Navigating the complexities of a divorce can feel like attempting to solve a multi-layered puzzle without all the pieces. Amidst the emotional toll and legal intricacies, one of the most significant challenges is often the meticulous organization and valuation of assets and debts. This critical phase requires a level of detail and precision that can overwhelm even the most organized individuals, highlighting the crucial need for a structured approach to manage what is often a person’s entire financial life.

For anyone who values efficiency, clarity, and a systematic approach to personal or business documentation, a well-designed inventory template is not just helpful—it’s indispensable. Such a tool provides a clear roadmap through the financial landscape of a marital estate, ensuring that nothing is overlooked. It transforms a daunting task into a manageable project, offering a sense of control and empowerment during a time that often feels anything but. This guide is tailored for productivity enthusiasts, organizational aficionados, and anyone seeking to streamline the often-complex documentation required for a divorce or similar significant life transitions.

Mastering Organization During Significant Life Transitions

In our fast-paced world, the ability to organize information effectively is a cornerstone of productivity, whether managing a business project, a household budget, or a major life event. Structured lists and templates serve as powerful frameworks that guide us through intricate processes, reducing mental load and preventing costly omissions. For a situation as comprehensive as asset and debt division, relying on a haphazard collection of notes or scattered documents simply isn’t an option.

Implementing a formalized inventory system brings order to chaos. It ensures that every piece of financial information, from bank accounts to retirement plans, real estate, and liabilities, is accounted for in a systematic manner. This organized approach not only saves valuable time but also minimizes the stress associated with tracking down disparate pieces of information, allowing for a more focused and efficient progression through the legal or personal settlement process. It’s about building a robust foundation of data that stands up to scrutiny and facilitates informed decision-making.

Unlocking the Benefits of a Structured Financial Checklist

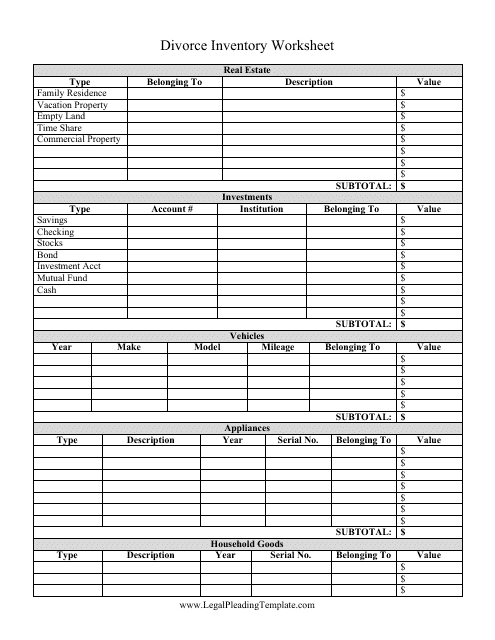

The advantages of employing a specialized template for financial disclosure during a divorce are numerous and profound, extending far beyond simple organization. Primarily, such a document provides unparalleled clarity. It consolidates all relevant financial data into a single, cohesive view, making it easier to understand the full scope of marital assets and liabilities. This clear overview is essential for both parties to grasp their financial standing.

Furthermore, leveraging a detailed inventory tool is an enormous time-saver. Instead of scrambling to compile information piecemeal, you have a pre-defined structure that prompts you for specific details, significantly reducing the time spent in document discovery and compilation. This consistency ensures that no vital asset or debt is overlooked, providing a comprehensive and accurate financial snapshot. The structured nature of a divorce inventory list template also aids in ensuring equitable division, as it presents all information in a fair and transparent manner, reducing disputes and streamlining negotiations. It’s an invaluable aid for legal counsel, enabling them to represent their clients more effectively with a complete data set at their fingertips.

Tailoring Your Asset and Debt Tracker

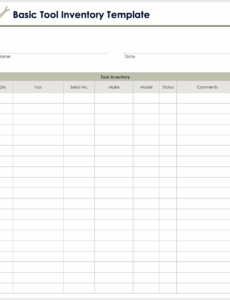

One of the most valuable aspects of a well-designed template is its inherent adaptability. While the core purpose remains consistent—listing assets and debts—the specific details and categories can be meticulously customized to suit various needs and scenarios. For instance, a template used for a straightforward personal separation might focus primarily on common household items, joint bank accounts, and basic liabilities like credit card debt.

