This unique set of circumstances underscores the critical need for financial tools that are not only effective but also easy to use and specifically tailored to these specific demands.

Why a Dedicated Budget Template is Essential

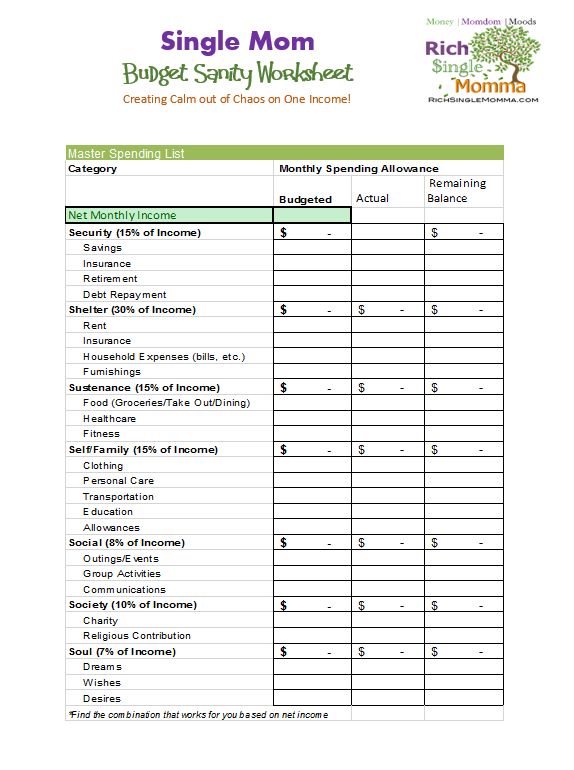

While generic budgeting apps and spreadsheets abound, a resource designed with the specific needs of single parents in mind offers invaluable advantages. It anticipates common expense categories like childcare, school supplies, and children’s activities, which might be less prominent in a general template. This tailored approach ensures that no critical financial area is overlooked, providing a comprehensive overview of your family’s spending and saving patterns.

Utilizing a single mother’s budget worksheet goes beyond mere tracking; it’s about strategic planning. It helps you visualize your financial flow, identify areas where you might be overspending, and pinpoint opportunities to reallocate funds towards savings or debt reduction. This structured approach helps transform abstract financial goals into achievable steps, reducing stress and fostering a sense of control over your economic future.

Key Benefits of Using a Financial Planning Tool for Solo Parents

Embracing a dedicated budget plan for single parents can unlock a multitude of benefits that extend far beyond simply balancing the books. It provides a clear and honest snapshot of your financial reality, empowering you to make informed decisions and set realistic goals. This clarity is the first step toward significant financial improvement.

Here are some of the transformative benefits you can expect:

- **Gain Unprecedented Clarity:** Understand exactly where every dollar of your income is going. This transparency is crucial for making smart financial choices.

- **Identify Savings Opportunities:** Pinpoint unnecessary expenditures or areas where you can cut back, freeing up funds for savings or other priorities.

- **Reduce Financial Stress:** When you have a clear plan, the anxiety surrounding money significantly diminishes, allowing you to focus on your family.

- **Plan for the Future:** Establish realistic goals for an emergency fund, your children’s education, a down payment on a home, or retirement.

- **Improve Financial Literacy:** Become more comfortable with financial terminology and management, setting a great example for your children.

- **Empower Decision-Making:** With a full understanding of your finances, you can make more confident and strategic decisions about major purchases, job changes, or investments.

How This Financial Planning Tool Works

A typical budget plan for a single mother works by systematically categorizing your income and expenses. It begins by listing all sources of income, whether it’s your primary salary, child support, or any supplemental earnings. This provides a clear top-line figure for your family’s monthly resources.

Next, the template guides you through categorizing your expenditures. These are often divided into fixed expenses, which remain relatively consistent each month (like rent or mortgage payments, loan installments, and insurance premiums), and variable expenses, which fluctuate (such as groceries, utilities, transportation, and entertainment). Crucially, it also includes sections for unique single-parent expenses like childcare costs, school fees, and children’s activity fees, ensuring these significant outlays are properly accounted for. By meticulously filling out each section, you create a detailed ledger that shows exactly how your money is allocated.

Customizing Your Single Mom’s Budget

No two families are exactly alike, and neither are their financial situations. That’s why the beauty of a budget template for single parents lies in its adaptability. While it provides a foundational structure, you are empowered to personalize it to fit your unique circumstances, income patterns, and specific family needs. This customization ensures the tool remains relevant and highly effective for you.

