Introduction

A rental receipt is a crucial document for both landlords and tenants. It’s essentially proof of payment for rent and serves as a record of the transaction. While landlords often provide standardized receipts, understanding the key elements can be beneficial for both parties. This guide will break down the essential components of a rental receipt in a casual, easy-to-understand manner.

Key Components of a Rental Receipt

1. Date of Receipt

This field clearly states the date on which the rent payment was received.

2. Landlord’s Information

This section includes the landlord’s full name, contact information (phone number, email address), and mailing address.

3. Tenant’s Information

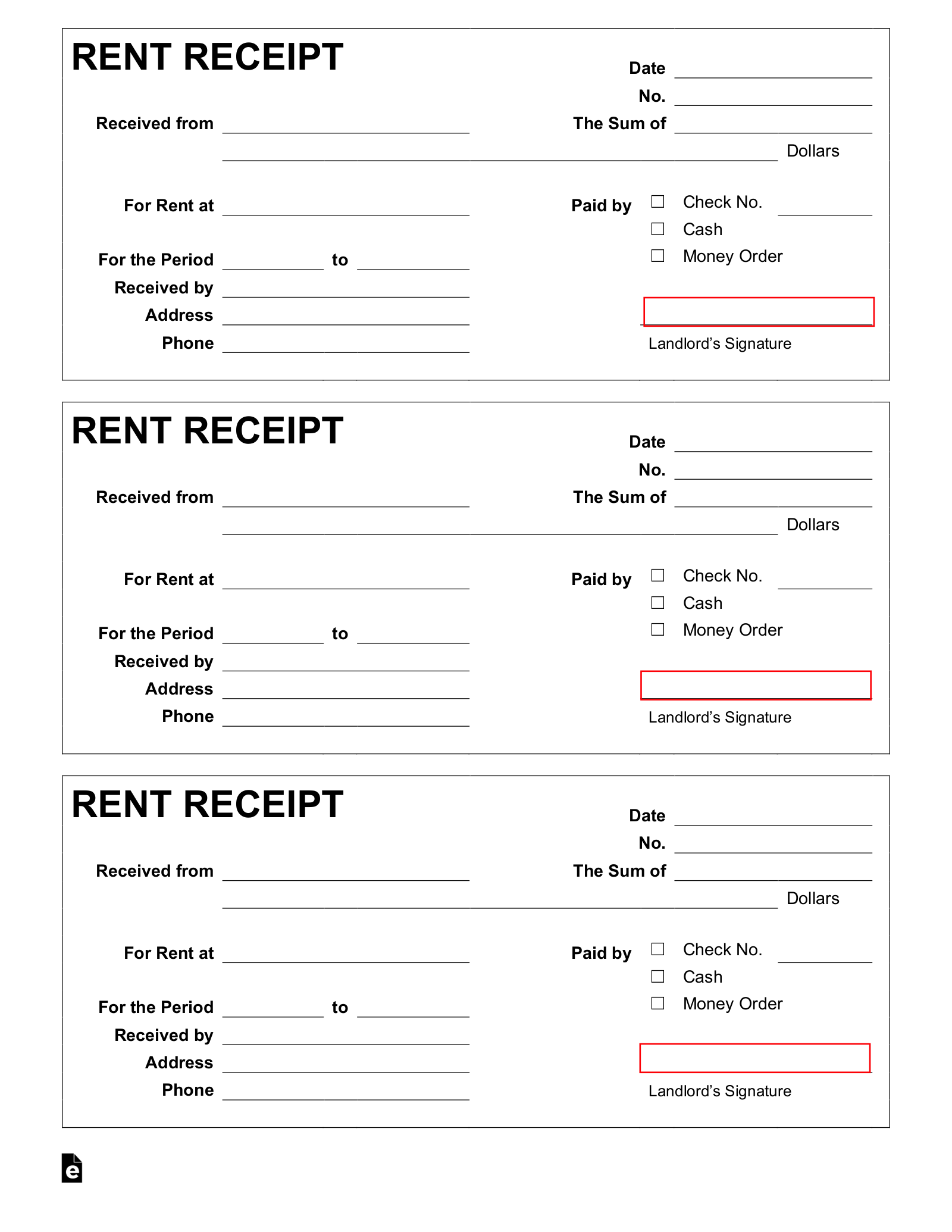

Image Source: eforms.com

Similarly, this section includes the tenant’s full name and the address of the rental property.

4. Property Address

This explicitly states the address of the rental property for which the payment is being made.

5. Rent Amount

This is the most crucial part – the exact amount of rent paid. It should be clearly stated in both numerals and words (e.g., “$1,500.00” and “One Thousand Five Hundred Dollars”).

6. Payment Method

This indicates how the rent was paid, such as:

7. Payment Period

This specifies the period for which the rent covers. For example:

8. Late Fees (if applicable)

If the rent payment was late, this section will outline any late fees charged.

9. Security Deposit Deductions (if applicable)

If any deductions were made from the security deposit (e.g., for property damage), this section will detail the reason and amount.

10. Landlord’s Signature

The landlord or their authorized representative must sign the receipt to validate its authenticity.

11. Tenant’s Signature (optional)

While not always required, the tenant’s signature can act as acknowledgment of receipt.

Benefits of a Detailed Rental Receipt

A well-documented rental receipt offers numerous benefits for both landlords and tenants:

Proof of Payment: It provides irrefutable evidence of rent payment in case of disputes.

Tips for Creating a Rental Receipt

Use a Template: Many online resources offer free, downloadable rental receipt templates.

Conclusion

A rental receipt is a vital document in any landlord-tenant relationship. By understanding its key components and maintaining accurate records, both parties can minimize potential conflicts and ensure a smoother rental experience.

FAQs

1. Can I create my own rental receipt?

Yes, you can create your own simple receipt using a word processing program or a spreadsheet. However, using a standardized template is generally recommended for clarity and legal compliance.

2. What happens if the landlord doesn’t provide a receipt?

If your landlord fails to provide a receipt upon payment, you can request one in writing. You can also document your payment methods (e.g., bank statements, canceled checks) as proof.

3. Can I make changes to a rental receipt after it’s issued?

It’s generally not recommended to alter a rental receipt after it’s been issued. If changes are necessary, both the landlord and tenant should sign and date any modifications.

4. Are digital receipts valid?

Yes, digital receipts are generally considered valid. However, ensure that the digital receipt is properly maintained and easily accessible.

5. What should I do if there’s a discrepancy on the receipt?

If you notice any discrepancies on the receipt, contact your landlord immediately to discuss the issue.

Disclaimer: This article is for informational purposes only and does not constitute legal advice. Please consult with a qualified legal professional for any specific legal questions or concerns related to landlord-tenant law.

This article aims to provide comprehensive information on rental receipts in a casual, engaging style, making it easily understandable for a general audience.

Rental Receipt Sample