Navigating the complexities of estate administration can be one of the most challenging tasks an individual or family will ever face. Beyond the emotional weight of loss, there’s a labyrinth of legal, financial, and logistical responsibilities that demand meticulous attention. At the heart of this process lies clear and compassionate communication, particularly when it comes to informing beneficiaries about the distribution of assets. This is where an effective estate distribution letter template becomes not just a convenience, but a critical tool for ensuring transparency, compliance, and peace of mind.

This comprehensive guide is designed for executors, trustees, legal professionals, and anyone tasked with the solemn duty of distributing an estate. It offers a framework for crafting communications that are not only legally sound and informative but also empathetic and professional. By providing a structured approach to this vital correspondence, we aim to simplify a potentially overwhelming process, ensuring that every recipient receives clear, accurate, and timely information, helping to prevent misunderstandings and foster trust during a sensitive period.

The Imperative of Precise Estate Correspondence

In the realm of estate administration, every piece of correspondence carries significant weight. A poorly worded or incomplete letter can lead to confusion, raise unnecessary questions, and even ignite disputes among beneficiaries. Given the sensitive nature of the subject matter—often involving cherished memories, financial legacies, and the wishes of a deceased loved one—the demand for precision and clarity is paramount.

Beyond the emotional considerations, there are strict legal and ethical obligations that govern estate distribution. Executors and trustees are fiduciaries, meaning they hold a position of trust and must act in the best interests of the beneficiaries. This responsibility extends to all forms of communication, which must be accurate, comprehensive, and compliant with relevant laws and the provisions of the will or trust instrument. A well-crafted letter serves as a formal record, protecting the sender from potential liabilities and providing recipients with the verifiable information they need.

Moreover, professional correspondence establishes a tone of respect and competence. It reassures recipients that the estate is being handled with due diligence and care, mitigating anxiety during what is often an already stressful time. From initial notifications to final distribution statements, each communication contributes to the overall perception of how the estate is being managed, underscoring the critical role of a thoughtful and professional approach.

Streamlining Your Communication with a Ready-Made Framework

The administrative burden of managing an estate can be immense, often involving numerous parties, complex assets, and varying beneficiary situations. Creating tailored letters from scratch for each communication can consume valuable time and introduce inconsistencies, increasing the risk of errors. This is precisely where the strategic advantage of leveraging a ready-made framework, such as an estate distribution letter template, truly shines.

One of the primary benefits is the significant time savings it offers. Instead of drafting each letter individually, an executor can rely on a pre-structured document that already contains all the necessary sections and placeholders. This efficiency allows more time to be dedicated to other critical aspects of estate management, from asset valuation to tax preparation. Furthermore, templates ensure consistency across all communications, presenting a unified and professional front to every recipient.

