For many agricultural producers, managing the unpredictable nature of farm income and expenses feels like navigating a ship through ever-changing seas. The cyclical nature of seasons, volatile market prices, and unforeseen challenges like weather events can make financial planning a daunting task. Yet, robust financial foresight isn’t just a luxury; it’s a critical tool for survival and growth in today’s competitive agricultural landscape.

A well-structured farm cash flow budget serves as your financial roadmap, providing clarity on where your money comes from and where it goes. It’s more than just a list of numbers; it’s a dynamic planning instrument that empowers farmers to make informed decisions, anticipate challenges, and seize opportunities. Understanding and utilizing such a budgeting tool for agricultural businesses can transform uncertainty into strategic advantage, paving the way for a more stable and prosperous future for your operation.

Why a Cash Flow Budget is Your Farm’s Financial Compass

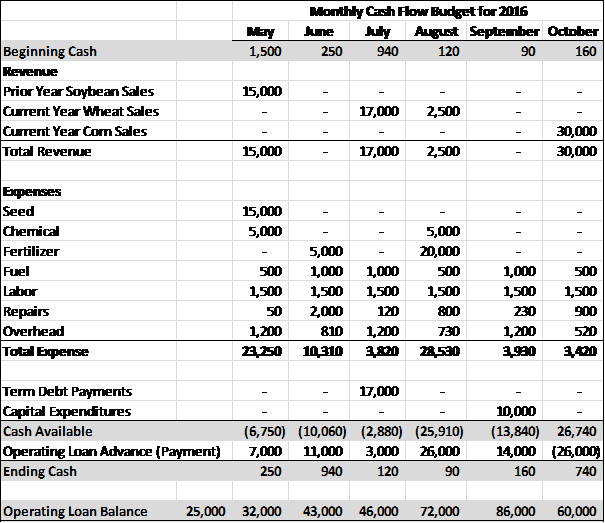

At its core, a farm cash flow budget provides a detailed projection of all cash inflows (income) and outflows (expenses) over a specific period, typically a year, broken down by month or quarter. This isn’t merely about tracking past performance; it’s about forecasting the future to ensure you have enough liquidity to meet your obligations when they come due. Without this crucial insight, even profitable farms can face cash shortages at critical times, jeopardizing operations.

The benefits extend far beyond simply avoiding financial surprises. A robust cash flow budgeting for farms allows you to proactively manage debt, identify peak spending periods, and strategically time purchases or sales. It strengthens your position when negotiating with lenders, suppliers, or buyers, as you can present a clear, credible picture of your farm’s financial health. Ultimately, it’s a proactive strategy for maintaining stability and driving profitability in an industry known for its inherent variability.

Key Elements of an Effective Farm Cash Flow Budget

To truly capture the financial pulse of your operation, an agricultural cash flow planning document must be comprehensive. It needs to reflect all facets of your farm’s financial life, from the smallest operational cost to the largest capital investment. Here are the essential components that every effective budgeting guide for farmers should include:

-

**Cash Inflows:** This section details all expected sources of money coming into the farm.

- **Crop Sales:** Revenue from corn, soybeans, wheat, specialty crops, etc.

- **Livestock Sales:** Income from cattle, hogs, poultry, dairy products.

- **Government Payments:** Subsidies, disaster relief, conservation programs.

- **Custom Work:** Income from providing services like planting, harvesting, or baling for others.

- **Other Income:** Rental income, off-farm income contributing to the farm, insurance payments.

-

**Cash Outflows:** This covers all anticipated expenditures.

- **Operating Expenses:** Costs directly related to production, such as **seed, fertilizer, feed, chemicals, fuel, veterinary care, repairs and maintenance**, and hired labor wages.

- **Capital Expenditures:** Investments in long-term assets like **new machinery, equipment upgrades, land purchases, building construction**, or significant improvements.

- **Debt Service Payments:** Principal and interest payments on **operating loans, term loans, and mortgages**.

- **Family Living Expenses:** Funds drawn from the farm for **household expenses, personal taxes, and health insurance**.

- **Taxes:** Property taxes, payroll taxes, and estimated income taxes related to the farm business.

- **Insurance:** Premiums for crop insurance, liability insurance, property insurance.

- **Rent/Lease Payments:** For land, equipment, or facilities.

By meticulously detailing both sides of the equation, a farmer gains a granular view of their operational cash flow, allowing for precise management and forecasting.

