In the whirlwind of daily life, managing household finances can often feel like navigating a dense fog. Bills arrive, income fluctuates, and the endless stream of expenses can leave even the most organized individuals feeling adrift. Many families find themselves caught in a cycle of guessing, hoping, and occasionally panicking, without a clear picture of their financial landscape. This common struggle isn’t due to a lack of effort, but often a lack of a clear, actionable plan.

Imagine having a detailed map that shows you exactly where your money comes from, where it goes, and, most importantly, where you want it to go. That’s precisely the power of a well-crafted spending plan. It transforms abstract numbers into a tangible strategy, allowing you to move from financial uncertainty to confident decision-making. For anyone looking to gain control over their household’s economic future, embracing such a financial framework isn’t just helpful – it’s transformative.

The Foundation of Financial Freedom

A robust domestic budget template isn’t merely about tracking expenditures; it’s a strategic blueprint for achieving your financial aspirations. It shifts the narrative from restrictive austerity to empowered allocation. By understanding your cash flow, you gain the ability to make informed choices, whether that means saving for a down payment on a home, funding your children’s education, or building a secure retirement nest egg. This proactive approach significantly reduces financial stress, replacing anxiety with clarity and control.

One of the primary benefits of implementing a structured financial plan is the insight it provides into spending habits. Many people are surprised to discover how much money leaks away on forgotten subscriptions or small, impulsive purchases. A comprehensive financial planning document shines a light on these patterns, offering an opportunity to reallocate those funds towards more meaningful goals. It acts as a mirror, reflecting your financial reality and highlighting areas where mindful adjustments can yield significant benefits.

Key Elements of an Effective Household Spending Plan

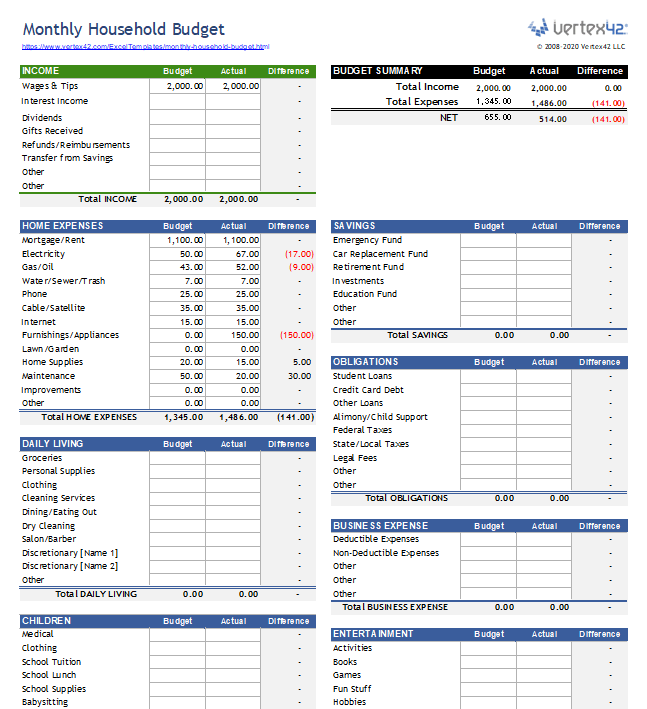

A truly useful budget framework needs to be comprehensive yet flexible, providing a clear overview without being overly complicated. It should capture all relevant financial data to present an accurate picture of your economic health. While individual needs vary, several core components are universally essential for any effective money management tool.

These elements work together to give you a holistic view of your financial situation, enabling you to make informed decisions and adjust your strategy as life evolves. Without these critical components, your financial oversight might be incomplete, leading to blind spots in your fiscal planning.

Here are the fundamental categories every strong home budget framework should include:

- Income Sources: This includes all net income streams entering your household, such as salaries, side hustle earnings, rental income, or benefits. It’s crucial to use your **after-tax income** for realistic planning.

- Fixed Expenses: These are predictable costs that typically remain the same each month. Examples include mortgage or rent payments, car loans, insurance premiums, and subscription services.

- Variable Expenses: These costs fluctuate from month to month and require careful tracking. Groceries, utilities (electricity, water, gas), transportation (gas, public transit), dining out, and entertainment fall into this category. This is often where **overspending** occurs.

- Savings & Investments: Dedicated allocations for future goals, such as an emergency fund, retirement accounts, college savings, or a down payment for a major purchase. Prioritizing these is key to **long-term wealth building**.

- Debt Repayment: Beyond fixed loan payments, this category includes any extra payments towards credit card debt, student loans, or personal loans. Accelerating debt repayment can free up significant **future cash flow**.

- Discretionary Spending: Funds allocated for non-essential items that contribute to quality of life but can be adjusted. This might include hobbies, vacations, or personal care items. This category offers the most flexibility for **trimming expenses**.

Getting Started: Customizing Your Financial Blueprint

Implementing a household financial blueprint might seem daunting at first, but with a structured approach, it becomes an empowering exercise. The beauty of a good financial planning document is its adaptability; it’s designed to be molded to your specific circumstances, not the other way around. The first step involves gathering all your financial information, which provides the raw data needed to populate your chosen format.

Whether you opt for a digital spreadsheet (like Excel or Google Sheets), a dedicated budgeting app, or even a pen-and-paper ledger, consistency is paramount. Once you have your tools ready, begin by meticulously listing every source of income and every outgoing expense over the past one to two months. This historical data offers crucial insights into your actual spending habits before you start making any changes.