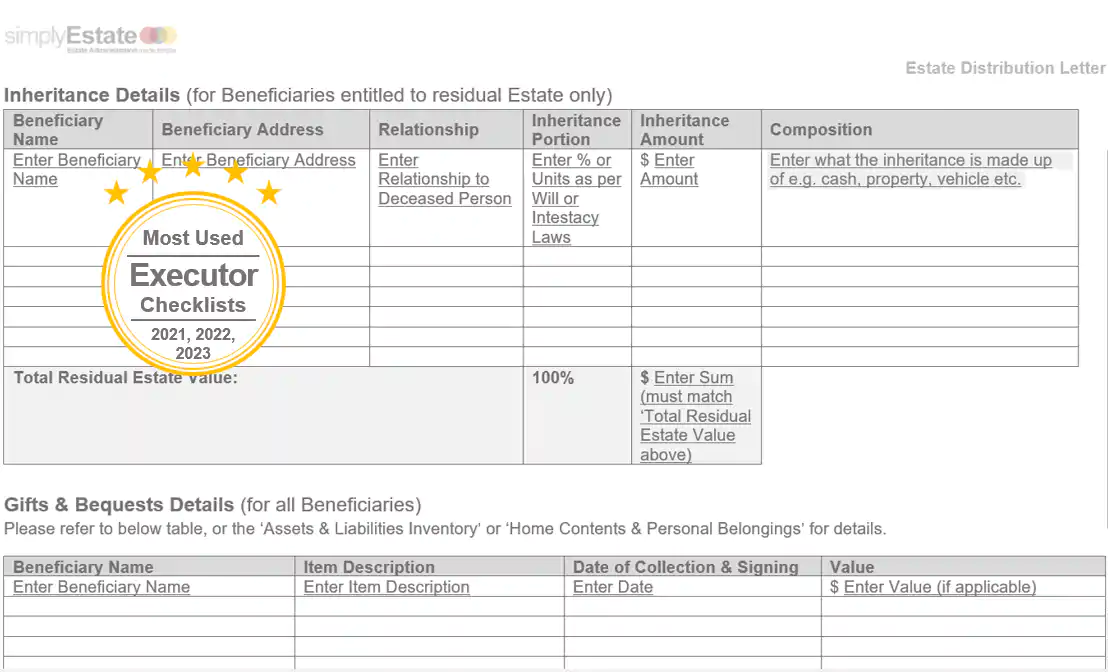

A robust template also acts as a comprehensive checklist, ensuring that no vital information is inadvertently omitted. It guides the sender through the essential details that must be included, from identifying the estate and the decedent to specifying the distributed assets and outlining any required actions from the beneficiary. This systematic approach drastically reduces the likelihood of errors, incomplete information, or having to issue follow-up communications simply to correct oversights in the initial correspondence. It provides a standardized layout that not only looks professional but also enhances readability for the recipient.

Adapting Your Letter for Diverse Situations

While the core purpose of distributing an estate remains constant, the specific circumstances and communication needs can vary greatly. A versatile estate distribution letter template is designed not as a rigid script but as a flexible foundation that can be meticulously tailored to address a multitude of scenarios within estate administration. This adaptability is key to maintaining both legal precision and a personalized approach.

Consider, for instance, the initial notification to beneficiaries about the commencement of probate versus a letter detailing the distribution of specific financial assets or tangible heirlooms. Each scenario requires distinct information, a particular tone, and potentially different legal references. A customizable template allows the sender to adjust the body of the letter to:

- Initial notifications: Clearly state the purpose of the letter, introduce the executor/trustee, and inform beneficiaries about their role.

- Specific asset distribution: Precisely describe the asset (e.g., specific stock shares, real property, jewelry), its valuation, and the method of transfer.

- Financial disbursements: Detail the exact monetary amount, the source of funds, and the method of payment (e.g., check, wire transfer).

- Updates and progress reports: Inform beneficiaries about ongoing processes, potential delays, or significant milestones in the estate’s administration.

- Requests for information or action: Clearly outline any documents required from the beneficiary or steps they need to take, such as signing a release form.

- Communication with other parties: Adaptations can also be made for correspondence with creditors, financial institutions, or government agencies, though these might require more specialized templates.

The ability to personalize the content, while retaining a professional structure, ensures that each communication is highly relevant and addresses the recipient’s specific situation without compromising legal accuracy or the overall professional image of the estate administration.

Essential Components of an Effective Distribution Notice

Regardless of the specific assets being distributed or the unique circumstances of the estate, certain key sections are universally critical for any comprehensive distribution notice. Adhering to these structural elements ensures clarity, completeness, and professionalism in every piece of correspondence.

- Sender’s Contact Information: Full name, title (Executor/Trustee), address, phone number, and email. This establishes who is sending the communication and how they can be reached.

- Date: The exact date the letter is composed and sent.

- Recipient’s Contact Information: Full name, address, and any other relevant contact details for the beneficiary.

- Salutation: A formal and respectful greeting, e.g., "Dear [Beneficiary’s Name]."

- Subject Line: A clear, concise, and informative summary of the letter’s purpose, such as "Regarding the Estate of [Decedent’s Name] – Distribution Notice."

- Opening Statement: Briefly state the purpose of the letter and refer to the estate it concerns. This sets the context immediately.

- Estate Details: Explicitly state the full name of the decedent, the date of their passing, and any official estate or probate identification numbers.

