In today’s intricate and interconnected business landscape, the exchange of sensitive financial information is almost inevitable. Whether you’re a startup seeking venture capital, a seasoned investor conducting due diligence, or a business owner exploring a potential acquisition, the stakes are incredibly high. Trust, while fundamental, must be underpinned by robust legal safeguards to protect invaluable data from unauthorized disclosure or misuse.

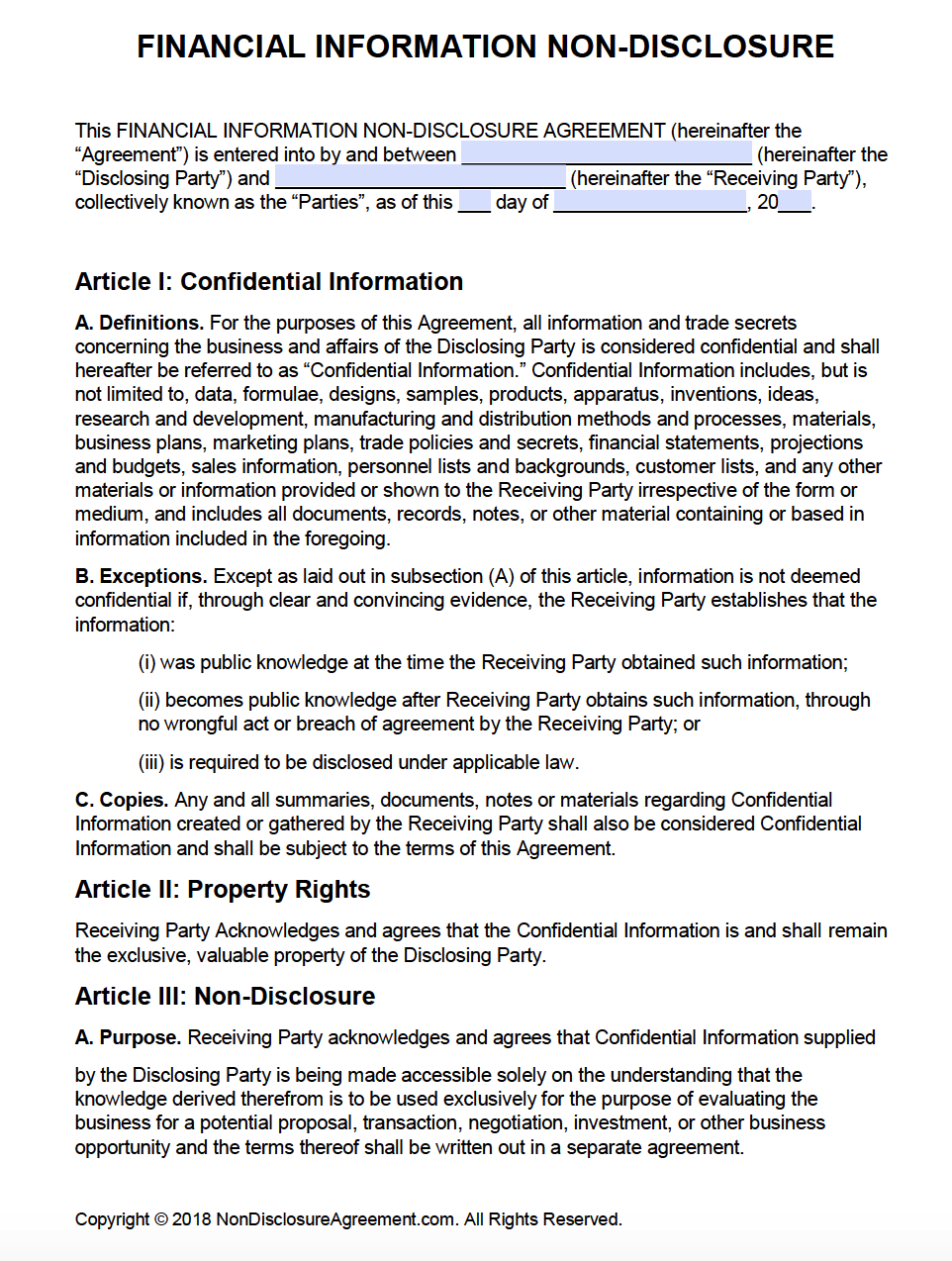

This is where a meticulously crafted legal instrument becomes indispensable. A well-structured document not only sets clear boundaries around what information is considered private but also outlines the obligations of those who receive it. For professionals navigating complex transactions, from mergers and acquisitions to partnership negotiations or even detailed financial planning, having a reliable framework to protect proprietary data is not just an advantage—it’s a necessity.

The Imperative of Documented Understanding

In an era defined by rapid information flow and ever-increasing data breaches, relying solely on verbal agreements or implied trust is a perilous gamble. A written contract serves as a tangible record of mutual understanding and commitment, reducing ambiguity and preventing disputes before they escalate. It formalizes the expectations of all parties involved, ensuring everyone understands their responsibilities regarding sensitive data.

Beyond simple protection, a clear, written contract provides a robust legal foundation. Should a breach occur, this document is your primary evidence in seeking remedies and enforcing the agreed-upon terms. It clearly delineates what constitutes confidential information and precisely how it should be handled, making it an invaluable asset in safeguarding intellectual property, trade secrets, and personal financial data against competitive harm or regulatory non-compliance.