Conversely, for individuals with more complex financial portfolios, the asset and debt tracker can be expanded to include intricate sections for business valuations, intellectual property, stock options, trusts, and detailed investment portfolios. Even for household use, it can be adapted to track significant personal property like art collections or specialized equipment, ensuring every item of value is cataloged. The flexibility of this document means it can serve as a simple checklist for quick reference or evolve into a comprehensive financial disclosure statement required by legal and financial professionals, truly becoming a dynamic tool for any level of complexity.

Essential Elements of a Comprehensive Financial Disclosure Document

To be truly effective, any financial inventory document must be thorough, covering all potential aspects of an individual’s or couple’s financial landscape. The following components are critical for ensuring completeness and utility:

- Personal and Case Information: Clearly identify names, case numbers (if applicable), and contact details for both parties and their legal representation.

- Assets:

- Real Estate: Residential properties, vacation homes, land, investment properties (include addresses, estimated market value, mortgage details).

- Vehicles: Cars, boats, RVs, motorcycles (include make, model, year, VIN, estimated value, loan details).

- Bank Accounts: Checking, savings, money market accounts (include institution, account numbers, current balances).

- Investments: Stocks, bonds, mutual funds, brokerage accounts (include institution, account numbers, current values, types of investments).

- Retirement Accounts: 401(k)s, IRAs, pensions (include institution, account numbers, current values, vested amounts).

- Personal Property: Furniture, electronics, jewelry, art, collectibles (itemize high-value items, use general categories for others, estimated values).

- Business Interests: Ownership stakes in businesses, partnerships (include name, valuation method, percentage owned).

- Intellectual Property: Patents, copyrights, trademarks (details, valuation).

- Debts:

- Mortgages/Home Equity Loans: Property tied to the debt, outstanding balance, lender.

- Loans: Personal loans, student loans, car loans (lender, original amount, outstanding balance, payment terms).

- Credit Cards: Institution, account number, outstanding balance, minimum payment.

- Taxes Owed: Federal, state, property taxes (amount, period).

- Other Liabilities: Judgments, liens, legal fees owed.

- Income and Expenses (Optional but Recommended): Detailed breakdown of monthly income sources and regular expenses to provide a full financial picture.

- Supporting Documentation Checklist: A list of all necessary documents to attach or reference (bank statements, tax returns, property deeds, etc.).

- Valuation Notes: Space to record the source of valuations (e.g., appraisal, Kelley Blue Book, recent statement) and the date of valuation.

- Dates and Signatures: Sections for both parties to date and sign, acknowledging review and accuracy, if used as a formal disclosure.

Each section should include columns for description, account/identifier, estimated value/balance, and notes. This level of detail ensures no stone is left unturned and provides a robust foundation for any negotiations or legal proceedings.

Enhancing Readability and Usability for Your Inventory Document

A powerful organizational tool is only as effective as its usability. Regardless of whether your inventory document is primarily for print or digital use, its design and layout play a crucial role in its effectiveness. For both formats, prioritizing clarity and readability is paramount. This means employing clear, consistent headings and subheadings, using an easily legible font, and incorporating ample white space to prevent the document from looking cluttered and overwhelming. Logical grouping of related items and consistent formatting throughout the inventory document also contribute significantly to ease of use.

For digital versions, consider features that enhance functionality: editable fields for quick data entry, direct links to electronic copies of supporting documents, and built-in search capabilities. Implementing version control is also vital for digital files, ensuring you’re always working with the most current information. If the document is intended for print, design it with enough room for handwritten notes, clear demarcations between sections, and perhaps a checklist format for reviewing completed entries. Thoughtful design not only makes the process smoother but also reflects a professional approach to managing complex personal or financial data.

The journey through a divorce is undeniably challenging, demanding meticulous attention to detail at a time when emotional resources are often stretched thin. Embracing a structured organizational tool like a comprehensive inventory template can dramatically alleviate the burden of financial compilation and disclosure. It empowers individuals to regain a sense of control over their financial narrative, transforming what could be a chaotic process into a streamlined, efficient, and transparent endeavor.

By providing a clear, consistent, and adaptable framework, a carefully prepared divorce inventory list template not only ensures accuracy and completeness but also fosters a more equitable and less contentious resolution. It is a testament to the power of proactive organization, proving invaluable for anyone seeking to navigate one of life’s most significant transitions with clarity, confidence, and peace of mind. Investing in such a productivity tool truly means investing in a smoother path forward.