Navigating the complexities of household finances can often feel like steering a ship through uncharted waters. Between income streams, fixed expenses, variable costs, and the occasional unexpected curveball, it’s easy for families to lose sight of where their money truly goes. Many find themselves caught in a cycle of guessing, hoping, and worrying, rather than confidently planning for their financial future. This common struggle highlights a critical need for a structured approach to managing money.

Imagine having a clear financial roadmap that not only illuminates your current spending habits but also empowers you to make informed decisions that align with your family’s goals. This is precisely what a well-designed Family Household Budget Template offers. It transforms abstract numbers into actionable insights, providing a foundation for financial stability and growth. Whether you’re saving for a down payment, planning for retirement, or simply aiming to reduce financial stress, a robust budgeting tool is your essential companion.

Why a Family Budget is Non-Negotiable

In today’s economic landscape, a proactive approach to financial management is more important than ever. A household budget isn’t just about restricting spending; it’s about making conscious choices that reflect your values and priorities. It provides transparency, allowing every family member to understand their collective financial standing and contribute to shared goals. Without a clear financial plan, it’s easy for expenses to creep up unnoticed, leading to debt and missed opportunities.

A well-maintained family financial plan acts as an early warning system, highlighting potential shortfalls before they become crises. It encourages open communication about money within the household, fostering a sense of shared responsibility and teamwork. Beyond preventing financial pitfalls, a comprehensive spending plan paves the way for achieving significant milestones, such as buying a home, funding education, or enjoying a well-deserved vacation. It turns dreams into tangible targets, making the path to financial freedom much clearer.

Understanding the Anatomy of a Household Budget

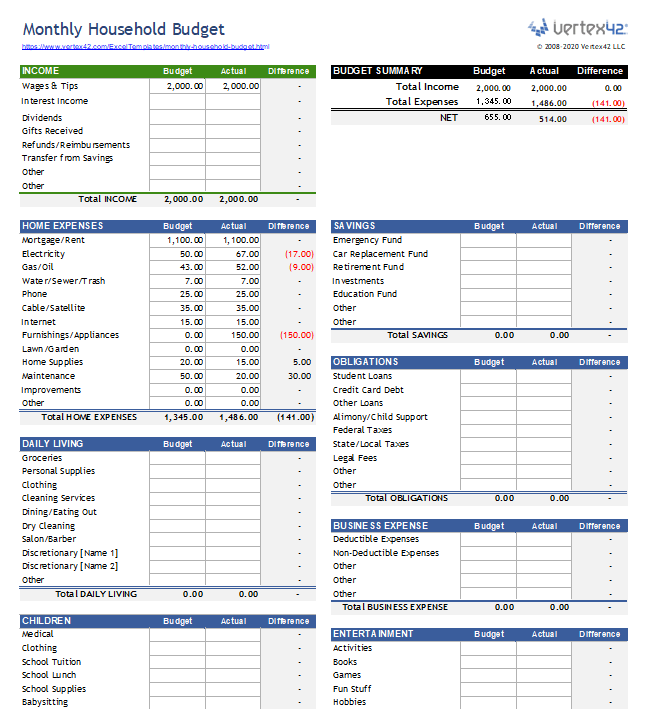

To effectively manage your money, it’s crucial to understand the core components of any robust budgeting tool. A typical budget framework centers around three main elements: income, expenses, and savings/debt repayment. Breaking these down into manageable categories makes tracking and analysis far more straightforward. A good Family Household Budget Template will provide sections for each of these, allowing for a holistic view of your financial health.

When setting up your initial budget sheet, consider these key categories:

- **Income:** All money flowing into the household. This includes salaries, wages, freelance income, benefits, investment dividends, and any other sources of revenue. It’s important to list both gross and net income to understand what you truly have available after taxes and deductions.

- **Fixed Expenses:** Costs that typically remain the same each month. Examples include **rent or mortgage payments**, loan repayments (car, student), insurance premiums, subscriptions, and childcare costs. These are often easier to budget for as they are predictable.

- **Variable Expenses:** Costs that fluctuate from month to month. This category covers items like **groceries**, dining out, utilities (electricity, water, gas, unless fixed rate), transportation (gas, public transit), entertainment, and clothing. Tracking these carefully is where many people find opportunities to save.

- **Discretionary Spending:** Non-essential purchases that bring enjoyment but can be reduced or eliminated if necessary. Think of **hobbies**, vacations, impulse buys, or extra entertainment. This is often the first area to adjust when trying to cut costs.

- **Savings & Investments:** Money set aside for future goals. This could include an **emergency fund**, retirement accounts, college savings, or a down payment fund. Treat savings as a non-negotiable expense, paying yourself first.

- **Debt Repayment:** Extra payments towards loans or credit cards beyond the minimum required. Prioritizing **high-interest debt** can significantly improve your financial standing over time.

Choosing and Customizing Your Budget Tool

The beauty of a modern budgeting tool is its flexibility. While the core principles remain consistent, the way you implement your financial tracking sheet can vary widely based on your comfort level with technology and your specific needs. There’s no one-size-fits-all solution, and finding the right fit is key to long-term success. Some families prefer the simplicity of a pen-and-paper ledger, while others thrive with sophisticated digital tools.