Benefits of a Standardized Non-Disclosure Framework

Utilizing a pre-drafted framework for non-disclosure offers a myriad of advantages, streamlining a critical aspect of business operations. Primarily, it ensures consistency across various dealings, meaning you’re not reinventing the wheel with every new partner or investor. This saves significant time and legal costs, allowing you to focus on the core aspects of your transactions rather than drafting legal text from scratch.

A well-designed financial confidentiality agreement template provides a protective shield for your most sensitive data. It safeguards proprietary financial models, client lists, investment strategies, due diligence findings, and other critical information that could severely impact your competitive standing if compromised. Furthermore, it helps establish a professional image, signaling to others that your organization takes data security seriously and operates with a high degree of legal prudence.

Tailoring Your Agreement for Specific Needs

One of the greatest strengths of a robust template is its adaptability. While it provides a solid legal backbone, it’s designed to be customized to fit the unique nuances of different industries, transactional contexts, and specific financial scenarios. This flexibility ensures that the document remains relevant and effective, regardless of the particular circumstances in which it’s employed.

Consider, for instance, a startup in the tech sector seeking Series A funding. Their agreement might need specific clauses addressing proprietary algorithms or intellectual property valuation. In contrast, a real estate developer partnering with an investor for a new project would emphasize clauses related to property valuations, zoning plans, and project financing details. Similarly, a wealth management firm sharing client portfolio strategies would focus on client privacy and investment methodologies. The ability to adapt the language and scope to these varied situations ensures maximum relevance and legal efficacy.

Essential Components of a Comprehensive Confidentiality Document

Every effective confidentiality agreement, particularly one focused on financial matters, must contain several core clauses to be truly robust. These sections define the scope of the agreement, the obligations of the parties, and the recourse available in case of a breach.

Here are the critical components every financial confidentiality agreement template should include:

- Identification of Parties: Clearly state the names and addresses of both the disclosing party (who owns the information) and the receiving party (who will access it).

- Definition of Confidential Information: This is perhaps the most crucial section. It explicitly lists or describes what types of information are considered confidential. For financial agreements, this might include financial statements, business plans, valuation models, investment strategies, client lists, proprietary algorithms, financial projections, and any other data marked as confidential.

- Obligations of the Receiving Party: Detail how the receiving party must handle the confidential information. This typically includes commitments to:

- Keep the information strictly confidential.

- Use it only for the specified purpose (e.g., evaluating a transaction).

- Limit access to only those employees or agents who have a "need to know."

- Implement reasonable security measures to protect the information.

- Exclusions from Confidentiality: Specify information that is not considered confidential, such as information already publicly known, independently developed by the receiving party, or legally required to be disclosed.

- Term of Confidentiality: Define how long the confidentiality obligations will last, which can extend beyond the duration of the underlying transaction or relationship.

- Return or Destruction of Information: Stipulate what happens to the confidential information once the purpose of the disclosure has been fulfilled or the agreement terminates. This usually involves returning or destroying all copies.

- Remedies for Breach: Outline the consequences of violating the agreement. This often includes provisions for injunctive relief (stopping further disclosure) and monetary damages.

- Governing Law and Jurisdiction: Specify which state’s laws will govern the interpretation of the agreement and in which courts any disputes will be resolved. This is particularly important for multi-state or international dealings.

- No License or Waiver: Clarify that signing the agreement does not grant any intellectual property rights or imply a waiver of any existing rights.

- Entire Agreement Clause: States that the written document constitutes the complete agreement between the parties, superseding any prior discussions or understandings.

- Signatures: Ensure all parties (or their authorized representatives) sign and date the document.

Practical Tips for Usability and Professional Presentation

Beyond the legal language, the usability and presentation of your confidentiality document significantly impact its effectiveness. A well-formatted agreement is easier to read, understand, and comply with, reducing the likelihood of errors or disputes arising from misinterpretation. Whether for print or digital use, attention to detail in presentation is key.

For optimal readability, use clear, concise language and avoid excessive legal jargon where possible. Employ standard fonts (e.g., Arial, Times New Roman) in a legible size (10-12pt) with appropriate line spacing. Utilize headings and subheadings to break up long sections, making it easier for users to navigate the document. For digital versions, ensure the document is easily searchable and compatible with common PDF readers. Consider adding a table of contents for longer documents. Finally, always maintain version control and use clear file naming conventions, especially when multiple revisions are being exchanged between parties, to prevent confusion and ensure everyone is working with the most current version.

In the complex tapestry of modern business and finance, where sensitive information is routinely exchanged, the value of a robust and adaptable legal instrument cannot be overstated. A thoughtfully developed financial confidentiality agreement template provides not just a safeguard, but also a professional framework that instills confidence and clarity in critical dealings. It represents a proactive step towards mitigating risk, protecting proprietary interests, and ensuring legal compliance.

By leveraging a well-structured agreement, businesses and individuals can significantly streamline their legal processes, saving invaluable time and resources that would otherwise be spent on drafting bespoke contracts. It empowers parties to engage in sensitive discussions with greater assurance, knowing that a clear, enforceable commitment to discretion is in place. Ultimately, adopting such a template is an investment in security, efficiency, and professional peace of mind, allowing you to focus on growth and innovation rather than worrying about data vulnerability.