- Distribution Details: This is the core of the letter. Clearly articulate what is being distributed—whether it’s cash, specific assets, property, or a share of the residue. Provide precise amounts, descriptions, and, if applicable, the method of delivery or transfer.

- Legal Formalities and References: Reference the relevant legal document (e.g., "as per Article X of the Last Will and Testament of [Decedent’s Name] dated [Date]") or the applicable state laws governing the distribution.

- Action Required (if any): Clearly outline any steps the recipient needs to take, such as signing an acknowledgment of receipt, providing bank details, or returning a release form. Include deadlines if applicable.

- Timeline and Next Steps: Inform the beneficiary about expected timelines for transfers, follow-up communications, or any subsequent distributions.

- Contact Information for Questions: Reiterate how the beneficiary can reach the sender for any clarifications or further information.

- Closing: A professional closing, such as "Sincerely" or "Respectfully."

- Signature: The sender’s handwritten signature (for printable versions) followed by their typed name and title.

- Attachments: List any documents enclosed with the letter, such as account statements, property deeds, or inventory lists.

Elevating Your Message: Tone, Formatting, and Presentation

The content of your estate distribution letter template is undeniably crucial, but the manner in which it is presented can significantly impact its reception and effectiveness. Attention to tone, formatting, and overall presentation ensures your message is not only understood but also conveys the professionalism and empathy required for such sensitive correspondence.

Tone: The tone should strike a balance between formal professionalism and empathetic understanding. Avoid overly legalistic jargon where simpler language suffices, but maintain a clear, authoritative voice that leaves no room for ambiguity. Be respectful, compassionate, and direct without being cold. Acknowledging the recipient’s potential grief or distress through subtle phrasing can humanize the communication, while still focusing on the objective details of the distribution. Ensure the tone is consistent throughout the document, reflecting careful consideration for the recipient during a difficult time.

Formatting: A well-formatted letter enhances readability and professionalism.

- Layout: Utilize a standard business letter format with clear sections and logical flow.

- Font and Size: Choose a professional, easy-to-read font (e.g., Arial, Times New Roman, Calibri) in a standard size (10-12pt).

- White Space: Ample margins and spacing between paragraphs prevent the letter from appearing dense and overwhelming.

- Headings and Bullet Points: Within the letter itself, use internal headings (if the letter is very long) or bullet points for lists (e.g., assets being distributed) to break up text and highlight key information.

- Paragraph Length: Keep paragraphs concise, typically 2-4 sentences, to ensure the information is easily digestible.

Presentation (Digital and Printable Versions):

- Digital: When sending digitally, a Portable Document Format (PDF) is almost always preferred. It ensures that the document’s formatting remains consistent across various devices and operating systems, and it provides a level of security against unauthorized alterations. If sending via email, the email body itself should be professional, referencing the attached letter.

- Printable: For physical letters, use high-quality paper. Print clearly, ensuring all text is legible. If mailing, fold the letter neatly and use a professional envelope. Always proofread the final document meticulously, checking for any typographical errors, grammatical mistakes, or factual inaccuracies, before it is sent. This final review step is critical for maintaining credibility and preventing costly miscommunications.

Ultimately, mastering these elements ensures that your correspondence is not just informative, but also a reflection of diligent and compassionate estate administration.

The journey of estate administration, while often emotionally taxing and administratively complex, is significantly eased by the right tools. The judicious application of an estate distribution letter template stands out as an indispensable resource in this challenging landscape. It transforms a potentially daunting communication task into a structured, efficient, and professional process, ensuring that critical information is conveyed with clarity, accuracy, and the necessary degree of empathy.

By providing a consistent framework, reducing the margin for error, and allowing for crucial customization, a well-designed estate distribution letter template empowers executors and trustees to fulfill their duties with confidence and competence. It frees them from the minutiae of drafting, allowing them to focus on the broader responsibilities of estate management and, most importantly, on supporting beneficiaries through a delicate transition. Ultimately, embracing this template is not merely a matter of administrative convenience; it is a commitment to respectful, transparent, and legally sound communication that honors the legacy of the deceased and supports those they have left behind.