Navigating the landscape of personal and business finance can often feel like sailing without a compass. Money comes in, money goes out, and without a clear system for tracking these movements, it’s easy to feel lost, wondering where all your hard-earned cash disappeared to. This lack of visibility isn’t just frustrating; it’s a significant barrier to achieving financial stability, reaching savings goals, or making informed decisions about future investments.

The solution isn’t about earning more money (though that certainly helps!), but rather about understanding and controlling the money you already have. This is where a structured financial tool becomes indispensable. It serves as your financial compass, providing clarity on every dollar and cent. Whether you’re an individual aiming for a new home, a small business owner looking to optimize operations, or a family striving to build an emergency fund, a comprehensive system for tracking your financial outflows is the foundational step towards fiscal empowerment.

The journey to financial mastery begins with a single, crucial step: clearly understanding where your money is going.

The Unseen Power of Financial Clarity

Many people approach their finances with a sense of dread or, at best, a vague understanding. They know their income, and they know their bank balance, but the crucial link between the two – the detailed breakdown of expenditures – remains a mystery. This financial ambiguity leads to impulsive spending, missed savings opportunities, and a constant low hum of money-related stress.

An effective financial budgeting framework transforms this guesswork into precise knowledge. It’s not merely about restricting your spending; it’s about gaining full transparency into your financial habits. By meticulously documenting every outgoing penny, you move from a reactive financial posture to a proactive one, allowing you to make conscious, deliberate choices that align with your long-term goals.

The benefits extend far beyond just knowing your numbers. With a robust expense tracking tool, you empower yourself with data for better decision-making. Imagine being able to confidently allocate funds for a family vacation, identify areas where you can comfortably cut back, or project your savings growth with accuracy. This level of control reduces financial stress, fosters a sense of accomplishment, and puts you firmly in the driver’s seat of your financial destiny.

Decoding Your Spending: What Goes Into a Budgeting Tool?