When it comes to selecting the right Family Household Budget Template, consider a few options. Spreadsheet programs like Microsoft Excel or Google Sheets offer immense customization, allowing you to build a system tailored precisely to your income and expense categories. You can download free templates online or create one from scratch. For those seeking more automation, dedicated budgeting apps like Mint, YNAB (You Need A Budget), or Personal Capital link directly to your bank accounts, categorizing transactions and providing real-time insights. The most effective money management system is one you will consistently use, so choose a format that feels intuitive and manageable for your family.

Putting Your Budget into Practice: A Step-by-Step Guide

Implementing a new household spending guide might seem daunting initially, but by breaking it down into manageable steps, you can establish a routine that becomes second nature. Consistency is the cornerstone of effective financial planning, so commit to regularly reviewing and adjusting your budget. This isn’t a one-time task but an ongoing conversation with your money.

Here’s a practical approach to getting started with your financial blueprint:

- Gather Your Financial Data: Collect all relevant documents: pay stubs, bank statements, credit card statements, and bills from the past 1-3 months. This will give you a realistic picture of your income and spending.

- Calculate Your Total Monthly Income: Add up all net income sources for the month. Be conservative if your income fluctuates.

- List All Fixed Expenses: Document every recurring bill and payment that remains constant each month, such as rent, loan payments, and insurance.

- Track Variable Expenses: For a month or two, diligently track every dollar spent in categories like groceries, dining, and entertainment. This can be done with an app, a notebook, or by reviewing bank statements. This step is crucial for understanding where your money is actually going.

- Assign Budget Categories and Amounts: Based on your tracking, allocate specific amounts to each variable expense category. Be realistic and a little generous at first, you can tighten it later. Don’t forget to include a line item for savings.

- Monitor and Adjust Regularly: At least once a week, or at the end of each pay cycle, review your spending against your budget. If you overspend in one category, look for areas to cut back in others. If you consistently underspend, you might reallocate those funds to savings or debt.

- Hold Family Meetings: Discuss the budget with your family regularly. This ensures everyone is on the same page, understands the goals, and feels empowered to contribute to the household’s financial health.

Navigating Common Budgeting Challenges

Even with the best intentions and a robust income-expense planner, families often encounter hurdles on their budgeting journey. One common issue is over-optimistic budgeting, where initial allocations are unrealistic, leading to frustration and abandonment. It’s better to be slightly conservative with income estimates and a bit generous with expense categories, especially for variable costs, until you have a clear pattern established. Another challenge is the "set it and forget it" mentality. A budget is a living document, requiring regular attention and adjustments as life circumstances change.

Unexpected expenses, often referred to as "budget busters," can derail even the most carefully laid plans. Building an emergency fund is the best defense against these surprises, preventing them from forcing you into debt or derailing your long-term goals. Lastly, budget fatigue can set in, making the ongoing tracking and adjusting feel like a chore. To combat this, automate as much as possible, use tools that simplify the process, and celebrate small financial victories. Remember, the goal is financial peace, not perfection, and even small improvements add up significantly over time.

Frequently Asked Questions

How often should I review my household budget?

Ideally, you should review your budget at least once a week or every two weeks, especially when you’re first getting started. This allows you to catch any overspending early and make necessary adjustments. A more thorough review, perhaps monthly or quarterly, is beneficial to assess long-term progress and adjust for changing financial situations or goals.

What if my income fluctuates significantly each month?

For those with irregular income, a “zero-based budget” or an “average income” approach can be highly effective. With a zero-based budget, every dollar has a job, even if it’s sitting in a buffer account. For the average income method, budget based on your lowest typical monthly income and save any surplus from higher-earning months. This ensures you always have enough to cover essential expenses.

Should I include my children in the budgeting process?

Absolutely! Involving children, especially older ones, in age-appropriate discussions about the family’s financial planning can be a powerful educational tool. It teaches them about the value of money, the importance of saving, and the concept of needs versus wants. This fosters financial literacy and responsibility from a young age, preparing them for their own financial futures.

What’s the difference between a budget and an expense tracker?

An expense tracker primarily records where your money has gone, offering a historical view of your spending. A budget, on the other hand, is a forward-looking plan that allocates your income to various categories before you spend it, guiding your financial decisions. While distinct, they work best together: an expense tracker provides data for your budget, and the budget gives purpose to your tracking.

How much should I allocate to savings each month?

A common guideline is the 50/30/20 rule: 50% of your income for needs, 30% for wants, and 20% for savings and debt repayment. However, this is just a starting point. The ideal amount depends on your individual financial goals, current debt, and income level. Prioritize building an emergency fund (3-6 months of living expenses) first, then focus on retirement and other long-term savings.

Adopting a disciplined approach to your family’s finances doesn’t have to be a source of stress; it can be an empowering journey toward peace of mind and financial freedom. By harnessing the power of a well-structured financial planning tool, you’re not just tracking numbers—you’re actively shaping your family’s future. It’s about gaining control, making intentional choices, and building a secure foundation for generations to come.

Embrace the clarity and confidence that comes with knowing exactly where you stand financially. Start today by exploring a template that fits your family’s unique dynamics, commit to consistent tracking, and watch as your financial goals transition from aspirations to achievements. Your family’s journey to financial stability begins with a single, deliberate step, guided by a clear and comprehensive budget.