Consider adding unique categories that reflect your family’s lifestyle or recurring costs. If your income fluctuates, you might adapt the template to track an "average" month or implement a "zero-based budget" approach, where every dollar is assigned a job. You can also adjust savings goals, prioritize different debts, or even modify the design if you prefer a printable PDF over a digital spreadsheet. The key is to make this cost-tracking sheet for single mothers a living document that evolves with your family’s journey, rather than a rigid, unchangeable one.

Essential Components of an Effective Budget

To ensure your financial planning is comprehensive and truly impactful, any effective budget template for single mothers should include several key components. These categories help you capture all aspects of your financial life, preventing unexpected financial surprises and building a strong foundation.

Here are the critical sections you should look for and meticulously fill out:

- **Income Sources:** Clearly list all money coming in, including your **salary**, child support, alimony, or any **side hustle earnings**.

- **Fixed Expenses:** These are your non-negotiable, consistent monthly bills. Think **rent/mortgage**, car payments, insurance premiums, and subscription services.

- **Variable Expenses:** Categories that change month-to-month, such as **groceries**, dining out, entertainment, clothing, and personal care. This is often where the most savings can be found.

- **Childcare and Education Costs:** A crucial category for single moms, including **daycare**, after-school programs, school supplies, tutoring, and extracurricular activities.

- **Debt Repayment:** Dedicated sections for **credit card payments**, student loans, or any other personal debts you are actively paying down.

- **Savings and Emergency Fund:** Allocate a specific amount each month, no matter how small, towards building a **financial cushion** for unforeseen circumstances and future goals.

- **Miscellaneous/Buffer:** A small, flexible category for unexpected minor expenses, preventing you from dipping into **dedicated funds**.

Practical Tips for Managing Finances as a Single Mother

Beyond simply filling out your budget plan, successful financial management as a single mother requires consistent effort and smart strategies. Incorporating these practical tips into your routine can significantly enhance your financial stability and long-term security. These are not just budgeting hacks; they are sustainable habits for a healthier financial future.

First, make it a habit to track every expense, no matter how small, for at least the first few months. This practice helps you truly understand where your money goes. Second, consider automating savings and bill payments to ensure you’re consistently putting money aside and never missing a due date. Third, review and adjust your budget regularly, ideally monthly, to accommodate changing circumstances or unexpected costs. Fourth, explore available government assistance programs or local community resources that might offer support for childcare, housing, or food. Finally, prioritize building a robust emergency fund, aiming for three to six months of essential living expenses, to create a vital safety net for your family.

Frequently Asked Questions

What if my income fluctuates from month to month?

Managing a fluctuating income requires a flexible approach. Try to budget based on your lowest expected income for the month, and consider any extra earnings as a bonus to put towards savings or debt. You can also build a buffer in your savings to smooth out the lean months.

How often should I review my budget?

Ideally, you should review your budget monthly to ensure it accurately reflects your current income and expenses. This allows you to make necessary adjustments, track your progress, and stay on top of your financial goals. A quarterly in-depth review for major changes is also beneficial.

Can I use this budget plan if I have multiple children?

Absolutely! A single mother’s budget worksheet is designed to be highly adaptable. You would simply expand the relevant expense categories, like childcare, education, clothing, and activities, to account for each of your children’s needs, ensuring all family members are covered.

Where can I find additional financial resources and support?

Many non-profit organizations offer free financial counseling and workshops. Websites of government agencies (like USA.gov) provide information on assistance programs. Local community centers and credit unions can also be great sources for financial education and support tailored to single-parent families.

Is a free template truly effective, or is there a catch?

Yes, a free template can be incredibly effective, especially as a starting point. Many organizations and financial bloggers offer them as a valuable resource to help individuals take control of their finances. The “catch,” if any, is usually a request for your email address to send updates or other helpful content, which can actually be a benefit as it provides ongoing support.

Taking control of your finances as a single mom isn’t just about managing money; it’s about building resilience, securing your family’s future, and empowering yourself with knowledge and control. The journey to financial stability might seem long, but with the right tools and a commitment to understanding your financial landscape, every step forward is a victory. This proactive approach will not only alleviate current stressors but also pave the way for a more secure and thriving environment for your children.

Embrace the power of organization and foresight that a well-crafted Free Budget Template For Single Mom offers. It’s an invaluable resource designed to support your unique journey, providing the clarity and structure needed to navigate economic challenges confidently. Start today, take that crucial first step towards financial empowerment, and watch as your peace of mind and financial security begin to grow, creating a stronger foundation for your family’s bright future.