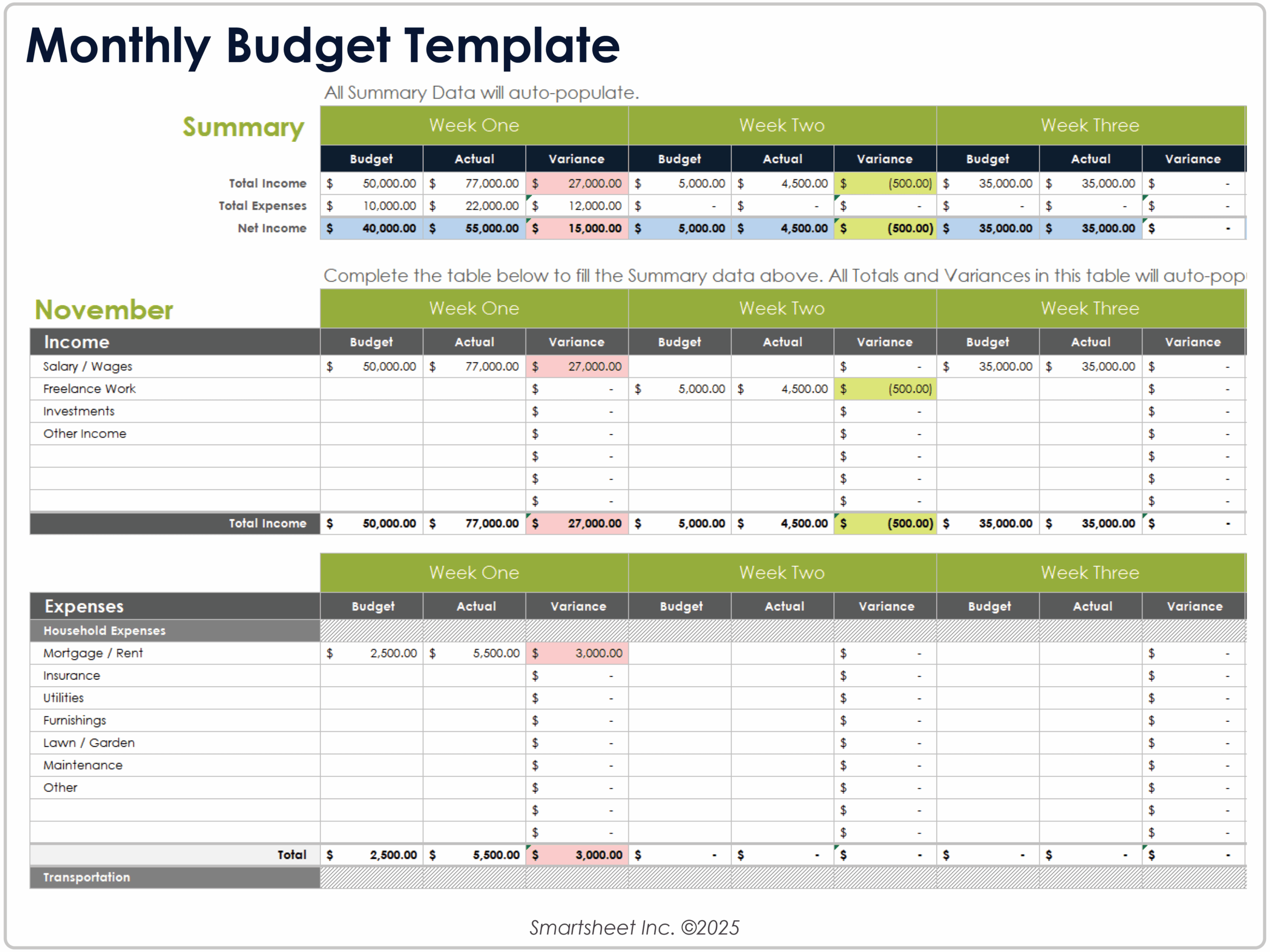

A truly effective cost management tool isn’t just a simple list of transactions; it’s a dynamic instrument designed to categorize, analyze, and inform. To build a comprehensive and useful financial overview, you need to ensure that certain key elements are consistently tracked. The power lies in the detail and the ability to compare your actual spending against your planned allocations.

Regardless of whether you use a digital spreadsheet or a dedicated app, the underlying components remain similar. Accurate data entry and a logical categorization system are paramount for deriving meaningful insights from your expenditure budget template. Without these, even the most sophisticated tool becomes little more than a disorganized ledger.

Here are the essential components that typically make up a thorough expense allocation sheet:

- Income Sources: Clearly list all sources of income, including your primary salary, freelance earnings, passive income, or any other money flowing into your accounts. This sets the baseline for your overall financial capacity.

- Fixed Expenses: These are costs that typically remain constant each month and are often contractual. Examples include your rent or mortgage payment, car loans, insurance premiums, and subscription services like streaming platforms or gym memberships.

- Variable Expenses: This category encompasses costs that fluctuate month-to-month. This is often where the biggest opportunities for savings lie. Think groceries, dining out, entertainment, utilities (which can vary seasonally), and clothing.

- Savings & Investments: Crucially, treat your savings goals as a non-negotiable expense. This includes contributions to your emergency fund, retirement accounts (401k, IRA), college savings, or down payments for major purchases like a house or car.

- Debt Repayment: Beyond fixed loan payments, this category includes any additional payments towards credit card balances, personal loans, or student loans. Understanding your debt outflows is key to accelerating repayment.

- Miscellaneous & Discretionary: Life is full of unexpected costs and fun splurges. This covers everything from gifts, charitable donations, medical co-pays, home repairs, to that spontaneous coffee run. Giving this category a realistic budget prevents financial surprises.

Consistency in tracking these elements is the cornerstone of any successful financial planning template. Regularly reviewing these categories allows you to identify trends, pinpoint areas of overspending, and adjust your financial habits accordingly.

