In the intricate world of facilities management, balancing operational demands with financial realities is a constant, often daunting, challenge. Facility managers are the silent heroes keeping buildings functional, safe, and efficient, but their impact extends far beyond leaky faucets and flickering lights. At its core, effective facilities management is about strategic resource allocation and sound financial planning. This is where a robust Facilities Management Budget Template becomes not just a tool, but a cornerstone of success.

Imagine navigating a complex urban landscape without a map or GPS. You might eventually reach your destination, but the journey would be inefficient, costly, and fraught with unexpected detours. Similarly, managing a facility’s finances without a clear, structured budget is an invitation to unforeseen expenses, missed opportunities, and an inability to demonstrate value to stakeholders. A well-designed budget framework provides that essential roadmap, guiding decisions, optimizing spending, and ultimately empowering facility professionals to elevate their role from reactive problem-solvers to proactive strategic partners.

Why a Well-Crafted Budget is Your FM Superpower

A comprehensive facilities budget is far more than just a list of expenses; it’s a strategic document that reflects the operational priorities and long-term vision for your assets. It provides a clear, defensible justification for every dollar spent, translating maintenance requests and energy consumption into tangible financial data. This transparency is invaluable when communicating with senior leadership, especially during budget allocation cycles.

Having a robust financial blueprint empowers you to anticipate future needs, allocate resources wisely, and mitigate risks before they escalate. It shifts the focus from emergency spending to proactive maintenance and strategic improvements, ultimately extending asset lifespans and enhancing occupant satisfaction. Without this foundational budgeting tool, facility managers often find themselves in a reactive cycle, constantly battling unforeseen costs and struggling to demonstrate their department’s true economic contribution.

Key Elements of an Effective Facilities Budget

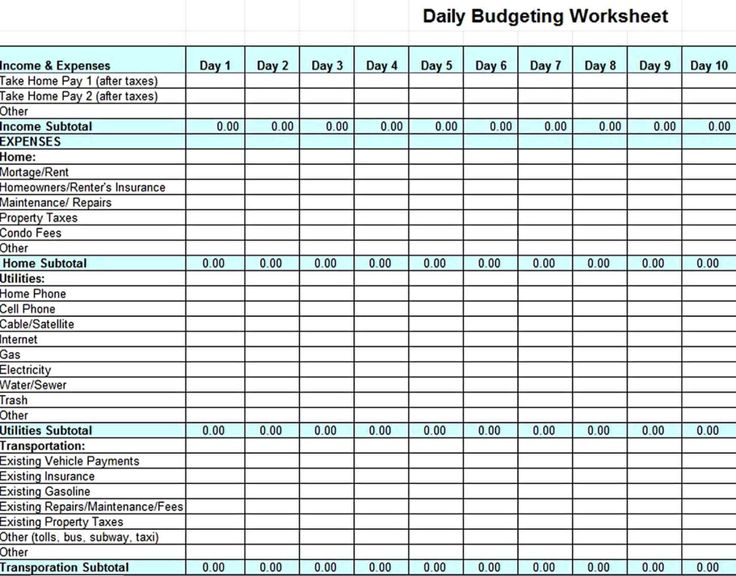

Developing an effective facilities financial plan requires a meticulous breakdown of all potential costs associated with operating, maintaining, and improving a facility. These costs typically fall into several key categories, each demanding careful consideration and forecasting. Understanding these elements is crucial for building a comprehensive and realistic budget model.

- Operating Expenses (OpEx): These are the day-to-day costs of keeping a facility running. They are typically recurring and essential for normal operations.

- Utilities: Costs for electricity, gas, water, sewage, and waste management. Often a significant portion of the budget, subject to market fluctuations and usage.

- Maintenance & Repairs: Routine servicing, preventive maintenance, and unexpected repairs for equipment, HVAC, plumbing, electrical systems, and building structure. This includes both in-house labor and external contractors.

- Janitorial & Cleaning: Services to maintain cleanliness and hygiene, including supplies and labor.

- Security: Costs associated with security personnel, alarm systems, surveillance equipment, and access control.

- Groundskeeping: Maintenance of exterior landscaping, parking lots, and walkways.

