In the intricate world of business transactions and real estate deals, a handshake, while symbolic, is rarely enough to secure a commitment. What truly solidifies a prospective buyer’s intent, and provides the seller with a tangible assurance, is the earnest money deposit. This crucial financial gesture demonstrates genuine interest and acts as a preliminary commitment, allowing both parties to move forward with confidence. However, the true strength of this commitment, and the protection it offers, lies not just in the deposit itself, but in the clear, legally sound framework that governs it.

This is where a well-crafted earnest money deposit agreement template becomes an indispensable tool. It serves as the bedrock for a transparent transaction, outlining the precise terms under which a deposit is made, held, and eventually disbursed or forfeited. For real estate professionals, business brokers, legal advisors, and individuals navigating complex sales, this document is paramount. It mitigates misunderstandings, reduces potential disputes, and ensures that the earnest money deposit fulfills its intended purpose: to provide security and clarity as a deal progresses toward its final closing.

The Imperative of Documented Commitments in Modern Transactions

In today’s fast-paced commercial and real estate environments, the need for explicit written agreements has never been more critical. Gone are the days when verbal assurances held significant weight in high-stakes transactions. The complexities of legal compliance, coupled with the potential for substantial financial implications, demand an unequivocal record of all understandings and obligations. A clearly articulated earnest money deposit agreement helps to circumvent ambiguities that can otherwise lead to costly litigation or irreparable damage to business relationships.

This commitment document acts as a safeguard, providing a definitive reference point for all parties involved. It clearly delineates responsibilities, timelines, and the precise conditions under which the deposit operates. Without such a document, determining who is entitled to the funds if a deal falters can become a contentious and protracted battle, diverting valuable resources and time away from productive ventures. Therefore, establishing a written agreement from the outset is not merely a best practice; it is an essential component of robust risk management and professional conduct.

Safeguarding Your Transaction: The Template’s Advantages

Utilizing a comprehensive earnest money deposit agreement template offers a multitude of benefits, extending crucial protections to both the depositor (buyer) and the recipient (seller). For the buyer, it clearly defines the conditions under which their deposit is refundable, such as the failure of certain contingencies like financing approval or a satisfactory inspection. This transparency reassures the buyer that their funds are not at undue risk and provides a clear path for recovery if the deal legitimately falls through.

Conversely, sellers gain significant protection through the explicit outline of forfeiture conditions. Should a buyer default on their obligations without valid reason, the agreement specifies the circumstances under which the seller is entitled to retain the earnest money as liquidated damages. Beyond protection, the template fosters efficiency by standardizing the process. It eliminates the need to draft a new agreement from scratch for every transaction, saving considerable time and legal fees while ensuring consistency and reducing the likelihood of critical omissions.

Adapting Your Agreement for Diverse Scenarios

One of the most valuable attributes of a robust earnest money deposit agreement template is its inherent flexibility and adaptability. While the core purpose of an earnest money deposit remains consistent across various sectors, the specific details and contingencies often differ significantly. For instance, an agreement used in a commercial real estate purchase might include clauses related to zoning approvals or environmental assessments, which would be irrelevant in a residential home sale.

Similarly, an earnest money deposit for a business acquisition could involve more complex terms regarding due diligence, inventory valuation, or transfer of intellectual property. The beauty of a well-designed template is that it provides a foundational structure, allowing users to easily customize clauses, add specific conditions, or remove irrelevant sections to perfectly align with the unique requirements of their particular transaction. This ensures the document remains relevant, comprehensive, and legally sound, regardless of the industry or scale of the deal.