Crafting Your Custom Financial Blueprint

The beauty of a robust financial planning template is its adaptability. There’s no single, universally perfect spending plan because everyone’s financial situation, goals, and spending habits are unique. The most effective cost management tool is one that you can tailor to reflect your specific circumstances, making it a truly personal financial blueprint.

Customization is key to making your budgeting efforts sustainable and effective. Don’t feel obligated to fit your life into a rigid mold. Instead, mold your expense tracking system to fit your life. This might mean adjusting categories, setting different review frequencies, or emphasizing certain financial goals over others at various stages of your life or business.

Here are some practical tips for customizing and effectively utilizing your monthly budget organizer:

- Start Simple, Then Refine: Don’t get bogged down in excessive detail from day one. Begin with broad categories, track for a month or two, then break down the larger categories (like "Household") into more specific ones (e.g., "Utilities," "Maintenance," "Supplies") as you gain clarity.

- Set Realistic Goals: An overly ambitious budget is a recipe for frustration. Be honest about your income and your current spending habits. Gradually challenge yourself to reduce discretionary spending rather than making drastic, unsustainable cuts.

- Review Regularly: Schedule a weekly or bi-weekly check-in to review your transactions and update your expense allocation sheet. A monthly deep dive is essential, but more frequent smaller reviews help you stay on track and course-correct quickly.

- Automate Where Possible: Many banks and credit card companies offer categorization tools or export features that can simplify data entry into your financial planning template. Consider automating savings transfers to ensure you "pay yourself first."

- Involve Your Household: If you share finances with a partner or family, make budgeting a collaborative effort. Open communication about financial goals and spending habits is crucial for shared success.

By actively engaging with and personalizing your financial outflow analysis, you transform a potentially daunting task into an empowering routine that supports your financial aspirations.

Beyond the Basics: Advanced Strategies for Budget Mastery

Once you’ve mastered the fundamentals of tracking income and expenses using your Expenditure Budget Template, you’re ready to move beyond simple categorization to more strategic financial management. The data collected in your financial budgeting framework isn’t just for looking backward; it’s a powerful tool for looking forward and making informed, proactive decisions.

Advanced budgeting strategies leverage your historical spending data to optimize your financial future. This could involve adopting specific budgeting philosophies or utilizing your expense tracking system for sophisticated financial forecasting. These techniques allow you to not only manage your current cash flow but also to strategically plan for long-term wealth building and risk mitigation.

Consider incorporating these advanced strategies:

- The 50/30/20 Rule: Allocate 50% of your after-tax income to needs (housing, utilities, groceries), 30% to wants (dining out, entertainment, hobbies), and 20% to savings and debt repayment. Your detailed expense tracking provides the perfect data to ensure you adhere to these percentages.

- Zero-Based Budgeting: This method requires you to assign every dollar of your income a "job" – whether it’s an expense, savings, or debt repayment. The goal is for your income minus your expenses and savings to equal zero. This ensures maximum efficiency and intentionality with every dollar.

- Projecting Future Costs: Use your past data from your monthly budget organizer to forecast upcoming irregular expenses. Anticipate annual insurance premiums, holiday spending, vehicle maintenance, or even medical deductibles. Setting aside money for these throughout the year prevents financial shocks.

- Scenario Planning: What if your income changes? What if a major expense arises? Use your financial outflow analysis to run different scenarios. This preparedness can be invaluable for making confident decisions during uncertain times, whether it’s for personal finance or a small business’s resource allocation tool.

By implementing these advanced techniques, your simple cost management tool evolves into a sophisticated engine for sustained financial health and strategic growth, allowing you to not just track money, but to truly master it.

Common Pitfalls and How to Avoid Them

Even with the best intentions and a well-designed financial planning template, challenges can arise. Budgeting is a journey, not a destination, and it’s common to encounter obstacles or make missteps along the way. Recognizing these common pitfalls is the first step toward overcoming them and maintaining your commitment to financial discipline.