- Administrative Costs: Software licenses, office supplies for the FM department, training, and professional development.

- Personnel Costs: Salaries, benefits, and training for in-house facilities staff.

- Capital Expenditures (CapEx): These are investments in major asset upgrades, replacements, or new constructions that extend the life or significantly improve the value of a facility. They are typically large, non-recurring expenses.

- Major Equipment Replacement: HVAC systems, roofs, elevators, or other large, long-life assets.

- Renovations & Upgrades: Projects to modernize spaces, improve energy efficiency, or enhance building accessibility.

- Infrastructure Improvements: Upgrades to electrical grids, data networks, or plumbing systems.

- Contingency Fund: A critical component often overlooked, this fund accounts for unforeseen emergencies, unexpected repairs, or sudden price increases. A typical recommendation is 5-10% of the total budget.

- Compliance & Regulatory Costs: Expenses related to meeting local, state, and federal regulations (e.g., ADA compliance, environmental permits, safety inspections).

- Technology & Software: Investment in Computerized Maintenance Management Systems (CMMS), Building Management Systems (BMS), or other FM software.

Crafting Your Facilities Management Budget Template: A Step-by-Step Guide

Developing a usable facilities budget template involves a systematic approach, ensuring all relevant financial aspects are captured and managed effectively. This structured method helps in creating a clear and actionable financial plan.

- Review Historical Data: Begin by analyzing past spending. Look at invoices, previous budgets, and financial reports from the last 3-5 years. This provides a baseline for recurring costs and identifies any historical variances.

- Conduct a Facility Assessment: Perform a thorough inspection of all assets and systems. Document their current condition, expected lifespan, and any upcoming major maintenance or replacement needs. This informs your CapEx planning.

- Forecast Future Needs:

- Operational Growth/Shrinkage: Account for changes in facility usage, occupancy rates, or business expansion/downsizing.

- Inflation & Market Trends: Research expected increases in utility costs, labor rates, and material prices.

- Regulatory Changes: Anticipate any new compliance requirements that might incur costs.

- Planned Projects: Integrate any approved upgrades, renovations, or energy-saving initiatives.

- Engage Stakeholders: Collaborate with departmental heads, procurement, finance, and senior leadership. Their input ensures the budget aligns with broader organizational goals and secures buy-in.

- Categorize and Detail Expenses: Using the key elements outlined above, create detailed line items within your template. Be specific, for example, breaking down "HVAC Maintenance" into "Preventive Maintenance Contracts," "Emergency Repairs," and "Parts & Supplies."

- Allocate Resources and Justify: Assign specific dollar amounts to each line item. Be prepared to justify each allocation with data, ROI calculations, and strategic importance.

- Build in Flexibility (Contingency): Always include a contingency fund. This buffer is crucial for absorbing unexpected costs without derailing the entire facilities financial strategy.

- Implement Review Cycles: Establish a regular review schedule (monthly, quarterly) to track actual spending against the budget. This allows for timely adjustments and identifies areas for cost savings or potential overruns.

Leveraging Technology for Budgetary Excellence

In today’s fast-paced environment, static spreadsheets for managing your maintenance budget model can quickly become unwieldy and outdated. Modern technology offers powerful solutions to enhance the accuracy, efficiency, and real-time visibility of your facilities financial planning. Integrating specialized software can transform your approach.

Computerized Maintenance Management Systems (CMMS) are invaluable for tracking maintenance history, asset condition, and repair costs, directly informing your budget forecasts. Building Management Systems (BMS) provide real-time data on energy consumption, allowing for precise utility cost projections and identifying opportunities for savings. Moreover, dedicated budgeting software or enterprise resource planning (ERP) modules can automate data collection, generate reports, and facilitate scenario planning, helping you proactively manage your facilities spending plan. These tools not only streamline the budgeting process but also provide critical insights for strategic decision-making.

Tips for Budget Optimization and Cost Savings

Beyond simply tracking expenses, a smart facilities manager uses their annual facilities budget as a tool for continuous improvement and cost reduction. Proactive strategies can significantly impact your bottom line.