After compiling your financial data, categorize each transaction according to the elements outlined above. Sum your total net income and then sum your total expenses. The difference will reveal your starting point: are you operating with a surplus, breaking even, or facing a deficit? This initial assessment is critical for setting realistic goals and making informed adjustments to your spending and saving strategy. Remember, the goal is not perfection from day one, but progress and consistent engagement with your financial reality.

Strategies for Budgeting Success

A comprehensive expense tracking sheet is a powerful tool, but its effectiveness hinges on how consistently and intelligently you use it. Merely filling it out once won’t unlock its full potential. Successful financial management requires ongoing engagement, adaptability, and a commitment to refining your approach over time. These strategies will help you transform your personal finance tool from a static document into a dynamic instrument for wealth building and peace of mind.

Regular review is perhaps the most critical strategy. Life is dynamic, and your spending plan should be too. Set aside time weekly or bi-weekly to review your actual spending against your planned allocations. This allows you to catch overspending early, identify areas for improvement, and celebrate successes. It’s an iterative process, not a one-time setup, ensuring your financial plan remains relevant and effective.

Consider these tried-and-true approaches to maximize the impact of your family budget guide:

- Be Realistic, Not Restrictive: Set achievable goals. A budget that’s too tight is unsustainable and often leads to frustration and abandonment. Allow for some discretionary spending to prevent feeling deprived.

- Track Every Dollar: For a truly accurate picture, account for all your money. This might involve using apps that link to your bank accounts, or diligently logging every purchase manually. Every small expense adds up.

- Automate Savings: Treat your savings like a non-negotiable expense. Set up automatic transfers from your checking to your savings or investment accounts each payday. This “pay yourself first” strategy ensures your financial goals are prioritized.

- Build an Emergency Fund: Before tackling aggressive debt repayment or major investments, prioritize saving 3-6 months’ worth of living expenses in an easily accessible savings account. This safety net prevents minor setbacks from becoming financial crises.

- Involve the Whole Household: If you share finances with a partner or family, make budgeting a collaborative effort. Open communication and shared goals foster accountability and ensure everyone is on the same page.

- Plan for Irregular Expenses: Annual subscriptions, holiday gifts, or car maintenance can derail a monthly budget. Create a separate sinking fund for these costs, setting aside a small amount each month.

- Celebrate Small Wins: Acknowledge your progress! Reaching a savings goal, paying off a credit card, or simply sticking to your plan for a month are all victories worth recognizing. Positive reinforcement encourages continued effort.

Beyond the Numbers: The Psychological Impact

While the quantifiable benefits of a clear spending tracker are evident in improved savings and reduced debt, its psychological impact is equally profound. Many individuals report a significant reduction in stress and anxiety once they adopt a structured approach to their finances. The unknown is often the most fear-inducing aspect of money management, and a well-defined plan eliminates much of that uncertainty. It provides a sense of control and predictability that permeates beyond just your bank account.

This newfound clarity empowers individuals and families to make proactive decisions rather than reactive ones. Instead of worrying about unexpected expenses, they can consult their household financial blueprint and see how to adjust. This cultivates a more peaceful and confident mindset, allowing mental energy to be redirected from financial worry towards more productive or enjoyable aspects of life. Ultimately, a carefully managed financial plan doesn’t just manage money; it enhances overall well-being and fosters a sense of security for the future.

Frequently Asked Questions

How often should I review and adjust my financial plan?

Ideally, you should review your spending against your budget weekly or bi-weekly to catch deviations early. A more comprehensive review, including re-evaluating categories and goals, should happen monthly or quarterly. Life changes, so your financial plan should too.

What if my income is irregular or fluctuates significantly?

For irregular incomes, consider budgeting based on your lowest predictable income. Allocate funds for fixed expenses first, then build an emergency fund. Any surplus income can be directed towards savings, debt repayment, or a “buffer” for leaner months. Tools like “zero-based budgeting” can also be highly effective for fluctuating incomes, ensuring every dollar has a job.

Is a budget only for people who are struggling financially?

Absolutely not. A spending plan is a powerful tool for everyone, regardless of their financial standing. It helps high-income earners optimize investments and reach ambitious goals, just as it helps those on tighter budgets make ends meet and build security. It’s about intentional spending and maximizing your money’s potential.

How do I handle unexpected expenses without derailing my financial plan?

The best way to handle unexpected expenses is to anticipate them by having an emergency fund. For smaller, less critical unexpected costs, try to reallocate funds from a flexible category like “discretionary spending” or “entertainment.” Avoid using credit cards for emergencies unless absolutely necessary, and always plan to replenish your emergency fund swiftly after use.

What’s the easiest way to track my daily expenses?

Many options exist, from simple pen-and-paper logs to robust budgeting apps that sync directly with your bank accounts (like Mint, YNAB, or Personal Capital). Spreadsheets (Excel, Google Sheets) offer a good balance of customization and automation. Choose the method you’re most likely to stick with consistently, as consistency is key.

Embracing a structured financial approach is more than just an administrative task; it’s an investment in your peace of mind and your future prosperity. By understanding where your money is going, you unlock the power to direct it towards your deepest desires and most pressing goals. This journey from financial uncertainty to confident management is not always easy, but the rewards are immeasurable, offering a tangible path to security and freedom.

Take the first step today. Whether you start with a simple spreadsheet, an intuitive app, or even just a notebook, the act of confronting your finances with a clear framework is the most crucial move you can make. Begin building your financial roadmap, make informed decisions, and watch as your aspirations transition from distant dreams to achievable realities. Your future self will thank you for the clarity, control, and calm that a well-managed household spending plan brings.