Many people get discouraged and abandon their efforts when faced with initial setbacks. However, understanding that these are normal parts of the process allows you to approach them with resilience and a strategy for correction. The goal isn’t perfection, but consistent improvement and learning.

Here are some common pitfalls in managing your spending plan and how to avoid them:

- Being Unrealistic with Categories: If you drastically cut back on essential variable expenses like groceries or gas without a plan, you’re setting yourself up for failure. Be honest about your actual needs and gradually work towards optimization.

- Inconsistency in Tracking: Sporadic logging of expenses defeats the purpose of an expense tracking system. Make it a daily or at least weekly habit. Utilize technology like budgeting apps that link to your bank accounts to minimize manual entry.

- Ignoring Small Expenses: Those daily coffees, online subscriptions, or impulse buys quickly add up. Don’t underestimate the power of "latte factor" expenses. Track everything, no matter how small, to get a true picture of your financial outflows.

- Giving Up After a "Slip-Up": Everyone overspends occasionally. Instead of abandoning your budget entirely, treat it as a learning opportunity. Adjust your plan for the next month, identify why it happened, and move forward.

- Not Categorizing Properly: Vague or inconsistent categories (e.g., "Misc." or "Stuff") make it impossible to glean useful insights from your data. Take the time to create clear, specific categories that reflect your actual spending patterns.

- Failing to Review and Adjust: A budget is a living document. It needs regular review and adjustment as your income, expenses, and goals change. A static budget quickly becomes irrelevant.

By proactively addressing these potential challenges, you can build a more robust and sustainable financial discipline, ensuring your expenditure budget template remains a powerful ally in your financial journey.

Frequently Asked Questions

What is the primary benefit of using an expenditure budget template?

The primary benefit is gaining comprehensive clarity and control over your financial resources. It allows you to understand exactly where your money goes, make informed spending decisions, allocate funds towards savings and debt repayment, and ultimately achieve your financial goals with greater confidence and reduced stress.

How often should I review and update my spending plan?

While a comprehensive monthly review is essential, it’s highly beneficial to conduct weekly check-ins. Weekly reviews help you stay on top of your spending, catch any discrepancies early, and make minor adjustments before they become significant issues. This consistent engagement makes your budget a more effective tool.

Can a single financial planning template work for both personal and small business use?

While the core principles of tracking income and expenses are similar, it’s generally recommended to use separate tools for personal and small business finances. Business templates often include specific categories like revenue streams, Cost of Goods Sold (COGS), payroll, operating expenses, and tax considerations that are not relevant to personal budgets, and vice-versa.

What if my actual expenses consistently exceed my budgeted amounts?

If your actual expenses frequently exceed your budget, it indicates a need for re-evaluation. This could mean your budget is unrealistic, or you need to identify areas where you can genuinely reduce spending. Use the data from your financial outflow analysis to pinpoint the problem areas and make necessary adjustments to either your budget or your habits.

Are there free resources available for an expense tracking system?

Absolutely! Many excellent free resources exist. You can find numerous free templates for spreadsheet programs like Microsoft Excel or Google Sheets. Additionally, many budgeting apps offer free basic versions that provide effective expense tracking and categorization features to help you start managing your money without an upfront cost.

Taking control of your finances doesn’t have to be an overwhelming ordeal. It begins with the fundamental step of understanding where your money is going, and an Expenditure Budget Template provides the perfect framework for this vital insight. It’s more than just a list of numbers; it’s a dynamic tool for personal growth, strategic planning, and achieving peace of mind.

By embracing the discipline of a well-maintained spending plan, you unlock the potential to make every dollar work harder for you. Imagine the satisfaction of consistently hitting your savings targets, paying down debt ahead of schedule, or confidently investing in your future. This is the empowerment that comes from clear, data-driven financial management.

So, whether you’re just starting your financial journey or looking to refine your existing habits, take the leap. Invest the time in establishing a robust expense tracking system. The clarity, control, and confidence it brings will be an invaluable return on your effort, propelling you towards a more secure and prosperous financial future.