- Prioritize Preventive Maintenance (PM): Investing in regular PM reduces the likelihood of costly emergency repairs and extends asset life, offering a significant return on investment.

- Energy Management: Implement energy audits, upgrade to energy-efficient lighting (LED), optimize HVAC schedules, and explore renewable energy options. Even small adjustments can lead to substantial savings over time.

- Vendor Negotiation: Regularly review contracts with suppliers and service providers. Consolidate vendors where possible, negotiate bulk discounts, and periodically solicit competitive bids to ensure you’re getting the best value.

- Lifecycle Costing: When purchasing new equipment, consider the total cost of ownership over its entire lifespan, not just the initial purchase price. This includes energy consumption, maintenance, and disposal costs.

- Waste Reduction & Recycling: Implement robust recycling programs and waste reduction initiatives. This not only benefits the environment but can also reduce waste disposal costs.

- Space Utilization Optimization: Efficiently using existing space can defer the need for costly expansions or new leases, directly impacting capital expenditure planning for facilities.

- Employee Engagement: Encourage occupants to report issues promptly, conserve energy, and follow facility guidelines. A facility-aware culture can significantly contribute to operational savings.

Benefits of a Standardized Budget Framework

Adopting a consistent and well-defined FM budget framework brings a multitude of advantages beyond mere financial tracking. It elevates the entire facilities management operation, turning it into a more strategic and accountable function. A standardized approach ensures uniformity across different facilities or departments, making comparative analysis and performance benchmarking much easier.

It enhances transparency, allowing all stakeholders to clearly understand how funds are allocated and spent. This clarity builds trust and facilitates smoother approvals for necessary expenditures. Furthermore, a consistent framework aids in regulatory compliance and internal auditing, providing clear documentation of financial practices. Ultimately, it transforms the facilities budget from a reactive accounting exercise into a proactive financial blueprint for facility management, aligning spending with organizational goals and fostering long-term sustainability.

Frequently Asked Questions

What is the primary goal of an FM budget?

The primary goal of a facilities management budget is to accurately plan, allocate, and control financial resources required for the effective operation, maintenance, and improvement of an organization’s physical assets. It aims to ensure optimal functionality, safety, and efficiency while aligning with overall business objectives and financial constraints.

How often should a facilities budget be reviewed?

While the main budget is typically set annually, it should be reviewed at least quarterly to track actual spending against planned expenditures. Monthly reviews are even better for high-spending areas or during periods of significant operational change. This allows for timely adjustments and ensures the budget remains relevant and effective.

What’s the difference between OpEx and CapEx in FM?

Operating Expenses (OpEx) are the day-to-day costs of running a facility, such as utilities, routine maintenance, cleaning, and security. Capital Expenditures (CapEx) are investments in major upgrades, replacements, or new constructions that enhance the facility’s value or extend its lifespan, like a new roof or HVAC system.

Can a smaller organization benefit from a detailed facilities financial plan?

Absolutely. Even small organizations benefit immensely from a detailed facilities financial plan. It provides clarity on spending, helps avoid unexpected costs, allows for better resource allocation, and supports long-term planning, regardless of scale. A budget tool for FM is beneficial for any size operation.

How do I account for unexpected costs?

The best way to account for unexpected costs is to include a contingency fund in your facilities budget. This typically ranges from 5-10% of your total budget, depending on the age and condition of your facilities and the volatility of your operating environment. This buffer ensures you have funds available for emergencies without disrupting planned projects.

Mastering the financial aspects of facilities management is no small feat, but with the right tools and strategies, it transforms from a burden into a powerful lever for organizational success. A well-constructed and diligently maintained Facilities Management Budget Template is your clearest path to demonstrating value, gaining strategic influence, and ensuring your facilities contribute positively to the overall health of your organization. It’s not just about managing money; it’s about proactively managing the future of your assets and the people who depend on them.

Embrace the discipline of strategic financial planning. By taking control of your facilities’ finances, you’re not just budgeting; you’re investing in operational resilience, long-term sustainability, and a more efficient, productive environment for everyone. Start building your robust budget framework today and unlock the full potential of your facilities management operations.