The Power of Forecasting: Anticipating Income and Expenses

The true utility of a Farm Cash Flow Budget Template lies in its ability to forecast. Farmers must make informed estimates about future prices for inputs and outputs, yields, and potential market shifts. This isn’t about having a crystal ball, but rather using historical data, current market trends, and expert projections to create a realistic outlook. For instance, knowing when you’ll receive payment for crops sold in the fall versus when you’ll need to purchase spring inputs is crucial for managing liquidity.

Dealing with variability is inherent in agriculture. A good budgeting tool for agricultural businesses accounts for different scenarios, allowing you to model best-case, worst-case, and most likely outcomes. This prepares you for potential downturns and allows you to capitalize on unexpected opportunities. By anticipating when you might have a surplus or deficit, you can proactively seek financing, plan large purchases, or adjust your operational strategy before issues arise, solidifying your farm financial planning.

How to Implement and Customize Your Budgeting Tool

Implementing a cash flow management strategy doesn’t have to be overly complicated. Many resources are available, from sophisticated agricultural budgeting software to customizable spreadsheet templates provided by universities or extension offices. The key is to choose a system that you understand and can commit to updating regularly. Start by gathering all your financial records from previous years – income statements, balance sheets, and tax returns – as these provide a solid basis for your initial projections.

Once you have your data, input your estimated monthly income and expenses. This process will naturally prompt you to think critically about each line item. Customization is vital; a generic agricultural budgeting spreadsheet won’t perfectly fit every farm. Adjust categories to reflect your specific operation, whether it’s row crops, a diversified livestock enterprise, specialty crops, or an agritourism venture. Review and revise your budget monthly, comparing actual figures against your projections. This allows you to identify discrepancies, understand why they occurred, and refine your forecasting for the future. Regular review transforms this financial template from a static document into a dynamic decision-making tool.

Beyond the Numbers: Strategic Uses for Your Financial Plan

While the immediate benefit of a cash flow budget is clear financial oversight, its strategic value extends far deeper. This detailed financial plan can become the cornerstone for broader business decisions, influencing everything from expansion plans to risk mitigation. For example, a clear understanding of your cash flow allows you to assess the feasibility of investing in new land or equipment, projecting how such a capital expenditure will impact your monthly liquidity.

Furthermore, a well-managed farm financial template enhances your ability to manage risk. By identifying potential periods of cash shortfall, you can explore options like forward contracting, adjusting payment terms with suppliers, or establishing lines of credit in advance. It also serves as a critical document for succession planning, providing future generations with a transparent view of the farm’s financial workings. Ultimately, this comprehensive financial plan moves you beyond day-to-day management to strategic long-term planning, securing the future of your agricultural enterprise.

Frequently Asked Questions

How often should I update my farm cash flow budget?

Ideally, you should review and update your farm cash flow budget monthly. Comparing actual income and expenses against your projections allows you to make timely adjustments and keeps your financial plan relevant and accurate throughout the year.

Is a Farm Cash Flow Budget Template suitable for all farm sizes?

Yes, a Farm Cash Flow Budget Template is beneficial for farms of all sizes, from small family operations to large commercial enterprises. While the complexity might vary, the fundamental principles of tracking and forecasting cash flow remain essential for financial health regardless of scale.

What’s the difference between a cash flow budget and an income statement?

A cash flow budget projects future cash inflows and outflows over a specific period, focusing on liquidity. An income statement (or profit and loss statement) reports past financial performance over a period, detailing revenues and expenses to show net profit or loss, often including non-cash items like depreciation.

Where can I find reliable data for my projections?

Reliable data can come from several sources: your farm’s historical records (tax returns, bank statements, sales receipts), local extension offices, university agricultural economics departments, USDA reports, commodity market outlooks, and reputable agricultural industry publications. Combining these sources helps build more accurate forecasts.

Mastering the art of managing farm finances is an ongoing journey, but a well-constructed and regularly updated farm cash flow budget is arguably the most powerful tool you can wield. It offers not just a snapshot, but a moving picture of your financial health, empowering you to navigate the complexities of agriculture with confidence and precision.

Embrace the discipline of financial planning. By investing your time and effort into creating and maintaining a detailed agricultural cash flow planning document, you are not just tracking money; you are actively shaping the future profitability and resilience of your farming operation. Start building your financial roadmap today and steer your farm towards sustained success.