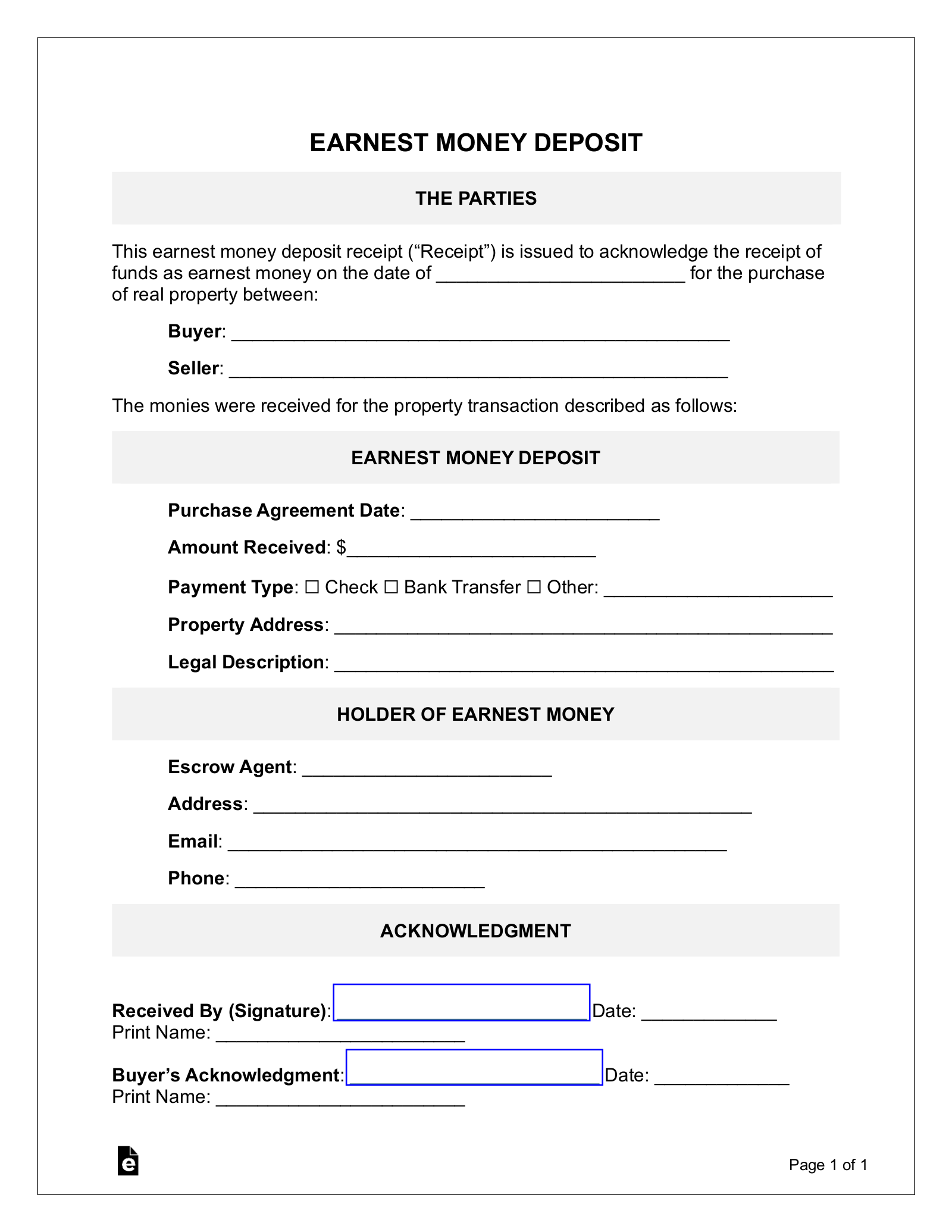

Anatomy of a Robust Deposit Agreement

Every effective earnest money deposit agreement, regardless of its specific application, must contain certain fundamental elements to be complete and legally enforceable. These essential clauses ensure clarity, protect all parties, and streamline the transaction process.

- Identification of Parties: Clearly state the full legal names and addresses of both the buyer(s) and seller(s) involved in the transaction.

- Property/Asset Description: Provide a precise and unambiguous description of the property or asset being purchased, including legal descriptions for real estate or detailed lists for business assets.

- Deposit Amount and Form: Specify the exact amount of the earnest money deposit and the accepted form of payment (e.g., certified check, wire transfer).

- Escrow Agent Details: Identify the neutral third party (e.g., title company, attorney, escrow firm) who will hold the deposit, along with their contact information and responsibilities.

- Conditions for Release: Detail the circumstances under which the earnest money will be released to the seller, typically upon successful closing of the transaction.

- Conditions for Forfeiture: Clearly outline the specific events or breaches by the buyer that would result in the forfeiture of the earnest money to the seller as liquidated damages.

- Contingencies: List all conditions that must be met for the transaction to proceed, such as financing approval, satisfactory property inspection, appraisal contingency, or review of financial records. Specify the timeline for each contingency.

- Closing Date and Location: State the agreed-upon date and location for the final closing of the transaction.

- Governing Law: Indicate the state or jurisdiction whose laws will govern the interpretation and enforcement of the agreement.

- Dispute Resolution: Outline the process for resolving any disagreements that may arise, such as mediation or arbitration, before resorting to litigation.

- Signatures: Include spaces for the dated signatures of all parties involved, confirming their agreement to the terms.

Optimizing Your Document for Clarity and Ease of Use

Beyond legal substance, the presentation and usability of your earnest money deposit agreement are crucial for its effectiveness. A document that is difficult to read, poorly organized, or visually unappealing can create unnecessary friction and misinterpretations. Therefore, practical tips for formatting, usability, and readability are paramount, whether for print or digital distribution.

Employ a clean, professional font with an appropriate size (e.g., 10-12pt for body text). Use clear headings and subheadings to break up content and guide the reader. Ample white space around text and between sections significantly improves readability and reduces eye strain. For digital use, ensure the template is compatible across various devices and platforms, and consider incorporating fillable fields for ease of data entry. Implementing clear instructions for completion and designating areas for initialing important clauses can further enhance usability. Finally, always include a version control system if the document undergoes revisions, ensuring all parties are working with the most current iteration.

In the complex landscape of property and business transactions, the earnest money deposit agreement template stands out as an indispensable tool for fostering clarity, security, and efficiency. By providing a structured and adaptable framework, it empowers both buyers and sellers to approach significant financial commitments with confidence, knowing that their interests are clearly defined and protected.

The strategic deployment of a well-drafted earnest money deposit agreement template ultimately serves as a cornerstone of professional conduct. It not only safeguards financial investments but also streamlines the negotiation process, mitigates potential disputes, and lays a solid foundation for successful, mutually beneficial outcomes. Investing in a robust template is investing in peace of mind, allowing all parties to focus on the successful culmination of their deal, rather than the complexities of contractual ambiguity.